RCL Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RCL Foods Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Export-ready design allows RCL Foods to quickly build presentations. This saves time and effort.

Preview = Final Product

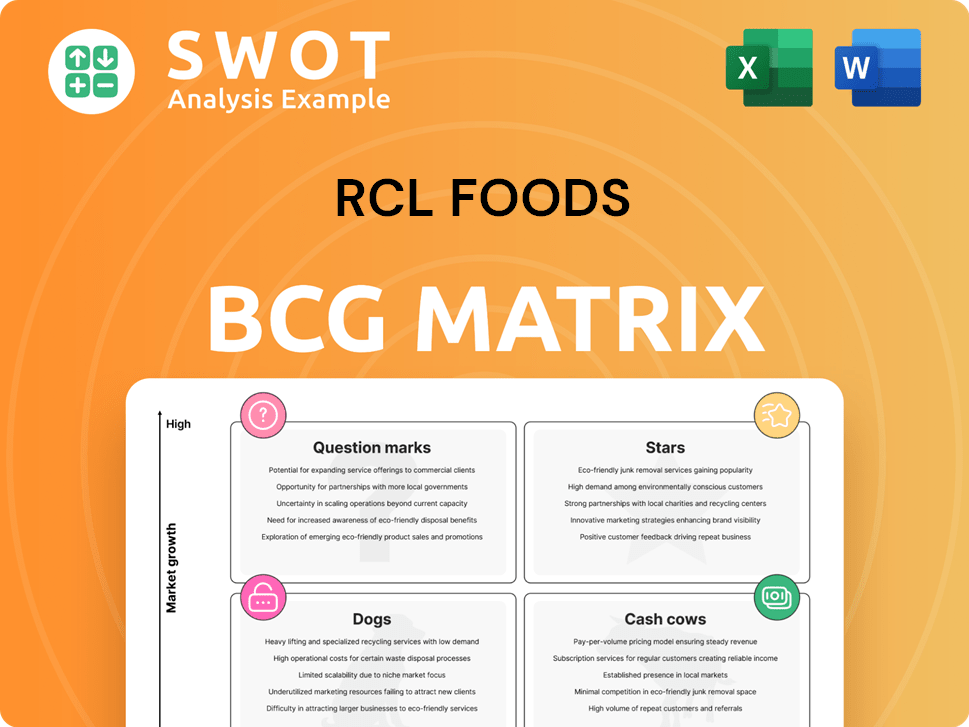

RCL Foods BCG Matrix

The preview displays the complete RCL Foods BCG Matrix you’ll receive. This is the fully formatted, ready-to-use document – no hidden content or edits required upon purchase.

BCG Matrix Template

RCL Foods navigates a dynamic market, and the BCG Matrix offers crucial strategic insights. Their portfolio likely features a mix of high-growth "Stars" and stable "Cash Cows." "Dogs" and "Question Marks" reveal areas needing attention and potential investment shifts. This quick snapshot highlights competitive positioning, but the full analysis is vital.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

RCL Foods' premium pet food brands are a "Star" in its BCG matrix, showing strong performance. This segment benefits from a positive product mix and better margins. The strategy of focusing on high-value products supports continued growth. In 2024, the Groceries segment, including pet food, contributed significantly to overall revenue. This reflects innovation and category expansion.

The Baking business unit, especially Speciality and Milling, shines as a Star. It boasts strong performance, with improved margins offsetting volume drops elsewhere. RCL Foods' focus on innovation and efficiency helps keep prices competitive. In 2024, baking contributed significantly to overall revenue.

RCL Foods' Sugar business, a Star in its BCG Matrix, shines due to a robust local market share. This success stems from a larger sugar crop and operational efficiencies, boosting milling performance. Despite high market prices, the sugar unit has consistently delivered positive outcomes for the company. In 2024, RCL Foods' sugar segment saw a notable increase in revenue, reflecting its strong market position.

Groceries (Culinary - Brand Equity)

Groceries (Culinary - Brand Equity) within RCL Foods' portfolio has demonstrated improved profitability. This success stems from strategic investments in brand equity and maintaining market leadership. Despite experiencing volume declines, the segment's margins have been sustained, signaling robust brand strength and effective marketing. The company's ongoing investments in brand equity are expected to continue driving positive results.

- Improved profitability through brand investments.

- Maintained margins despite volume declines.

- Strategic focus on brand equity.

- Expected continued investment in brand growth.

Animal Feed (Molatek)

Molatek, within RCL Foods' portfolio, shines as a Star due to its robust performance. In 2024, this animal feed business demonstrated remarkable growth, driven by strategic sales and cost efficiencies. Revenue and EBITDA saw substantial increases, with underlying EBITDA surging by nearly 21%. The company anticipates continued success from this segment.

- Record-breaking year with a focus on high-margin products.

- Strong operational efficiencies and cost savings.

- Significant revenue and EBITDA growth.

- Underlying EBITDA increased by approximately 21%.

RCL Foods' Star businesses show strong growth, particularly in Baking, Sugar, and Molatek. These segments benefit from strategic focus, improved margins, and operational efficiencies. Pet food also contributes, thanks to product mix and expansion. In 2024, these sectors drove revenue increases, highlighting their significance.

| Business Segment | Performance Driver | 2024 Highlights |

|---|---|---|

| Pet Food | Premium products, innovation | Significant Groceries revenue contribution |

| Baking | Innovation, efficiency | Revenue increase, margin improvements |

| Sugar | Local market share, efficiency | Notable revenue increase |

| Molatek | Strategic sales, cost efficiencies | Revenue & EBITDA growth (underlying EBITDA +21%) |

Cash Cows

Ouma Rusks, a cash cow for RCL Foods, leads the rusk market with a 60% share as of December 2024. This strong market position ensures a steady revenue stream. The brand's market share remains stable, indicating continued success. Ouma Rusks is a beloved South African brand.

Selati Sugar, a key part of RCL Foods, is a strong brand within its portfolio, ensuring steady performance for the Sugar unit. Its underlying performance is solid, boosted by favorable local and export prices. As a trusted South African household name, Selati Sugar consistently delivers. In 2024, RCL Foods' Sugar business showed robust revenue growth.

Sunbake Bread, a cornerstone of RCL Foods' Baking unit, significantly boosts segment revenue. As a household name in South Africa, it has a strong market presence. In 2024, the brand maintained a steady market share, reflecting its enduring consumer appeal. The company anticipates continued stability for Sunbake Bread.

Nola Mayonnaise

Nola Mayonnaise, a cornerstone in RCL Foods' portfolio, consistently generates substantial revenue. As a prominent brand in South Africa's grocery sector, it benefits from high consumer trust. In 2024, Nola produced a significant 85 million jars of mayonnaise, solidifying its market presence. This steady performance positions Nola as a reliable "Cash Cow" within the BCG Matrix, fueling other ventures.

- Leading brand in Groceries segment.

- Household name in South Africa.

- Produced 85 million jars in 2024.

- Provides steady income for RCL Foods.

Yum Yum Peanut Butter

Yum Yum Peanut Butter is a cornerstone in RCL Foods' Groceries portfolio, recognized for its steady sales and strong brand presence. It's a household staple in South Africa, enjoying high consumer trust. In 2024, the brand manufactured 26 million jars, reflecting its substantial market share and consistent demand. This positions Yum Yum as a "Cash Cow" in the BCG Matrix, generating significant cash flow.

- Consistent sales and brand recognition.

- A trusted brand in South Africa.

- 26 million jars produced in 2024.

- Generates significant cash flow.

Cash Cows within RCL Foods, like Nola Mayonnaise and Yum Yum Peanut Butter, are key for stable revenue. They have a strong market presence. Brands such as Nola and Yum Yum contribute significant cash flow, funding other company ventures. In 2024, Nola produced 85 million jars, and Yum Yum made 26 million jars.

| Brand | Product | 2024 Production |

|---|---|---|

| Nola | Mayonnaise | 85 million jars |

| Yum Yum | Peanut Butter | 26 million jars |

| Ouma Rusks | Rusks | 60% market share |

Dogs

The Beverage business within RCL Foods' portfolio faces volume declines, despite cost savings and sales mix improvements. This positioning suggests a "Dog" status in the BCG matrix. In 2024, the beverage sector's revenue was likely impacted by these volume challenges, requiring strategic attention. The company must focus on boosting sales to improve this segment's performance.

RCL Foods' Baking segment, specifically Bread, Buns & Rolls, is experiencing volume pressure. This decline necessitates strategies to boost sales. Despite margin improvements in Milling and Speciality, volume drops are negating these gains. In 2024, the Baking division's performance reflects these challenges, with reported volume declines impacting overall profitability.

RCL Foods' Culinary segment, categorized as a "Dog" in the BCG matrix, saw improved profitability in 2024 due to brand equity investments and margin maintenance, yet experienced volume decline. The strategic focus should be on reversing the volume decrease to enhance overall performance. In 2024, the Culinary segment's revenue decreased by 3.4%, despite margin improvements. Addressing volume loss is crucial for future growth.

Poultry (Prior to Unbundling)

Prior to its unbundling in 2024, Rainbow Chicken, part of RCL Foods, might have been categorized as a 'Dog' in the BCG matrix due to industry headwinds like avian flu and import competition, affecting profitability. However, post-unbundling, Rainbow Chicken is now a separate entity. The company is now listed on the Johannesburg Stock Exchange and is operating as a vertically integrated poultry producer and feed manufacturer.

- In 2023, RCL Foods reported a 13.8% decrease in revenue for its chicken business.

- The unbundling aimed to unlock value and allow focused management.

- Rainbow Chicken's focus is on optimizing its vertically integrated model.

- The company faces challenges from fluctuating feed costs and disease outbreaks.

Vector Logistics (Prior to Disposal)

Prior to its disposal in 2023, Vector Logistics likely fit the 'Dog' classification in RCL Foods' BCG matrix. The logistics sector faced headwinds, influencing its performance. The sale of Vector Logistics, completed in 2023, allowed RCL Foods to streamline its focus. This strategic shift aimed to strengthen core business areas.

- Disposal in 2023.

- Logistics sector challenges.

- Focus on core businesses.

- Strategic portfolio adjustment.

Culinary, Baking, and Beverages within RCL Foods were "Dogs" due to volume declines, despite margin improvements. Revenue decrease in Culinary was 3.4% in 2024, highlighting sales challenges. Strategic focus aims to reverse volume declines to enhance profitability.

| Segment | Status | 2024 Performance |

|---|---|---|

| Culinary | Dog | Revenue -3.4% |

| Baking | Dog | Volume Pressure |

| Beverages | Dog | Volume Declines |

Question Marks

RCL Foods aims to boost export revenue in the SADC region. This signifies a growth prospect, but demands more investment. The company is actively broadening its African footprint, a trend expected to continue. In 2024, RCL Foods' revenue reached R38.2 billion, showing its financial standing. They are strategically positioning themselves in Africa.

RCL Foods can tap into the expanding health-conscious market with new bakery products. The shift towards vegan and low-carb options presents growth opportunities. In 2024, the global vegan bakery market was valued at $1.3 billion, projected to reach $2.2 billion by 2029. The company's R&D focused management trainee program supports product innovation.

RCL Foods is strategically focusing on Speciality Pet Food, aiming for growth. This segment is considered a potential growth area, demanding investments and market expansion. The company’s moves in 2024 show it is actively growing its presence in the pet food market. In 2024, the global pet food market was valued at approximately $120 billion.

Expansion into Adjacent Categories

RCL Foods is exploring growth by moving into related areas. A recent example is the Sunshine Bakery acquisition in KwaZulu-Natal. This allows for expansion, but needs more investment and market building. The company aims to grow its baking presence and is expected to keep doing so. This strategic move aligns with broader consumer trends.

- Sunshine Bakery integration boosts market reach.

- Expansion needs investment in new markets.

- Focus on baking reflects consumer preferences.

- Strategic moves aim for increased revenue.

Beverages (Innovation & New Products)

The beverage sector within RCL Foods has seen improvements due to cost efficiencies and sales adjustments, though volume remains a concern. To address this, the company should focus on new product development. This could involve innovative beverages. The goal is to boost sales and align with consumer trends.

- Improved results from cost savings and sales mix shift.

- Low volumes in the beverage business need attention.

- New products could cater to changing consumer preferences.

- Focus on increasing sales to drive growth.

Question Marks for RCL Foods represent high-growth potential yet require substantial investment.

RCL Foods faces the challenge of turning these areas into Stars, with market share gains. This phase needs careful resource allocation. Question Marks require strategic decisions.

RCL Foods' success hinges on how it invests in and manages these initiatives in 2024. Successful strategies can turn these Question Marks into future growth drivers.

| Segment | Market Growth | RCL Foods Strategy |

|---|---|---|

| Export Expansion | High | Increase investment in SADC region |

| New Bakery Products | High | Focus on product innovation, R&D |

| Specialty Pet Food | High | Invest in market expansion |

BCG Matrix Data Sources

The RCL Foods BCG Matrix leverages financial reports, market share analysis, and competitor data. Industry publications, plus expert opinions, are also incorporated.