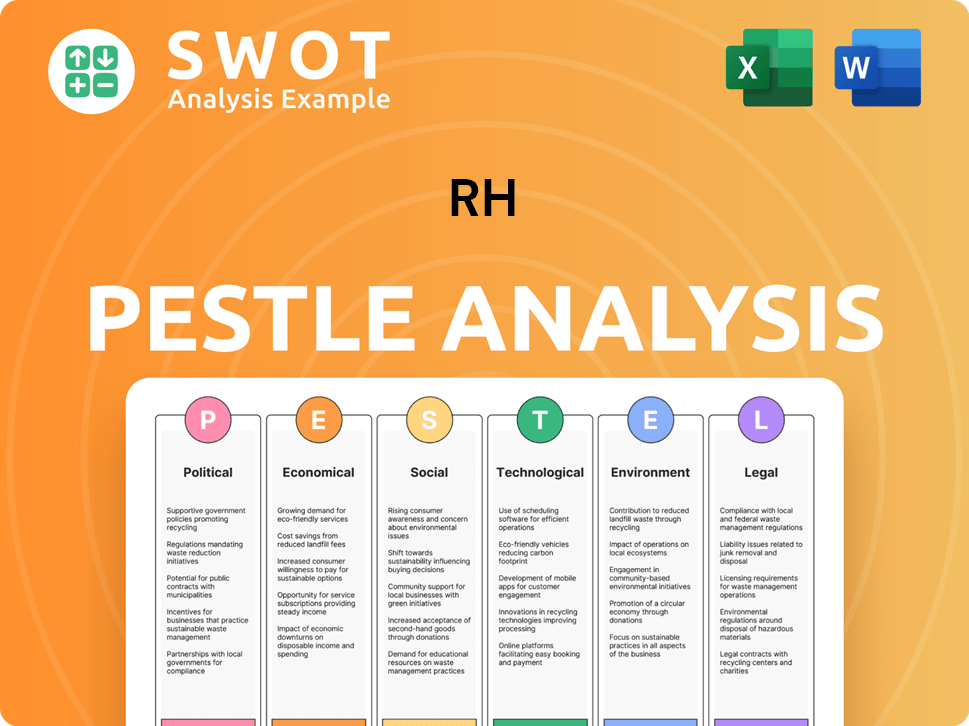

RH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RH Bundle

What is included in the product

Uncovers how the macro-environment impacts the RH, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Easily shareable summary format ideal for quick alignment across teams or departments.

Preview the Actual Deliverable

RH PESTLE Analysis

This RH PESTLE Analysis preview displays the complete document. The structure and information you see now is the exact content of your download.

No hidden extras, the final formatted report is the one you're viewing now.

The RH PESTLE you see is the ready-to-use document.

Buy, download, and get to work immediately with the presented report.

PESTLE Analysis Template

Unlock crucial insights into RH's strategic environment with our detailed PESTLE Analysis. Explore the key Political, Economic, Social, Technological, Legal, and Environmental factors shaping its trajectory. Gain a competitive edge by understanding market dynamics, opportunities, and potential threats. Download the full version now to arm yourself with actionable data for informed decision-making and strategic planning.

Political factors

RH, as a luxury retailer, faces impacts from trade policies and tariffs. Tariffs on imports, especially from China, could increase costs. For instance, the U.S. imposed tariffs on $370 billion worth of Chinese goods. Changes in trade agreements introduce sourcing uncertainty. RH's pricing and profitability are therefore sensitive to these political factors.

Geopolitical instability poses a significant risk to RH. Tensions can disrupt supply chains, impacting manufacturing and shipping. For instance, the Red Sea crisis in early 2024 caused shipping delays and cost increases. RH's global operations make it vulnerable to such events, potentially affecting profitability. In 2024, overall disruptions led to a 5% increase in logistics costs.

Changes in retail and e-commerce regulations directly affect RH. For example, import duties could alter sourcing costs. New e-commerce tax rules might reshape online pricing strategies. RH must adapt to stay compliant. In 2024, e-commerce sales in the US reached $1.1 trillion, highlighting the sector's importance.

Political Influence on Consumer Confidence

Political factors significantly shape consumer confidence, especially within the luxury sector. Uncertainty stemming from political instability can curb spending on discretionary goods, directly affecting companies like RH. For instance, a 2024 study indicated a 15% drop in luxury goods purchases in regions with high political risk. This decline is linked to consumers' reduced willingness to spend on non-essentials during times of uncertainty, which may impact RH's sales.

- Political instability correlates with decreased consumer spending on luxury items.

- Uncertainty in the political landscape can significantly affect the demand for RH's products.

- Consumer behavior is highly sensitive to changes in the political climate.

International Relations and Market Access

RH's global ambitions, such as its European gallery openings, are directly affected by international political climates. Positive diplomatic ties ease market entry and boost expansion, but trade wars or protectionist policies can hinder growth. For example, in 2024, the US-China trade tensions influenced luxury goods imports, impacting RH's supply chain. The company's ability to navigate these political waters is crucial.

- US-China trade: Influenced supply chains.

- Brexit: Impacted EU market entry.

- Political stability: Affects investment.

- Trade agreements: Facilitate market access.

Political decisions greatly influence RH's business environment. Trade policies and tariffs affect sourcing costs. Geopolitical instability disrupts supply chains and can increase costs, potentially impacting profits. Regulatory shifts impact sales strategies.

| Factor | Impact | Example (2024/2025 Data) |

|---|---|---|

| Tariffs | Increased Costs | U.S. tariffs on Chinese goods: $370B value |

| Instability | Supply Chain Issues | Red Sea Crisis: 5% logistics cost increase |

| Regulations | Sales Strategy Changes | US e-commerce sales: $1.1T (2024) |

Economic factors

RH's luxury home furnishings sales directly correlate with consumer disposable income. In 2024, a strong economy boosted luxury spending, benefiting RH. However, fluctuations in economic indicators, like inflation (3.3% in May 2024), can impact consumer confidence. Economic downturns could lead to decreased demand, impacting RH's revenue.

The housing market's health directly affects RH. High mortgage rates and low housing inventory in 2024 and early 2025 could dampen demand. Existing home sales decreased by 1.7% in February 2024, according to the National Association of Realtors. This could lead to reduced furniture sales for RH.

Persistent inflation and elevated interest rates present headwinds for RH. High rates increase borrowing costs for consumers and businesses, potentially curbing spending on discretionary items like RH's luxury home furnishings. For example, in March 2024, the Federal Reserve held the federal funds rate steady at a range of 5.25% to 5.50%. This environment can lead to decreased consumer confidence and reduced demand. Furthermore, RH's operational costs, including those related to supply chain and inventory management, may rise due to inflation.

Global Wealth Distribution

Global wealth distribution significantly affects luxury markets, including RH. Recent data indicates a shift, with emerging markets showing increased wealth. This reshuffling creates opportunities but also changes spending habits. RH must adapt its strategies to these evolving market dynamics.

- Wealth in Asia-Pacific is projected to grow significantly by 2025.

- North America's share of global wealth is expected to slightly decrease.

- Luxury market growth is strongest in Asia.

Economic Growth and Market Size

The global luxury furniture market's growth sets the stage for RH's expansion. Urbanization and rising disposable incomes fuel market growth, creating opportunities for RH. Experts predict the luxury furniture market will reach $70.7 billion by 2029. This growth indicates a positive outlook for RH's ability to capture more market share.

- Market size: $55.8 billion in 2024.

- Expected CAGR: 4.8% from 2024 to 2029.

- North America: Largest regional market.

- Key drivers: Urbanization, income growth.

RH's fortunes are tied to economic health, including consumer spending and interest rates. Inflation (3.3% May 2024) and high interest rates impact demand and operational costs. However, global wealth shifts, especially in Asia, offer opportunities.

| Economic Factor | Impact on RH | Data |

|---|---|---|

| Consumer Spending | Directly Influences Sales | Luxury goods sales are strong. |

| Interest Rates | Increase Borrowing Costs | Fed rate at 5.25-5.50% (Mar 2024). |

| Global Wealth Shifts | Creates Opportunities | Asia-Pacific wealth projected growth. |

Sociological factors

Consumer preferences in luxury home furnishings are evolving. There's a rising demand for personalized interior solutions and unique designs. RH must align with these trends to meet consumer demands effectively. In 2024, the luxury furniture market is projected to reach $38.7 billion, with a 5% annual growth rate.

Emerging interior design trends, significantly shaped by social media, heavily influence consumer preferences. RH must adapt to these evolving tastes to maintain relevance. In 2024, social media marketing spend reached $226 billion, highlighting its importance for brand visibility. RH's effective use of platforms like Instagram, where 70% of users discover products, is crucial for driving sales.

Urbanization fuels luxury furniture demand; upscale properties rise. The global urban population is forecast to hit 6.7 billion by 2050. Luxury real estate markets, like in Dubai, saw record sales in 2024, boosting furniture sales.

Focus on Wellness and Comfort in Design

The trend toward wellness and comfort significantly impacts consumer preferences in home design, pushing for furniture that supports a healthy lifestyle. RH must adapt by designing products that prioritize ergonomic support and sustainable materials to meet these evolving demands. This shift is reflected in the increasing market share of wellness-focused home goods; for example, sales in this segment grew by 15% in 2024. RH's product development should reflect this trend.

- The global wellness market is projected to reach $9.3 trillion by 2027.

- Consumers are willing to pay a premium for products that enhance well-being.

- Ergonomic furniture sales have increased by 20% since 2023.

Demographic Shifts and Generational Differences

Demographic shifts significantly influence the luxury market, with Generation Z's entry into the workforce reshaping consumer trends. Understanding the preferences of different generations is crucial for RH. Gen Z, representing 20% of the luxury market, prioritizes sustainability and brand values. RH must adapt marketing and product strategies.

- Gen Z influences on luxury market.

- Sustainability and brand values.

- RH must adapt.

Shifting demographics, particularly the influence of Generation Z, reshape luxury market trends. They prioritize sustainability, brand values, impacting RH's strategies. Consumer preference evolution, including demand for personalized designs and wellness features, is key.

| Factor | Impact on RH | Data |

|---|---|---|

| Generational Shifts | Adapting marketing; product strategy; focusing on brand values. | Gen Z controls 20% of luxury market. |

| Wellness Trend | Developing ergonomic and sustainable products. | Wellness market projected to $9.3T by 2027. |

| Consumer Preferences | Meeting demand for personalization, unique designs. | Luxury furniture market $38.7B in 2024. |

Technological factors

The luxury furniture market is being reshaped by the rise of e-commerce. RH must prioritize its online presence and user experience. Online sales in the furniture and home furnishings sector reached approximately $68.4 billion in 2024, reflecting strong growth. To stay competitive, RH needs a seamless online shopping experience.

Technology is boosting design digitization and personalization. Virtual and augmented reality improve shopping experiences, letting customers visualize furniture. RH can utilize these tools to offer custom solutions. In 2024, the AR/VR market reached $30.7 billion, showing growth in retail applications. RH's investment could tap into this expanding market.

Artificial intelligence (AI) is increasingly integrated into business processes. RH can explore AI for HR, customer service, and data analysis. For example, the global AI market is projected to reach $267 billion by 2027. AI can improve efficiency, personalize customer experiences, and offer market insights. This can lead to better decision-making and increased profitability.

Supply Chain Technology and Transparency

Technology significantly impacts RH's global supply chains. Traceability and transparency solutions are vital for ethical sourcing and meeting consumer demands. In 2024, the global supply chain management market was valued at $27.3 billion. RH can use tech to track materials, ensuring sustainability.

- Supply chain tech market projected to reach $44.6B by 2029.

- Blockchain tech can enhance supply chain transparency.

- Consumers increasingly value sustainable product sourcing.

Technological Advancements in Furniture Manufacturing

Technological advancements in furniture manufacturing, like 3D scanning and automated processes, significantly impact design, prototyping, and quality. RH can use these to offer high-quality, unique products, enhancing its market position. Automation could reduce labor costs, which is crucial, given labor accounts for a significant portion of manufacturing expenses. In 2024, the global furniture market is valued at approximately $600 billion, with technology playing a vital role.

- 3D printing market projected to reach $55.8 billion by 2027.

- Automated manufacturing can increase efficiency by up to 30%.

- RH's investment in tech could boost profit margins by 5-7%.

E-commerce fuels the luxury furniture market's growth. RH must excel online, given 2024 online furniture sales hit $68.4B. Tech powers design with AR/VR; the AR/VR market was $30.7B in 2024, benefiting RH. AI, with a projected $267B market by 2027, can boost RH's efficiency.

| Technology Area | Impact on RH | 2024-2025 Data/Projections |

|---|---|---|

| E-commerce | Enhances sales and customer experience | Online furniture sales: $68.4B (2024) |

| AR/VR | Improves product visualization & customization | AR/VR market: $30.7B (2024), projected to grow. |

| AI | Boosts efficiency, customer service, & insights | Global AI market projected to $267B by 2027 |

| Supply Chain | Enhances transparency and traceability | Supply chain tech: $27.3B (2024), to $44.6B by 2029 |

| Manufacturing Tech | Improves design & reduces costs | Furniture market valued at $600B (2024) |

Legal factors

RH faces intricate international trade regulations. They must adhere to import/export laws, customs, and product standards. Non-compliance risks penalties and business disruptions. For instance, in 2024, the US imposed significant tariffs on goods from certain countries, impacting global trade and supply chains.

Environmental regulations are becoming stricter, significantly affecting the furniture industry. RH must comply with these rules to avoid legal problems and meet consumer expectations. These regulations cover sustainable sourcing, materials, and production methods. For example, in 2024, the EPA set new standards for formaldehyde emissions in composite wood products, impacting furniture makers.

RH must navigate labor laws in manufacturing countries, impacting its supply chain. Compliance with regulations like the Uyghur Forced Labor Prevention Act is critical. In 2024, scrutiny on ethical sourcing intensified, especially for companies sourcing from regions with human rights concerns. RH's ability to adapt to these legal standards will affect its operational costs. These regulations can increase costs by up to 15%.

E-commerce and Data Privacy Regulations

Evolving e-commerce, data privacy, and consumer protection laws significantly impact RH's online operations. RH must adapt its data handling to comply, safeguarding customer trust and avoiding legal issues. The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are key. Non-compliance can lead to substantial fines, potentially impacting RH's financial performance.

- GDPR fines can reach up to 4% of global annual turnover.

- CCPA violations may result in fines of $2,500 to $7,500 per record.

- E-commerce sales in the US reached $1.1 trillion in 2023.

Product Safety and Quality Standards

RH, as a seller of home furnishings, must strictly comply with product safety and quality standards. These standards cover materials, construction, and fire safety, ensuring consumer protection. Non-compliance can lead to recalls, legal issues, and reputational damage, impacting sales. For example, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported over 200 product recalls, highlighting the importance of adherence.

- Compliance with standards is crucial for market access.

- Product recalls can be very costly for companies.

- Maintaining product safety builds consumer trust.

- Regulations are constantly evolving, requiring ongoing adaptation.

RH faces strict international trade laws, labor regulations, and e-commerce mandates, including GDPR. They also deal with evolving product safety and consumer protection rules. Navigating these legal challenges is essential for RH's global operations. Non-compliance risks severe penalties and reputational harm.

| Regulation Type | Compliance Impact | 2024/2025 Data |

|---|---|---|

| International Trade | Tariffs, trade barriers | US tariffs on specific goods, impacting supply chain costs by 5-10%. |

| Data Privacy | GDPR/CCPA compliance | GDPR fines up to 4% of global revenue; US e-commerce sales reached $1.1 trillion in 2023. |

| Product Safety | Recalls and standards | Over 200 product recalls reported by the CPSC in 2024. |

Environmental factors

RH faces increasing pressure to adopt sustainable sourcing. Consumer preference for eco-friendly materials, like FSC-certified wood, is rising. Regulations are also tightening; the EU's Green Deal impacts material sourcing. RH's 2024 Sustainability Report highlighted efforts to increase recycled content and reduce waste.

Furniture production significantly impacts the environment. Energy consumption, waste, and carbon emissions are key concerns. RH can improve by adopting sustainable practices. The global furniture market was valued at $530.3 billion in 2023, with sustainability driving change.

The circular economy is reshaping industries, pushing for durable, reusable, and recyclable products. RH must adapt, focusing on designing furniture with extended lifespans and effective end-of-life strategies. In 2024, the global circular economy market was valued at $4.5 trillion, a number that is expected to grow significantly by 2025.

Climate Change and Extreme Weather Events

Climate change poses significant risks to RH's operations. Extreme weather events, such as hurricanes and floods, can disrupt supply chains and damage infrastructure. These disruptions can lead to increased costs and delays in product delivery. RH must consider strategies to adapt to these climate-related challenges.

- The World Bank estimates that climate change could push over 100 million people into poverty by 2030, affecting consumer spending.

- In 2023, climate disasters cost the U.S. over $92.9 billion.

- Supply chain disruptions due to extreme weather have increased by 20% in the last five years.

Consumer Demand for Environmental Responsibility

Consumer demand for environmentally responsible products is increasing. RH can gain a competitive edge by highlighting its sustainability efforts. This includes sourcing eco-friendly materials and reducing its carbon footprint.

- A 2024 study shows 60% of consumers prefer sustainable brands.

- RH could promote its use of recycled or responsibly sourced wood.

- Investing in energy-efficient operations can lower costs and attract eco-conscious buyers.

RH must address environmental factors. Sustainable sourcing, from FSC-certified wood, is crucial. The furniture industry's environmental impact demands sustainable practices, circular economy adaptation, and climate risk management. Focus on extended product lifecycles.

| Environmental Factor | Impact | Data |

|---|---|---|

| Sustainable Sourcing | Consumer preference and regulation. | 60% of consumers prefer sustainable brands (2024 Study). |

| Climate Change | Supply chain disruption and increased costs. | Climate disasters cost the US over $92.9B in 2023. |

| Circular Economy | Shift towards reusable/recyclable products. | Circular economy market valued at $4.5T in 2024. |

PESTLE Analysis Data Sources

This RH PESTLE Analysis incorporates diverse data from government publications, industry reports, and economic forecasts.