Ramsay Sante Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ramsay Sante Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

A shareable, one-page overview of the BCG Matrix helps stakeholders digest key information immediately.

What You See Is What You Get

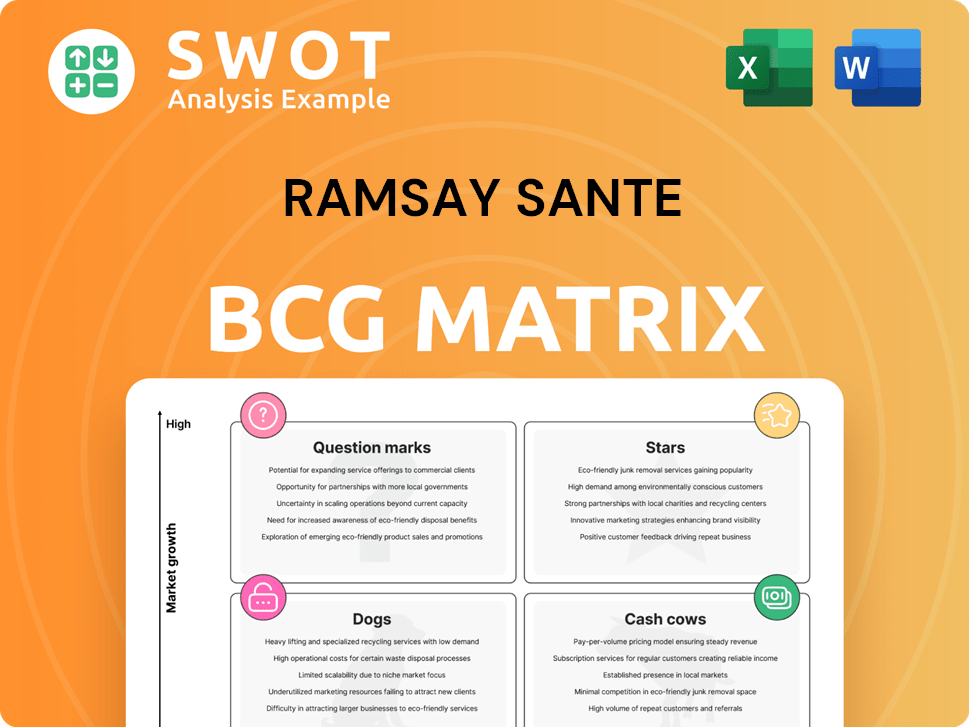

Ramsay Sante BCG Matrix

The BCG Matrix preview showcases the complete document you'll gain access to upon purchase. This report, identical to the download, offers strategic insights and is ready for immediate application in your business analysis. No modifications, just the finalized BCG Matrix.

BCG Matrix Template

Ever wonder how Ramsay Santé positions its diverse services? This BCG Matrix snapshot reveals the potential of their offerings across various markets. Question Marks signal areas for investment, while Stars suggest strong growth potential. Cash Cows often drive revenue, and Dogs may need rethinking. This is just a glimpse.

Uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions with the full BCG Matrix report.

Stars

Ramsay Santé's 'Yes We Care 2025' strategy emphasizes integrated care, extending beyond hospitals. This involves more imaging tech, primary care centers, and mental health facilities. The goal is a complete patient journey, boosting Ramsay Santé's healthcare leadership. In 2024, Ramsay Santé increased its outpatient revenue by 7.8%.

Ramsay Santé's digital healthcare solutions are a "Star" in its BCG matrix, indicating high growth and market share. The company's investment in digital capabilities boosts patient care access and experience. In Sweden, a digital platform manages about 10,000 monthly patient transfers. The Swedish digital front door serves over 800,000 customers.

Ramsay Santé has strategically acquired healthcare providers. Notable acquisitions include Capio AB and Générale de Santé. In June 2024, the company acquired 12 Cosem primary care centers in France. These moves boost its market presence; in 2024, Ramsay Santé's revenue grew by 8.7% to €5.1 billion.

Capio's Contract Extension

Capio, a Ramsay Santé subsidiary, secured an eight-year extension for care at St. Göran's Hospital in Stockholm, starting January 2026. This contract is valued at about €4.8 billion over twelve years, highlighting Capio's importance to Ramsay Santé. The deal boosts Ramsay Santé's revenue and strengthens its position in the Swedish healthcare sector. This extension is key for Ramsay Santé’s future growth.

- Contract Value: Approximately €4.8 billion over 12 years.

- Start Date: January 2026.

- Location: St. Göran's Hospital, Stockholm.

- Impact: Strengthens Ramsay Santé's market position.

Innovation in Medical Services

Ramsay Santé shines as a "Star" in the BCG Matrix, fueled by a commitment to innovation. The company allocates over 200 million euros annually to innovation, spanning medical, hospital, digital, and administrative domains. This investment enhances care accessibility and improves patient outcomes, solidifying their position. Advanced tech and novel treatments are key.

- Ramsay Santé's revenue in 2024 reached approximately 5.2 billion euros.

- The firm's EBITDA in 2024 was around 650 million euros.

- They have over 400 facilities across several countries.

Ramsay Santé's "Stars" are digital healthcare and strategic acquisitions, showing high growth and market share. These areas receive significant investment, fueling innovation and expanding market presence. In 2024, revenue hit roughly €5.2 billion, with EBITDA at about €650 million.

| Key Feature | Details | 2024 Data |

|---|---|---|

| Digital Healthcare | Focus on digital solutions. | Digital platform in Sweden: 10,000 monthly patient transfers. |

| Strategic Acquisitions | Expanding healthcare provider network. | Revenue growth: 8.7% to €5.1 billion. |

| Innovation Investment | Annual spending to advance care. | Over €200 million yearly. |

Cash Cows

Ramsay Santé dominates the European private healthcare market, especially in France. Their established presence in key countries like Sweden and Italy supports consistent revenue. In 2024, they reported a revenue of €4.8 billion. This strong market position allows them to maintain profitability.

Ramsay Santé’s diverse service portfolio, encompassing medicine, surgery, and mental health, positions it as a comprehensive healthcare provider. This wide array attracts a consistent patient flow, solidifying revenue streams. Their extensive offerings create a one-stop healthcare solution for patients. In 2024, Ramsay Santé reported a revenue of €4.5 billion, driven by its broad service range. This approach helped secure a market share of 10% in the private healthcare sector.

Ramsay Santé prioritizes high-quality care, with 95% of its French facilities certified by the Haute Autorité de Santé. This focus builds patient trust and loyalty, securing a stable market share. Their dedication to quality, including ongoing improvements, solidifies their position as a leading healthcare provider. In 2024, Ramsay Santé's patient satisfaction scores remained consistently high, reflecting their commitment.

Focus on Cost Control

Ramsay Santé, a cash cow in the BCG matrix, prioritizes cost control and operational efficiency. This strategy helps maintain profitability despite rising costs, including salaries and procurement. They've focused on restructuring their cost base and boosting productivity. This commitment ensures stable financial performance. In 2024, the healthcare sector faced significant cost pressures.

- Salary inflation remains a key challenge.

- Procurement costs for medical supplies continue to increase.

- Staff shortages impact operational efficiency.

- Cost control is critical for maintaining margins.

Strong Relationships with Public Healthcare Systems

Ramsay Santé's close ties with public healthcare systems are a key asset. They support public health services and integrate into national healthcare networks. This collaboration gives them access to a steady flow of patients and funding. These solid relationships are vital for their operational stability and financial performance. For example, in 2024, they generated over €5.3 billion in revenue, partly thanks to these relationships.

- Collaboration with public health services.

- Integration into national healthcare networks.

- Stable patient and funding base.

- Revenue of over €5.3 billion in 2024.

Ramsay Santé, as a Cash Cow, focuses on financial stability through cost control. They maintain profitability despite challenges like rising costs in 2024, which are detailed below. Their operational efficiency and strategic collaborations with public systems are key.

| Factor | Details | Impact |

|---|---|---|

| Cost Control | Focus on operational efficiency and cost restructuring. | Maintains profit margins in a high-cost environment. |

| Public Healthcare Ties | Collaborations with public systems and funding networks. | Secures a stable patient base and consistent revenue. |

| Financial Performance (2024) | Revenue of over €5.3 billion due to strategies. | Demonstrates robust financial health and resilience. |

Dogs

Ramsay Santé faces challenges with underperforming facilities. In France, about 6 out of 150 hospitals and clinics struggle financially. These facilities, with low growth and market share, could be categorized as "Dogs." For instance, in 2024, some French clinics reported lower occupancy rates.

Ramsay Santé grapples with occupancy issues in mental health and neurological services. Slow occupancy ramp-up at new sites affects performance negatively. These struggles may indicate a 'Dog' status for these service areas. For example, in 2024, occupancy rates remained below target in several facilities. This underperformance has led to financial strain.

Elysium Healthcare, part of Ramsay's UK mental health business, struggles with profitability. Rising UK Living Wages and National Insurance contributions hinder margin recovery. These financial pressures could make Elysium a 'Dog' in Ramsay Santé's portfolio. In 2024, the UK healthcare sector faced substantial cost increases.

Slow Tariff Adjustments

Slow tariff adjustments in regions like France have created financial strain because increases haven't matched inflation. The French tariff indexation for the private sector, for example, was initially below the public sector's, affecting profitability. This can lead to services being classified as "dogs" in the BCG matrix. In 2024, inflation in France was around 2.5%, impacting businesses reliant on these tariffs.

- Tariff increases lag inflation.

- French private sector indexation lower.

- Impact on service profitability.

- Inflation rate in France (2024): ~2.5%.

Potential Divestitures

Ramsay Health Care is evaluating strategic options for its majority stake in Ramsay Santé, potentially signaling a divestiture. This move could involve selling off assets, possibly categorized as "Dogs" in a BCG matrix, due to their low market share and growth prospects. Any divestiture decisions would be based on market conditions and strategic goals. In 2024, Ramsay Santé's financial performance and market position are critical factors.

- Ramsay Health Care announced in 2024 that it was exploring strategic options for its stake in Ramsay Santé.

- The decision to potentially divest assets indicates a shift in strategic focus.

- Divestiture decisions will be based on market conditions and strategic goals.

- Ramsay Santé's financial performance in 2024 is a key factor.

Several Ramsay Santé facilities and services struggle with low growth and market share. This underperformance may classify them as "Dogs" within the BCG matrix. Occupancy issues and slow tariff adjustments contribute to this status. Strategic evaluations, potentially leading to divestitures, further highlight the challenges.

| Category | Details | 2024 Data |

|---|---|---|

| Underperforming Facilities | Financial struggles in specific clinics. | ~6/150 hospitals/clinics in France struggle. |

| Service Areas | Occupancy issues in mental health. | Occupancy rates below target in some facilities. |

| Financial Pressures | Rising costs and lagging tariff adjustments | France inflation ~2.5%, tariff indexation lag. |

Question Marks

Ramsay Santé's move into primary care, such as acquiring Cosem centers in France, is a growth opportunity. These centers boost revenue, yet demand substantial investment for integration and expansion. They fit the "Question Mark" category because of their high growth potential but relatively low market share. In 2024, Ramsay Santé's primary care initiatives are expected to show revenue growth, reflecting the ongoing investments.

Ramsay Santé's 'New Ramsay Services' is a digital venture, positioning it in the 'Question Mark' quadrant of the BCG Matrix. This new digital platform requires marketing and user adoption investments to succeed. Its success is uncertain, with digital health market growth at 15% in 2024. This initiative's future profitability remains unclear.

Ramsay Santé's investments in innovative medical technologies, including advanced imaging and robotic surgery, place them in the Question Marks quadrant of the BCG matrix. These technologies aim to enhance patient outcomes and draw in new patients. However, their market share and profitability remain uncertain, similar to other healthcare providers. Until a clear return on investment is established, these technologies are categorized here. In 2024, the global medical robotics market was valued at $13.8 billion.

Mental Health Day Facilities

The launch of mental health day facilities in France marks a growth prospect within a sector experiencing rising demand. These facilities necessitate substantial investments in personnel and infrastructure to attain profitability. Given the need to rapidly capture market share, these new facilities are question marks in Ramsay Santé's BCG matrix. This sector witnessed a 15% increase in demand for mental health services in 2024, highlighting its potential.

- Investment in staffing and infrastructure is essential for profitability.

- The facilities are in a growth phase, requiring rapid market share gains.

- High demand for mental health services presents a significant opportunity.

- Ramsay Santé's strategy must focus on efficient resource allocation.

Geographic Expansion into Italy

Ramsay Santé's Italian operations are considered a 'Question Mark' in its BCG Matrix. This designation arises because, despite being part of Ramsay Santé's European presence, Italy might have a smaller market share compared to its more established positions in France and the Nordics. To strengthen its standing in Italy, Ramsay Santé might need to invest more and implement specific strategic plans. The goal is to boost its market share and achieve a more competitive position in the Italian healthcare market.

- Ramsay Santé operates in Italy as part of its broader European footprint.

- Market share in Italy could be lower than in France or the Nordics.

- Further investment and strategic initiatives are likely needed.

- The aim is to improve market position and competitiveness.

Question Marks in Ramsay Santé's portfolio require strategic investment for high growth potential, but face uncertain market share. These ventures demand focused resource allocation, as seen with new facilities. The goal is to boost market position and competitiveness, as demonstrated by the Italian operations.

| Aspect | Details | 2024 Data |

|---|---|---|

| Primary Care Revenue | Growth initiatives like Cosem centers | Expected revenue growth reflects ongoing investments. |

| Digital Health Market | 'New Ramsay Services' expansion | Market grew by 15%. |

| Medical Robotics Market | Tech investments for advanced care | Valued at $13.8 billion. |

BCG Matrix Data Sources

Ramsay Santé's BCG Matrix leverages data from financial filings, market analysis, and industry research for insightful strategic evaluations.