Republic Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Republic Services Bundle

What is included in the product

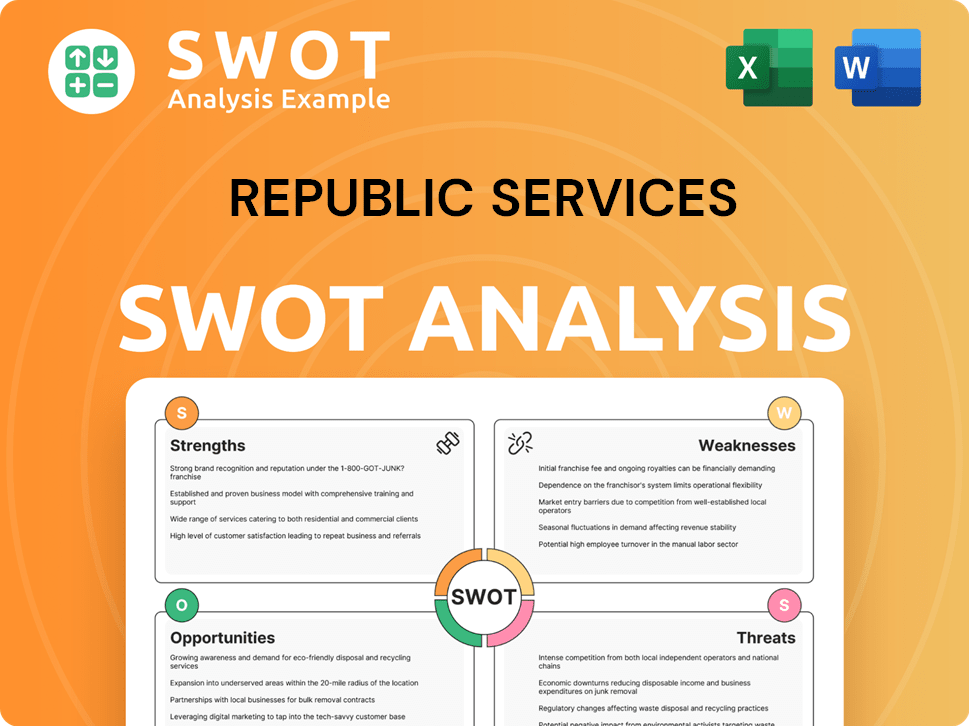

Outlines the strengths, weaknesses, opportunities, and threats of Republic Services.

Facilitates interactive planning with a structured, at-a-glance view.

Preview the Actual Deliverable

Republic Services SWOT Analysis

This preview showcases the very same SWOT analysis you'll receive upon purchase. There's no hidden content or altered format. Every detail presented here is identical to the downloadable report. This means professional analysis, fully accessible immediately after purchase.

SWOT Analysis Template

Republic Services shows strong infrastructure but faces environmental scrutiny and competition. Their strengths include a vast network and brand recognition. Yet, regulatory changes and commodity price fluctuations pose threats. Understanding these dynamics is crucial for any stakeholder. Analyzing these elements is vital.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Republic Services is a leader in the U.S. waste industry. They are the second-largest in solid waste services. In 2024, revenue and net income increased. Projections show continued growth through 2025. The company's financial performance often surpasses expectations.

Republic Services demonstrates strong pricing power, a crucial strength in the waste management industry. This ability allows the company to adjust prices effectively, even in challenging economic times. Its capacity to raise prices has supported consistent financial results and margin growth. For instance, in Q1 2024, Republic Services reported a 6.8% increase in average yield. This pricing strategy helps offset rising operational costs.

Republic Services is bolstering its position with significant investments in sustainability. These include electric vehicle fleets, polymer centers for plastic recycling, and renewable natural gas projects. These initiatives align with the growing global emphasis on environmental responsibility. Such investments are expected to drive long-term value and growth within its Environmental Solutions segment. In 2024, Republic Services reported over $1 billion in sustainability-related investments.

Strategic Acquisitions and Expansion

Republic Services excels in strategic acquisitions, broadening its reach and service portfolio. Recent moves include industrial waste and wastewater treatment acquisitions, boosting its market presence. These acquisitions are key to revenue growth, anticipated to continue in 2025. The company's smart expansion strategy is evident. It reinforces its market leadership through strategic investments.

- 2024: Republic Services acquired several waste management companies.

- 2024: Revenue growth from acquisitions is projected at 3-4%.

- 2025: Further acquisitions are planned.

- 2023: The company's revenue reached $14.5 billion.

Operational Efficiency and Technology Adoption

Republic Services excels in operational efficiency, leveraging technology for enhanced performance. Route optimization software boosts safety and service quality. The company is modernizing financial and asset management systems for streamlined processes. These upgrades offer better data visibility and operational insights.

- In Q1 2024, Republic Services increased its core price by 7.4%.

- The company’s adjusted EBITDA margin was 28.9% in Q1 2024.

- Republic Services invested in technology to improve efficiency and customer service.

Republic Services leads in the U.S. waste sector. They leverage strong pricing, which increases profitability and surpasses industry averages. Strategic investments include environmental solutions and acquisitions for long-term gains.

| Strength | Details | 2024/2025 Data |

|---|---|---|

| Pricing Power | Ability to adjust prices | Q1 2024 average yield increased 6.8% |

| Sustainability | EV fleets, recycling | Over $1B invested in 2024 |

| Strategic Acquisitions | Industrial waste, wastewater | Revenue growth proj. 3-4% in 2024 |

Weaknesses

Republic Services has faced volume declines. Residential and construction sectors have seen drops. In Q1 2024, volumes decreased. This reflects contract losses and market softness. These declines impact revenue growth.

Republic Services' pricing power faces potential hurdles. Increased competition, especially from smaller waste management firms, could pressure margins. Regulatory changes, such as stricter environmental standards, might also impact costs, affecting pricing flexibility. Economic downturns could make customers more price-sensitive, potentially leading to contract renegotiations and reduced profitability. These factors could erode Republic Services' ability to maintain current pricing strategies. In 2024, Republic Services reported a revenue of $15.07 billion, with a gross profit margin of 39.5%.

Republic Services' high operational costs, including depreciation and amortization, can pressure profitability. In 2024, these costs amounted to billions, impacting net income. This is typical for capital-intensive waste management. High costs may limit financial flexibility for strategic initiatives.

Integration Challenges from Acquisitions

Republic Services faces integration challenges from acquisitions, a key part of its growth strategy. Successfully merging acquired companies is vital for achieving the expected financial gains. These integrations can be complex, potentially disrupting operations and culture. The company needs to streamline these processes to maximize value. In 2024, Republic Services completed several acquisitions, highlighting the ongoing need for efficient integration.

- In Q1 2024, Republic Services completed the acquisition of GFL Environmental's solid waste operations in Maryland, which increased its market presence.

- Post-acquisition, the company must focus on consolidating back-office functions and streamlining operations to achieve cost synergies.

- Cultural integration is essential to retain key employees and customers, ensuring smooth transitions.

- The company's ability to manage and integrate these acquisitions effectively will determine its financial success.

Exposure to Commodity Price Volatility

Republic Services' recycling segment faces commodity price volatility, which can significantly affect its financial results. In 2024, rising commodity prices supported revenue growth; however, this dynamic can shift. For example, fluctuations in recycled paper prices can directly impact profitability. The company must manage this risk.

- In Q1 2024, Republic Services' recycling revenue increased due to higher commodity prices.

- Recycling commodity prices are subject to global economic conditions.

- Republic Services' financial performance is sensitive to these price changes.

Republic Services struggles with weaknesses, impacting financial performance. Volume declines and competitive pressures pose challenges to growth. Operational costs and acquisition integration also create difficulties.

| Weakness | Impact | Data |

|---|---|---|

| Volume Declines | Lower revenue, reduced market share | Q1 2024 volumes down, contract losses |

| Pricing Pressures | Margin erosion, less profit | Competition and regulations affect pricing power |

| High Costs | Impact profitability and flexibility | Significant depreciation and amortization costs |

Opportunities

Republic Services has a substantial opportunity to expand its Environmental Solutions segment. Demand for services like PFAS remediation is rising, driven by new regulations. The company's investments in polymer centers and renewable natural gas projects support this growth. In Q1 2024, Environmental Solutions revenue grew, showing potential for future gains. Republic Services is well-positioned to capitalize on these opportunities.

Republic Services is set to invest about $1 billion in acquisitions in 2025, aiming to grow its market presence. This strategy allows them to broaden their service portfolio. In 2024, Republic Services completed several acquisitions, enhancing its operational footprint. These moves are part of a broader plan to increase market share and profitability. This expansion through acquisitions is a key element of their growth strategy.

Republic Services can boost efficiency by using digital tools. This includes asset management systems to optimize operations. In 2024, they spent $300 million on tech. Such tech investments could increase customer satisfaction. Digital adoption improves productivity and service.

Growing Focus on Sustainability and Circularity

The growing emphasis on sustainability and circularity offers Republic Services significant opportunities. They can provide solutions helping customers meet environmental goals. This includes offering eco-friendly equipment and innovative recycling processes. The global waste management market is projected to reach $2.8 trillion by 2025, showing strong growth. Republic Services' investments in renewable natural gas (RNG) facilities, with 13 operational by 2024, exemplifies this.

- Market growth: $2.8 trillion by 2025

- RNG facilities: 13 operational by 2024

- Customer demand: Increased for sustainable solutions

Potential for Volume Improvement

Republic Services could see volume improvements if construction and the economy strengthen, boosting waste generation. This could significantly increase revenue. For example, in Q1 2024, volumes slightly decreased, but economic recovery could reverse this. Revenue growth in 2023 was 7.6%, indicating the potential impact of volume changes.

- Economic recovery could boost waste volumes.

- Construction activity is a key factor.

- Volume improvements can lead to higher revenue.

Republic Services has growth potential in environmental solutions and acquisitions. Expansion in the waste management market, expected to reach $2.8 trillion by 2025, supports their plans. Technology investments like the $300 million in 2024 also enable increased customer satisfaction and operational efficiency.

| Opportunity | Details | Financial Impact |

|---|---|---|

| Environmental Solutions Expansion | Demand for services like PFAS remediation; investments in polymer centers. | Q1 2024 revenue growth |

| Strategic Acquisitions | $1 billion planned for 2025; expansion of service portfolio | Enhanced market share, higher profitability |

| Digitalization | Asset management systems to boost efficiency; 2024 tech spend. | Increased customer satisfaction, higher productivity |

Threats

Republic Services faces fierce competition in waste management. Established companies and newcomers constantly vie for market share. Intense rivalry can squeeze profit margins and limit pricing flexibility. For instance, the waste management market in North America is projected to reach $75 billion by 2025. This dynamic demands ongoing strategic adjustments.

Potential regulatory shifts pose a threat. Changes in waste management, environmental standards, and disposal rules could affect Republic Services. Anticipated EPA regulations on PFAS are a key concern. Compliance costs could rise. The waste management market was valued at $53.4 billion in 2024.

Economic downturns pose a significant threat to Republic Services. Reduced commercial and industrial waste volumes directly impact revenue. For example, during the 2008 financial crisis, waste volumes decreased significantly. This can lead to lower profitability. In 2024, analysts are watching economic indicators closely, with potential for volatility.

Challenges in Integrating Acquired Companies

Republic Services faces integration challenges when acquiring other waste management companies. Failed integrations can prevent the company from achieving projected cost savings and revenue growth. This can lead to operational inefficiencies and cultural clashes. The company’s 2023 annual report highlights potential risks in integrating new acquisitions.

- Integration challenges can disrupt existing operations.

- Cultural differences can hinder the merging process.

- Failed integrations may lead to financial losses.

- Achieving synergy benefits might be delayed.

Operational Risks and Environmental Liabilities

Republic Services faces operational risks and environmental liabilities due to waste handling. Improper waste management could cause contamination and legal issues. Operational disruptions might affect customer satisfaction and brand image. In 2024, the EPA reported over 1,000 environmental violations by waste management companies. This includes Republic Services, which paid $3.5 million in settlements.

- Environmental fines and lawsuits can strain finances.

- Operational failures could lead to service interruptions.

- Brand damage may reduce customer loyalty.

Republic Services contends with intense competition and regulatory shifts. Economic downturns pose risks to revenue and profitability. Integrating acquisitions and operational/environmental liabilities are also substantial threats.

| Threat | Description | Impact |

|---|---|---|

| Competition | Market rivalry and pricing pressures. | Reduced profit margins. |

| Regulation | Changes in environmental rules. | Increased compliance costs. |

| Economic Downturns | Reduced commercial waste volume. | Lower revenues. |

SWOT Analysis Data Sources

This SWOT analysis utilizes SEC filings, market reports, and industry publications to deliver an accurate overview.