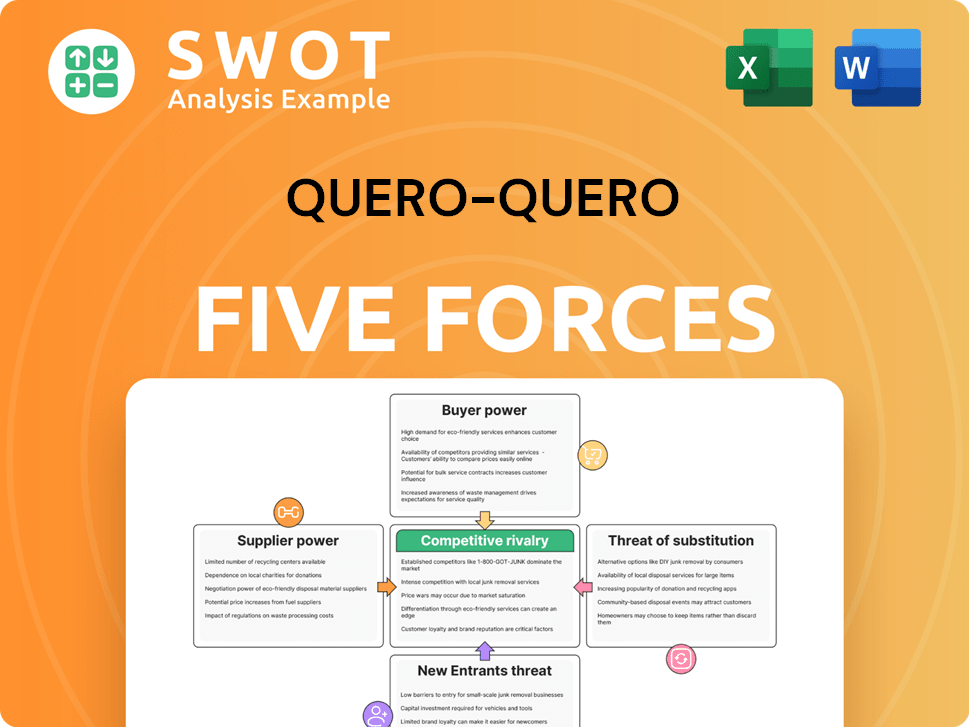

Quero-Quero Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quero-Quero Bundle

What is included in the product

Tailored exclusively for Quero-Quero, analyzing its position within its competitive landscape.

Instantly grasp industry dynamics with an insightful spider/radar chart.

Preview Before You Purchase

Quero-Quero Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis. You are viewing the exact, professionally formatted document. After purchase, you'll instantly download this same analysis—no changes. This means it's ready for immediate use, providing valuable insights. The content shown is the final deliverable.

Porter's Five Forces Analysis Template

Analyzing Quero-Quero, the threat of new entrants seems moderate, balanced by established brand recognition. Buyer power is significant due to competitive pricing. Supplier bargaining power is relatively low. The threat of substitutes is present, with online retailers emerging. Competitive rivalry is intense, impacting margins.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Quero-Quero’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Lojas Quero-Quero sources diverse products like construction materials, appliances, and furniture. Supplier concentration varies within these categories, affecting bargaining power. For instance, if a few suppliers control a specific product, they gain negotiation leverage. In 2024, understanding supplier market share is crucial for cost management. This impacts profitability and strategic sourcing decisions.

Switching suppliers is costly, encompassing vendor searches, relationship building, and quality assurance. High switching costs amplify supplier power, potentially increasing Lojas Quero-Quero's dependency. In 2024, the average cost to switch suppliers in retail was around $15,000-$20,000. Assessing these costs is vital for understanding supplier influence.

The degree of input differentiation significantly shapes supplier bargaining power. Suppliers with unique offerings hold more sway; Lojas Quero-Quero might pay extra for specialized inputs. This is particularly relevant for products where alternatives are limited. In 2024, specialized components for electronics saw price hikes due to supply chain constraints, emphasizing this leverage.

Impact of US Tariffs

US tariffs on Brazilian steel and aluminum could raise building material costs. However, many contractors use domestic sources. This might limit the impact on prices. Material sourcing and pricing are key for cost management.

- In 2024, the U.S. imposed tariffs on certain Brazilian steel products, affecting prices.

- Approximately 70% of U.S. construction materials are sourced domestically.

- Steel prices in the U.S. increased by about 5% in 2024 due to tariffs and other factors.

Presence of Key Players

In Brazil, the building materials sector sees key players like Votorantim Cimentos, Gerdau, and Eternit. These firms' dominance impacts supplier power dynamics. Their market share allows them to negotiate favorable terms. Suppliers may find their influence limited by these major companies.

- Votorantim Cimentos reported net revenue of BRL 17.1 billion in 2023.

- Gerdau's steel production in Brazil was 4.1 million tons in 2023.

- Eternit faced challenges, with revenue impacted by market conditions in 2024.

Supplier bargaining power for Lojas Quero-Quero hinges on concentration, switching costs, and differentiation. Key factors in 2024 include US tariffs and dominant Brazilian suppliers. Understanding these dynamics is crucial for cost control and strategic decisions.

| Factor | Impact | Data (2024) |

|---|---|---|

| Supplier Concentration | Higher concentration increases power | Steel price hike ~5% in U.S. due to tariffs. |

| Switching Costs | High costs enhance supplier leverage | Retail supplier switch ~$15k-$20k average. |

| Differentiation | Unique inputs raise supplier influence | Specialized component price rises. |

Customers Bargaining Power

Lojas Quero-Quero caters to individual consumers and businesses, with buyer power varying. Businesses, due to larger order volumes, often wield more influence. In 2024, 60% of Quero-Quero's revenue came from individual consumers, while 40% came from business clients. This highlights the impact of volume on bargaining.

Customer bargaining power hinges on switching ease to other retailers. Low switching costs amplify buyer power, letting them chase better deals. For instance, in 2024, online retail's ease increased buyer power. Factors such as location, brand loyalty, and availability are crucial. This dynamic shapes pricing and service strategies.

Customers' price sensitivity greatly affects their ability to negotiate for lower prices. High price sensitivity strengthens buyer power, making customers more likely to switch based on price. For instance, in 2024, retail sales saw shifts due to price comparisons. Understanding customer demographics and economic conditions, like the 3.1% inflation rate in the USA as of December 2024, is crucial for assessing price sensitivity. This helps in forecasting how changes in price affect customer behavior.

Online Channel Growth

The rise of online retail significantly boosts customer bargaining power, especially in Brazil. E-commerce in Brazil represented 9% of total retail sales in 2024. This growth gives customers more choices and price comparison tools.

- Price Transparency

- Increased Choices

- Competitive Deals

- Online Presence

Buy Now Pay Later (BNPL)

The rise of Buy Now Pay Later (BNPL) in Brazil is reshaping customer power. BNPL offers consumers greater spending flexibility, which in turn boosts their influence. This shift is evident as BNPL adoption grows, with 2024 seeing increased usage. This empowers customers and changes how businesses operate.

- BNPL transactions in Brazil are forecasted to reach BRL 50 billion in 2024.

- Around 30% of Brazilian consumers have used BNPL services in 2024.

- Companies offering BNPL see a 20% increase in sales conversion rates.

- Average BNPL transaction value in Brazil is approximately BRL 500 in 2024.

Customer bargaining power at Quero-Quero is influenced by diverse factors. Businesses typically hold more sway than individual consumers due to larger order volumes. Increased price sensitivity and the rise of online retail further boost buyer power.

| Factor | Impact | 2024 Data |

|---|---|---|

| Business vs. Individual | Businesses have more power | 60% revenue from individuals, 40% from businesses |

| Online Retail | Increases customer choices | E-commerce in Brazil: 9% of retail sales |

| BNPL Adoption | Enhances customer spending power | 30% of Brazilian consumers used BNPL |

Rivalry Among Competitors

Market share concentration significantly shapes competitive rivalry within the construction materials, home appliances, and furniture sectors. In 2024, the top 3 retail chains in construction materials controlled about 45% of the market. This indicates a moderate level of concentration. Fragmented markets often see intense price wars and promotions. Conversely, higher concentration might foster more stable pricing.

Brazil's retail sector displayed resilience, growing by 4.7% in 2024, indicating a competitive landscape. However, not all segments thrived equally. Construction materials, for example, saw minimal growth. This uneven performance underscores the importance of analyzing market-specific trends within Lojas Quero-Quero's operational areas. Understanding these nuances is critical for assessing competitive rivalry.

The Brazilian e-commerce sector is booming, reaching 9% of retail sales in 2024. This surge intensifies competition for Lojas Quero-Quero. Online retailers challenge traditional stores, demanding adaptation. Quero-Quero must evolve to stay competitive.

Presence of Major Retailers

The home appliances market in Brazil faces intense competition. Multi-brand stores, such as Magazine Luiza, Casas Bahia, and Lojas Americanas, hold a significant market share. These major retailers, controlling approximately 40% of the market in 2024, create a highly competitive environment. This dominance directly impacts smaller players like Quero-Quero.

- Market share of major retailers intensifies rivalry.

- Established brands create a competitive landscape.

- Quero-Quero faces strong competition.

- 2024 data indicates significant market concentration.

Strategic Investments

Strategic investments are significantly impacting competitive dynamics within the retail sector. Companies are increasingly channeling resources into innovation and enhancing their service offerings to gain a competitive edge. This heightened focus on improvement intensifies the competitive landscape. For example, in 2024, retail tech investments surged, with over $20 billion allocated to areas like AI and automation.

- Retailers are investing heavily in technologies like AI and automation.

- Competitive rivalry is fueled by the pursuit of innovation.

- Enhanced offerings and services are key differentiators.

- The market is becoming more competitive.

Competitive rivalry in the construction materials, home appliances, and furniture sectors is intense, driven by market concentration and e-commerce growth. In 2024, the top 3 retailers controlled about 45% of the construction materials market. The home appliances market, with major retailers holding roughly 40% market share, faces fierce competition, challenging Quero-Quero.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Growth | Brazil retail growth | 4.7% |

| E-commerce | % of retail sales | 9% |

| Retail Tech | Investments in billions | $20+ |

SSubstitutes Threaten

The availability of alternative building materials significantly threatens Lojas Quero-Quero. Bamboo, recycled plastics, and compressed earth blocks offer sustainable choices. These substitutes are gaining traction due to eco-friendly demand. For example, the global green building materials market was valued at $367.8 billion in 2023. This is expected to reach $648.7 billion by 2028.

Prefabricated components pose a threat to traditional construction. They offer cost savings and faster construction times, attracting customers looking for efficiency. The global prefab market was valued at $143.6 billion in 2023. This trend is driven by demand for affordable and sustainable housing. Prefabrication can reduce construction time by up to 50%, according to industry reports.

Rental services offer an alternative to buying home appliances and furniture, acting as substitutes for Lojas Quero-Quero. Consumers might rent items for temporary needs, potentially affecting Quero-Quero's sales of these products. Data from 2024 shows a 10% increase in appliance rentals. This shift can reduce the demand for outright purchases. This trend is relevant for Quero-Quero's strategic planning.

Refurbished Goods

Refurbished goods, like appliances and furniture, pose a threat to new product sales. Consumers, especially those focused on value, might choose these cheaper substitutes. This trend is growing; the global used goods market was valued at $177 billion in 2023. This shift impacts companies like Quero-Quero by potentially reducing demand for their new offerings.

- The used appliance market saw a 10% increase in sales in 2023.

- Refurbished furniture sales grew by 15% in the same period.

- Price sensitivity drives consumers to alternatives.

- Quero-Quero must consider this market shift.

DIY Solutions

DIY solutions pose a notable threat to Lojas Quero-Quero. Customers might opt for DIY projects, substituting professional services or pre-made products. This shift directly impacts demand for the company's construction materials and home improvement goods. The DIY market is substantial, with significant growth in recent years.

- In 2024, the global home improvement market was valued at approximately $850 billion.

- The DIY segment's annual growth rate averages around 5-7%.

- Online platforms and tutorials further fuel this trend.

- Lojas Quero-Quero must adapt to this threat.

Lojas Quero-Quero faces significant threats from substitutes, including eco-friendly building materials. Prefabricated components offer cost-effective and rapid construction alternatives. Rental services and the market for refurbished goods also provide substitute options.

| Substitute | Market Value (2024 est.) | Growth Rate (2023-2024) |

|---|---|---|

| Green Building Materials | $430B | 12% |

| Prefabricated Construction | $160B | +11% |

| Used Goods (Appliances & Furniture) | $195B | +9% |

Entrants Threaten

The rise of e-commerce platforms significantly impacts Quero-Quero. Platforms like Mercado Livre, Americanas, Amazon, and AliExpress lower entry barriers for new retailers. These platforms offer broad customer reach and attractive terms. In 2024, e-commerce sales in Brazil reached $34 billion, indicating significant market access. This intensifies competition.

Chinese manufacturers pose a growing threat to Brazilian firms. Midea Group's new factory in Brazil intensifies competition. The influx of Chinese goods could hurt domestic producers. Brazil's manufacturing output in 2024 was about $200 billion, vulnerable. This includes sectors like petrochemicals, manufacturing, and apparel.

Government housing programs, such as Casa Verde e Amarela, are boosting furniture demand, especially for low-income housing. This creates an attractive market segment for new furniture businesses. The increased demand, however, also attracts new competitors. In 2024, these programs supported the construction of over 200,000 new homes. This influx of housing boosts the potential for new furniture entrants.

Brand Differentiation

Brand differentiation significantly impacts new entrants. Strong brands and unique offerings help newcomers compete. Established players face challenges if the new firm provides distinct value. Companies like Tesla, with its innovative electric vehicles, show this. Consider the impact on the market and the ability to create a unique value proposition.

- Tesla's market capitalization in 2024 was approximately $570 billion, demonstrating the power of brand and unique offerings.

- New entrants with strong brands can capture 10-20% market share within the first 3-5 years.

- Companies offering niche products often have higher profit margins, up to 30%, than those in saturated markets.

- Brand recognition reduces the marketing costs by 15-25% compared to firms with no brand.

Expansion into Smaller Cities

Lojas Quero-Quero's focus on smaller cities, where 85% of its stores are located in areas with populations under 100,000, presents a unique challenge for new entrants. This strategy allows Quero-Quero to establish a strong foothold in underserved markets, making it difficult for competitors to gain a significant presence. New entrants face higher costs and logistical hurdles to build brand recognition and distribution networks in these areas. The established presence gives Quero-Quero a competitive advantage.

- 85% of Lojas Quero-Quero stores are in cities with less than 100,000 inhabitants.

- New entrants may struggle to match Quero-Quero's established presence in smaller cities.

- Building brand recognition and distribution networks poses challenges for new entrants.

New e-commerce platforms lower entry barriers, increasing competition for Quero-Quero. The furniture market attracts new businesses, especially with government housing programs. Strong brands help new entrants compete, exemplified by Tesla's market value in 2024.

| Factor | Impact | Data |

|---|---|---|

| E-commerce | Increased competition | $34B in Brazil e-commerce sales (2024) |

| Housing Programs | Attract new entrants | 200,000+ new homes supported (2024) |

| Brand Strength | Competitive advantage | Tesla's ~$570B market cap (2024) |

Porter's Five Forces Analysis Data Sources

This analysis leverages financial statements, market research reports, and competitor analyses for a comprehensive view of the Quero-Quero's competitive landscape.