Revolve PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Revolve Bundle

What is included in the product

Analyzes macro-environmental forces, from politics to law, shaping Revolve’s strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

What You See Is What You Get

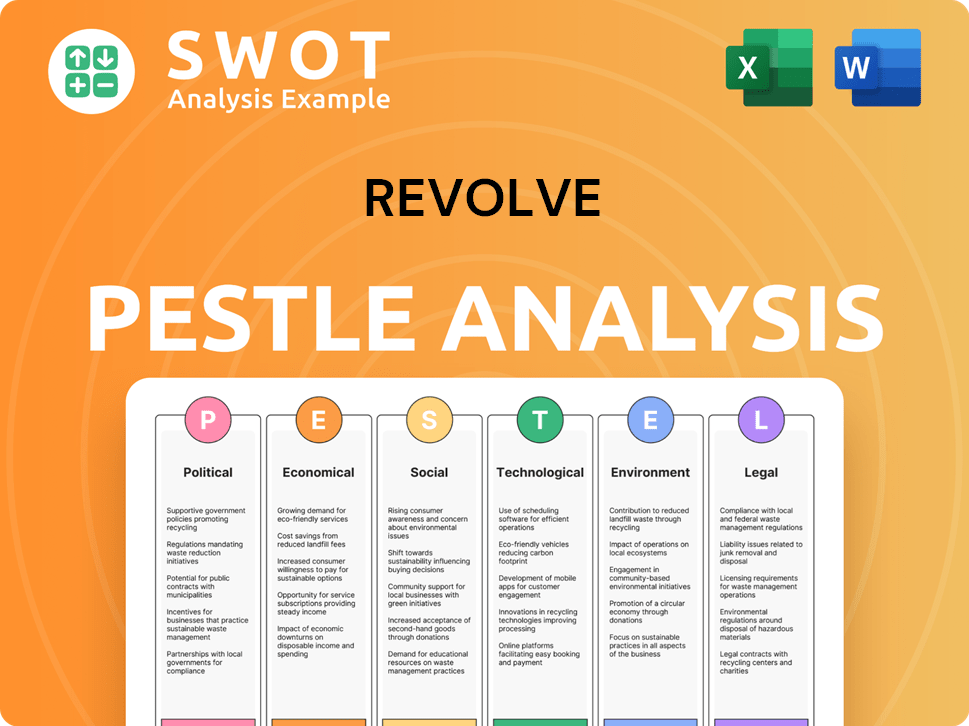

Revolve PESTLE Analysis

The Revolve PESTLE analysis preview demonstrates the complete final document.

The structure, content, and format you see now reflects the downloaded file.

What you're previewing here is the actual, ready-to-use Revolve analysis.

Get the precise document with your purchase—no editing needed.

Instantly own this fully formatted PESTLE after buying.

PESTLE Analysis Template

Navigate the fashion industry's complexities with our Revolve PESTLE Analysis. Uncover the external factors shaping Revolve's strategies and performance. We provide concise insights into political, economic, social, technological, legal, and environmental impacts. Enhance your market analysis with these critical findings. Gain a competitive edge with the full PESTLE analysis today!

Political factors

Trade policies, like tariffs, directly affect import costs. Higher tariffs can increase consumer prices and disrupt supply chains. Revolve, relying on international sourcing, faces these risks. For example, the US is considering new tariffs. Companies must optimize supply chains or relocate factories. In 2024, the US imposed tariffs on approximately $300 billion worth of Chinese goods.

Government regulations on imports and exports significantly impact Revolve's global operations. These rules dictate the ease and expense of moving goods across borders, directly affecting inventory management. For instance, tariffs can increase costs; in 2024, the average U.S. tariff rate was about 3%. Delays from customs inspections can also impact shipping times and operational efficiency.

Political stability is paramount for Revolve's sourcing. Instability in supplier countries can severely disrupt operations. For instance, political turmoil in key textile-producing nations like Bangladesh (which supplied $8.8 billion in apparel to the US in 2023) could halt production. This could increase costs and delay product launches.

Anti-Trust Issues and Fair Competition Laws

Government policies on anti-trust and fair competition significantly impact large retailers. These policies dictate how companies handle data and compete in the market. Failure to comply can lead to investigations and financial penalties. Recent examples include the scrutiny of data practices by the FTC and EU, affecting businesses like Revolve.

- FTC fines for data privacy violations can reach millions.

- EU's GDPR imposes strict data handling rules.

- Antitrust cases can lead to forced divestitures.

- Fair competition laws ensure market access.

Influence of Political Figures on Fashion Trends

Political figures’ fashion choices can indirectly shape consumer preferences, affecting demand for specific styles or brands. For instance, when a prominent figure wears a particular designer, it can boost that brand's visibility and desirability. This influence requires retailers like Revolve to monitor political fashion trends closely to anticipate and respond to shifts in consumer behavior. In 2024, this influence is amplified through social media, with politicians' outfits quickly gaining attention.

- Political figures' fashion choices can indirectly shape consumer preferences.

- Retailers must monitor political fashion trends.

- Social media amplifies politicians' outfits' attention.

Trade policies, like tariffs, impact import costs and supply chains. In 2024, the U.S. imposed tariffs on roughly $300B of Chinese goods. Government regulations on imports and exports affect inventory management and shipping times.

Political stability in supplier countries is vital for operations. Political figures' fashion choices influence consumer preferences and demand.

The FTC fines for data privacy violations may reach millions. Retailers should closely monitor political trends.

| Aspect | Impact | Example (2024/2025) |

|---|---|---|

| Tariffs | Increase costs; disrupt supply | US tariffs on ~$300B Chinese goods. |

| Regulations | Affect inventory & shipping | Avg. U.S. tariff rate ≈ 3%. |

| Political Fashion | Influence demand | Social media amplifies trends. |

Economic factors

High inflation and the increasing cost of living can curb consumer spending, especially on discretionary items such as fashion. The U.S. inflation rate in March 2024 was 3.5%, potentially influencing Revolve's sales. A more price-conscious consumer base could impact Revolve's profitability and sales.

Economic downturns and elevated unemployment rates significantly curb consumer spending. This is especially true for discretionary items like apparel. In 2024, the US unemployment rate hovered around 3.7%, impacting retail sales. To counter this, fashion retailers often implement discount strategies. These help to boost sales, but they can also affect profit margins.

Exchange rate fluctuations significantly affect international retailers like Revolve. In 2024, the USD's strength against other currencies impacted sourcing costs. For example, a 5% shift in the EUR/USD rate can change the cost of goods. This necessitates hedging strategies. Maintaining profitability requires diligent monitoring and flexible pricing models.

Growth of E-commerce Sales

The expansion of e-commerce offers Revolve a major growth avenue. Online shopping's rise, fueled by the pandemic, boosts market size. Global e-commerce sales hit $6.3 trillion in 2023, and are projected to reach $8.1 trillion by 2026. This trend aligns well with Revolve's digital-first strategy.

- E-commerce sales are expected to grow by approximately 10-12% annually.

- Mobile commerce accounts for over 70% of e-commerce sales.

- The US e-commerce market is projected to reach $1.5 trillion by 2027.

- Fashion and apparel remain leading e-commerce categories.

Consumer Confidence

Consumer confidence significantly impacts retail performance, especially for discretionary goods like Revolve's fashion offerings. High consumer confidence often leads to increased spending on apparel and accessories. Conversely, economic uncertainty can cause consumers to cut back on non-essential purchases. Recent data shows consumer sentiment fluctuating; for example, the University of Michigan's Consumer Sentiment Index registered 77.2 in March 2024, indicating some hesitancy.

- Consumer spending on clothing and accessories in the U.S. reached $283 billion in 2023.

- The Conference Board's Consumer Confidence Index stood at 104.7 in March 2024.

- Revolve's sales growth is correlated with consumer spending trends.

Economic pressures such as inflation, which was 3.5% in March 2024, influence consumer spending, particularly on discretionary items like fashion. The U.S. unemployment rate, approximately 3.7% in 2024, impacts retail sales affecting retailers’ profitability and sales. The strengthening USD and exchange rate fluctuations pose challenges to retailers' international sourcing costs.

| Factor | Impact | Data (2024) |

|---|---|---|

| Inflation | Reduces spending | U.S. Inflation: 3.5% (March) |

| Unemployment | Curb sales | U.S. ~3.7% |

| Exchange Rates | Affects sourcing | USD strength impacts costs |

Sociological factors

Revolve heavily relies on Millennials and Gen Z, its core demographic. These consumers prioritize digital experiences and are highly influenced by social media and influencers. In 2024, Gen Z and Millennials accounted for 60% of online fashion purchases. Understanding their preferences, such as sustainability and inclusivity, is key.

Social media and influencers are crucial for Revolve. They shape trends and buying habits, especially among its young target audience. Revolve's strategy heavily relies on influencer marketing, with 75% of its marketing budget allocated to it. This approach has driven a 30% increase in sales.

Consumers, particularly Gen Z and Millennials, strongly favor inclusive brands. A 2024 study showed 70% of these groups prefer brands reflecting diversity. Revolve's marketing and product lines must mirror this. Failing to do so risks alienating potential customers. This impacts sales and brand image.

Shift Towards Value-Driven Fashion and Secondhand Markets

Economic pressures and heightened environmental awareness are reshaping consumer behavior in the fashion industry. This shift significantly boosts value-driven fashion, particularly the resale and secondhand markets. Revolve faces potential impacts from this trend, requiring strategic adaptation. For instance, the global secondhand fashion market is projected to reach $218 billion by 2027.

- Resale market growth: anticipated to outpace the primary fashion market.

- Sustainability concerns: influencing purchasing decisions.

- Consumer behavior: moving towards value and circularity.

- Revolve's response: adapting to changing consumer preferences.

Changing Consumer Expectations for Shopping Experience

Consumer expectations for shopping experiences are rapidly changing. They now seek seamless, engaging, and personalized interactions both online and offline. This shift requires retailers to invest in technology and adapt strategies. For instance, in 2024, 70% of consumers expect personalized recommendations.

- Personalization is Key.

- Omnichannel Integration.

- Tech Investments are Needed.

Revolve's success depends on trends set by Millennials and Gen Z, with 60% of their online fashion purchases made in 2024. Influencer marketing is key, as 75% of its marketing budget targets this. Inclusive brands are preferred, 70% of Gen Z and Millennials prioritize this.

Resale, sustainability, and value are key drivers; the secondhand market projects to $218B by 2027. Shoppers desire seamless, personalized interactions.

Consumer preferences are evolving rapidly, with personalization and omnichannel experiences being crucial. Failing to adapt will negatively affect the brand's sales and image.

| Factor | Impact on Revolve | Data Point (2024/2025) |

|---|---|---|

| Demographics | Core customer preference | 60% online fashion purchases (Millennials/Gen Z) |

| Influencer Influence | Marketing effectiveness | 75% marketing budget allocated, 30% sales increase |

| Inclusivity | Brand preference | 70% prefer inclusive brands |

Technological factors

Revolve heavily uses data analytics and AI. They use it for merchandising, predicting trends, managing inventory, customer service, and personalization. These tools are vital for streamlining operations and improving customer satisfaction. In 2024, the AI market is expected to reach $200 billion, highlighting its impact.

Revolve's success hinges on its e-commerce platform and mobile apps. Mobile commerce is crucial, given its customer base's preferences. In 2024, mobile accounted for over 70% of e-commerce sales. Investing in user experience and features is vital. Fast loading times and secure payment options are essential for sales.

Social commerce is booming; it's where shopping meets social media. Revolve heavily uses social media and influencers. In 2024, social commerce sales hit $99.9 billion in the U.S. and are predicted to reach $134 billion by 2025. Revolve's strategy fits this trend perfectly.

Exploration of New Technologies like AR and VR

Augmented reality (AR) and virtual reality (VR) are revolutionizing online shopping, offering immersive experiences like virtual try-ons. Implementing these technologies can significantly boost customer engagement and sales. For example, the global AR and VR market is projected to reach $86.5 billion in 2024. This helps businesses stand out in a crowded market.

- Virtual try-ons can increase conversion rates by up to 40%.

- AR/VR in retail is expected to grow to $12.8 billion by 2025.

- Early adopters often gain a competitive advantage by attracting tech-savvy consumers.

- Investment in these technologies can lead to higher customer satisfaction.

Cybersecurity Threats and Data Privacy

Revolve's digital operations expose it to cybersecurity threats and data privacy concerns. The fashion industry saw a 20% rise in cyberattacks in 2024. Compliance with GDPR and CCPA is crucial for Revolve. Breaches can lead to financial losses and reputational damage.

- Cybersecurity incidents cost companies an average of $4.45 million in 2023.

- Data breaches in retail increased by 15% in 2024.

- Revolve must invest in robust security measures to protect customer data.

- Compliance is vital to avoid regulatory penalties and maintain customer trust.

Revolve utilizes AI, e-commerce, and social commerce. These technologies are key for trend prediction and operational efficiency. Investment in AR/VR is vital; by 2025, AR/VR retail market could reach $12.8 billion. However, cybersecurity and data privacy are essential considerations.

| Technology Aspect | Impact | 2024/2025 Data |

|---|---|---|

| AI Market | Enhances operations & predictions | $200 billion in 2024 |

| Mobile Commerce | Crucial for sales | Over 70% of e-commerce sales in 2024 |

| Social Commerce | Boosts sales via social media | $99.9B in 2024 (US), $134B forecast by 2025 |

| AR/VR Retail | Enhances customer experience | Projected $12.8B market by 2025 |

| Cybersecurity | Protects data | Data breaches increased by 15% in 2024 |

Legal factors

Revolve faces legal hurdles concerning data protection and privacy. It must adhere to global laws like GDPR and CCPA. These laws dictate how customer data is managed. Failure to comply can lead to hefty fines and reputational damage. In 2024, GDPR fines reached €1.8 billion, highlighting the stakes.

Revolve must safeguard its brand and designs through trademarks and patents. This also means respecting the intellectual property of other brands. In 2024, global spending on IP protection reached $1.5 trillion, reflecting its importance. Legal battles over copyright and trademarks are common in the fashion industry.

Consumer protection laws are crucial for Revolve, covering advertising, product safety, and online sales regulations. The Federal Trade Commission (FTC) enforces truth in advertising. In 2024, the FTC secured over $3 billion in consumer refunds. Compliance is vital to avoid penalties and maintain consumer trust. These laws influence how Revolve markets products and handles customer data.

International Trade Laws and Regulations

Revolve's international operations require strict adherence to global trade laws. This includes navigating customs, tariffs, and import/export controls across different markets. Compliance is crucial to avoid penalties and ensure smooth product movement.

- In 2024, global trade volume reached $32 trillion, highlighting the scale of international regulations.

- The World Trade Organization (WTO) plays a key role in setting trade standards, with over 160 member countries.

- Failure to comply can lead to significant fines; for example, in 2023, companies faced over $1 billion in penalties for trade violations.

Labor and Employment Regulations

Revolve faces labor and employment regulations, covering wages and working conditions, significantly impacting its supply chain. These laws are crucial in ensuring fair practices across its operations. Compliance with these regulations is vital for maintaining legal and ethical standards. Non-compliance can lead to legal issues and reputational damage. These regulations can influence operational costs and supply chain efficiency.

- In 2024, the U.S. Department of Labor recovered over $279 million in back wages for workers.

- The International Labour Organization (ILO) estimates that 24.9 million people globally are in forced labor.

- California's AB 701 law, effective 2024, increases scrutiny of warehouse worker quotas.

Revolve must navigate strict legal requirements including data privacy laws like GDPR. In 2024, global spending on IP protection was $1.5 trillion, vital for safeguarding designs. Compliance with labor and trade regulations is essential, impacting costs and supply chains, with over $32 trillion in global trade volume in 2024.

| Legal Area | Regulation Type | Impact |

|---|---|---|

| Data Privacy | GDPR, CCPA | Fines up to €1.8B in 2024 |

| Intellectual Property | Trademarks, Patents | Protection costs globally |

| Trade Compliance | WTO Standards | Global trade volume $32T (2024) |

Environmental factors

Consumers increasingly prioritize eco-friendly brands, influencing purchasing decisions. Revolve must address its environmental impact, including supply chain emissions. The fashion industry faces significant scrutiny, with greenwashing a major concern. In 2024, the global fashion market's sustainability efforts are valued at $34.2 billion, projected to reach $43.2 billion by 2027.

The fashion industry faces a major environmental hurdle: textile waste. In 2023, the U.S. generated 17 million tons of textile waste. Circular economy principles, like recycling, are key. The global textile recycling market is projected to reach $24.8 billion by 2025.

Revolve's supply chain faces environmental scrutiny, particularly regarding water use, carbon emissions, and pollution from its manufacturing. The fashion industry accounts for about 10% of global carbon emissions. Fast fashion significantly contributes to textile waste. Water usage in textile production is substantial, with an estimated 20,000 liters needed to make one kilogram of cotton.

Climate Change Impacts on Supply Chains

Climate change presents significant risks to Revolve's supply chains. Extreme weather, like the floods in Thailand in 2011, can disrupt manufacturing and shipping. These events can cause delays and increase costs, impacting Revolve's profitability. For example, the World Bank estimates that climate change could push 100 million people into poverty by 2030.

- Increased shipping costs due to extreme weather disruptions.

- Potential material shortages from affected suppliers.

- Higher insurance premiums reflecting climate-related risks.

Regulations Related to Environmental Compliance

Environmental regulations are increasingly impacting retailers like Revolve. These include rules on chemical use, waste disposal, and carbon emissions. Failure to comply can lead to hefty fines and reputational damage. The EU's Carbon Border Adjustment Mechanism (CBAM), starting October 2023, is a key example affecting imports.

- CBAM will initially cover imports of certain goods like iron and steel.

- Non-compliance with environmental standards can result in significant financial penalties.

- Revolve must adapt to new standards to avoid legal and financial risks.

Revolve faces environmental pressures from eco-conscious consumers and scrutiny of its supply chain. Textile waste and carbon emissions pose major challenges for the fashion industry. In 2024, the global market's sustainability efforts reached $34.2 billion, with projections of $43.2 billion by 2027, highlighting increasing consumer demand.

Climate change and environmental regulations like the EU's CBAM, which began in October 2023, pose risks and require proactive adaptation. Increased shipping costs and potential material shortages, compounded by climate-related risks, impact Revolve's financial health. The textile recycling market, estimated at $24.8 billion by 2025, highlights potential opportunities.

To navigate these challenges, Revolve needs strategies to reduce its environmental impact. Circular economy principles are crucial for waste reduction, water usage management, and the implementation of carbon-emission reduction strategies. This approach includes adopting sustainable practices in sourcing and operations.

| Environmental Aspect | Impact | Financial Implication |

|---|---|---|

| Carbon Emissions | Supply chain and operations contribution. | CBAM fines, increased operational costs |

| Textile Waste | High volume from fast fashion. | Recycling cost, landfill fees, and damage. |

| Water Usage | Intensive use in textile production. | Increased operational costs, possible penalties. |

PESTLE Analysis Data Sources

The analysis integrates diverse data from economic databases, industry reports, government portals, and global organizations for insights.