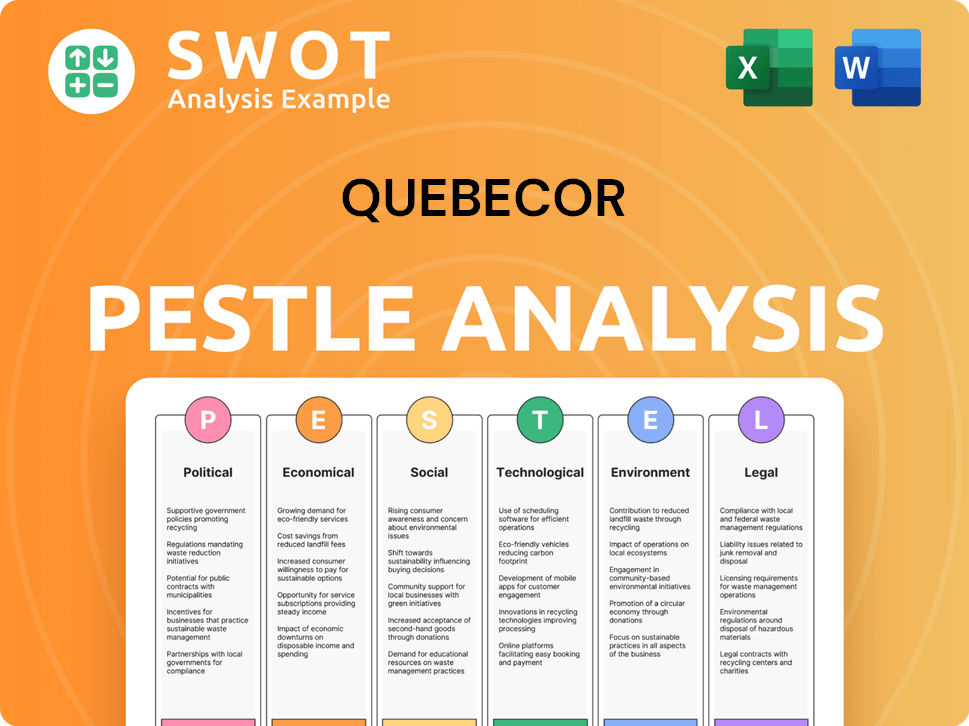

Quebecor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quebecor Bundle

What is included in the product

Evaluates external macro-environmental forces impacting Quebecor.

A readily shareable format simplifies distribution across teams for unified understanding.

Full Version Awaits

Quebecor PESTLE Analysis

What you’re previewing here is the actual file—a complete PESTLE analysis of Quebecor. This document dives deep, covering Political, Economic, Social, Technological, Legal, and Environmental factors. See the layout, data, and insights now. This is the exact, ready-to-use file you’ll get upon purchase.

PESTLE Analysis Template

Navigate Quebecor's landscape with our detailed PESTLE analysis. Understand the political and economic factors influencing their market position. Explore social trends, technological advancements, legal regulations, and environmental impacts. This comprehensive analysis provides strategic foresight for informed decision-making. Enhance your understanding with data-driven insights and forecasts. Get the complete Quebecor PESTLE analysis now!

Political factors

Quebecor faces stringent government regulations, especially in telecommunications and broadcasting. The CRTC enforces the Broadcasting Act and Telecommunications Act. These regulations can affect Quebecor's operations. In 2024, regulatory changes impacted licensing and fees, potentially affecting revenue. Quebecor must navigate these rules.

Government policies and funding significantly impact Quebecor. The Canada Media Fund (CMF) offers crucial content development support. In 2023-2024, the CMF distributed over CAD 350 million. Quebecor actively lobbies on telecommunications and broadcasting regulations. This influences its operational landscape.

Political stability significantly impacts Quebecor's operations. Geopolitical issues or civil unrest could disrupt services. For instance, the 2024-2025 period reflects ongoing global instability. This can affect supply chains and market access. Any instability could lead to financial risks.

Trade Policies and Barriers

Quebecor faces political challenges from trade policies and barriers, impacting its global operations. Tariffs and trade barriers can affect equipment and service costs. Although it's mainly focused on Canada, international factors still play a role. For instance, in 2024, Canada's trade with the US reached $880 billion.

- Tariffs can raise the prices of imported equipment.

- Trade barriers may limit access to global markets.

- Changes in trade agreements can affect Quebecor's costs.

Government's Role in Competition

The government and regulatory bodies significantly influence competition. Quebecor has voiced concerns about an uneven playing field, particularly regarding foreign digital companies and the public broadcaster's advantages. In 2024, debates intensified over digital taxation and media regulations. Quebecor's lobbying efforts aim to address these perceived inequities. The company is navigating a complex environment shaped by policy decisions.

- Quebecor's advocacy focuses on fair competition.

- Digital taxation and media regulations are current focus areas.

- Public broadcaster's advantages are a key concern.

Quebecor's political landscape is heavily influenced by stringent regulations and government policies in broadcasting and telecommunications. The CRTC enforces regulations impacting licensing and fees. Canada's trade with the US in 2024 was approximately $880 billion, underlining the relevance of trade policies. Competition is also affected by government and regulatory bodies.

| Factor | Impact | Data |

|---|---|---|

| Regulations | Affect licensing and operational costs | CRTC, Broadcasting Act |

| Trade Policies | Affect equipment prices | 2024 trade with US: $880B |

| Competition | Shaped by government | Digital taxation debates |

Economic factors

Quebecor's media and telecom operations are influenced by economic cycles. Economic downturns can reduce advertising spending and consumer demand. For instance, in 2023, advertising revenue in Canada saw fluctuations. Costs, however, may stay constant, affecting profitability.

Consumer confidence and spending are crucial for Quebecor. If people feel good, they spend more on media and telecom services. This boosts Quebecor's revenue. In 2024, consumer spending in Canada saw moderate growth. However, confidence levels can shift rapidly, impacting demand.

The advertising market is crucial for Quebecor's media revenue. However, media fragmentation and digital competition threaten advertising income. In 2024, digital ad spending in Canada is projected to reach $14.7 billion. This trend challenges Quebecor's profitability. Declining print ad revenues are a specific concern.

Interest Rates and Debt Levels

Quebecor's financial health is sensitive to both interest rates and its debt burden. Higher interest rates can increase borrowing costs, affecting profitability and potentially lowering its valuation. Effectively managing and decreasing debt is crucial for financial flexibility and resilience. For 2024, the company's net debt was a key area of focus.

- Interest rate hikes can increase borrowing costs.

- Managing debt is critical for financial flexibility.

- Quebecor's 2024 strategy focused on debt.

Acquisitions and Market Expansion

Strategic acquisitions, like Freedom Mobile, are pivotal for Quebecor's financial health and market dominance. These acquisitions fuel revenue expansion, enabling Quebecor to compete effectively. In 2024, Freedom Mobile's revenue contributed significantly to Quebecor's overall growth. This expansion allows the company to access new markets and enhance its service offerings.

- Freedom Mobile acquisition boosted revenue.

- Market expansion enhances competitiveness.

- Strategic moves drive financial performance.

- Acquisitions open new market access.

Economic cycles impact Quebecor's advertising revenue, with downturns affecting profitability. Consumer spending, crucial for telecom and media services, saw moderate 2024 growth. The digital advertising market is key, with a projected $14.7 billion in Canada for 2024, impacting Quebecor.

Higher interest rates raise borrowing costs, affecting debt management strategies. Strategic acquisitions, like Freedom Mobile, boost revenue. In 2024, Freedom's revenue was key to Quebecor's financial performance, with focus on debt reduction.

| Factor | Impact | Data |

|---|---|---|

| Advertising Revenue | Affected by economic cycles | Canadian digital ad spend projected $14.7B in 2024 |

| Consumer Spending | Drives media/telecom demand | Moderate 2024 growth in Canada |

| Interest Rates & Debt | Influence borrowing costs | Focus on debt reduction in 2024 |

Sociological factors

Quebecor's identity is deeply rooted in Québec's culture and French language. The company heavily invests in local content, supporting artists and creators. In 2024, the media sector's cultural spending in Québec reached $2.5 billion. This commitment strengthens its brand and resonates with the local audience. Quebecor's strategy fosters a strong connection with its customer base.

Quebecor demonstrates strong community engagement, supporting Québec through donations and sponsorships. In 2024, they invested millions in cultural, health, and educational initiatives. This commitment enhances their public image and fosters goodwill. Their focus on entrepreneurship also boosts local economic development. These actions align with evolving societal expectations.

Shifting consumer tastes significantly impact Quebecor. In 2024, digital media consumption surged by 15% in Canada. Adapting to these changes is crucial. Quebecor must evolve its offerings. This includes embracing new technologies to meet demand.

Employee well-being and engagement

Quebecor prioritizes employee well-being and engagement through a stimulating work environment and community project involvement. The company invests in health and wellness programs for its staff. These initiatives aim to boost productivity and morale. Such strategies help Quebecor attract and retain talent.

- In 2024, Quebecor's employee satisfaction score was 78%, reflecting positive engagement.

- The company invested $2.5 million in employee wellness programs.

- Employee participation in community projects increased by 15% in the last year.

Support for Entrepreneurship and Youth

Quebecor actively fosters entrepreneurship and supports youth initiatives. The company partners with educational institutions, promoting programs that help young people start businesses. This commitment is reflected in its community investment strategy. Quebecor’s investments in youth programs reached $15 million in 2024. These efforts highlight Quebecor’s dedication to social responsibility.

- $15 million invested in youth programs in 2024.

- Partnerships with educational institutions.

Quebecor's deep connection to Quebec's culture and community is a key strength. It supports local content and invests in initiatives, which boosts its image. Shifting consumer habits, like the 15% surge in digital media in Canada in 2024, demand adaptation. Employee well-being is also a priority.

| Factor | Details | 2024 Data |

|---|---|---|

| Community Investment | Focus on Culture, Health, Education | $2.5B media sector cultural spending in Québec |

| Employee Engagement | Well-being and Community Projects | 78% Satisfaction, $2.5M wellness program. |

| Youth Programs | Entrepreneurship Support | $15M invested |

Technological factors

Technological advancements drive Quebecor's industries. The company must invest in new tech to stay competitive. 5G networks and digital platforms are vital. Quebecor's capital expenditures in technology reached $350 million in 2024. This reflects its focus on digital transformation and innovation.

Quebecor's success hinges on its infrastructure. They need substantial capital for network development, which faces risks like equipment failures. In 2024, they invested $1.7 billion in network infrastructure. Any disruptions could impact service delivery and financial performance. Maintaining a robust network is critical for competitive advantage.

Digital transformation and convergence are reshaping the media and telecom sectors. Quebecor is integrating its media and telecommunications assets. This strategy aims to enhance content delivery and user experience. In 2024, Quebecor's revenues were approximately $4.7 billion, reflecting its digital focus.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for Quebecor in 2024/2025. The company's digital infrastructure is a prime target for cyberattacks, with the media and telecommunications sectors experiencing a rise in threats. Quebecor must invest in robust cybersecurity measures to safeguard its data and ensure business continuity. According to recent reports, the global cybersecurity market is projected to reach $345.7 billion by 2025.

- Cybersecurity breaches can lead to significant financial losses, reputational damage, and legal liabilities.

- Quebecor needs to comply with evolving data protection regulations, such as GDPR and CCPA.

- Investing in cybersecurity is crucial for maintaining customer trust and protecting sensitive information.

Development of New Products and Services

Quebecor's technological advancements are crucial for maintaining its market position. Innovation in product and service offerings, such as the launch of all-digital television services and enhanced mobile plans, is essential for attracting and retaining customers. The company's investments in cutting-edge technologies have led to improved network speeds and expanded service capabilities. This focus helps Quebecor stay competitive.

- Quebecor invested $1.1 billion in its network infrastructure in 2023.

- Videotron's mobile network now covers 99% of Quebec's population.

Quebecor’s tech focus includes network development, with $1.7B invested in 2024. Cybersecurity is critical, as global spending is set to hit $345.7B by 2025. They improve services like digital TV, using innovation for customer appeal.

| Technology Area | Investment (2024) | Impact |

|---|---|---|

| Network Infrastructure | $1.7 Billion | Service Delivery & Competitiveness |

| Cybersecurity | Ongoing Investment | Data Protection & Trust |

| Digital Transformation | $350 Million (Capex) | Innovation & Market Position |

Legal factors

Quebecor faces stringent broadcasting and telecommunications regulations. These rules impact licensing, content creation, and market behavior. In 2024, the CRTC's decisions on content quotas and ownership structures will directly affect Quebecor. Regulatory compliance costs are significant, with potential fines for non-compliance. For example, in 2023, total revenue of Quebecor Media was $4.18 billion.

Competition law significantly shapes Quebecor's business moves, especially regarding acquisitions and pricing strategies within its diverse media and telecom sectors. The Competition Bureau regularly assesses Quebecor's activities to ensure fair market practices. In 2024, the Canadian Radio-television and Telecommunications Commission (CRTC) continues to oversee competition in broadcasting and internet services, influencing Quebecor's operational scope. Regulatory decisions and competitor actions are always under legal scrutiny.

Quebecor faces extensive legal and regulatory compliance demands. These include media ownership rules, broadcasting standards, and data privacy laws, which are constantly evolving. For instance, in 2024, Quebecor invested heavily in cybersecurity, allocating $50 million to comply with stricter data protection regulations. Changes in these areas directly impact operational costs and investment strategies, particularly for digital services.

Protection of Intellectual Property

Quebecor heavily relies on protecting its intellectual property within the media and entertainment industries. Copyright laws and content usage regulations are vital for its operations. The company must navigate these legal frameworks to safeguard its assets and revenue streams. According to the World Intellectual Property Organization, copyright infringement cases have increased by 15% globally in 2024. These protections are essential for Quebecor's various content offerings.

- Copyright laws are crucial for protecting Quebecor’s content.

- Content usage regulations impact how Quebecor distributes its media.

- Intellectual property rights are vital for its financial success.

- Quebecor must stay updated on copyright law changes.

Labor Laws and Agreements

Quebecor faces labor law impacts, especially with collective agreements. These agreements affect costs and operational agility. In 2024, labor costs accounted for a significant portion of operational expenses. The company continuously negotiates with unions to manage these costs effectively. Any labor disputes could disrupt services.

- Negotiations with unions are ongoing.

- Labor costs are a significant operational factor.

- Disruptions can arise from labor disputes.

Quebecor must adhere to broadcasting and telecom regulations affecting licensing and content. Competition law impacts acquisitions and pricing, under scrutiny by the Competition Bureau and CRTC. Intellectual property, vital for Quebecor, is protected by copyright laws, with global infringement cases up by 15% in 2024. Labor law influences costs, requiring union negotiations, with labor costs significantly impacting operational expenses.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Compliance | Licensing, Content, Market Behavior | CRTC decisions; $50M for cybersecurity |

| Competition Law | Acquisitions, Pricing | Ongoing CRTC oversight; Competitive market analysis |

| Intellectual Property | Content Protection | 15% global increase in infringement cases |

| Labor Law | Operational Costs | Union negotiations; Significant portion of expenses |

Environmental factors

Quebecor actively combats climate change, aligning with Québec's energy transition goals. The company focuses on reducing greenhouse gas emissions across its operations. They also prioritize enhancing energy efficiency to minimize environmental impact. In 2024, Quebecor invested $10 million in green initiatives.

Quebecor is electrifying its vehicle fleet, a key environmental move. This transition aligns with broader sustainability goals. The company aims to significantly reduce its carbon footprint through this initiative. As of late 2024, the EV market share is growing, supporting Quebecor's plans.

Quebecor actively manages waste through reduction, reuse, and recycling initiatives. They aim to decrease landfill waste, promoting environmental responsibility. The company's recycling programs cover various materials, including electronic devices. In 2024, Quebecor invested $5 million in waste reduction tech. Their waste diversion rate is 70%, with a goal of 80% by 2025.

Responsible Use of Natural Resources

Quebecor emphasizes the responsible use of natural resources. This includes sustainable forestry practices for paper production, crucial for its media and telecommunications divisions. The company likely adheres to environmental regulations to minimize its ecological footprint. Such initiatives can lead to cost savings and enhance its brand reputation.

- Sustainable forestry practices reduce environmental impact.

- Quebecor's commitment aligns with growing consumer and investor expectations.

- In 2024, the company invested $25 million in sustainable practices.

Environmental Impact of Events and Productions

Quebecor's subsidiaries are focusing on eco-friendly practices. This includes sustainable mobility and better waste management. They are also improving energy management across their events and productions. The goal is to lessen the environmental footprint of their operations. These efforts align with growing consumer and regulatory demands for sustainability.

- Sustainable practices reduce emissions.

- Waste management aims for circular economy.

- Energy efficiency lowers operational costs.

- Compliance with environmental regulations.

Quebecor champions environmental sustainability via green tech, waste reduction, and efficient energy usage. Their investments totaled $25 million in 2024, targeting lowered emissions. The 2025 goal is 80% waste diversion rate by expanding eco-friendly strategies.

| Initiative | Investment (2024) | Goal (2025) |

|---|---|---|

| Green Initiatives | $10M | N/A |

| Waste Reduction Tech | $5M | 80% Waste Diversion |

| Sustainable Practices | $25M | Sustainable practices |

PESTLE Analysis Data Sources

Quebecor's PESTLE analysis uses data from government reports, financial institutions, industry-specific research, and credible news sources.