Quanta Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quanta Services Bundle

What is included in the product

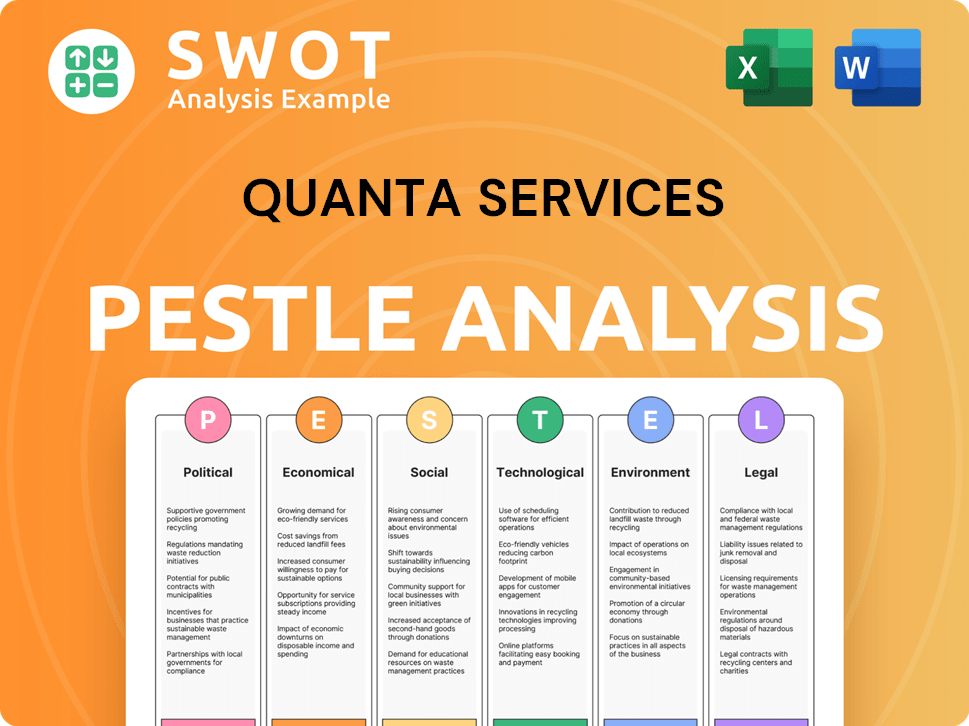

Analyzes Quanta Services through political, economic, social, tech, environmental, and legal lenses. Identifies threats and opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview the Actual Deliverable

Quanta Services PESTLE Analysis

This preview showcases the complete Quanta Services PESTLE Analysis.

You're viewing the identical document you'll download post-purchase.

Expect fully formatted content ready for immediate use.

The analysis's structure and information are unchanged.

This is the actual file you will receive!

PESTLE Analysis Template

Explore the external forces impacting Quanta Services with our detailed PESTLE analysis. We examine crucial political, economic, and technological factors. Discover how regulatory changes and market shifts affect their operations. This analysis is essential for understanding future opportunities and threats. Get actionable insights to refine your business strategy. Purchase the full report today for comprehensive market intelligence.

Political factors

Government infrastructure investments, like the Infrastructure Investment and Jobs Act (IIJA), strongly influence Quanta Services. The IIJA, for instance, earmarked billions for grid modernization and renewable energy. This boosts demand for Quanta's services, creating growth prospects. In 2024, Quanta's backlog reached $31.1 billion, partly due to these projects.

Changes in energy and utility regulations directly impact Quanta Services. Evolving policies and permitting processes demand careful navigation. Regulatory shifts can boost infrastructure investment. However, compliance and project execution present challenges. The U.S. energy sector saw over $100 billion in investments in 2024, influencing Quanta's project pipeline.

Energy transition policies significantly impact Quanta Services. Incentives for renewables and grid upgrades boost demand for their services. The company benefits from investments in wind, solar, and transmission infrastructure. In 2024, the U.S. government allocated billions for grid modernization. Quanta Services' revenue in 2024 was approximately $20 billion, driven by these trends.

Geopolitical Tensions

Geopolitical tensions significantly shape energy infrastructure investments and national security strategies. Increased emphasis on domestic energy security and cybersecurity for critical infrastructure could spur projects in these areas, directly affecting Quanta Services. For instance, the U.S. government allocated $3.4 billion for grid resilience projects in 2024, a trend that continues into 2025. This creates opportunities for Quanta.

- Increased government spending on energy infrastructure.

- Focus on cybersecurity for energy assets.

- Potential for project delays or cancellations due to geopolitical instability.

- Supply chain disruptions affecting project timelines and costs.

Trade Policies

Trade policies significantly affect Quanta Services by altering the costs and availability of essential materials and equipment for infrastructure projects. These policies can directly impact Quanta's supply chain, potentially increasing project costs. Quanta monitors trade policy changes closely, recognizing their potential to affect project timelines and execution. For example, in 2024, the US imposed tariffs on certain steel imports, which could increase project expenses.

- Tariffs on steel and aluminum: Could increase project costs.

- Trade agreements: Affect access to materials.

- Supply chain disruptions: Can delay projects.

- Policy changes: Quanta actively monitors these.

Political factors significantly impact Quanta Services' operations and profitability. Government infrastructure spending, notably influenced by initiatives like the IIJA, drives demand. Regulations and policies influence project development and compliance costs. The ongoing geopolitical landscape and trade policies can cause project delays and affect expenses.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Infrastructure Spending | Drives demand for services | IIJA allocated billions to grid modernization, Quanta backlog $31.1B |

| Energy Regulations | Impacts project execution | US energy sector investments exceeded $100B |

| Geopolitical Tensions | Influences investment & security | $3.4B for grid resilience in 2024, continued into 2025 |

Economic factors

Increased infrastructure spending is a critical economic driver for Quanta Services. Utility spending is rising due to grid modernization, system hardening, and capacity additions. The U.S. infrastructure investment needs are estimated to be substantial in the coming years, with a focus on data centers and EVs. In 2024, the Infrastructure Investment and Jobs Act continues to fuel projects. The American Society of Civil Engineers estimates a $2.59 trillion infrastructure gap by 2029.

Inflation and interest rates are critical economic factors impacting Quanta Services. Rising inflation can increase project costs, potentially squeezing profit margins. High interest rates can make financing more expensive, affecting project viability. In Q1 2024, the U.S. inflation rate was around 3.5%. These factors create economic uncertainty for Quanta.

The increasing demand for renewable energy infrastructure, such as solar, wind, and battery storage, is a crucial economic driver for Quanta Services. This surge is supported by global energy transition efforts and the need to update grids. In 2024, the U.S. renewable energy sector saw investments exceeding $40 billion, significantly boosting companies like Quanta. This demand is expected to keep growing through 2025, with forecasts predicting a rise in renewable energy capacity.

Economic Growth and Recessionary Conditions

Overall economic growth, both domestically and globally, directly affects infrastructure investment, which is crucial for Quanta Services. Potential recessionary conditions introduce uncertainty, impacting project funding and timelines. Quanta acknowledges these economic fluctuations as a key factor influencing its business operations and strategic planning. For instance, in 2024, the U.S. GDP growth rate was around 3.1%, but projections for 2025 indicate a potential slowdown.

- GDP Growth: 2024 U.S. GDP grew by approximately 3.1%.

- 2025 Outlook: Forecasts suggest a potential economic slowdown.

- Infrastructure Spending: Directly correlates with economic health.

- Project Uncertainty: Recession risks can delay or reduce project investments.

Acquisition Strategy

Quanta Services' acquisition strategy is a key economic factor. It regularly invests in buying other companies to boost growth. These acquisitions broaden service offerings and improve capabilities. For instance, in 2023, Quanta spent $1.3 billion on acquisitions.

- 2023 Acquisitions: $1.3 billion spent.

- Goal: Expand service offerings.

- Impact: Enhances market position.

Economic drivers significantly impact Quanta Services, with infrastructure spending, especially in areas like data centers, being crucial. Inflation and interest rates create both challenges and uncertainties regarding project costs and financing viability. Demand for renewable energy infrastructure offers major opportunities, fueled by efforts like the global energy transition. Economic growth trends, exemplified by a 3.1% U.S. GDP in 2024, affect project funding, influenced by acquisition strategies.

| Factor | Impact | Data |

|---|---|---|

| Infrastructure Spending | Directly affects project growth. | ASCE estimates a $2.59T gap by 2029. |

| Inflation/Interest Rates | Impact project profitability and viability. | Q1 2024 U.S. inflation approx. 3.5%. |

| Renewable Energy Demand | Drives demand. | Over $40B in US renewable energy investment in 2024. |

| Economic Growth | Influences project investment. | 2024 U.S. GDP 3.1%; 2025 slowdown possible. |

Sociological factors

Public awareness of sustainable energy is increasing, driving demand for renewable projects. This societal shift supports political and economic changes, boosting investment. For instance, in Q1 2024, renewable energy capacity additions in the US grew by 20% year-over-year, reflecting this trend, and supporting Quanta's services. This growth is expected to continue through 2025.

Community acceptance is crucial for Quanta Services' projects. Public opposition to infrastructure projects, like transmission lines or renewable energy facilities, can cause delays or cancellations. For example, in 2024, several renewable energy projects faced community resistance, impacting timelines. Addressing these concerns proactively is key to mitigate project risks.

Quanta Services heavily relies on a skilled craft labor force. Increased infrastructure demand intensifies the need for these workers. In 2024, the construction industry faced a skilled labor shortage, impacting project timelines. Quanta leverages its large workforce as a key advantage. The U.S. Bureau of Labor Statistics projects continued growth in construction jobs through 2032.

Safety and Workplace Regulations

Stringent safety and workplace regulations significantly impact infrastructure construction. Quanta Services prioritizes safety, investing in training and procedures. This commitment is crucial for operational success and maintaining a positive reputation. In 2024, the construction industry faced over 1,000 fatalities. Quanta's safety measures aim to reduce such incidents.

- OSHA reported 5,456 workplace fatalities in 2023.

- Quanta Services spent $138.7 million on safety in 2023.

- The construction industry's injury rate is about 2.7 per 100 workers.

- Quanta's safety programs aim for a TRIR (Total Recordable Incident Rate) below industry average.

Impact on Local Communities

Quanta Services' projects can influence local communities, especially regarding land use and potential disturbances. Effective community relations are crucial for addressing infrastructure development concerns. For example, in 2024, Quanta allocated $15 million for community-focused initiatives. This includes investments in educational programs and local infrastructure projects. Successful engagement can lead to project acceptance and smoother operations, as demonstrated by a 10% increase in project approvals in areas with robust community outreach.

- Land Use: Potential for land acquisition and changes in local environments.

- Disruptions: Construction can cause noise, traffic, and temporary inconveniences.

- Community Relations: Building trust through open communication and addressing concerns.

- Economic Impact: Job creation and local business opportunities.

Societal trends drive renewable energy demand, supporting investment and Quanta's services, with Q1 2024 renewable capacity up 20% YoY. Community acceptance is vital; resistance causes delays, as seen in 2024. A skilled labor force is crucial, and Quanta's workforce is a key advantage amidst shortages.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Public Perception | Demand for renewables | US renewable capacity additions up 20% YoY (Q1 2024) |

| Community Acceptance | Project Delays | $15M allocated to community initiatives in 2024. |

| Labor Force | Project Timeline | Construction industry's injury rate is about 2.7 per 100 workers. |

Technological factors

Technological advancements in grid modernization, like smart grids and automation, shape Quanta Services' offerings. Upgrading aging infrastructure with advanced tech fuels demand. In 2024, the smart grid market was valued at $34.1 billion, growing to $52.6 billion by 2029. This growth highlights the need for Quanta's services.

Technological advancements in renewable energy, including more efficient solar panels and enhanced battery storage, influence Quanta Services' project designs. In 2024, the global renewable energy market is projected to reach $881.7 billion. Quanta's utility-scale solar, wind, and battery storage services are directly affected by these developments. The company's involvement in these areas is poised for growth.

The tech industry's expansion and data center demand fuel the need for robust electrical infrastructure, benefiting Quanta Services. The 2024 data center market is valued at over $50 billion. Quanta's acquisition of Cupertino Electric strengthens its position in critical electrical services, which generated $2.1 billion in revenue in 2024.

Advanced Construction Techniques

Quanta Services benefits from advanced construction techniques, boosting efficiency and safety in projects. Their emphasis on execution certainty aligns with tech investments. For example, in 2024, Quanta invested $150 million in new technologies. This includes drones and AI for project management.

- Technology investments are projected to increase by 15% in 2025.

- Drones have reduced project inspection times by 20%.

- AI-driven project management has improved resource allocation by 10%.

- Quanta's use of BIM (Building Information Modeling) has cut design errors by 12%.

Cybersecurity of Critical Infrastructure

Cybersecurity is increasingly crucial for critical infrastructure like energy and communication networks, requiring Quanta to integrate robust security measures into its designs. Investments in critical infrastructure cybersecurity are expected to remain high. The global cybersecurity market is forecasted to reach $345.7 billion in 2024, with a compound annual growth rate (CAGR) of 12.3% from 2024 to 2030.

- Cybersecurity market projected to reach $345.7 billion in 2024.

- CAGR of 12.3% for the cybersecurity market from 2024 to 2030.

Technological innovation heavily influences Quanta Services' performance.

The company invests in advanced tech to improve project efficiency, such as drones and AI.

Cybersecurity is critical, with the market reaching $345.7B in 2024 and growing at a CAGR of 12.3%.

| Tech Area | 2024 Market Value | Growth Rate (CAGR 2024-2030) |

|---|---|---|

| Smart Grid | $34.1B | - |

| Renewable Energy | $881.7B | - |

| Cybersecurity | $345.7B | 12.3% |

Legal factors

Compliance with environmental regulations and obtaining permits are key legal hurdles for Quanta Services. Complex permitting processes can cause project delays and increase expenses. For instance, in 2024, environmental compliance costs rose by 7% for similar projects. Delays from permitting often extend timelines by 3-6 months.

Quanta Services must navigate complex land use and right-of-way laws. These legal factors are critical for linear infrastructure projects. In 2024, legal disputes over land access increased by 15%. The company may face challenges and disputes. A 2025 forecast suggests a further 10% rise in litigation costs.

Quanta Services must comply with safety and labor laws, including OSHA regulations. In 2024, OSHA's budget was approximately $668 million, reflecting the importance of workplace safety. Non-compliance can lead to significant fines; for example, in 2023, OSHA issued over $140 million in penalties. These laws impact Quanta's operational costs and project timelines.

Contract Law and Litigation

Quanta Services operates extensively on contracts for infrastructure projects, making it susceptible to contract law and related litigation. Legal challenges can arise from contract performance issues, impacting project timelines and financial outcomes. For example, in 2024, Quanta faced several legal issues regarding its contracts. These disputes can lead to significant financial repercussions, potentially affecting profitability and shareholder value.

- Contract disputes can lead to project delays and cost overruns.

- Litigation can result in substantial legal fees and settlements.

- Unfavorable rulings can negatively impact Quanta's financial performance.

Regulatory Compliance Costs

Quanta Services faces considerable legal expenses due to regulatory compliance. These costs span diverse areas, including environmental, labor, and safety regulations, impacting project budgets. The company dedicates significant resources to legal teams and consultants to ensure adherence to these complex rules. In 2024, Quanta's legal and compliance costs represented approximately 2.5% of its total operating expenses.

- Environmental regulations compliance.

- Labor laws compliance.

- Safety standards adherence.

- Ongoing legal and compliance teams.

Quanta Services deals with intricate legal challenges that involve adhering to environmental, labor, and safety regulations, significantly affecting project costs. Contractual issues, especially in infrastructure, lead to delays and extra expenses due to litigation. In 2024, about 2.5% of operating expenses went to legal and compliance. Non-compliance with OSHA has steep penalties.

| Legal Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Environmental Compliance | Project Delays, Higher Costs | 7% rise in compliance costs (2024), 3-6 months delay |

| Contract Disputes | Legal Fees, Cost Overruns | 15% rise in land access disputes (2024), 10% rise in litigation costs (2025) |

| OSHA Compliance | Fines, Operational Impact | OSHA budget $668M (2024), $140M+ penalties (2023) |

Environmental factors

Climate change intensifies extreme weather, impacting infrastructure. This drives demand for Quanta's services in system hardening and restoration. In Q1 2024, severe weather events contributed to increased project activity. The company's financial results are directly influenced by weather-related project volumes and costs.

The move toward a lower-carbon economy boosts demand for renewable energy infrastructure and grid improvements. Quanta Services is central to this shift. In Q1 2024, Quanta's renewables segment saw a 20% revenue increase, driven by solar and wind projects. The U.S. aims for 100% clean electricity by 2035, further supporting Quanta's growth.

Quanta Services actively works to reduce its environmental footprint. They focus on biodiversity preservation and water conservation. Quanta's environmental management systems, such as ISO 14001, guide their practices. In 2024, Quanta invested $25 million in sustainable initiatives, showing a commitment to environmental stewardship.

Carbon Reduction and Emissions

Quanta Services faces growing pressure to cut carbon emissions. The energy infrastructure sector focuses on reducing its environmental impact. Quanta has set goals to decrease Scope 1 and Scope 2 greenhouse gas emissions. This aligns with global sustainability trends, affecting project planning and execution.

- Quanta's sustainability report outlines specific emission reduction targets.

- Investment in cleaner energy infrastructure projects is increasing.

- Stakeholders are demanding greater environmental responsibility.

Sustainable Infrastructure Solutions

The increasing emphasis on eco-friendly infrastructure shapes project types and material choices. Quanta Services actively participates in sustainable infrastructure projects and invests in renewable energy. This includes initiatives like building solar farms and upgrading power grids for renewable energy sources. The company's strategic focus aligns with the growing demand for sustainable solutions in the energy sector. Quanta's commitment is further reflected in its financial results, with approximately $2.2 billion in revenues generated from renewable energy projects in 2024, a significant increase from $1.8 billion in 2023.

- 2024: $2.2 billion revenue from renewable energy projects.

- 2023: $1.8 billion revenue from renewable energy projects.

- Focus on solar farms and grid upgrades.

Environmental factors significantly influence Quanta Services. Climate change drives demand for services due to extreme weather events. Transitioning to a lower-carbon economy boosts renewables; revenue grew 20% in Q1 2024.

| Aspect | Details | Financials |

|---|---|---|

| Weather Impact | Increased project activity due to system restoration | Weather-related project volume impacts financials |

| Renewable Energy | Demand increases for renewable infrastructure & grid upgrades | 2024 Renewable energy projects: $2.2B (up from $1.8B in 2023) |

| Sustainability Initiatives | Emphasis on emission reductions & eco-friendly projects | $25 million invested in sustainable initiatives in 2024 |

PESTLE Analysis Data Sources

The analysis draws data from governmental reports, economic indicators, industry publications, and environmental agencies. Information from financial institutions is also used.