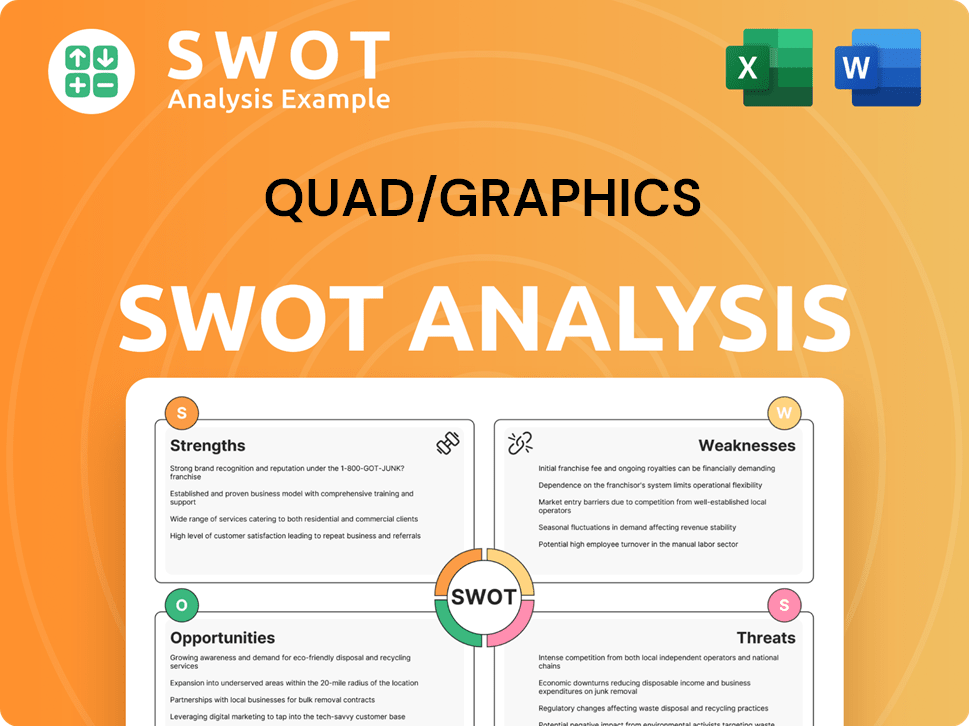

Quad/Graphics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quad/Graphics Bundle

What is included in the product

Outlines the strengths, weaknesses, opportunities, and threats of Quad/Graphics.

Simplifies Quad/Graphics' complex data for strategic business reviews.

Preview Before You Purchase

Quad/Graphics SWOT Analysis

Take a peek at the actual Quad/Graphics SWOT analysis document.

What you see below is what you get: a comprehensive, in-depth report.

There are no content differences between the preview and the purchased version.

Purchase today, and the complete analysis is yours.

It's that straightforward!

SWOT Analysis Template

Our Quad/Graphics SWOT analysis reveals key insights into the company's strengths, weaknesses, opportunities, and threats. We've explored areas like market position and financial performance. What you've seen is just the beginning. Gain full access to a professionally formatted, investor-ready SWOT analysis of the company, including both Word and Excel deliverables. Customize, present, and plan with confidence.

Strengths

Quad/Graphics' strength lies in its integrated marketing platform, positioning it as a marketing experience company. This platform offers a comprehensive suite of services, including creative, production, media, and technology solutions. This integrated approach simplifies marketing complexities for clients. In 2024, the company reported $3.1 billion in net sales, showcasing the scale of its integrated offerings.

Quad/Graphics' proprietary data stack is a significant strength. It offers a competitive edge through its extensive reach, covering a substantial portion of US households. This data, containing billions of validated points, fuels audience intelligence and activation services. In 2024, Quad's data-driven solutions generated approximately $500 million in revenue.

Quad/Graphics has strategically reduced its net debt, showcasing strong financial management. This proactive approach has fortified its balance sheet. In 2024, Quad reported a net debt reduction, enhancing its ability to invest in growth. This financial discipline supports future strategic initiatives.

Strategic Investments and Acquisitions

Quad/Graphics strategically invests and acquires to boost its market position. They focus on innovative offerings, like data-driven solutions and AI. In 2024, Quad invested $30 million in AI and data analytics. This includes co-mailing asset acquisitions for better postal optimization. These moves aim to improve efficiency and expand their service portfolio.

- Data-driven solutions and AI capabilities investments.

- Acquisition of co-mailing assets for postal optimization.

- $30 million invested in AI and data analytics in 2024.

Expansion in Targeted Print and Other Services

Quad/Graphics capitalizes on targeted print's growth, especially in catalogs and direct marketing, while expanding its In-Store Connect retail media network. This strategic shift helps offset declines in traditional print. The company is also focusing on higher-margin areas, including packaging and digital services. This diversification is crucial for sustained financial health. In Q1 2024, Quad reported net sales of $793 million, with packaging solutions growing.

- Targeted Print Growth: Catalogs, direct marketing.

- Retail Media Expansion: In-Store Connect network.

- Focus on Margins: Packaging and digital services.

- Q1 2024: Net sales of $793 million.

Quad/Graphics leverages an integrated marketing platform to offer comprehensive creative, production, media, and technology solutions. Their proprietary data stack, boasting billions of data points, enhances audience intelligence, driving approximately $500 million in data-driven revenue in 2024. The company's strategic investments include $30 million in AI and data analytics and acquisitions. Quad capitalizes on targeted print growth, retail media expansion, and high-margin services to offset declines.

| Strength | Details | 2024 Data |

|---|---|---|

| Integrated Platform | Comprehensive suite of services | $3.1B Net Sales |

| Data Stack | Billions of data points | $500M Data-driven Revenue |

| Strategic Investments | AI, acquisitions, etc. | $30M AI Investment |

Weaknesses

Quad/Graphics faces declining net sales, a significant weakness. In 2024, net sales decreased, and Q1 2025 continued this trend compared to prior periods. This decline stems from lower paper sales and reduced print volumes. The loss of major clients also contributes to this financial challenge.

Quad/Graphics faced a setback with negative free cash flow in Q1 2025. This is a decline from Q1 2024, signaling potential financial strain. The increase in cash used in operating activities, partly due to inventory purchases, contributed to this negative trend. For instance, the company's cash flow from operations decreased by $15 million in Q1 2025.

The loss of major clients, like a key grocery chain, significantly hurts Quad's sales. This issue affects both print and agency services, showcasing a reliance on a few big accounts. Recent data reveals a sales dip tied to losing key contracts, indicating a vulnerability to client turnover. This dependence makes Quad susceptible to market shifts and client decisions. The company's financial reports from 2024/2025 often reflect these impacts.

High Capital Expenditure Requirements

Quad/Graphics faces high capital expenditure requirements due to its need to maintain advanced printing technology, which can strain financial resources. This includes significant investments in state-of-the-art machinery and regular upgrades to stay competitive. For instance, in 2024, the company allocated approximately $100 million for capital expenditures to support its operations and technology enhancements. These costs can impact profitability, especially during economic downturns, as seen in 2023 when such expenses rose by 5%.

- High upfront costs for new equipment purchases.

- Ongoing expenses for maintenance and repairs.

- Potential for technological obsolescence requiring frequent upgrades.

- Impact on cash flow and financial flexibility.

Sensitivity to Economic Downturns

Quad/Graphics faces the challenge of being sensitive to economic downturns. Economic fluctuations can significantly affect the company's performance. Clients often cut advertising and marketing budgets during recessions, which directly reduces the demand for Quad's services. This sensitivity can lead to revenue and profit declines. For instance, in 2023, the company's net sales were $3.3 billion, a decrease from $3.5 billion in 2022, reflecting economic pressures.

- Reduced marketing spend during downturns.

- Potential impact on revenue and profitability.

- Economic cycles influence service demand.

- Financial performance can be volatile.

Quad/Graphics is dealing with decreased sales, evident in Q1 2025's decline. They struggle with negative free cash flow, influenced by operational costs. Loss of key clients highlights revenue concentration risks.

| Weaknesses | Description | Impact |

|---|---|---|

| Declining Sales | Net sales reduction from Q1 2025 compared to 2024 due to reduced paper sales and print volumes. | Potential impact on revenue and profitability and decreased net sales by $100M. |

| Negative Free Cash Flow | Negative free cash flow in Q1 2025, which decreased by $15 million. | Strain on financial flexibility and reduced capital for investments. |

| Client Dependence | Loss of significant clients impacts print and agency services. | Vulnerability to market shifts and client decisions, which can reduce profit up to 10%. |

Opportunities

The digital printing and personalization market is expanding. Quad/Graphics can use its current setup to grow digital services. The global digital printing market was valued at $28.5 billion in 2023 and is projected to reach $40 billion by 2028. This growth presents Quad with opportunities.

The digital printing and integrated marketing sectors are expanding, offering Quad/Graphics growth prospects. Quad's shift towards a marketing experience company fits this trend, enabling cross-channel solutions. This strategic alignment is crucial in a market projected to reach $27.7 billion by 2025, with a CAGR of 10.2% from 2024. Quad can leverage this by enhancing its service offerings, improving market share and profitability.

Quad/Graphics could acquire businesses in growing print tech areas or enhance its marketing services. In 2024, Quad's revenue was about $3.3 billion. Strategic acquisitions could boost this figure. The company has a history of successful integrations, which supports this opportunity. Such moves could broaden Quad's market reach and service offerings.

Increasing Need for Sustainable Printing Solutions

The rising interest in sustainable printing is a significant opportunity for Quad/Graphics. This shift allows Quad to stand out by offering eco-friendly services, attracting clients focused on environmental responsibility. In 2024, the sustainable printing market grew, with projections estimating a continued increase in demand through 2025. This trend aligns with consumer preferences and corporate sustainability goals, potentially boosting Quad's market share.

- Market growth for sustainable printing solutions is projected at 8-10% annually through 2025.

- Companies are increasingly setting environmental targets, driving demand for green printing.

- Quad can leverage certifications like FSC to showcase its commitment to sustainability.

Developing Value-Added Services

Quad/Graphics can boost revenue by offering services beyond printing, like digital asset management and marketing tech. This expansion into digital services could attract new clients and increase customer spending. For example, in 2024, the marketing services sector saw a 7% growth. The company's ability to adapt and offer these services could significantly improve its market position and financial performance.

- Digital Asset Management: Streamlines content storage and distribution.

- Marketing Technology Services: Offers data-driven marketing solutions.

- Content Creation: Provides custom content for various platforms.

- Increased Revenue: Diversifies income streams.

Quad/Graphics can seize growth by expanding into digital services like marketing tech, boosted by a 7% sector increase in 2024. Sustainable printing offers a 8-10% annual market surge through 2025. Acquisitions and eco-friendly options help Quad gain market share and enhance profitability.

| Opportunity | Details | Data |

|---|---|---|

| Digital Services Expansion | Offer digital asset management, marketing tech, and content creation. | Marketing services grew by 7% in 2024. |

| Sustainable Printing | Offer eco-friendly printing solutions. | Sustainable printing market projected at 8-10% annual growth through 2025. |

| Strategic Acquisitions | Acquire companies in print tech and marketing services. | Quad's 2024 revenue was approximately $3.3B. |

Threats

Quad/Graphics faces a persistent threat from the decline in traditional print media. The digital shift continues to erode demand, directly impacting its core print business. Projections for the global print media market indicate a continued downturn. In 2024, the market is expected to shrink further, reflecting the ongoing trend. This poses a significant challenge.

Rising paper costs and supply chain issues pose significant threats to Quad/Graphics. Fluctuating paper prices directly affect operational expenses and profitability. In Q1 2024, lower paper sales were a factor in declining net sales, as reported by the company. The volatility in these areas requires careful management to mitigate financial impacts.

Increased postal rates pose a threat by raising clients' marketing expenses. This could decrease demand for direct mail services, a core Quad/Graphics offering. In 2024, the USPS implemented rate increases, impacting businesses heavily. For example, the price of a First-Class Mail Forever stamp rose to 68 cents. This impacts Quad's revenue.

Intensified Competition

Quad/Graphics faces intense competition in printing and marketing services, which can squeeze profit margins. Competitors constantly innovate, pressuring pricing strategies. The company must adapt to maintain its market position. The industry's competitive nature presents ongoing challenges.

- In 2024, Quad/Graphics' gross profit margin was approximately 14.5%, reflecting pricing pressures.

- The marketing services sector is seeing increased competition from digital platforms.

- Ongoing investments in technology are necessary to stay competitive.

Macroeconomic Conditions and Recessionary Pressures

Uncertain economic conditions and the risk of a recession pose significant threats to Quad/Graphics. Businesses often reduce advertising and marketing budgets during economic downturns, directly impacting Quad's revenue. For instance, in 2023, the advertising market faced fluctuations, with digital ad spending growth slowing to around 7-8%, according to recent reports.

This trend can lead to decreased demand for Quad's printing and marketing services. Moreover, rising inflation and interest rates may increase operational costs, squeezing profit margins.

This can make it harder for Quad to maintain its financial performance.

- Advertising spending is directly related to economic cycles, with downturns leading to cuts.

- Inflation and interest rates can increase Quad's operational costs, affecting profitability.

- Recessionary pressures can lead to decreased demand for printing and marketing services.

Quad/Graphics faces ongoing threats from declining print media demand and competition from digital platforms. Rising costs for paper, postal rates, and labor also squeeze margins. Economic downturns can reduce advertising spending, impacting revenue.

| Threat | Impact | 2024 Data |

|---|---|---|

| Print Decline | Reduced demand | Global print market declined 2-3% |

| Cost Increases | Margin pressure | Paper prices up 5-7% (Q1) |

| Economic Slowdown | Decreased ad spend | Advertising growth slowed to ~8% in 2023. |

SWOT Analysis Data Sources

The Quad/Graphics SWOT draws on SEC filings, market analysis, and expert publications for data-driven insights.