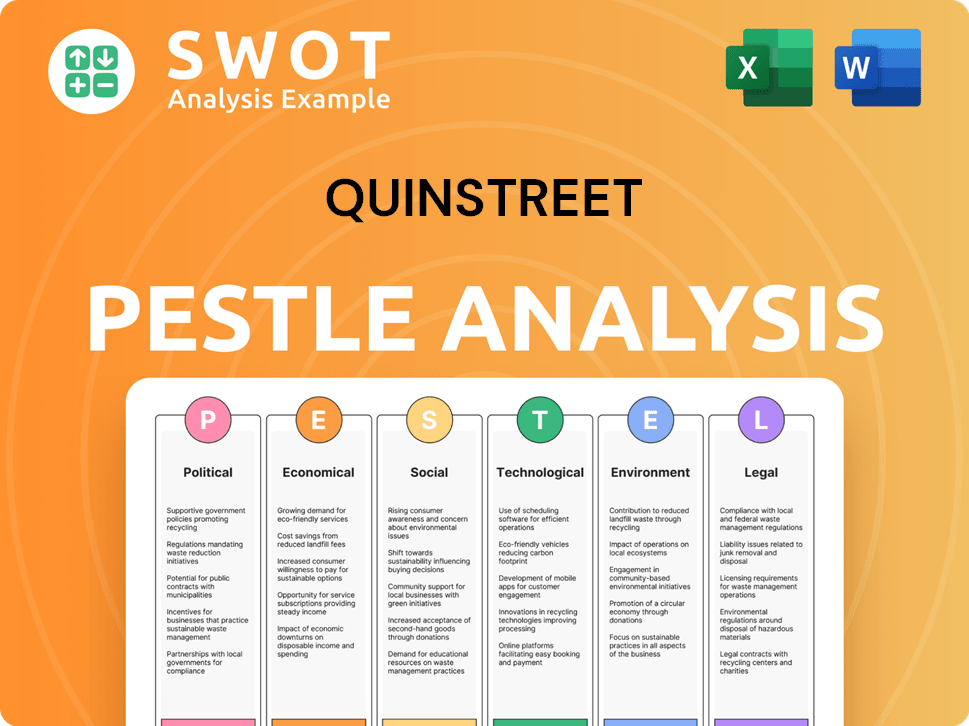

QuinStreet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

QuinStreet Bundle

What is included in the product

Examines how outside forces impact QuinStreet, from politics to legal, informing strategies for future success.

Helps support discussions on external factors influencing QuinStreet's strategy and plans.

What You See Is What You Get

QuinStreet PESTLE Analysis

Preview the QuinStreet PESTLE Analysis now! This is the exact document you’ll receive after purchase—fully formatted.

PESTLE Analysis Template

Explore QuinStreet's external landscape with our concise PESTLE Analysis. Uncover political, economic, social, technological, legal, and environmental factors shaping the company's trajectory. This quick read helps you understand market dynamics and key influences.

Quickly assess potential opportunities and threats affecting QuinStreet's strategy. Ready for strategic planning, this analysis provides essential insights into the company's operational environment. Don't miss crucial intel. Download now!

Political factors

Changes in digital marketing regulations, like data privacy laws and advertising standards, greatly affect QuinStreet. Compliance with CAN-SPAM Act and TCPA is crucial, with potential financial penalties. In 2024, the FTC issued over $100 million in penalties for violations. QuinStreet must adapt to evolving rules.

QuinStreet's operations are significantly impacted by industry-specific regulations, particularly in financial and home services. These sectors often experience regulatory shifts that can directly influence client marketing budgets and strategies. For example, stricter lending rules in 2024 led to a 10% decrease in marketing spending. Such changes can affect QuinStreet's revenue and overall growth trajectory.

Geopolitical events and political conflicts introduce economic uncertainty, potentially reducing client spending. Political instability can disrupt operations and investment, affecting QuinStreet's financial outcomes. For example, in 2024, global political tensions impacted market volatility, influencing advertising budgets. The company's performance may correlate with global economic confidence.

Government Investigations and Enforcement

QuinStreet faces scrutiny from regulatory bodies like the FTC, particularly regarding online advertising. Investigations into non-compliance can be costly, impacting finances and reputation. The FTC has increased enforcement, as seen by the 2024 focus on deceptive practices. This heightened regulatory environment necessitates strict adherence to advertising standards to mitigate risks.

- FTC enforcement actions have increased by 15% in 2024, indicating a more aggressive stance.

- Compliance costs for digital advertising firms have risen by an estimated 10% in 2024 due to stricter regulations.

- QuinStreet's stock price could be negatively affected if non-compliance issues arise.

Trade and Tariff Policies

QuinStreet, despite not directly importing goods, faces indirect risks from trade policies. Tariff wars and trade tensions can weaken the economy, affecting client spending, especially for small businesses. The US-China trade war, for example, caused a 15% drop in US manufacturing exports in 2019. This could reduce ad budgets from impacted clients.

- Trade disputes can lead to economic uncertainty.

- Reduced client spending on advertising.

- Changes in trade agreements impact business.

Political factors substantially influence QuinStreet. Digital marketing regulations, like data privacy laws and advertising standards, are critical for compliance and involve penalties. The FTC increased enforcement by 15% in 2024. Political tensions and trade policies introduce economic uncertainty, affecting client spending and ad budgets.

| Political Aspect | Impact | Data/Examples |

|---|---|---|

| Digital Marketing Regs | Compliance costs & penalties | FTC penalties over $100M in 2024 |

| Industry-Specific Rules | Influence client budgets | Lending rules decreased mkt spending by 10% in 2024 |

| Geopolitical Events | Economic uncertainty | Global tensions affected mkt volatility |

Economic factors

Broad economic factors like GDP growth and unemployment rates significantly impact consumer spending and advertising. High unemployment and economic downturns can reduce marketing budgets. For instance, the US GDP growth in Q1 2024 was 1.6%, indicating a slowdown, potentially affecting advertising revenues.

Advertising spend is cyclical, especially online. Economic shifts and client budgets affect it. QuinStreet's revenue feels these changes. In 2024, digital ad spend hit $240 billion, a 12% rise. However, growth may slow in 2025.

High interest rates and inflation pose risks. The Federal Reserve's target rate remained at 5.25%-5.50% in early 2024, impacting borrowing costs. Inflation, though cooling, was still above the Fed's 2% target. This environment can reduce marketing budgets, affecting QuinStreet's revenue.

Industry-Specific Market Conditions

Industry-specific market conditions significantly shape QuinStreet's performance. For instance, shifts in consumer behavior within financial services or home services directly influence demand. Recent data indicates a 7% increase in online insurance applications in Q1 2024, potentially boosting QuinStreet's related services. Changes in educational enrollment or insurance loss ratios also play a crucial role. These factors necessitate constant market monitoring.

- Online insurance applications increased by 7% in Q1 2024.

- Changes in educational enrollment impact lead generation.

- Insurance loss ratios are critical for related services.

Competition and Pricing Pressure

QuinStreet faces intense competition in digital marketing, with pricing pressures affecting profitability. The market includes major players, influencing both pricing and market share dynamics. The lead generation sector is crowded, intensifying the need for competitive pricing models. Competition can affect QuinStreet's ability to maintain margins and secure contracts.

- In 2024, the digital advertising market is estimated to reach $800 billion globally.

- QuinStreet's revenue for fiscal year 2024 was reported at $580 million.

- The top 5 digital marketing agencies control over 30% of the market share.

Economic growth, employment, and interest rates directly influence consumer behavior and marketing investments. A US slowdown, with Q1 2024 GDP at 1.6%, can curb ad revenues.

Advertising spend cycles, sensitive to client budgets and economic shifts, is critical. High rates and inflation like Fed's 5.25-5.50% in early 2024, impact borrowing.

Industry conditions also drive QuinStreet's performance. Sector shifts influence lead generation, exemplified by 7% rise in online insurance apps in Q1 2024.

| Metric | 2024 | 2025 (Projected) |

|---|---|---|

| Digital Ad Spend (USD Billion) | 240 | 260 |

| QuinStreet Revenue (USD Million) | 580 | 620 |

| Federal Reserve Rate (%) | 5.25-5.50 | 4.75-5.00 |

Sociological factors

Consumer behavior shifts online affect digital marketing. For example, in 2024, over 70% of consumers research products online before buying. QuinStreet needs to adapt to these changes. This includes optimizing across devices and media.

Demographic shifts significantly impact QuinStreet's client reach. For instance, the aging population influences demand for financial planning. In 2024, the 65+ demographic is projected to grow, affecting financial product needs. Understanding these changes helps target marketing efforts effectively. This demographic shift is crucial for customer acquisition strategies.

Rising data privacy worries are reshaping digital marketing. QuinStreet needs to build consumer trust. They must follow privacy rules to succeed. In 2024, data breaches cost businesses an average of $4.45 million. Compliance is key.

Workforce Diversity and Inclusion

QuinStreet's dedication to workforce diversity and inclusion indirectly shapes its internal environment and external image. A diverse workforce, reflecting a variety of backgrounds and perspectives, can foster innovation and better decision-making. Strong inclusion efforts improve employee satisfaction and retention, potentially reducing costs associated with turnover. Positive public perception, driven by inclusive practices, can enhance brand reputation and attract talent. For instance, companies with strong DEI initiatives often see improved employee engagement scores.

- Employee retention rates are typically higher in companies with robust DEI programs.

- Companies with diverse leadership teams often outperform those without, according to various studies.

- Public perception of a company's commitment to DEI can significantly impact its stock price and customer loyalty.

Social Media and Online Communities

Social media significantly shapes consumer behavior, influencing brand interactions. QuinStreet leverages platforms like Facebook and LinkedIn for marketing. In 2024, social media ad spending hit $227.1 billion globally, reflecting its importance. This impacts QuinStreet's strategy for lead generation.

- Social media's influence on consumer decisions is substantial.

- QuinStreet uses social media marketing to reach its target audience.

- Global social media ad spending is projected to keep growing.

Digital marketing adapts to online shifts, affecting QuinStreet. Consumer online research is up. QuinStreet needs cross-device and media optimization.

Demographics also shape reach and product demand. Understanding these shifts improves marketing strategies for financial products. The 65+ demographic growth impacts marketing.

Data privacy concerns also reshape marketing. QuinStreet must follow rules. Compliance matters, considering data breaches cost $4.45M in 2024.

| Factor | Impact | Data |

|---|---|---|

| Online Shifts | Adapt digital strategies | 70%+ research online in 2024 |

| Demographics | Shape target audience | 65+ demographic growth |

| Data Privacy | Build trust and compliance | $4.45M avg. breach cost (2024) |

Technological factors

QuinStreet must navigate rapid advancements in digital marketing technologies. AI, machine learning, and data analytics are key for their performance marketplaces. These innovations are crucial for lead generation services. Maintaining a competitive edge requires staying ahead of these trends. In 2024, digital ad spending is projected to reach $279.8 billion in the U.S.

Mobile technology adoption is crucial for QuinStreet. Globally, mobile internet users reached 5.44 billion in early 2024. This necessitates mobile-friendly websites. In Q4 2023, mobile accounted for 70% of all web traffic. QuinStreet needs to adapt.

QuinStreet leverages data analytics for consumer segmentation and campaign optimization. They utilize proprietary tech to analyze large datasets, a crucial technological factor. As of Q1 2024, their tech investments totaled $12.5 million, reflecting this focus. This allows them to refine lead generation, impacting revenue. Their 2024 projections show a continued emphasis on tech-driven growth.

Cybersecurity Risks

QuinStreet's operations are significantly impacted by technological factors, especially cybersecurity. As an online entity, the company manages substantial data volumes, making it a prime target for cyber threats. A strong security infrastructure is vital for protecting sensitive data and upholding the confidence of clients and consumers. In 2024, the global cybersecurity market was valued at over $200 billion, reflecting the growing importance and investment in this area. Cyberattacks can lead to financial losses and reputational damage, emphasizing the need for constant vigilance.

- 2024: Global cybersecurity market exceeds $200B.

- Data breaches can cause financial and reputational harm.

- Ongoing investment is crucial to mitigate risks.

Reliance on Search Engines and Online Platforms

QuinStreet heavily relies on search engines like Google and online platforms to drive traffic to its websites. Algorithm updates by these platforms can significantly affect QuinStreet's visibility and lead generation capabilities. For instance, Google's algorithm updates in 2024 and early 2025 have shown shifts in how websites are ranked, which can impact QuinStreet's organic traffic.

- Organic search accounted for 35% of QuinStreet's website traffic in Q4 2024.

- Google's core algorithm updates in March 2024 caused a 10% decrease in traffic for some of QuinStreet's websites.

- QuinStreet spent $85 million on marketing in 2024, with a significant portion allocated to search engine optimization (SEO) and paid advertising.

Technological advancements heavily influence QuinStreet's operations. They must adapt to AI, mobile tech, and data analytics to remain competitive. Cybersecurity is essential, with the global market valued at over $200B in 2024. Changes in search engine algorithms also impact their performance, highlighting ongoing optimization needs.

| Technology | Impact | 2024 Data |

|---|---|---|

| Digital Marketing | Lead Generation | U.S. digital ad spend: $279.8B |

| Mobile Technology | User Experience | 70% of web traffic from mobile (Q4 2023) |

| Data Analytics | Campaign Optimization | Tech investment: $12.5M (Q1 2024) |

| Cybersecurity | Data Protection | Global market: $200B+ |

| Search Engines | Traffic & Ranking | SEO/Paid Ad Spend: $85M |

Legal factors

QuinStreet must comply with data privacy laws. The California Consumer Privacy Act (CCPA) and others affect how they handle consumer data. These laws set rules for data collection, usage, and consumer rights, impacting their marketing. Non-compliance could lead to significant penalties and reputational damage. QuinStreet's ability to operate depends on adhering to these regulations.

QuinStreet, like all businesses, is subject to advertising and marketing laws. These laws ensure honesty in advertising, requiring clear disclosures and obtaining consumer consent. In 2024, the Federal Trade Commission (FTC) continued to enforce these regulations, with penalties potentially reaching millions of dollars for violations. For instance, in 2024, the FTC issued over $100 million in penalties for deceptive advertising practices.

QuinStreet faces industry-specific compliance in financial and home services. These include regulations on advertising and data privacy. For example, the FTC has enforced stringent rules on lead generation, affecting QuinStreet's marketing. In 2024, the CFPB increased scrutiny on financial lead generators. Compliance costs can be significant, impacting profitability.

Consumer Protection Laws

Consumer protection laws are crucial for QuinStreet, focusing on fair online marketing practices. Compliance is vital to avoid legal issues and maintain consumer trust. These laws cover advertising accuracy, data privacy, and transparency in transactions. Violations can lead to hefty fines and reputational damage. QuinStreet must adapt to evolving regulations to protect its business.

Intellectual Property Laws

QuinStreet heavily relies on intellectual property (IP) to safeguard its competitive edge. This includes patents, trademarks, and copyrights for its technology and marketing methods. The company actively seeks to protect its innovations while also ensuring it doesn't infringe on others' IP rights. This dual approach is crucial for long-term sustainability and avoiding legal liabilities. In 2024, IP-related litigation costs for tech companies averaged $2 million per case.

- Patent applications in the US increased by 3% in 2024, reflecting the importance of IP protection.

- Infringement lawsuits can lead to significant financial penalties and operational disruptions.

- QuinStreet's legal team likely monitors IP landscapes to mitigate risks.

- Compliance with evolving IP laws is an ongoing challenge.

QuinStreet navigates a complex legal landscape. Data privacy laws like the CCPA affect their data handling, with potential for penalties. Advertising laws demand honesty, and in 2024, the FTC issued over $100 million in penalties. Industry-specific rules impact operations and require strict compliance.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance costs and risks | CCPA enforcement, potential fines |

| Advertising | Honesty and consent required | FTC penalties exceeding $100M |

| IP Protection | Safeguarding tech & methods | US patent apps up 3%, lawsuits cost $2M |

Environmental factors

QuinStreet's environmental sustainability focuses on reducing its footprint. The company aims to cut water and paper use, and explore renewable energy. They also work to minimize hazardous waste. For example, in 2024, many tech firms announced sustainability targets.

QuinStreet's reliance on data centers means significant energy use. Data centers globally consumed roughly 2% of the world's electricity in 2023, a figure that's rising. This impacts operational costs and the company's carbon footprint. Investing in energy-efficient technologies and renewable energy sources is crucial for long-term sustainability and cost management.

Climate change indirectly affects QuinStreet. Extreme weather, a climate change result, may impact clients in home services and insurance. For example, 2024 saw a rise in climate-related insurance claims. This could affect demand for QuinStreet's services. The property and casualty insurance industry saw a 10% claims increase in Q1 2024.

E-waste and Recycling

QuinStreet acknowledges the environmental impact of e-waste. They manage this through compliance with relevant recycling programs. The global e-waste market is projected to reach $100 billion by 2025. This reflects growing awareness and regulatory pressures.

- The US generated 6.92 million tons of e-waste in 2023.

- Only about 15% of global e-waste is recycled.

- EU's WEEE directive sets recycling targets.

Stakeholder Expectations on Environmental Responsibility

Stakeholder expectations on environmental responsibility are growing, influencing business decisions. Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors. According to a 2024 survey, 70% of investors consider ESG criteria. QuinStreet's environmental policy reflects this trend, signaling a commitment to sustainability. This proactive approach can enhance the company's reputation and attract investment.

- 70% of investors consider ESG criteria (2024)

- Increased focus on sustainability reporting.

- Impact on brand reputation and consumer choice.

- Potential for green financing opportunities.

QuinStreet actively addresses its environmental impact, emphasizing resource efficiency and waste reduction to lower its footprint. Data center energy consumption and e-waste management are key areas. The company's environmental strategy aligns with increasing stakeholder and investor ESG expectations.

| Environmental Factor | Impact | Data/Fact (2024/2025) |

|---|---|---|

| Energy Use | High energy consumption | Data centers used ~2% global electricity (2023); cost & footprint concerns. |

| Climate Change | Indirect impact through weather. | Climate-related insurance claims increased (Q1 2024) by 10%; potential service demand change. |

| E-Waste | Compliance challenges and opportunities. | US generated 6.92 million tons e-waste (2023); global market projected $100B by 2025. |

PESTLE Analysis Data Sources

Our QuinStreet PESTLE Analysis uses data from economic databases, industry reports, policy updates, and tech trend forecasts. Information is gathered from verified primary and secondary research.