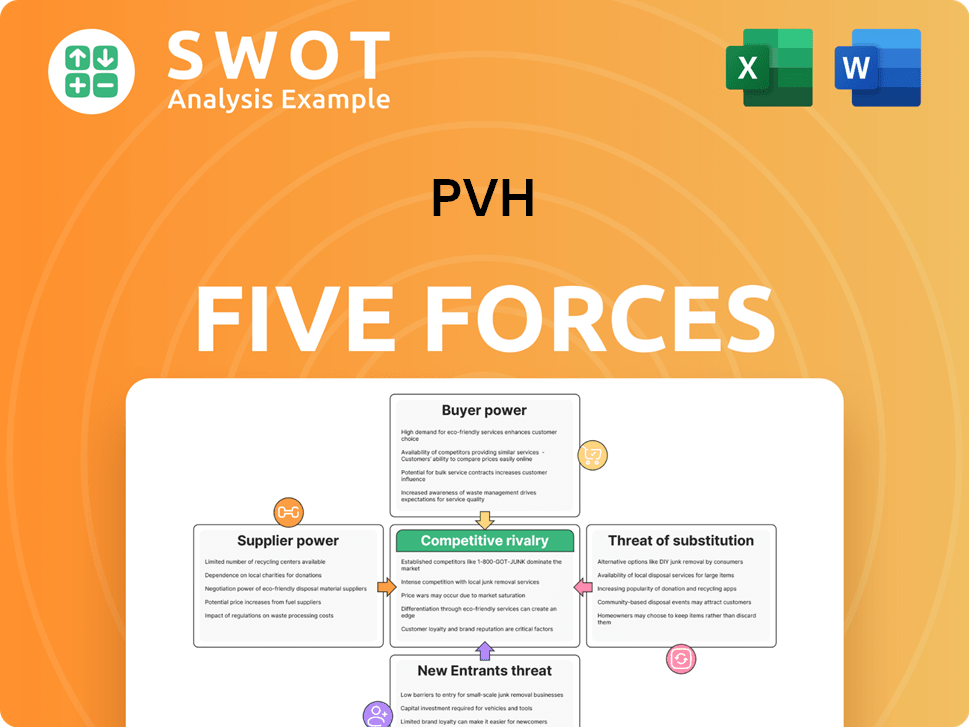

PVH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PVH Bundle

What is included in the product

Analyzes PVH's competitive environment, revealing buyer power, supplier influence, and threat of new entrants.

Instantly reveal Porter's Five Forces insights through a clear, visual dashboard.

Full Version Awaits

PVH Porter's Five Forces Analysis

This preview showcases the complete PVH Porter's Five Forces analysis. It details the competitive landscape, including the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry. The document provides insights into PVH's industry position and potential challenges. What you see here is precisely what you'll receive upon purchase, ready for your review and application.

Porter's Five Forces Analysis Template

PVH faces moderate buyer power, as consumers have diverse clothing options. Supplier power is relatively low due to a fragmented supply chain. Threat of new entrants is moderate, given brand recognition barriers. Intense competition exists among established apparel brands. The threat of substitutes, such as online retailers, is significant. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore PVH’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

PVH faces supplier concentration challenges. A limited number of key suppliers provide a significant portion of raw materials. In 2023, the top textile suppliers represented 35% of PVH's procurement volume. This concentration can give suppliers leverage, potentially impacting costs.

For premium brands, PVH depends on specialized manufacturers. In 2024, 12 manufacturers produced 45% of premium products, around 2.4 million units. This reliance boosts their bargaining power. Switching suppliers could halt production and harm brand image.

PVH's vast supply chain, operating in 25 countries, gives suppliers leverage. Asia accounts for 60% of suppliers, Europe 20%, and North America 15%. The company's reliance on these regions makes it vulnerable to disruptions. For example, in 2024, rising costs and geopolitical tensions impacted raw material prices.

Sustainable Sourcing Challenges

PVH faces challenges in sustainable sourcing. Despite investing $75 million in 2023, only 42% of materials are sustainably sourced. Limited availability of certified suppliers boosts their bargaining power. The cost of sustainable materials further strengthens this power.

- Sustainable sourcing is a growing concern for PVH.

- PVH invested $75 million in sustainable sourcing in 2023.

- Only 42% of materials are from sustainable suppliers.

- Limited supply increases supplier power.

Long-Term Relationships

PVH's long-standing supplier relationships, averaging 7.5 years, are a double-edged sword in 2024. These partnerships, with 87% of top suppliers lasting over 5 years, promote stability. However, this can reduce PVH's bargaining power, potentially leading to higher costs. This makes it more difficult to quickly adapt to market changes.

- Long-term partnerships average 7.5 years.

- 87% of top suppliers have worked with PVH for over 5 years.

- These relationships can limit negotiation leverage.

- Supplier dependencies can hinder quick changes.

Supplier power significantly impacts PVH due to concentration and specialized needs. In 2023, top textile suppliers comprised 35% of procurement. Premium brand reliance on a few manufacturers, with 12 producing 45% in 2024, boosts supplier leverage.

Geopolitical tensions and sustainable sourcing further affect this power. PVH invested $75M in 2023, but only 42% of materials are sustainably sourced, boosting supplier power. Long-term relationships, averaging 7.5 years, stabilize but reduce bargaining strength.

This dynamic poses risks, especially amidst rising costs and market shifts. Understanding these forces is crucial for PVH's cost management and strategic planning.

| Aspect | Details | Impact |

|---|---|---|

| Supplier Concentration | Top textile suppliers: 35% of volume in 2023 | Higher material costs |

| Specialized Manufacturers | 12 manufacturers produce 45% of premium in 2024 | Increased supplier power |

| Sustainable Sourcing | $75M invested, 42% sustainable in 2023 | Limited supplier availability |

Customers Bargaining Power

PVH's diverse customer base, spanning brands like Calvin Klein and Tommy Hilfiger, weakens customer bargaining power. Operating across various price points from premium to value, PVH reduces reliance on any single consumer group. This diversification strategy, reflected in its 2024 revenue of $9.7 billion, insulates PVH from shifts in consumer preferences.

Customers' sensitivity to fashion trends and pricing significantly impacts PVH. Data indicates 18% of consumers prioritize price over brand loyalty. Millennials, with 62% comparing prices, and 45% open to switching brands, boost customer bargaining power. This forces PVH to maintain competitive pricing strategies.

Online shopping and direct-to-consumer (DTC) channels have significantly increased customer bargaining power. PVH's digital sales reached $1.5 billion in 2023, representing 26.7% of total revenue. E-commerce gives customers broader product access, boosting price comparison abilities. This shift intensifies competition, pressuring pricing and service.

Demand for Sustainable Products

Customers' bargaining power is increasing due to their demand for sustainable products. A significant 73% of consumers show interest in sustainable fashion, and 58% are prepared to pay more for it. Transparency is also key, with 42% of consumers seeking it in the supply chain. PVH needs to adapt to these preferences to maintain customer loyalty and market share.

- Consumer interest in sustainable fashion is at 73%.

- 58% are willing to pay more for eco-friendly products.

- 42% of consumers want supply chain transparency.

Influence of Fashion Trends

Consumer preferences, heavily influenced by fashion trends and social media, significantly impact PVH. To stay relevant, PVH must continuously innovate and adapt its product offerings. Failing to align with current trends could lead to decreased sales. In 2024, the apparel market saw a 5% shift in consumer preferences. This dynamic environment demands vigilance.

- Consumer behavior is driven by fashion trends and social media.

- PVH needs to innovate and adapt its products.

- Trend misalignment can cause sales decline.

- The apparel market saw a 5% shift in 2024.

PVH faces moderate customer bargaining power, despite its diverse brand portfolio. Price sensitivity, with 18% prioritizing cost, and millennial price comparisons increase pressure. Online shopping, which made up 26.7% of revenue in 2023, and the demand for sustainable options further empower customers.

| Factor | Impact | Data Point |

|---|---|---|

| Price Sensitivity | High | 18% prioritize price |

| Online Shopping | Increasing | 26.7% digital sales (2023) |

| Sustainability Demand | Growing | 73% interested in sustainable fashion |

Rivalry Among Competitors

PVH Corp. operates within the highly competitive global apparel market. The global apparel market was valued at $1.9 trillion in 2024, reflecting intense rivalry among numerous players. PVH's market share is approximately 2.3%, generating $9.3 billion in revenue in 2023. This competition pressures pricing and innovation.

Established brands significantly increase competitive rivalry. PVH's Calvin Klein and Tommy Hilfiger, with revenues of $4.5B and $3.8B, respectively, face constant pressure. These brands must innovate and differentiate. Maintaining market share is a continuous challenge.

PVH actively fosters innovation and differentiation to maintain its competitive stance. In 2023, PVH allocated $127 million to R&D, a strategic move to create unique products. The company also invested heavily in marketing, spending $1.1 billion, which accounted for 12% of total revenue. These financial commitments are essential for success in the competitive apparel market.

Digital Platform Investments

PVH is actively boosting its digital platform investments to sharpen its online sales and customer engagement strategies. In 2023, PVH allocated $85 million towards its digital platforms. This investment underscores the company's commitment to digital growth. Online sales currently represent 28% of PVH's overall revenue.

- Digital investments are crucial for competitiveness.

- $85 million was invested in digital platforms in 2023.

- Online sales contribute 28% of total revenue.

Global Brand Recognition

PVH's strong global brand recognition, with key brands like Calvin Klein and Tommy Hilfiger, is a significant competitive advantage. These brands consistently rank among the top players in the premium fashion sector. PVH's extensive international footprint, operating in more than 40 countries, helps it compete effectively worldwide. This global presence allows the company to leverage diverse market opportunities.

- PVH's revenue in 2024 was approximately $9.7 billion.

- Calvin Klein and Tommy Hilfiger brands represent a major portion of the company's sales.

- PVH's international sales account for over 50% of total revenue.

- The company's global retail network includes over 1,000 owned stores.

Competitive rivalry in the apparel market is intense, with PVH facing numerous competitors. The global apparel market hit $1.9T in 2024. PVH's focus is on innovation, with $127M in R&D in 2023 and a strong digital presence.

| Metric | Value | Year |

|---|---|---|

| PVH Revenue | $9.7B | 2024 (Est.) |

| R&D Spend | $127M | 2023 |

| Digital Investment | $85M | 2023 |

SSubstitutes Threaten

The rise of fast fashion presents a notable threat to PVH. Competitors like Zara and H&M offer trendy alternatives at lower costs, appealing to budget-conscious shoppers. Zara's 2022 revenue hit $22.1 billion, highlighting their market presence. H&M Group's sales in 2022 were $22.4 billion. This competitive landscape pressures PVH's market share and pricing.

Online retail platforms, such as ASOS, pose a significant threat to PVH due to their wide array of apparel choices and competitive pricing. In 2022, ASOS reported a revenue of £3.9 billion, highlighting the scale of these online alternatives. Consumers are increasingly drawn to the ease and convenience of online shopping, making platforms like ASOS appealing substitutes for traditional stores. This shift puts pressure on PVH to compete effectively in the digital space.

The rise of rental and second-hand clothing poses a threat to PVH. Platforms like ThredUp, with a 2022 resale market of $36 billion, offer cheaper options. Rent the Runway's $157.4 million revenue highlights this shift. Consumers favor these sustainable, affordable alternatives.

Sustainable and Ethical Fashion

The threat of substitutes is rising for PVH due to the growing popularity of sustainable and ethical fashion. Consumers are drawn to brands like Patagonia, which reported $1.5 billion in revenue in 2022, and Everlane, with $250 million in annual revenue, indicating a shift in preferences. These brands offer alternatives that align with environmental and social values, posing a challenge to traditional apparel companies. This trend necessitates PVH to adapt.

- Patagonia's revenue reached $1.5 billion in 2022.

- Everlane's annual revenue was $250 million.

- Consumers increasingly favor sustainable options.

- PVH needs to address this shift.

Digital and Virtual Fashion

Digital and virtual fashion poses a growing threat to traditional apparel. Consumers can now buy digital clothing for avatars or online profiles, creating a substitute for physical garments. Nike's digital sales hit $6.7 billion in 2022, highlighting the market's potential. The global digital fashion market is expected to reach $8.3 billion by 2025, showing substantial growth.

- Nike's digital sales in 2022: $6.7 billion

- Roblox virtual fashion market revenue: $639 million

- Projected global digital fashion market by 2025: $8.3 billion

- Number of digital fashion consumers: 33.2 million

PVH faces threats from substitutes like fast fashion and online retail. These alternatives offer lower prices and greater convenience. Digital and virtual fashion also provide competition.

| Substitute | Example | 2022 Revenue/Sales |

|---|---|---|

| Fast Fashion | Zara | $22.1B |

| Online Retail | ASOS | £3.9B |

| Sustainable Brands | Patagonia | $1.5B |

Entrants Threaten

The surge in e-commerce platforms significantly lowers the entry barriers for new apparel brands. Online marketplaces enable new entrants to access a global customer base without substantial investment in physical stores. Shein, with its ultra-low prices and a responsive supply chain, has quickly risen to dominate the online market. In 2024, Shein's revenue is projected to be around $40 billion, showcasing the immense impact of new online entrants. This poses a considerable threat to established brands like PVH.

The apparel industry often sees low capital needs, simplifying market entry for new firms. This contrasts with sectors like aerospace, which require huge initial investments. Start-ups can begin with modest funds and grow. In 2024, the average start-up cost for an apparel business was roughly $50,000 to $150,000.

New entrants can rapidly build brand awareness using social media and influencer marketing, enabling them to compete with established brands. These strategies allow new brands to quickly gain traction, especially in the apparel industry. Social commerce offers substantial opportunities for marketing, design, and revenue, as seen with Shein's rapid growth. Shein's revenue in 2023 was $32 billion, showcasing the impact of these strategies.

Fast Fashion Trends

Fast-changing fashion trends pose a significant threat to PVH. New entrants can quickly adapt to emerging styles, like the "coastal grandmother" aesthetic, and gain market share. The rise of fast-fashion giants puts pressure on brands. Specifically, Temu's revenue soared to $20 billion in 2023, highlighting the impact. Brands face scrutiny over sustainability.

- Temu's 2023 revenue: $20 billion.

- Fast fashion's ability to capitalize on trends.

- Increased consumer and regulator scrutiny.

- PVH's need to adapt.

Global Supply Chains

The threat from new entrants is influenced by access to global supply chains. This access allows new businesses to source materials and manufacture goods at competitive prices, which levels the playing field. Fashion brands are expected to increase their sourcing diversification in Asia and prepare for nearshoring. In 2024, the fashion industry continues to see shifts in supply chain strategies.

- Diversification of sourcing in Asia remains a key strategy for many brands.

- Nearshoring efforts are gaining momentum, although the pace varies.

- The cost of raw materials and shipping continues to fluctuate.

- New entrants can leverage digital platforms to access global supply chains.

E-commerce reduces entry barriers, exemplified by Shein's $40B projected 2024 revenue. Low capital needs ($50K-$150K start-up costs) also simplify market entry for new apparel businesses. Social media and rapid trend adoption, as seen with Temu's $20B 2023 revenue, further intensify the threat.

| Factor | Impact | Example/Data (2023/2024) |

|---|---|---|

| E-commerce | Reduced barriers | Shein ($40B projected 2024 revenue) |

| Capital Needs | Low entry costs | Start-up costs ($50K-$150K) |

| Trend Adoption | Fast Market Entry | Temu ($20B 2023 revenue) |

Porter's Five Forces Analysis Data Sources

We leverage PVH's annual reports, SEC filings, industry analyses, and market share data from trusted sources.