Guangzhou R&F PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou R&F Bundle

What is included in the product

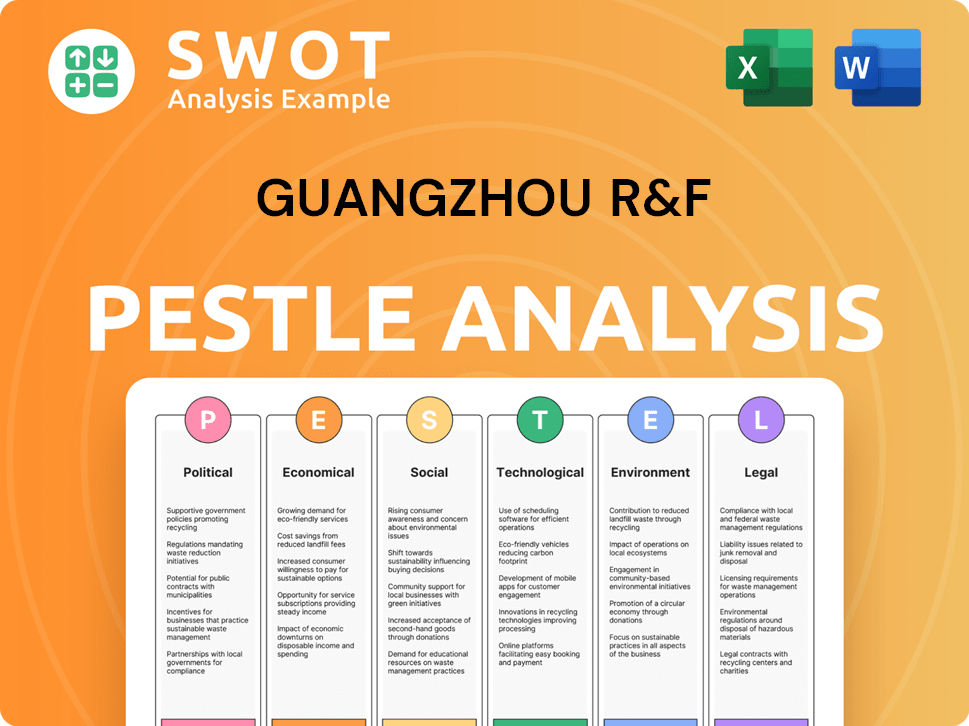

Explores external macro-environmental impacts on Guangzhou R&F's Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Guangzhou R&F PESTLE Analysis

Preview the complete Guangzhou R&F PESTLE analysis. The format, structure & content displayed in this preview mirror the final document you’ll download. After purchasing, you’ll immediately receive this in-depth PESTLE assessment of the company. This file is ready to use!

PESTLE Analysis Template

Explore Guangzhou R&F's external environment with our insightful PESTLE analysis. We delve into crucial political, economic, and technological factors impacting their performance. Analyze social and legal trends shaping their operations and environmental influences. This resource is perfect for investors and business strategists alike. Understand the complete picture—download the full analysis now for actionable insights!

Political factors

Government policies strongly influence Guangzhou R&F. In 2023, China's measures targeted property debt. These impact land, funding, sales, and pricing. The government's actions aim to stabilize the market. Regulations affect developers' operations significantly.

Political stability significantly impacts Guangzhou R&F's investments. China's stable political climate has historically fostered real estate investment. In 2024, foreign direct investment in China's real estate decreased. Political stability is crucial for project success; uncertainty can hinder development.

The Chinese government has rolled out stimulus measures to bolster the economy and property sector. This support, though not a direct bailout, aims to prevent the real estate market from being a drag on overall economic expansion. The People's Bank of China (PBOC) has cut the 5-year Loan Prime Rate (LPR) to 3.95% in February 2024. Future support's efficacy will significantly influence market recovery.

Regulatory environment and enforcement

The regulatory environment in China, particularly for property developers like Guangzhou R&F, is intricate and frequently updated. Adherence to construction, financing, and sales regulations is crucial for operational continuity. Stringent enforcement of these rules directly affects a company's financial stability and project timelines. For instance, in 2024, new regulations on pre-sales and financing requirements have increased compliance burdens. These changes can lead to project delays and impact profitability, as seen with several developers facing increased scrutiny.

- Increased scrutiny on developers' financial health.

- Tighter regulations on pre-sales and sales permits.

- More frequent inspections and stricter penalties for non-compliance.

- Changes in land use regulations impacting project viability.

International relations and trade policies

Guangzhou R&F Properties' international operations make them susceptible to international relations and trade policies. Geopolitical tensions, like those impacting China's Belt and Road Initiative, could hinder overseas projects. Trade disputes, such as those between China and the US, might affect access to international financing. For example, in 2024, China's trade surplus reached $823 billion, indicating its significant role in global trade.

- China's Belt and Road Initiative: Potentially affected by geopolitical tensions.

- Sino-US Trade Disputes: Could limit access to international finance.

- China's 2024 Trade Surplus: $823 billion, highlighting global trade importance.

Guangzhou R&F faces substantial political influence due to Chinese government policies, especially in property. China's economic stimulus, including the February 2024 3.95% LPR cut, supports the sector, though effects vary. Regulatory changes, like tightened pre-sales rules, increase compliance burdens.

| Political Aspect | Impact on R&F | Data (2024-2025) |

|---|---|---|

| Government Policies | Property Debt, Market Stability | 5-year LPR: 3.95% (Feb 2024); Real estate FDI decreased. |

| Political Stability | Investment Climate, Project Success | Foreign investment change rate (-9% YoY). |

| Regulations | Compliance, Financial Stability | Increased scrutiny on developers, new regulations. |

Economic factors

China's GDP growth significantly impacts Guangzhou R&F. A robust economy boosts property demand. In 2024, China aimed for ~5% GDP growth, influencing consumer spending. Slowdowns may curb investment, affecting property values.

Availability and cost of financing are crucial for Guangzhou R&F. In 2024, China's property sector faced tight credit conditions. Interest rates influence project funding. High rates increase debt burdens. Data from early 2024 shows rising borrowing costs.

Consumer confidence significantly influences property sales. High confidence boosts demand and prices, while uncertainty reduces them. In 2024, Guangzhou's housing sales saw fluctuations. For instance, in Q1 2024, sales volume decreased by 15% due to economic concerns.

Property market trends and price fluctuations

The Chinese property market's trends, including price changes and inventory levels, directly impact Guangzhou R&F Properties. A market downturn can lead to lower sales and reduced revenue. In 2024, new home prices in 70 major cities showed varied trends. Inventory levels are crucial for Guangzhou R&F's financial health.

- China's real estate sector faced challenges in 2024, affecting developers like Guangzhou R&F.

- Price fluctuations and inventory levels are key indicators of market health.

- Reduced sales and asset devaluation are potential risks during a downturn.

- Market analysis is essential for strategic decision-making.

Impact of global economic conditions

Guangzhou R&F Properties' international projects make it vulnerable to global economic shifts. Economic downturns in key markets can hinder overseas ventures and financial results. For example, a decline in China's GDP growth, which was 5.2% in 2023, could impact their domestic and international investments. Changes in international trade policies or currency fluctuations can also affect their profitability.

- China's GDP growth in 2024 is projected to be around 5%.

- The company has significant investments in Southeast Asia.

- Global interest rate hikes can increase borrowing costs.

China’s economic growth directly influences Guangzhou R&F's property business. Economic indicators such as GDP growth and consumer confidence are critical. For 2024, China's GDP is targeted at around 5% which impacts real estate demand. Declining markets can negatively affect sales and property values.

| Economic Factor | Impact on Guangzhou R&F | 2024/2025 Data Points |

|---|---|---|

| GDP Growth | Influences property demand & investment | 2023 GDP: 5.2%, 2024 target: ~5% |

| Interest Rates | Affects funding costs & project viability | Early 2024: Rising borrowing costs in China |

| Consumer Confidence | Drives sales volume and pricing | Q1 2024: Sales volume decreased by 15% |

Sociological factors

Urbanization fuels property demand for Guangzhou R&F. China's urban population grew to 65.2% in 2024. This trend boosts the need for housing and commercial spaces. Migration patterns affect development locations, influencing Guangzhou R&F's strategies.

Evolving lifestyles and housing preferences significantly influence Guangzhou R&F's residential projects. Demand for smart home features and flexible spaces is increasing, with 60% of urban homebuyers prioritizing these in 2024. Developers must adapt designs to include co-working spaces and wellness amenities to meet these evolving needs. These changes are crucial for maintaining competitiveness, especially in a market where 70% of new projects now integrate such features.

Guangzhou R&F faces increasing scrutiny regarding social responsibility. Developers must positively impact communities, a growing expectation. Community engagement and addressing social issues influence project success. In 2024, ESG factors significantly impact real estate valuations and investor decisions.

Demographic shifts and aging population

Guangzhou R&F Properties must consider demographic shifts, especially the aging population in China. This demographic change drives demand for specialized properties like healthcare facilities and senior living communities. The company's existing healthcare business is well-positioned to capitalize on this trend.

- China's elderly population (60+) is projected to reach 300 million by 2025.

- Healthcare spending in China is expected to increase significantly.

Cultural values and homeownership aspirations

Cultural emphasis on homeownership in China significantly impacts property demand. This deeply ingrained value influences purchasing decisions, particularly in cities like Guangzhou. Guangzhou R&F must align its strategies with these aspirations to succeed. Recent data shows a high homeownership rate in urban China, around 70% in 2024.

- Cultural preference for owning versus renting.

- Desire for intergenerational wealth transfer through property.

- Social status and family security tied to homeownership.

- Strong belief in property as a safe investment.

Shifting demographics, particularly an aging population (projected 300M seniors by 2025), drives demand for senior-focused properties, boosting healthcare spending. Cultural norms emphasize homeownership, with approximately 70% in urban areas owning property, directly influencing purchasing choices. Social responsibility is vital; ESG factors heavily impact real estate valuation and investment in 2024.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Increased demand for senior living/healthcare | 300M elderly by 2025, rising healthcare spend |

| Homeownership | Strong market, influences choices | 70% urban ownership rate (2024) |

| Social Responsibility | Affects valuation/investment | ESG factors significant in 2024 |

Technological factors

Guangzhou R&F Properties can benefit from digital tech adoption. For example, integrating AI and VR can boost customer experience and streamline sales. The proptech market is growing, with investments reaching $1.3 billion in Q1 2024. Digital tools can also improve property management efficiency. These advancements can enhance R&F's market competitiveness.

Technological advancements significantly impact construction efficiency, costs, and sustainability for companies like Guangzhou R&F. Innovative materials and methods offer a competitive edge. For example, 3D printing in construction is projected to grow, with a market size of $7.8 billion by 2025. Implementing these technologies can lower project costs by up to 20% and reduce construction time by 30%.

E-commerce significantly reshapes commercial properties in Guangzhou. The shift impacts demand for retail spaces, with some malls struggling. Developers must integrate online-offline experiences. For instance, 2024 saw online retail grow, influencing property designs. This requires adapting to evolving consumer behaviors.

Building information modeling (BIM) and smart buildings

Building Information Modeling (BIM) and smart buildings are increasingly important in Guangzhou R&F's projects. BIM enhances design and construction efficiency, potentially reducing costs by 10-15% according to recent industry reports. Smart building technologies, integrating systems for energy management and security, are also on the rise. These features can boost property values and attract tenants. In 2024, the smart building market in China is projected to reach $30 billion.

- BIM can reduce construction costs.

- Smart building tech is growing.

- China's smart building market is big.

Online property platforms and sales channels

Online property platforms are revolutionizing property sales and marketing. Guangzhou R&F must maintain a robust online presence to reach potential buyers. Digital marketing strategies are crucial for promoting their projects. In 2024, over 60% of property searches began online.

- Online platforms offer wider market reach.

- Digital marketing enhances brand visibility.

- Data analytics provide insights into buyer behavior.

- Virtual tours and online transactions streamline the process.

Guangzhou R&F Properties benefits from digital tech, improving sales via AI and VR. Construction sees tech gains, with 3D printing’s 2025 market at $7.8B. Smart buildings and BIM enhance efficiency.

| Technology | Impact | Data |

|---|---|---|

| Proptech | Boosts sales | $1.3B investment Q1 2024 |

| 3D Printing | Reduces costs | $7.8B market by 2025 |

| Smart Buildings | Increases value | $30B market in 2024 (China) |

Legal factors

Guangzhou R&F faces strict property laws in China and abroad. Compliance covers land use, zoning, and construction permits. In 2024, China's real estate regulations saw increased scrutiny, impacting project timelines. R&F's adherence to these laws is crucial for avoiding penalties and project delays. Understanding these regulations is key.

Contract law in Guangzhou significantly influences property development, impacting agreements with various stakeholders. Enforceability is key for risk management; in 2024, legal disputes in real estate increased by 15% in Guangdong. Sound contracts are vital to protect investments. The legal framework ensures fair dealings.

Guangzhou R&F must strictly adhere to construction safety standards and building codes to ensure development quality and safety. Non-compliance can lead to significant legal liabilities, including hefty fines and project delays. For instance, in 2024, several construction projects in Guangzhou faced inspections, with penalties reaching over 1 million RMB for safety violations. These standards are regularly updated; current regulations include the "Guangzhou Construction Safety Regulations," effective since January 2024.

Environmental regulations and compliance

Guangzhou R&F must comply with environmental laws for construction and property development. These laws cover emissions, waste management, and environmental impact assessments. Compliance is crucial, especially with increasing environmental awareness and stricter enforcement. Non-compliance can lead to significant penalties and project delays. In 2024, the Chinese government increased environmental fines by 15% for construction companies.

- Environmental impact assessments are now mandatory for all new projects.

- Waste disposal regulations are being updated to promote recycling.

- Emission standards are becoming stricter, requiring cleaner technologies.

Labor laws and employment regulations

Guangzhou R&F Properties faces stringent labor laws and employment regulations. These laws dictate wages, working conditions, and employee rights, impacting operational costs and compliance. The company must adhere to China's labor laws, which have seen updates in 2024, affecting areas like minimum wage and social security contributions. Non-compliance can lead to penalties and reputational damage.

- Minimum wage adjustments in Guangzhou were made in 2024.

- Social security contribution rates are subject to periodic revisions.

- Employment contracts must adhere to legal standards to protect both the company and employees.

Guangzhou R&F's property ventures are bound by stringent property, contract, and construction laws in China and internationally. Regulations increasingly affect project timelines, emphasizing adherence to land use, zoning, and construction permits. Legal disputes rose by 15% in Guangdong in 2024, stressing the need for solid contracts.

Adherence to environmental and labor laws, covering emissions, waste, and employment, is mandatory. Non-compliance with environmental regulations saw fines up 15% in 2024, with updated Guangzhou Construction Safety Regulations effective from January 2024. Labor laws cover wages, rights, and working conditions.

The real estate company must also comply with labor laws impacting operations and finances. These laws enforce wages, conditions, and employee rights. The year 2024 saw updates in labor laws and minimum wage adjustments.

| Regulation Area | Impact | 2024 Data |

|---|---|---|

| Environmental Fines | Project Delays, Financial penalties | Fines up 15% |

| Construction Safety | Legal Liabilities, Project delays | Penalties up to 1M RMB |

| Contract Law | Legal Disputes | Increase by 15% |

Environmental factors

China's government enforces stricter environmental policies and emission reduction targets, influencing construction. Guangzhou R&F faces these regulations directly. For instance, in 2024, the government aimed for a 4.5% reduction in energy intensity. This drives demand for eco-friendly buildings, impacting R&F's strategies.

Guangzhou R&F Properties is adapting to the rising demand for eco-friendly construction, a key environmental factor. This shift involves using sustainable materials and green building techniques. In 2024, the company has invested significantly in green technologies. Their efforts align with China's goal to increase green buildings by 50% by 2025.

Climate change and extreme weather are growing concerns for construction and property. Guangzhou R&F must factor in risks during project planning. Consider rising sea levels and increased flooding in coastal areas. Insurance costs and property values could be affected. The construction industry is adapting with sustainable practices, which Guangzhou R&F should adopt too.

Environmental impact assessments and mitigation

Property development projects in Guangzhou, including those by R&F, face mandatory environmental impact assessments (EIAs). These EIAs evaluate potential environmental consequences, influencing project approvals and design modifications. Mitigation strategies are crucial, focusing on reducing the ecological footprint of developments. In 2024, the Chinese government increased enforcement of environmental regulations, impacting construction practices.

- EIAs are essential for project approval.

- Mitigation includes sustainable building materials.

- R&F must comply with stricter 2024 regulations.

Resource scarcity and waste management

Resource scarcity and waste management are critical environmental factors. The construction industry faces increasing scrutiny regarding its resource use. Sustainable practices are crucial for long-term viability. Guangzhou R&F must prioritize these areas.

- China's construction waste reached 2.8 billion tons in 2023.

- Recycling rates in construction are still low, around 10-15%.

- Sustainable practices can reduce costs by 5-10%.

Environmental regulations impact Guangzhou R&F's operations; they must comply with strict 2024/2025 guidelines. Focus shifts toward eco-friendly buildings to meet demand and government goals. Resource scarcity and waste management are also key, requiring sustainable practices. China's construction waste hit 2.8B tons in 2023; recycling rates stay low.

| Aspect | Details | Impact on R&F |

|---|---|---|

| Green Building Targets | China aims for 50% increase in green buildings by 2025. | R&F must invest in sustainable technologies. |

| Construction Waste | 2.8B tons in 2023, recycling around 10-15%. | Focus on waste reduction; cost savings up to 10%. |

| Energy Intensity Reduction | 2024 target: 4.5% reduction. | Drives demand for eco-friendly builds. |

PESTLE Analysis Data Sources

Our Guangzhou R&F PESTLE analysis relies on Chinese government data, industry reports, and economic databases. Global institutions and trusted news sources also provide critical context.