Qantas Airways Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qantas Airways Bundle

What is included in the product

Tailored analysis for Qantas' product portfolio.

Printable summary optimized for A4 and mobile PDFs, offering a clear view for Qantas' BCG analysis.

Delivered as Shown

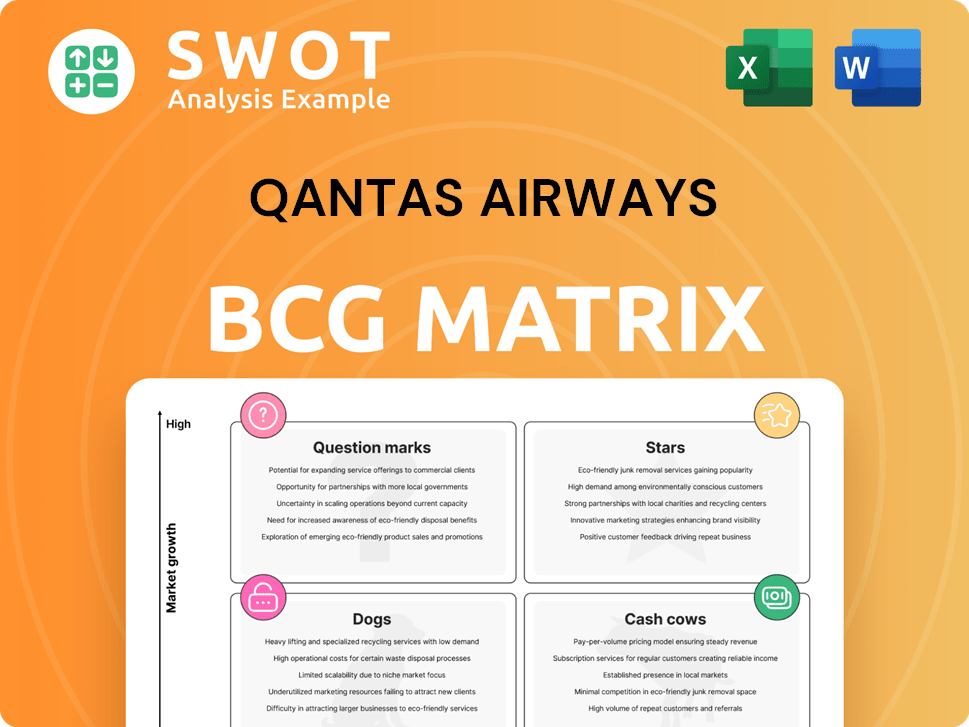

Qantas Airways BCG Matrix

The Qantas Airways BCG Matrix preview mirrors the purchased version. This is the complete document you’ll receive, fully formatted for immediate strategic assessment.

BCG Matrix Template

Qantas's diverse offerings, from international flights to loyalty programs, paint a complex picture in the BCG Matrix. Some routes might be "Stars," shining brightly in growing markets. Others, like mature domestic services, could be "Cash Cows," generating steady profits. Emerging services may be "Question Marks," requiring careful investment decisions. Underperforming routes could be classified as "Dogs," needing strategic attention.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Qantas demonstrates robust performance in the domestic market. In 2024, the airline saw 76.1% of flights departing on time. This marks the fifth consecutive year of being the most punctual major domestic airline. This strong operational performance enhances customer satisfaction.

Qantas Loyalty is a star, with strong growth and diverse earnings. The program boasts over 800 partners. In 2024, Qantas Loyalty saw a 25% increase in revenue. It's a key driver for customer engagement and retention.

Qantas's fleet renewal, including A321LRs and A220s, is a key strategy. These new planes boost fuel efficiency; in 2024, fuel costs were a significant expense. The first A321XLR arrives in June 2025, expanding route options. This investment supports future growth and customer satisfaction, improving Qantas's market position.

International Network Expansion

Qantas is significantly boosting its international presence, making it a "Star" within its BCG matrix. The airline is introducing new routes and increasing capacity, with around 220,000 extra seats added internationally in a year. This expansion is fueled by new aircraft and schedule adjustments, targeting high-demand markets.

- New routes and increased seat capacity.

- Approximately 220,000 seats added to international routes.

- Focus on Asia Pacific and US markets.

- Supported by new aircraft and schedule changes.

Sustainability Initiatives

Qantas positions its sustainability efforts as a star within its BCG matrix. The airline actively invests in sustainable aviation fuel (SAF) and nature-based carbon projects. This commitment aims for net-zero emissions by 2050. Qantas is also focusing on interim targets for emissions reduction and fuel efficiency improvements.

- Qantas invested $400 million in sustainable aviation fuel (SAF) projects in 2023.

- The airline aims to use 10% SAF in its fuel mix by 2030.

- Qantas has a target to reduce emissions by 25% by 2030 (compared to 2020 levels).

- These initiatives enhance Qantas' brand reputation and appeal to environmentally conscious travelers.

Qantas is strategically expanding its international routes, adding approximately 220,000 seats. This expansion is primarily focused on the Asia Pacific and US markets. The airline's growth is supported by new aircraft and optimized schedules.

| Strategic Area | Initiative | Data (2024) |

|---|---|---|

| International Expansion | Seat Capacity Increase | 220,000 additional seats |

| Market Focus | Key Regions | Asia Pacific, US |

| Operational Support | Aircraft & Schedules | New aircraft & schedule changes |

Cash Cows

Qantas' established domestic routes, like Sydney to Melbourne, are cash cows, providing steady revenue. These routes leverage strong brand recognition and a loyal customer base. In 2024, domestic flights represented a significant portion of Qantas' $12.5 billion revenue. Operational efficiency and customer service help maintain profitability in this segment.

QantasLink, handling about 60% of domestic flights, serves regional areas. These routes offer steady revenue and support Qantas. In 2024, QantasLink saw a 10% increase in passenger numbers. Investments in its fleet ensure reliable service, boosting customer satisfaction.

Qantas Frequent Flyer is a cash cow. It generates revenue through partnerships. In 2024, the program had over 15 million members. Its stability comes from a large membership base. Efforts to increase active members continue to pay off.

Premium Services

Qantas' premium services, like business and first class, are cash cows. These services offer high profit margins. They attract business travelers and wealthy customers. Qantas enhances the customer experience in these cabins. This helps maintain its competitive edge.

- In 2024, premium services accounted for a significant portion of Qantas' revenue.

- Business and first-class fares command a substantial price premium.

- Customer satisfaction scores for premium cabins consistently exceed those for economy.

- Qantas invests heavily in premium cabin upgrades and amenities.

Freight Business

Qantas's freight business is a cash cow, offering diversification and steady earnings. It benefits from the rising e-commerce sector in Australia. Qantas Freight showed resilience, helping the group's finances. The airline's investments secure its future in freight.

- Qantas Freight revenue rose significantly in 2024, with a 10% increase.

- Domestic e-commerce is growing, boosting freight demand.

- Strategic partnerships are key for Qantas Freight's expansion.

- Infrastructure investments enhance operational efficiency.

Qantas' cash cows include established domestic routes like Sydney to Melbourne, generating consistent revenue with a strong brand. QantasLink, handling regional flights, also contributes, supporting overall operations, with a 10% passenger increase in 2024. The Frequent Flyer program and premium services, which accounted for a significant portion of Qantas' revenue in 2024, are other key cash generators.

| Cash Cow | Key Features | 2024 Data Highlights |

|---|---|---|

| Domestic Routes | Strong brand, loyal customer base | $12.5B revenue (domestic flights) |

| QantasLink | Regional flight operations | 10% increase in passengers |

| Frequent Flyer | Partnerships, large membership | Over 15M members |

| Premium Services | High margins, customer experience | Significant revenue portion |

| Freight Business | Diversification, e-commerce growth | 10% revenue increase |

Dogs

The Boeing 717 fleet, a dog in Qantas's BCG matrix, is being replaced by Airbus A220s. These older planes have higher operating costs. They offer lower fuel efficiency. This shift impacts profitability. In 2024, Qantas aims to retire the last 717s.

Some international routes for Qantas, like those to less popular destinations or facing intense competition, fit the "dogs" category in a BCG matrix. These routes might struggle to make a profit, potentially dragging down overall financial performance. For instance, in 2024, Qantas reported that some routes experienced lower load factors, indicating underutilization and financial strain. The airline consistently assesses its route network, aiming to improve profitability and efficiency, which in 2024 included route adjustments.

Aircraft with outdated in-flight entertainment systems fit the "Dogs" quadrant, diminishing customer satisfaction. These systems are a drag, potentially leading to revenue loss. Qantas is investing heavily; in 2024, they spent $400 million on cabin upgrades. This is part of its strategy to improve the in-flight experience.

Older Airport Lounges

Older Qantas airport lounges, lacking recent updates, fit the "Dogs" category due to their failure to meet current premium customer standards. These lounges necessitate substantial investments to modernize and enhance the overall customer experience. Qantas has recognized this and is actively allocating funds for new and upgraded lounges. For instance, in 2024, Qantas announced a $100 million investment to revamp its lounges.

- Outdated lounges may lead to customer dissatisfaction.

- Significant investment is needed for renovations.

- Qantas is actively investing in new lounges.

- The 2024 investment is a key strategic move.

Services with Low Customer Satisfaction

Services with low customer satisfaction at Qantas Airways can be classified as "Dogs" in the BCG matrix. These underperforming areas, like baggage handling, often require significant investment to improve. For example, in 2024, Qantas reported a 6.2% mishandled baggage rate, indicating a need for improvement. Addressing these issues is vital for overall customer experience.

- Baggage handling, booking, and in-flight service are key areas.

- Customer satisfaction scores directly reflect performance.

- Targeted improvements are essential for better results.

- Investment in these areas can boost customer experience.

Poor performing Qantas services, such as baggage handling, align with the "Dogs" category. Baggage mishandling, for instance, hit 6.2% in 2024, highlighting the need for upgrades. Addressing these issues, critical for the customer experience, often involves significant investment.

| Service Area | Performance Indicator (2024) | Financial Impact |

|---|---|---|

| Baggage Handling | 6.2% Mishandled Baggage Rate | Customer Dissatisfaction, Potential Revenue Loss |

| Booking System | Low Customer Satisfaction Scores | Reduced Bookings, Increased Support Costs |

| In-flight Service | Mixed Customer Feedback | Impact on Customer Loyalty, Brand Image |

Question Marks

Newly launched international routes for Qantas Airways are classified as question marks in the BCG Matrix. These routes are high-growth, but they have low market share. They require substantial investment in marketing and promotion to build brand awareness and capture market share. Qantas closely monitors these routes, as evidenced by the 2024 launch of Perth-Paris, to decide whether to invest further or exit.

Qantas's Sustainable Aviation Fuel (SAF) initiatives are currently question marks. The technology and infrastructure for SAF are still emerging. Although, the long-term financial returns are not yet guaranteed, Qantas invested $200 million in SAF projects by the end of 2024. SAF is a key part of Qantas's plan to cut emissions by 25% by 2030.

Digital transformation initiatives at Qantas, like new booking and customer service platforms, are question marks. These projects demand substantial investment with uncertain outcomes. Qantas allocated $400 million to digital initiatives in 2024. Success hinges on effective implementation and user adoption rates, which are still unfolding. The aim is to boost efficiency and enhance customer experience.

Partnerships with New Airlines

Partnerships with new airlines are indeed question marks in Qantas's BCG matrix. These ventures hinge on the partner's success and service integration. Qantas meticulously assesses potential partners to meet its strategic objectives. For example, Qantas recently expanded its codeshare agreement with Emirates, enhancing its global reach. This expansion is a calculated move to capture more market share and improve passenger convenience.

- Qantas's international capacity increased by 20% in the first half of FY24.

- The airline's net profit after tax reached $1.25 billion in the same period.

- Partnerships with new airlines are crucial for network expansion.

- Effective integration is key to success and profitability.

Expansion into New Markets

Expansion into new markets represents a question mark for Qantas Airways within the BCG matrix. These ventures demand substantial investment, encompassing market research and targeted marketing efforts. Qantas carefully evaluates the potential risks and rewards before entering new markets, like exploring routes to new destinations or targeting new customer segments. The airline faces uncertainty regarding market success, as these initiatives are not guaranteed to yield high returns.

- Market Entry: Qantas has been strategically expanding, with a focus on key international routes and partnerships to mitigate risks.

- Financial Commitment: These expansions require significant financial resources for marketing and operational setups.

- Strategic Decisions: Qantas must carefully assess market demand and competition before investing.

- Risk Assessment: The airline must evaluate potential returns against the risks associated with new market entry.

Qantas's question marks are areas of high growth but low market share. These initiatives require significant investment. Successful question marks can become stars, driving future growth. Qantas must carefully assess investments.

| Initiative | Investment (2024) | Strategic Goal |

|---|---|---|

| New Routes | Marketing & Operational Costs | Increase market share |

| SAF | $200M by end-2024 | Cut emissions by 25% by 2030 |

| Digital Transformation | $400M (2024) | Enhance efficiency |

BCG Matrix Data Sources

The Qantas BCG Matrix uses company financials, aviation industry data, market research, and expert opinions to inform each strategic position.