QuidelOrtho Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QuidelOrtho Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs makes sharing the BCG matrix effortless.

Preview = Final Product

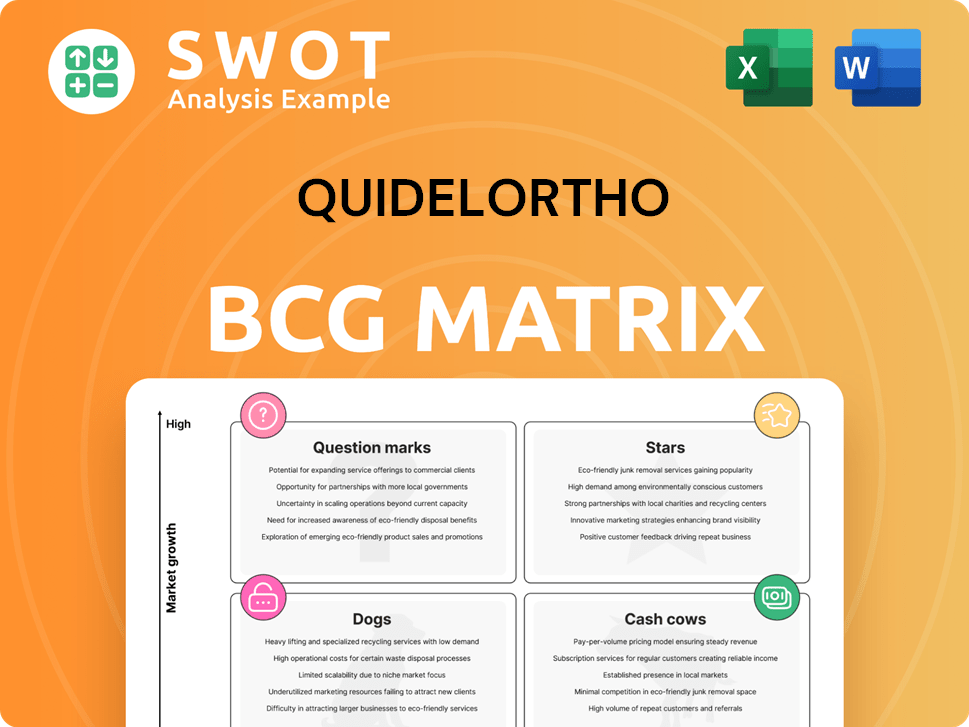

QuidelOrtho BCG Matrix

The BCG Matrix you're previewing mirrors the complete QuidelOrtho report you'll receive. Upon purchase, you'll get the same fully-featured document, optimized for strategic insights and actionable planning. This is the final, downloadable version, ready for immediate application and presentation.

BCG Matrix Template

Explore QuidelOrtho's strategic landscape! This is a snapshot, revealing key product positions within their portfolio. Spot potential stars and understand the cash cows fueling growth.

Uncover risks and opportunities within the Dogs and Question Marks quadrants. This glimpse provides a taste of the full strategic analysis. Gain the complete BCG Matrix for in-depth insights!

Stars

The Savanna platform is a key growth driver for QuidelOrtho. It's a molecular point-of-care system, already FDA-cleared. Respiratory panel clinical trials are ongoing. The launch is planned for late 2025, which could significantly boost revenue and margins.

QuidelOrtho's Labs business, representing about half its revenue, shows steady growth. In 2024, excluding specific revenues, the Labs segment rose by 4%. This segment thrives on recurring revenue from reagents, consumables, and services, providing financial stability.

The Immunohematology business within QuidelOrtho is a key player in transfusion medicine, holding a significant global footprint. This segment achieved a 4% growth in Q4 2024, demonstrating its sustained market relevance. This growth is supported by its comprehensive product portfolio. The business is critical for blood banks and hospitals.

Sofia Platform

The Sofia platform is a key component of QuidelOrtho's offerings, fitting into the Stars quadrant of the BCG Matrix. This rapid immunoassay platform showcases the company's dedication to point-of-care diagnostics, delivering quick and precise results through advanced fluorescence technology. The Sofia platform significantly impacts the healthcare value chain by enabling testing outside traditional central labs. In 2024, point-of-care testing is estimated to be a $35 billion market, reflecting the growing demand for platforms like Sofia.

- Rapid, accurate results using advanced fluorescence technology.

- Impacts the entire healthcare value chain with testing outside of central labs.

- Facilitates quick decision-making, improving patient outcomes.

- Supports a diverse range of diagnostic tests.

Strategic Partnerships

QuidelOrtho's "Stars" category includes strategic partnerships pivotal for innovation. Collaborative research efforts, like those with institutions and providers, are key. These alliances enable the company to stay ahead of emerging trends and clinical needs. Such partnerships are critical for creating useful diagnostic solutions. In 2024, QuidelOrtho invested $15 million in collaborative research projects.

- Partnerships fuel innovation in diagnostics.

- Collaborations focus on emerging healthcare trends.

- Investments support practical diagnostic solutions.

- $15 million invested in 2024 for research.

The "Stars" segment, featuring Sofia, excels in rapid diagnostics via advanced fluorescence. It influences the healthcare value chain by enabling testing beyond standard labs. Point-of-care testing, a $35 billion market in 2024, highlights Sofia's significance.

| Platform | Technology | Market Impact (2024) |

|---|---|---|

| Sofia | Rapid Immunoassay | $35B POC Testing Market |

| Savanna | Molecular POC | Late 2025 Launch |

| Immunohematology | Transfusion Medicine | 4% Growth in Q4 |

Cash Cows

QuidelOrtho's immunoassay products represent a cash cow due to its established market presence and expertise. These existing product lines consistently generate substantial revenue, providing a stable financial foundation. Designed for ease of use and reliability, they offer efficient testing solutions. In 2024, immunoassay sales contributed significantly to QuidelOrtho's revenue.

QuidelOrtho's clinical chemistry offerings are designed to aid clinical decision-making. The Vitros XT 7600 Integrated System is a leader in quality. This system uses Vitros MicroSlides and dry-slide technology. This technology offers flexibility and easy installation. In 2024, the clinical chemistry market showed steady growth, with an estimated value of $8.5 billion.

QuidelOrtho's transfusion medicine segment is a cash cow. It ensures safe blood management and compatibility testing. This segment generates consistent revenue. For instance, in 2024, the global transfusion diagnostics market was valued at $3.2 billion.

Established Molecular Diagnostic Assays

QuidelOrtho's established molecular diagnostic assays are crucial, detecting pathogens and genetic markers with high accuracy. These assays are a cornerstone of their diagnostic offerings, providing sensitive and specific results. They generate consistent revenue, fitting the "Cash Cow" profile within the BCG matrix. These tests are well-established in the market.

- Molecular diagnostics contributed significantly to QuidelOrtho's revenue in 2024.

- These assays have a proven track record of reliability.

- They maintain a strong market position due to their accuracy and dependability.

- The assays continue to generate steady cash flow for the company.

Global Distribution Network

QuidelOrtho's global distribution network is a cornerstone of its business. This network spans numerous countries, providing a significant competitive advantage. It enables the company to tailor its products to local markets. The company's reach is reflected in its diverse revenue streams.

- Presence in over 130 countries indicates a substantial global footprint.

- Adaptation to local regulatory environments is key for market access.

- Diverse product offerings meet varied healthcare needs.

- The global network supports sales of $3.6 billion in 2024.

QuidelOrtho's molecular diagnostic assays are cash cows, generating steady revenue. Their established position, accuracy, and dependability ensure a strong market presence. In 2024, these assays continued to be a reliable source of cash flow.

| Segment | 2024 Revenue (approx.) | Key Feature |

|---|---|---|

| Molecular Diagnostics | Significant | Reliable, accurate tests |

| Global Distribution | $3.6B | Presence in 130+ countries |

| Transfusion Medicine | Consistent | Safe blood management |

Dogs

QuidelOrtho is strategically winding down its U.S. Donor Screening business, a move expected to conclude by late 2025. This decision aligns with a focus on more profitable segments, reflecting a shift in resource allocation. In 2023, the company's revenue was approximately $2.6 billion. The strategic pivot aims to enhance overall financial performance.

COVID-19 testing, once a major revenue source, is now declining. The shift to endemic levels has significantly reduced demand. QuidelOrtho expects COVID-19 revenue to keep falling. In 2024, the company's revenues from COVID-19 testing are notably less. This impacts the overall financial performance.

QuidelOrtho's contract manufacturing revenue is classified as non-core, meaning it's not a primary strategic focus. The company separates core and non-core revenue in its financial reporting. This distinction helps investors understand where the company is directing its resources. In 2024, non-core revenues contributed a smaller portion of the total compared to core business lines.

Certain Cardiac Products

QuidelOrtho's cardiac product revenue has faced challenges. This suggests some cardiac lines may be struggling. This could stem from greater competition or changing market demands. For example, in 2024, the company's overall revenue decreased by approximately 10%, with cardiac products contributing to this decline.

- Cardiac product revenue has declined.

- This suggests underperformance in certain product lines.

- Increased competition is a potential factor.

- Evolving market needs could also play a role.

Legacy Products Facing Competition

QuidelOrtho's legacy products are feeling the heat of competition. The diagnostics market is becoming more crowded, intensifying competitive pressures. As a result, QuidelOrtho is adjusting its growth outlook. They anticipate mid-single-digit growth, reflecting these challenges.

- Increased competition in diagnostics affects older product lines.

- The market's competitive landscape is becoming more intense.

- QuidelOrtho is moderating growth forecasts.

Dogs in the BCG matrix for QuidelOrtho represent products or business units with low market share in a high-growth market, requiring significant investment. These could be products experiencing declining cardiac product revenues, or those facing increased competition in the diagnostic market, particularly from legacy products. QuidelOrtho needs to carefully manage these segments, possibly through strategic investments or divestitures. In 2024, cardiac product revenue declined by about 10% contributing to overall revenue decreases.

| Category | Description | Strategic Implication |

|---|---|---|

| Cardiac Products | Declining revenue. | Further investment or divestiture. |

| Legacy Products | Facing strong competition. | Manage growth outlook. |

| Overall Revenue 2024 | Decreased approximately 10% | Strategic adjustments needed. |

Question Marks

The ARK Fentanyl II Assay, integrated into U.S. Vitros systems in April 2024, is a key addition. This move by QuidelOrtho directly responds to the increasing demand for opioid testing solutions. While its full market potential is still unfolding, it represents a strategic expansion. The assay's impact is expected to grow amid rising concerns; the fentanyl crisis continues to evolve.

The FDA cleared the VITROS syphilis assay in August 2024, a key development. This strengthens QuidelOrtho's role in infectious disease testing. Market adoption and growth are still evolving. In 2024, the syphilis diagnostics market was valued at approximately $700 million. This assay is part of QuidelOrtho's BCG Matrix.

QuidelOrtho is advancing next-generation respiratory assays. These tools aim to expand access to molecular diagnostics. The launch of these assays could revolutionize the industry. In 2024, the respiratory diagnostics market was valued at approximately $8 billion. These innovations could significantly boost QuidelOrtho's market share.

STI and GI Panels

QuidelOrtho strategically focuses on launching sexually transmitted infections (STI) and gastrointestinal (GI) panels, recognizing significant market opportunities. These panels are designed to capitalize on unmet diagnostic needs, driving substantial growth. The strategy aims to enhance market share and improve patient outcomes through advanced diagnostic solutions. This focus aligns with the company's commitment to innovation and expanding its product portfolio.

- STI and GI panels address unmet needs.

- These panels are designed to drive growth.

- The company's commitment is to innovation.

- This strategy aims to enhance market share.

New Tests on Savanna Platform

QuidelOrtho is actively looking into expanding its Savanna platform by introducing new tests. These tests will be designed to identify a broader range of health conditions and diseases. This strategic move could lead to the creation of advanced diagnostic solutions. It aligns with the industry's shift towards more comprehensive and intelligent healthcare tools.

- Savanna platform expansion aims to increase market reach.

- New tests could include those for infectious diseases and chronic illnesses.

- The goal is to offer more complete diagnostic services.

- This strategy aligns with the increasing demand for point-of-care testing.

Question Marks in QuidelOrtho's BCG Matrix represent high-growth, low-share products. These products require significant investment to gain market share. Success hinges on converting these into Stars through strategic initiatives. 2024 STI/GI panel launch exemplifies this.

| Product Category | Strategic Focus | 2024 Market Value (Approx.) |

|---|---|---|

| Fentanyl Assay | Market Expansion | Evolving (related to opioid crisis) |

| Syphilis Assay | Infectious Disease Testing | $700 million |

| Respiratory Assays | Molecular Diagnostics | $8 billion |

BCG Matrix Data Sources

The BCG Matrix is constructed with data from company reports, market research, sales figures, and industry analyses for strategic decision-making.