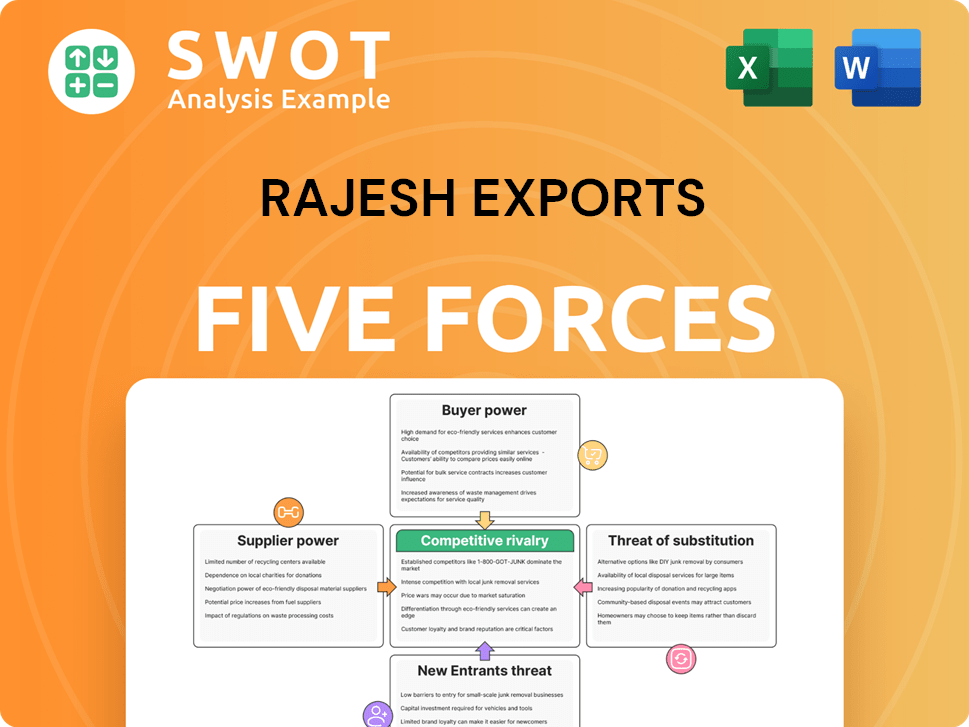

Rajesh Exports Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rajesh Exports Bundle

What is included in the product

Tailored exclusively for Rajesh Exports, analyzing its position within its competitive landscape.

Quickly identify vulnerabilities in Rajesh Exports with a visual threat assessment.

Same Document Delivered

Rajesh Exports Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis of Rajesh Exports. The displayed document is the full, ready-to-use analysis. Immediately after your purchase, you'll have instant access to this exact file. It's fully formatted, professional-grade, and ready for your needs. You're seeing precisely what you'll receive.

Porter's Five Forces Analysis Template

Rajesh Exports faces moderate rivalry, influenced by its market position. Supplier power is moderate due to reliance on raw materials. Buyer power is also moderate, reflecting diverse customer segments. The threat of new entrants is low, given high capital requirements. Substitute products pose a moderate threat.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Rajesh Exports’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Rajesh Exports' vertical integration, spanning mining to retail, offers some control over the gold supply chain. Yet, dependence on external suppliers for gold and diamonds exists. Supplier bargaining power hinges on concentration, substitutes, and Rajesh Exports' significance as a customer. In 2024, gold prices fluctuated, affecting supplier power. Consider factors like diamond supply concentration, which may vary by region.

Rajesh Exports' reliance on refining technology means its suppliers hold some sway. This is especially true if the tech is unique or hard to replace. The fewer the options, the stronger the suppliers' position becomes. If there are many tech providers, Rajesh Exports has more leverage. In 2024, the market for refining tech is competitive, impacting supplier power.

Rajesh Exports relies heavily on skilled artisans for jewelry manufacturing, making them a crucial "supplier." The concentration and availability of this skilled labor pool directly influence supplier power. If artisans are scarce or unionized, their ability to negotiate higher wages and benefits strengthens. In 2024, labor costs in the jewelry sector saw a 5-7% increase, reflecting this dynamic.

Transportation and Logistics

Rajesh Exports relies on transportation and logistics to manage its raw materials and finished products. The bargaining power of these suppliers, such as trucking companies and shipping lines, can be significant. It hinges on the availability of alternative transport options and the number of logistics providers available in the market. For instance, in 2024, the global logistics market was valued at over $10 trillion, showcasing the vastness and competitiveness of the sector.

- Concentration of Suppliers: High concentration increases supplier power.

- Availability of Alternatives: More options reduce supplier power.

- Switching Costs: High costs strengthen supplier power.

- Importance of Volume: Bulk shipments can influence prices.

Energy Suppliers

Energy suppliers significantly influence Rajesh Exports due to the energy-intensive nature of gold refining and jewelry manufacturing. High energy costs can impact profitability, increasing the bargaining power of suppliers. Limited access to cheaper energy sources, like renewable options, further strengthens their position. In 2024, electricity prices in India, where Rajesh Exports operates, averaged ₹8.31 per kWh, potentially affecting margins. This highlights how crucial energy costs are to the company.

- Energy costs form a substantial part of operational expenses.

- Limited alternative energy sources increase supplier power.

- Electricity prices in India averaged ₹8.31 per kWh in 2024.

Rajesh Exports' dependence on suppliers varies across its operations. The concentration of suppliers and availability of alternatives influence their power. In 2024, logistics costs impacted margins due to market dynamics. The jewelry sector's labor costs increased by 5-7%.

| Supplier Type | Influence | 2024 Impact |

|---|---|---|

| Gold/Diamond | Moderate, due to reliance. | Price fluctuations, potential supply issues. |

| Refining Tech | Moderate, depends on options. | Competitive market, some leverage. |

| Artisans | Significant, skilled labor. | Labor cost increase (5-7%). |

| Logistics | Significant, transport. | Global logistics valued at over $10T. |

| Energy | High, energy-intensive. | Electricity at ₹8.31/kWh in India. |

Customers Bargaining Power

Individual retail customers generally wield limited bargaining power in the jewelry market, which is highly fragmented. Nevertheless, customer preferences strongly shape Rajesh Exports' product designs and marketing. In 2024, Rajesh Exports reported a revenue of ₹25,000 crore, reflecting customer demand influence. Their purchasing decisions directly affect sales and profitability.

Wholesale buyers, such as other jewelry retailers and distributors, hold moderate bargaining power. They can switch suppliers, affecting pricing and terms. In 2024, Rajesh Exports' wholesale revenue was approximately ₹25,000 crore, demonstrating the impact of these buyers. The jewelry industry's competitive nature further strengthens their position.

Rajesh Exports' primary customers, bullion banks and central banks, wield substantial bargaining power. These entities purchase gold in immense quantities, influencing market prices. In 2024, central banks globally increased gold reserves, amplifying their negotiating leverage. For instance, the People's Bank of China significantly added to its gold holdings, impacting global demand dynamics. This allows them to secure advantageous terms and pricing.

Export Markets

Rajesh Exports' customers in export markets, such as international retailers and distributors, wield significant bargaining power. This power fluctuates based on market competition and brand recognition. Strong brands often face less pressure, enabling better pricing. Consider that in 2024, global jewelry retail sales reached approximately $300 billion.

- Market dynamics significantly affect negotiation leverage.

- Brand strength influences pricing power directly.

- Competition among retailers also impacts bargaining.

- Geographic market size determines customer influence.

Online Customers

Online customers have a significant bargaining power due to the ease of comparing prices and products. Rajesh Exports faces pressure to offer competitive pricing and enhance its online shopping experience. In 2024, e-commerce sales continued to grow, accounting for a substantial portion of retail sales. This requires Rajesh Exports to focus on customer experience.

- E-commerce sales in India are projected to reach $200 billion by 2026.

- Competitive pricing is crucial; data indicates that price is a top factor for online shoppers.

- Customer reviews and ratings influence purchasing decisions, affecting bargaining power.

Customer bargaining power at Rajesh Exports varies widely across segments. Retail customers have limited power, while wholesale buyers and online shoppers have moderate influence. Bullion banks and export market clients hold significant power, impacting pricing and terms. The jewelry market dynamics shape these customer interactions.

| Customer Segment | Bargaining Power | Impact |

|---|---|---|

| Retail | Low | Influences product design |

| Wholesale | Moderate | Affects pricing and terms |

| Bullion Banks | High | Controls market prices |

| Export | Significant | Dictates market competitiveness |

| Online | High | Forces competitive pricing |

Rivalry Among Competitors

Rajesh Exports competes with global gold refiners like Valcambi and PAMP. Rivalry intensity depends on refining capacity, technology, and raw material access. In 2023, Valcambi processed over 1,500 tons of gold. PAMP's market share is significant in Switzerland. Competition impacts pricing and market share, affecting profitability.

The jewelry manufacturing sector is fiercely competitive, involving many global and local firms. Rajesh Exports faces rivals like Titan Company and Gitanjali Gems. Success hinges on design, material quality, and brand strength. In 2024, the market saw intense price wars and innovation in product offerings.

Rajesh Exports' SHUBH Jewellers faces intense competition from established chains. Tanishq, Kalyan, and Malabar Gold & Diamonds are key rivals. Store locations and brand reputation are crucial. Competitive intensity is high due to similar product offerings. In 2024, Tanishq reported revenue of ₹34,836 crore.

Local Jewelers

In India, Rajesh Exports contends with many local jewelers and family-run firms. These businesses often have deep customer ties and offer bespoke designs. This can be a significant competitive advantage. According to a 2024 report, the unorganized jewelry sector still holds a sizable market share.

- The unorganized sector accounts for approximately 70% of the Indian jewelry market.

- Local jewelers benefit from lower overhead costs in many cases.

- Customization and personalized service are key differentiators.

E-commerce Platforms

The e-commerce landscape has dramatically increased competitive rivalry for Rajesh Exports. Online platforms such as Blue Nile and others continuously challenge traditional retailers. Rajesh Exports must strengthen its digital strategy to maintain competitiveness. This includes enhancing online presence and customer experience.

- E-commerce sales in India are projected to reach $111 billion in 2024.

- Blue Nile's revenue in 2023 was approximately $600 million.

- Rajesh Exports' revenue in 2023 was around $3 billion.

Rajesh Exports faces intense rivalry across gold refining, jewelry manufacturing, and retail. Competitive pressures influence pricing and market share, particularly from global refiners like Valcambi. In 2024, the jewelry market saw dynamic price wars impacting profitability. E-commerce further intensifies competition, with online sales projected to reach $111 billion in India.

| Rivalry Type | Key Competitors | Impact on Rajesh Exports |

|---|---|---|

| Gold Refining | Valcambi, PAMP | Pricing, Market Share |

| Jewelry Manufacturing | Titan, Gitanjali Gems | Design, Brand, Market Share |

| Jewelry Retail | Tanishq, Kalyan | Store locations, Revenue |

SSubstitutes Threaten

Platinum, silver, and other precious metals serve as substitutes for gold in jewelry and investment. The price of silver has fluctuated, trading between $22 and $30 per ounce in 2024. These alternatives become more attractive as gold prices rise. Their perceived value and market trends influence consumer choices. For example, in 2023, platinum prices were lower than gold, making it a viable option for some buyers.

Lab-grown diamonds pose a growing threat to Rajesh Exports. These synthetic gems are increasingly popular as jewelry alternatives. In 2024, lab-grown diamonds captured about 10% of the global diamond market. They provide a more sustainable, cost-effective choice. This attracts environmentally and price-sensitive buyers.

Costume jewelry poses a threat to Rajesh Exports, especially for budget-conscious buyers. Fashion trends significantly impact demand, with costume jewelry often mirroring high-end designs. In 2024, the costume jewelry market was valued at $33.8 billion globally. This substitution is a key factor.

Alternative Investments

Rajesh Exports' gold business faces competition from various alternative investments. These include stocks, bonds, real estate, and even cryptocurrencies, which vie for investors' capital. The allure of gold fluctuates with economic conditions; during economic uncertainty, its safe-haven status often makes it attractive. Conversely, a strong stock market can divert investment away from gold.

- In 2024, the price of gold saw fluctuations, influenced by inflation concerns and interest rate decisions.

- Real estate markets also present an alternative, with varying returns depending on location and market conditions.

- Cryptocurrencies, though volatile, continue to attract investors seeking high-growth opportunities.

Non-Traditional Jewelry

Non-traditional jewelry poses a threat as substitutes to traditional gold and diamond pieces, attracting consumers with unique designs and materials. This shift is particularly noticeable among younger demographics, who often prefer contemporary styles. For example, the global alternative jewelry market was valued at $27.8 billion in 2024, demonstrating its growing appeal. This presents a challenge to Rajesh Exports, as it competes with innovative alternatives.

- Market growth in alternative jewelry is projected to reach $38 billion by 2029.

- Titanium jewelry sales increased by 15% in 2024.

- Ceramic jewelry sales grew 10% in 2024.

- Wood jewelry sales saw an 8% increase in 2024.

Substitutes significantly impact Rajesh Exports' market position.

Alternative jewelry materials and lab-grown diamonds offer lower-cost options.

Investment alternatives like stocks and real estate compete for investor capital, and the global alternative jewelry market was valued at $27.8 billion in 2024.

| Substitute | Market Share/Value (2024) | Growth (2024) |

|---|---|---|

| Lab-Grown Diamonds | ~10% of global diamond market | Increasing |

| Costume Jewelry | $33.8 billion (global) | Stable |

| Alternative Jewelry | $27.8 billion (global) | Titanium +15%, Ceramic +10% |

Entrants Threaten

The gold and jewelry sector demands substantial capital for entry. Rajesh Exports, for example, needed major investments in its gold refineries and manufacturing facilities. This includes costs for machinery and establishing retail outlets. These high capital needs limit the number of new companies that can enter the market. This reduces competition.

Rajesh Exports benefits from its established brand reputation and a loyal customer base, creating a significant barrier for new competitors. Replicating this brand recognition requires substantial time and financial investment, which is a major hurdle. In 2024, the company's brand value was estimated at $1.5 billion, reflecting years of trust. New entrants often struggle to compete with such established market presence.

New entrants, like any new business, face the critical hurdle of accessing distribution channels. These channels include wholesale networks, retail stores, and online platforms, all vital for reaching customers. Securing these channels can be tough, particularly in mature markets. For instance, in 2024, Rajesh Exports' revenue was impacted by the competition from online platforms. The company's ability to adapt to these changes will determine its market share.

Regulatory Hurdles

Regulatory hurdles pose a significant threat to new entrants in the gold industry. Compliance with environmental regulations, import/export restrictions, and other requirements can be expensive. New businesses often struggle with these complexities, potentially deterring entry. These compliance costs can include fees for environmental impact assessments and permits.

- Environmental regulations compliance costs can range from $50,000 to over $1 million.

- Import/export compliance can involve fees of $1,000-$10,000 per shipment.

- Compliance with labor laws and safety standards adds to operational expenses.

Economies of Scale

Rajesh Exports leverages economies of scale due to its substantial refining and manufacturing capabilities, a significant advantage. New entrants face challenges competing on cost until they can match this scale. This cost advantage makes it difficult for smaller firms to enter the market and directly compete. Achieving similar operational efficiency requires substantial capital investment and time.

- Rajesh Exports reported revenue of ₹28,236.53 crore in FY23.

- The company's large-scale operations contribute to lower per-unit production costs.

- New entrants need significant capital to establish comparable infrastructure.

- Economies of scale create a formidable barrier to entry.

Rajesh Exports faces moderate threats from new entrants due to high capital requirements and brand advantages. Regulatory hurdles and economies of scale further protect Rajesh Exports. However, evolving distribution channels, particularly online, pose a challenge.

| Factor | Impact on Threat | Data Point (2024) |

|---|---|---|

| Capital Intensity | High Barrier | Refineries: $100M+ investment |

| Brand Reputation | High Barrier | Brand value: $1.5B |

| Distribution | Moderate Threat | Online sales growth: 15% |

| Regulations | High Barrier | Compliance costs: $50K-$1M+ |

| Economies of Scale | High Barrier | FY23 Revenue: ₹28236.53Cr |

Porter's Five Forces Analysis Data Sources

This analysis uses financial reports, industry research, and competitor analyses. Additional data comes from market reports to assess competition.