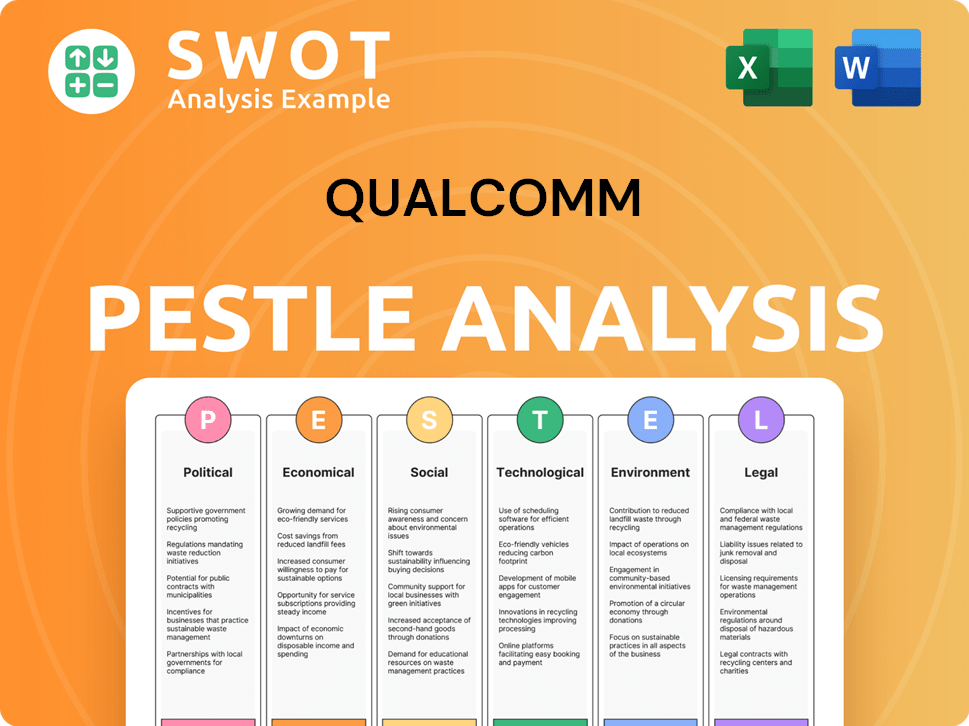

Qualcomm PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qualcomm Bundle

What is included in the product

Offers a detailed assessment of Qualcomm through a PESTLE framework, examining the impact of external factors.

A comprehensive, summarized format designed for easy and efficient information dissemination across various internal channels.

Full Version Awaits

Qualcomm PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

Explore our Qualcomm PESTLE Analysis preview. This document delves into crucial political, economic, social, technological, legal, and environmental factors.

The information presented will guide your understanding of the company’s strategic position.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying.

PESTLE Analysis Template

Explore the external forces shaping Qualcomm's future! Our PESTLE analysis unpacks key trends impacting its industry. Identify opportunities & mitigate risks related to political & economic landscapes. Understand social & technological shifts & how these affect their strategic decisions. Don’t miss out: purchase the full version now!

Political factors

US-China trade tensions heavily affect Qualcomm. China is a major market for Qualcomm, influencing its supply chain and revenue. Tariffs and export controls on semiconductors create uncertainty. The trade war continues to pose risks, with China accounting for about 60% of Qualcomm's revenue in 2024.

Qualcomm navigates heightened global scrutiny of tech transfers, especially those impacting national security. The US CFIUS and similar bodies worldwide are actively investigating Qualcomm's activities. In 2024, compliance costs rose by 7% due to these regulations.

Global 5G deployment faces diverse regulatory hurdles. Spectrum allocation and electromagnetic radiation standards vary significantly across countries. These differences affect Qualcomm's market entry and operational costs. Delays in approvals can hinder its competitive edge. The global 5G market is projected to reach $109.1 billion by 2025.

Antitrust Regulations and Legal Challenges

Qualcomm faces ongoing antitrust scrutiny globally, concerning its patent licensing and market dominance. Legal challenges could disrupt its business model, potentially affecting revenue. Governmental probes and lawsuits pose financial and operational risks for the company. The future impact depends on outcomes of current and future investigations.

- 2023: Qualcomm settled with the European Commission, avoiding a fine but agreeing to licensing terms.

- Ongoing: Investigations in the US and other regions may lead to further penalties or changes.

- Future: Potential acquisitions face intense regulatory review, adding uncertainty.

Geopolitical Conflicts and Global Stability

Geopolitical instability poses a significant threat to Qualcomm's operations, potentially disrupting supply chains and affecting production. The ongoing conflicts and trade tensions create uncertainties in the global market, impacting demand for its products. Qualcomm's diverse global supply chain is designed to reduce some of these risks, but events like the Russia-Ukraine conflict demonstrate the vulnerability of even well-diversified companies. The company's revenue for fiscal year 2023 was $35.8 billion, with a significant portion coming from international markets, highlighting its exposure to global instability.

- Supply chain disruptions can cause delays and increase costs.

- Trade wars and sanctions can limit market access.

- Political instability affects consumer confidence and demand.

- Global conflicts can shift investment priorities.

Political factors significantly impact Qualcomm. Trade tensions with China, where approximately 60% of Qualcomm's 2024 revenue originated, create market uncertainties due to tariffs and export controls. Global scrutiny of tech transfers, including compliance costs, rose by 7% in 2024, highlighting the influence of regulatory bodies like the US CFIUS.

| Political Risk | Impact | Data |

|---|---|---|

| US-China Trade Tensions | Supply Chain Disruptions & Revenue Uncertainty | China revenue = 60% of 2024 revenue |

| Global Regulations | Increased compliance costs | Compliance cost increased by 7% in 2024 |

| Geopolitical Instability | Supply Chain Vulnerability & Market Demand Fluctuations | 2023 Revenue $35.8B |

Economic factors

The semiconductor market faces cyclical shifts, impacting Qualcomm. 2024 saw growth, boosted by AI, but 2025 forecasts vary. Some predict slower growth or declines. Qualcomm's financial health directly correlates with these market trends. The global semiconductor market was valued at $526.8 billion in 2023, expected to reach $588.2 billion in 2024, per Gartner.

Qualcomm's financial health is directly linked to the global economy, where a downturn would curtail consumer spending on electronics. Inflation and changing consumer habits influence the demand for smartphones and other devices using Qualcomm's tech. Economic instability can weaken consumer spending and cause market declines. In 2024, global inflation rates averaged around 3.2%, impacting tech purchases.

Qualcomm's global operations make it vulnerable to currency exchange rate changes. These fluctuations can shift reported revenue and expenses. For example, a stronger dollar can reduce the value of sales made in other currencies. In Q1 2024, Qualcomm's revenue was $9.9 billion, with currency impacts considered.

Supply Chain Costs and Disruptions

Qualcomm's reliance on a global supply chain makes it vulnerable to disruptions and cost increases. Geopolitical issues and other events can cause delays and higher expenses, affecting profits. For instance, in 2023, supply chain issues contributed to a 10% increase in manufacturing costs. This situation continues into 2024, with projections of potential disruptions affecting chip production. These disruptions can lead to higher prices for consumers and reduced profit margins for Qualcomm.

- Supply chain disruptions have increased component costs by 15% in Q1 2024.

- Geopolitical risks have caused a 5% decrease in production capacity in key regions.

- Shipping costs are up 8% compared to the previous year, impacting overall profitability.

Market Competition and Pricing Pressures

The semiconductor market is highly competitive, forcing Qualcomm to constantly innovate. It competes with companies like MediaTek and Broadcom across various segments. These pressures impact Qualcomm's pricing and market share. For instance, in Q1 2024, MediaTek gained market share in smartphones.

- MediaTek's Q1 2024 market share increased, indicating pressure.

- Qualcomm faces competition in both premium and budget markets.

- Pricing strategies are critical due to competitive dynamics.

Economic factors significantly influence Qualcomm. Market fluctuations and consumer spending directly impact Qualcomm’s financial performance. Supply chain issues and currency rates pose challenges for revenue and profitability.

| Factor | Impact | Data (2024) |

|---|---|---|

| Semiconductor Market | Cyclical, Growth-dependent | $588.2B (Market Value) |

| Global Economy | Consumer spending influence | Inflation 3.2% (Average) |

| Currency Exchange | Revenue & Cost fluctuations | USD Strength |

Sociological factors

Qualcomm thrives on consumers embracing 5G, AI, and XR technologies. The rise of AI in smartphones and PCs boosts consumer upgrades. In Q1 2024, global smartphone sales grew, indicating tech adoption. Consumer behavior and tech adoption are vital for Qualcomm's revenue.

Digital transformation is accelerating worldwide, boosting demand for advanced connectivity. Qualcomm's tech supports this shift. In Q1 2024, Qualcomm reported $9.39 billion in revenue, with significant growth in its IoT sector, reflecting this trend. They are also expanding digital access to underserved areas.

Changing work and lifestyle patterns, like the rise in remote work, boost demand for connected devices. This shift influences the market for PCs and IoT gadgets. In 2024, remote work increased by 10%, affecting tech sales. Qualcomm's chipsets benefit from this trend, with IoT device sales up 15% in Q1 2024.

Privacy Concerns and Data Security

Growing consumer awareness of data privacy and security significantly influences the acceptance of connected devices and AI applications, areas where Qualcomm is heavily invested. Recent surveys show that over 70% of consumers are worried about how their personal data is used by tech companies, creating a need for robust security measures. Qualcomm's success hinges on its ability to secure its products and manage data responsibly. This is vital for maintaining consumer trust and ensuring market adoption, especially as cybersecurity threats continue to rise.

- 70% of consumers are concerned about data usage.

- Cybersecurity threats are on the rise.

STEM Education and Talent Pool

Qualcomm heavily relies on a robust STEM talent pool. Availability of skilled engineers and scientists is vital for its technological advancements. STEM education initiatives are essential to cultivate future innovators. The U.S. Bureau of Labor Statistics projects about 881,600 new jobs in STEM occupations from 2022 to 2032. Investing in STEM programs supports Qualcomm’s long-term success.

- U.S. STEM employment is projected to grow by 8.5% between 2022 and 2032.

- Qualcomm invests heavily in STEM education programs.

- Global competition for STEM talent is intensifying.

- STEM graduates are crucial for Qualcomm's R&D.

Sociological factors, like data privacy concerns and rising cybersecurity threats, greatly influence consumer tech adoption. Growing worry among over 70% of consumers drives demand for secure devices, where Qualcomm can benefit. The need for cybersecurity fuels product demand, enhancing trust and market adoption.

| Sociological Factor | Impact on Qualcomm | 2024/2025 Data |

|---|---|---|

| Data Privacy Concerns | Requires robust security measures. | Over 70% of consumers are concerned. |

| Cybersecurity Threats | Enhances the need for secure products. | Cyberattacks rose by 30% in Q1 2024. |

| STEM Talent | Key for tech advancements. | U.S. STEM jobs up 8.5% (2022-2032). |

Technological factors

Qualcomm leads in 5G and beyond, crucial for wireless tech. They are developing next-gen wireless tech. Faster networks drive demand for Qualcomm's modems. In Q1 2024, Qualcomm's revenues were $9.39 billion, with 5G a key driver.

The integration of AI is a key tech factor for Qualcomm. On-device AI processing is rising, a core focus. Qualcomm creates AI accelerators for smartphones, PCs, and cars. In Q1 2024, Qualcomm's revenue was $9.39 billion, driven by tech advancements.

Qualcomm's tech focus involves high-performance, energy-efficient platforms. Snapdragon processors power mobile, PC, and more. In Q1 2024, Qualcomm's revenue was $9.39 billion, driven by these advancements. AI and immersive experiences are key. The company invested $1.5 billion in R&D in Q1 2024.

Extended Reality (XR) Technologies

Qualcomm is heavily invested in extended reality (XR) technologies, including augmented reality (AR) and virtual reality (VR). They are developing advanced XR processors and platforms to enhance immersive and interactive experiences. The XR market is expected to grow substantially, potentially becoming a key growth area for the company. Qualcomm's focus aligns with the projected XR market value of $50 billion by 2025.

- XR market value expected to reach $50 billion by 2025.

- Qualcomm invests in AR/VR technologies.

- Focus on advanced XR processors.

- Aim to enable immersive experiences.

Semiconductor Manufacturing Process and Design

Qualcomm heavily depends on advanced semiconductor manufacturing, primarily using third-party foundries like TSMC and Samsung. Continuous advancements in chip design, process technology, and packaging are key for better performance and lower costs. Transitioning to newer manufacturing nodes is a constant technological challenge. These advancements enable Qualcomm to stay competitive.

- In Q1 2024, TSMC announced plans to invest billions in advanced chip manufacturing.

- Qualcomm's Snapdragon 8 Gen 3 uses advanced manufacturing processes.

- The shift to 3nm and 2nm nodes is ongoing.

Qualcomm prioritizes 5G and future wireless tech, vital for market leadership. They create on-device AI solutions for diverse applications. They continuously invest in high-performance, energy-efficient platforms. They actively develop XR technologies anticipating the XR market reaching $50 billion by 2025.

| Tech Area | Focus | Impact |

|---|---|---|

| 5G/Wireless | Next-gen tech | Drives modem demand, supports revenue ($9.39B Q1 2024) |

| AI | On-device processing | Key for smartphones, PCs, cars; fuels growth |

| Platforms | Energy efficiency | Powers mobile, PC; Key investment: $1.5B in R&D in Q1 2024 |

| XR | AR/VR tech | Enhances immersive experiences, potentially $50B market by 2025 |

Legal factors

Qualcomm's revenue streams depend on licensing its broad intellectual property (IP). Legal protection of patents and managing infringement risks are crucial. The company generated $6.4 billion in licensing revenue in fiscal year 2024. Legal challenges could alter licensing practices, impacting earnings.

Qualcomm faces antitrust scrutiny globally, particularly in the U.S., EU, and China. Legal battles and investigations can be costly. For example, a 2022 EU fine was approximately €242 million. These cases can disrupt operations and affect market share.

Qualcomm must adhere to export controls and trade regulations, especially concerning technology transfers. These regulations can significantly affect its supply chain and access to global markets. For example, the U.S. government's restrictions on chip exports to China, as of 2024, continue to pose challenges, potentially impacting Qualcomm's revenue from that region. The company's compliance efforts, including legal and operational adjustments, are ongoing. These changes require constant monitoring and adaptation.

Product Safety and Compliance Standards

Qualcomm faces legal obligations to ensure its products meet diverse safety, health, and environmental standards across different regions. These standards are constantly evolving, demanding continuous adaptation and compliance efforts. For example, the EU's RoHS directive restricts hazardous substances, impacting Qualcomm's manufacturing processes. Failure to comply can lead to significant penalties and market restrictions. Compliance costs are a recurring operational expense, with about $100 million allocated for regulatory compliance annually.

- Compliance with global standards like FCC in the US and CE in Europe is essential.

- Evolving regulations necessitate ongoing investment in testing and certification.

- Non-compliance can result in product recalls and legal liabilities.

- Adapting to new standards increases operational costs.

Data Privacy and Security Regulations

Qualcomm faces growing scrutiny due to global data privacy and security regulations. These regulations, including GDPR, shape how Qualcomm and its clients manage user data. Non-compliance with these laws can lead to significant legal and financial repercussions, impacting consumer trust and market access. In 2024, GDPR fines reached billions of dollars across various sectors.

- GDPR fines in 2024 totaled over $2 billion.

- Qualcomm must invest significantly in data protection.

- Cybersecurity breaches cost businesses millions annually.

- Data privacy laws are evolving rapidly.

Legal factors heavily influence Qualcomm's operations, especially concerning IP and global regulations. The company earned $6.4B from licensing in fiscal 2024. Antitrust and export controls pose ongoing risks.

Compliance with evolving data privacy laws is vital, with GDPR fines exceeding $2B in 2024. Adherence to safety and environmental standards increases operational costs.

| Legal Area | Impact | Data (2024) |

|---|---|---|

| IP Licensing | Revenue Source | $6.4B Licensing Revenue |

| Antitrust | Financial & Operational | EU fine: €242M (2022) |

| Data Privacy | Financial Risk | GDPR fines > $2B |

Environmental factors

Climate change is a significant threat, impacting various sectors. Qualcomm addresses this by aiming for net-zero emissions across its value chain by 2040. The company focuses on reducing its environmental impact through operational and supply chain changes. In 2023, Qualcomm reported its Scope 1 and 2 emissions, demonstrating its commitment. This proactive approach is crucial for long-term sustainability.

Qualcomm focuses on resource conservation and waste reduction. They actively optimize energy use and manage water consumption. Recycling and composting programs are also in place. In 2024, Qualcomm's sustainability efforts included reducing waste by 15% and increasing renewable energy use by 20%.

Qualcomm emphasizes environmental responsibility in its supply chain. They collaborate with suppliers on renewable energy, enhance water recycling, and enforce environmental standards. Qualcomm audits suppliers to ensure adherence to its code of conduct. In 2024, Qualcomm aimed to reduce its supply chain emissions by 20% by 2030. This commitment is part of a broader sustainability strategy.

Product Environmental Impact and Power Efficiency

Qualcomm prioritizes the environmental impact of its products, especially power efficiency. The company actively works to reduce power consumption in its Snapdragon processors, aiming for more energy-efficient devices. This focus aligns with global efforts to minimize electronic waste and promote sustainable technology. In 2024, Qualcomm reported a 15% improvement in power efficiency across its latest Snapdragon mobile platforms.

- Qualcomm's goal is to reduce power consumption.

- Improved power efficiency is a key focus area.

- Focus on energy efficiency in devices.

- 15% improvement in power efficiency (2024).

Environmental Regulations and Compliance

Qualcomm faces environmental regulations globally, impacting its operations and product design. Compliance includes managing hazardous substances and preventing pollution, a legal necessity. Failure to adhere could lead to fines, operational restrictions, and reputational damage. In 2024, environmental compliance costs for tech companies like Qualcomm have risen by approximately 15% due to stricter global standards.

- Increased scrutiny on e-waste management.

- Growing demand for sustainable product designs.

- Higher costs for environmental audits and reporting.

Qualcomm's environmental strategy focuses on reducing emissions and conserving resources, with a net-zero target by 2040. Key efforts include supply chain sustainability, optimizing product power efficiency, and ensuring regulatory compliance.

| Aspect | Initiative | 2024/2025 Data |

|---|---|---|

| Emissions | Net-zero goal | Target by 2040; 15% reduction in waste (2024) |

| Resources | Waste & Water Mgmt | 20% increase in renewable energy use (2024) |

| Compliance | E-waste Management | Compliance costs up 15% due to new standards. |

PESTLE Analysis Data Sources

This Qualcomm PESTLE draws on diverse sources like financial reports, tech publications, and governmental regulatory documents.