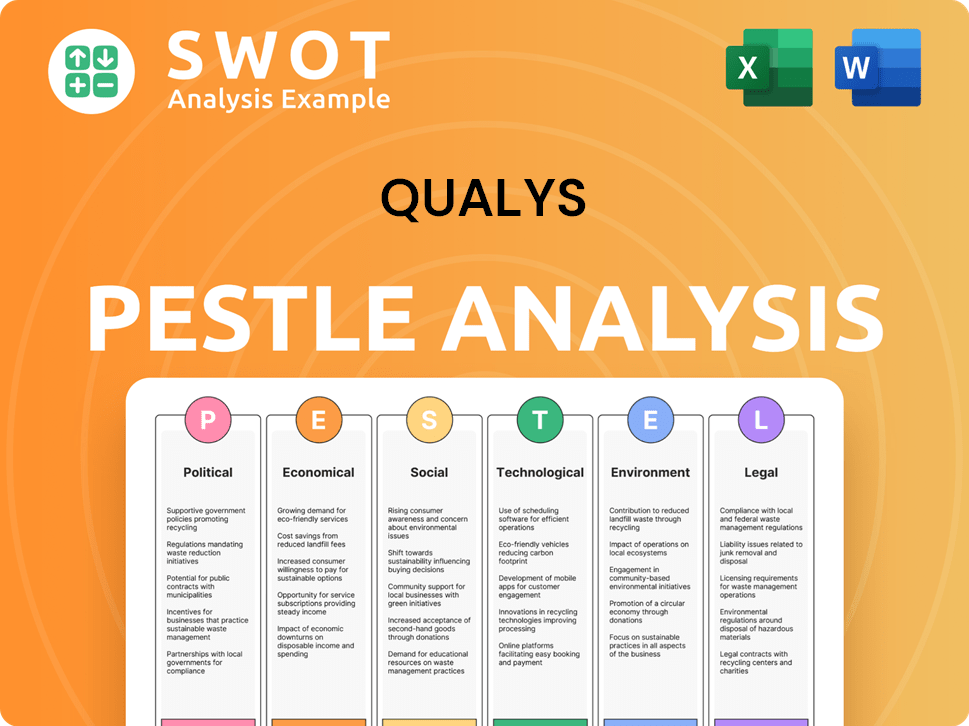

Qualys PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qualys Bundle

What is included in the product

Examines external factors that impact Qualys across political, economic, social, tech, environmental, and legal dimensions.

A comprehensive report that aids in efficient strategic discussions. It also highlights key areas to focus on for potential solutions.

Same Document Delivered

Qualys PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

Explore this Qualys PESTLE analysis to understand its strategic landscape.

You’ll examine crucial Political, Economic, Social, Technological, Legal, and Environmental factors.

This comprehensive overview is exactly what you receive instantly.

Buy now to access and utilize this complete document.

PESTLE Analysis Template

Explore the external factors impacting Qualys with our PESTLE analysis. Discover political, economic, social, technological, legal, and environmental influences. Uncover market opportunities and potential threats facing the company. Gain valuable insights to inform strategic decisions and understand the competitive landscape. Enhance your market analysis with the full report – download now!

Political factors

Governments globally are tightening cybersecurity regulations, impacting companies like Qualys. Data privacy laws like GDPR and CCPA necessitate compliance. Qualys must adapt its solutions to meet these evolving requirements. This ensures market access and product relevance. The global cybersecurity market is projected to reach $345.7 billion in 2024.

The geopolitical landscape heavily impacts cybersecurity demands. State-sponsored cyberattacks and warfare drive the need for strong defenses. Qualys' solutions are critical as threats from nations grow, with cyberattacks increasing 38% globally in 2024. The global cybersecurity market is projected to reach $345.7 billion in 2025.

Government cybersecurity budgets are crucial. Increased spending on national cyber defenses creates opportunities for Qualys. In 2024, the U.S. government allocated over $11 billion to cybersecurity. Budget cuts, however, could hinder government contracts. The U.S. federal government's cybersecurity spending is projected to reach $22.5 billion by 2025.

International Cooperation and Treaties

International agreements and treaties significantly shape Qualys' operational landscape. These agreements, particularly those addressing cybercrime and data sharing, directly influence the legal frameworks Qualys navigates. The harmonization or divergence of cybersecurity standards across different nations can impact the complexity of Qualys' solutions.

- In 2024, global cybersecurity spending reached $214 billion, reflecting the growing importance of international cooperation.

- The EU-US Data Privacy Framework, finalized in 2023, impacts data transfer and compliance for companies like Qualys.

- Cybersecurity incidents increased by 38% in 2024, highlighting the need for standardized international responses.

Political Stability in Key Markets

Political stability is crucial for Qualys's operations, especially in key markets. Instability, such as policy changes or civil unrest, directly impacts business. For instance, the cybersecurity market in Latin America, which grew by 13.2% in 2024, could be affected by political shifts. These changes can disrupt supply chains and alter regulatory landscapes.

- Cybersecurity spending in EMEA is projected to reach $82.4 billion in 2025.

- Political risks in regions like the Middle East, where cybersecurity spending is rising, pose challenges.

- Changes in data privacy laws due to political factors can impact compliance costs.

Political factors critically shape Qualys' market environment. Cybersecurity regulations, such as GDPR, are consistently updated globally. These laws affect data handling. In 2024, worldwide spending reached $214 billion on cybersecurity.

| Political Factor | Impact on Qualys | Data Point (2024/2025) |

|---|---|---|

| Cybersecurity Regulations | Mandates compliance; affects product development and market access. | Global cybersecurity market size: $345.7 billion in 2024 and 2025. |

| Geopolitical Instability | Increases the demand for robust cybersecurity solutions. | Cyberattacks increased by 38% globally in 2024. |

| Government Spending | Influences contract opportunities and revenue potential. | US federal cybersecurity spending: $22.5 billion projected by 2025. |

Economic factors

The global economic climate significantly affects IT spending and cybersecurity investments. Economic recessions often lead to budget cuts, potentially slowing Qualys' revenue. However, a robust global economy typically boosts security infrastructure investments. The World Bank projected global GDP growth of 2.6% in 2024, rising to 2.7% in 2025, which could influence Qualys' financial performance positively.

Qualys, as a global entity, faces currency exchange rate risks. Fluctuations can alter operational costs across regions. For example, a strong dollar in 2024/2025 could make international expansion more expensive. Currency shifts directly affect reported financials, potentially impacting profitability when converting foreign revenues.

Inflation can drive up Qualys' operational costs, impacting profitability; in 2024, the US inflation rate fluctuated, affecting business planning. Higher interest rates might increase borrowing costs for Qualys and its clients, potentially slowing investment in cybersecurity. The Federal Reserve's decisions in 2024 and early 2025 on interest rates directly impact Qualys' financial strategy. For example, a 0.25% rate hike will impact the borrowing costs.

Competition and Pricing Pressures

The cybersecurity market is intensely competitive, featuring many vendors providing similar services. This rivalry can drive down prices, affecting Qualys' profitability and market share. For example, in 2024, the average selling price (ASP) for cybersecurity solutions saw a 3% decrease due to heightened competition. Qualys needs to continuously innovate and showcase its value to stay ahead. Maintaining a competitive edge requires strategic pricing and enhanced service offerings to retain its customer base.

- ASP decline in 2024: 3%

- Market competition: High, numerous vendors

- Impact: Pressure on profitability

- Requirement: Continuous innovation

Market Growth in Cloud Solutions

The global market's shift towards cloud computing is a primary economic driver for Qualys. Cloud security solutions are in high demand as businesses worldwide increasingly adopt cloud services. The cloud security market's growth rate directly impacts Qualys' revenue and expansion potential. According to Gartner, the worldwide public cloud services market is projected to reach $678.8 billion in 2024, growing over 20% annually.

- Market growth is fueled by digital transformation.

- Qualys capitalizes on this trend with its cloud-based security platform.

- Revenue growth is linked to the adoption rate of cloud services.

Economic factors influence IT spending. The World Bank predicts 2.7% global GDP growth in 2025, possibly boosting Qualys' performance. Fluctuating exchange rates, especially the USD, impact costs. Inflation and interest rate changes affect borrowing costs, shaping financial strategies.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| GDP Growth | IT spending and revenue | 2.7% (projected, 2025) |

| Exchange Rates | Operational costs | USD impact on int'l costs |

| Inflation/Interest Rates | Borrowing and Investment costs | Fed rate decisions in focus |

Sociological factors

Growing public and business awareness of cyber threats fuels demand for security solutions. Recent data shows a 28% rise in global cyberattacks in 2024, with costs projected to reach $10.5 trillion by 2025. This environment favors companies like Qualys.

The persistent shortage of skilled cybersecurity professionals forces organizations to seek external help. This shortage drives demand for automated security solutions. The global cybersecurity workforce gap reached 3.4 million in 2024, according to (ISC)². Qualys benefits from this trend. Their platform automates security tasks, easing the skills shortage impact.

The rise of remote and hybrid work models has significantly altered how businesses operate, expanding the attack surface for cybersecurity threats. This shift necessitates robust security measures to protect distributed workforces. Qualys' cloud-based platform offers solutions to secure remote endpoints. According to a 2024 report, 70% of companies plan to maintain or increase remote work.

Customer Demand for Integrated Solutions

Customer demand is shifting towards integrated security and compliance solutions for a unified IT view and automated tasks. Qualys' platform, with its suite of integrated applications, directly addresses this need. This approach simplifies security management and reduces operational overhead. The market reflects this trend, with the integrated risk management market projected to reach $21.5 billion by 2025.

- The demand for integrated solutions is growing.

- Qualys' platform offers a unified approach.

- This aligns with market trends.

- The integrated risk market is growing.

Trust and Reputation

In the cybersecurity sector, trust and reputation are critical. Clients must believe their security vendor can safeguard their sensitive data and systems. Qualys' established presence and commitment to dependable solutions help build and sustain customer trust. This is reflected in its strong customer retention rates. For example, Qualys reported a customer retention rate of over 90% in 2024. The company's commitment to transparency and compliance further solidifies its reputation.

- Customer retention rates of over 90% in 2024.

- Focus on delivering reliable solutions.

- Commitment to transparency and compliance.

Societal focus on data protection grows, boosting demand for cybersecurity. A 2024 survey found 75% of businesses prioritize data security. Heightened public awareness, especially post-breaches, increases the need for trusted security providers.

Cybersecurity skills shortage leads to automation demand. The industry faces a persistent talent gap, compelling organizations to seek automated security tools. Automated solutions market growth is projected to hit $40 billion by 2025.

Remote work models continue, demanding security solutions. The shift towards remote work necessitates robust cybersecurity, which Qualys can supply, catering to distributed workforces. The global remote workforce is estimated to reach 70% by the end of 2025.

| Factor | Impact | 2025 Projection |

|---|---|---|

| Data Protection | Increased demand | Market size of $300B |

| Skills Shortage | Automation focus | Automated security at $40B |

| Remote Work | Distributed Security | Remote workers: 70% |

Technological factors

Qualys faces opportunities and challenges due to cloud computing advancements. The company must adapt its platform to secure evolving cloud environments. In 2024, the global cloud computing market was valued at $670 billion, projected to reach $800 billion by 2025. Qualys needs to integrate with new cloud technologies to stay competitive.

The rise of AI and ML significantly impacts cybersecurity. Qualys can improve threat detection using AI and ML. The global AI in cybersecurity market is projected to reach $46.3 billion by 2025. Attackers also use these technologies, demanding constant innovation. The cybersecurity market is expected to grow by 12-15% annually through 2025.

The Internet of Things (IoT) is rapidly expanding, with an estimated 14.4 billion active IoT devices worldwide in 2022, projected to reach 27 billion by 2025. This growth significantly broadens the attack surface for organizations. Qualys' ability to identify and secure these devices is crucial, given the increased cyber threats associated with IoT expansion. The global IoT security market is expected to reach $35.8 billion by 2028.

Development of New Attack Vectors and Techniques

Cybersecurity threats are ever-evolving. Attackers are consistently creating new ways to exploit weaknesses. Qualys needs to constantly improve its threat intelligence to stay ahead, especially for cloud and API vulnerabilities. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025.

- Ransomware attacks are up, with a 13% increase in 2023.

- Cloud-based attacks are growing, accounting for 30% of breaches.

- API vulnerabilities are a major concern, with 60% of companies reporting API security incidents.

Automation and Orchestration in Security

Automation and orchestration are critical in security due to the rising volume of threats. Qualys addresses this by offering tools that streamline security processes, boosting efficiency. For example, the global cybersecurity market is projected to reach $345.7 billion in 2024. This need is reflected in Qualys' strategy.

- Automation reduces manual tasks, saving time.

- Orchestration ensures coordinated responses to incidents.

- Qualys' platform integrates these capabilities.

- Efficiency gains lead to cost savings.

Qualys must adapt to cloud computing. The cloud market was $670B in 2024, aiming for $800B by 2025. AI in cybersecurity could reach $46.3B by 2025, driving innovation.

| Technology Area | Impact | Data Point (2024/2025) |

|---|---|---|

| Cloud Computing | Adaptation, Integration | Cloud Market: $670B (2024) to $800B (2025) |

| AI & ML | Threat Detection, Innovation | AI in Cybersecurity Market: $46.3B (by 2025) |

| IoT | Expansion of Attack Surface | IoT devices: 27B (by 2025) |

Legal factors

Data privacy regulations like GDPR and CCPA are critical. Qualys needs solutions to help clients comply with these rules. In 2024, GDPR fines reached €1.5 billion. Compliance is essential for Qualys' and its clients' success.

Industry-specific compliance standards are crucial. Healthcare (HIPAA) and payment card industries (PCI DSS) have strict rules. Qualys must support these standards. This ensures that they can serve a diverse customer base. In 2024, the global cybersecurity market reached approximately $223.8 billion, reflecting the importance of compliance.

Governments are actively implementing cybersecurity laws, such as the Cybersecurity Act of 2024 in the US, mandating security measures and breach reporting. Qualys' solutions help organizations comply with these legal demands. Data breaches increased by 15% in 2024, emphasizing the need for robust security.

Software Licensing and Intellectual Property Laws

Qualys, as a software company, heavily relies on software licensing and intellectual property protection. Legal issues like software piracy or patent infringement can significantly affect its operations. For example, in 2024, the global software piracy rate was estimated at around 37%, representing a substantial risk.

Qualys must actively defend its patents and licenses to maintain its competitive edge. Legal battles, even if resolved, can be costly and time-consuming.

Recent data shows that software patent litigation costs average $1.2 million per case.

Qualys's success hinges on its ability to navigate and adhere to these legal frameworks effectively.

- Software piracy costs the software industry billions annually.

- Patent infringement cases can lead to substantial financial penalties.

- Licensing disputes can disrupt service delivery.

- Compliance with data privacy laws is also crucial.

Export Controls and Trade Restrictions

Qualys must navigate export controls and trade restrictions, which can limit its ability to sell its cybersecurity solutions globally. These regulations, especially concerning data security and privacy, are crucial for international business, potentially impacting revenue streams. For instance, the U.S. government, in 2024, increased scrutiny on software exports to certain regions. Therefore, Qualys must ensure strict compliance to avoid penalties.

- U.S. export controls on software are tightened in 2024, affecting tech companies.

- Compliance costs for international trade are expected to rise by 5-7% in 2024/2025.

- Non-compliance can result in fines up to $1 million per violation.

Legal factors significantly impact Qualys. Data privacy rules, like GDPR, are critical, with fines hitting €1.5B in 2024. Software piracy poses a big risk, with a global rate of 37% in 2024, costing the industry billions annually. Export controls and trade restrictions also matter, as compliance costs are set to rise 5-7% by 2025.

| Legal Aspect | Impact on Qualys | 2024/2025 Data |

|---|---|---|

| Data Privacy | Compliance requirements; risk of fines | GDPR fines: €1.5B (2024) |

| Software Piracy | Financial losses; IP infringement | Global piracy: 37% (2024) |

| Export Controls | Market access limitations | Compliance costs increase 5-7% (2024/2025) |

Environmental factors

As a cloud provider, Qualys' operations depend on data centers, which are energy-intensive. The tech sector faces pressure to lower its environmental impact. In 2024, data centers globally used about 2% of all electricity. Qualys states a dedication to energy-efficient networks and data centers. This includes efforts to utilize renewable energy sources.

Qualys, being a software company, indirectly impacts e-waste through its customers' hardware usage. The global e-waste generation reached 62 million tons in 2022, a number that's expected to increase. This growing concern influences customer choices regarding sustainability. Companies like Qualys face pressure to consider their environmental footprint.

Climate change increases extreme weather, potentially disrupting data centers and network connectivity. This could affect Qualys' cloud services. For instance, the 2024 Atlantic hurricane season saw 20 named storms. Business continuity and disaster recovery planning are crucial. In 2024, insured losses from natural disasters totaled $60 billion.

Sustainability and Corporate Social Responsibility (CSR)

Environmental factors are increasingly important for tech companies like Qualys. Customers and investors now expect strong commitments to sustainability and CSR. This focus impacts brand perception and attracts those prioritizing environmental responsibility. For instance, in 2024, ESG-focused funds saw inflows, reflecting this trend.

- 2024 saw over $2.5 trillion in global sustainable fund assets.

- Companies with strong ESG performance often see higher valuations.

- Qualys can leverage green initiatives to enhance its market position.

Supply Chain Environmental Practices

Qualys, like other tech companies, depends on a network of suppliers. The environmental conduct of these suppliers affects Qualys' environmental impact and public image. Considering the rising focus on ESG, Qualys must make sure its suppliers follow eco-friendly standards. This includes things like carbon emissions and waste management.

- In 2024, about 60% of businesses surveyed reported that their supply chain sustainability was a top priority.

- Companies with sustainable supply chains often see a 5-10% cost reduction.

- The EU's Corporate Sustainability Reporting Directive (CSRD) will affect how Qualys' suppliers report environmental data.

Qualys must consider energy use from its data centers, which consume significant power. Data centers globally used roughly 2% of all electricity in 2024. Climate change impacts operations; extreme weather threatens data center reliability.

The rising e-waste issue related to customer hardware is another challenge. E-waste generated 62 million tons worldwide in 2022. ESG is crucial, as customers and investors demand sustainability.

Qualys' supply chain also has an impact. In 2024, approximately 60% of businesses prioritized sustainable supply chains, highlighting the importance of environmental practices.

| Aspect | Details | Data/Impact (2024) |

|---|---|---|

| Energy Use | Data centers are energy intensive | Approx. 2% of global electricity |

| E-waste | Impacts customer hardware usage | 62M tons of e-waste in 2022 |

| Supply Chain | Sustainability practices of suppliers | 60% of businesses prioritized sustainable supply chains |

PESTLE Analysis Data Sources

The Qualys PESTLE analysis incorporates data from industry reports, regulatory bodies, and global databases for accurate insights.