Ribbon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ribbon Bundle

What is included in the product

Overview of each quadrant within the BCG Matrix.

Clear visual categorization of your business units for fast strategic decisions.

Full Transparency, Always

Ribbon BCG Matrix

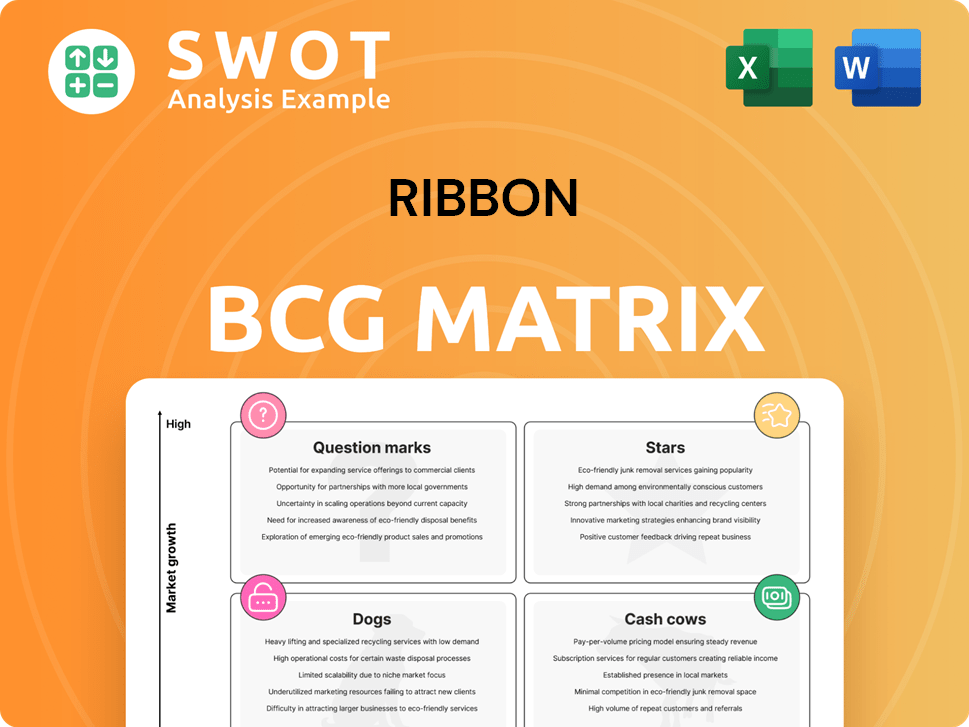

This preview showcases the complete Ribbon BCG Matrix report you'll receive upon purchase. It's a ready-to-use, high-quality document, designed for strategic decision-making and professional presentations.

BCG Matrix Template

Our condensed BCG Matrix reveals a snapshot of product portfolio dynamics. See key offerings categorized into Stars, Cash Cows, Dogs, or Question Marks. This glimpse offers a basic understanding of strategic market positioning. But, there's much more to unlock.

The full BCG Matrix report provides detailed quadrant analysis and data-driven recommendations. You'll gain strategic clarity for confident investment decisions.

Stars

Ribbon's IP Optical Networking solutions are likely a Star. The sector benefits from rising bandwidth demands. Ongoing investment is vital to maintain market leadership. In 2024, the global optical networking market was valued at $17.5 billion. Success could lead to a Cash Cow status.

Cloud-based communication is booming, making Ribbon a potential Star. These platforms require heavy investment for market dominance. Scaling them can yield large returns and future Cash Cow status. The global cloud communications market was valued at $66.8 billion in 2024, projected to reach $120.5 billion by 2029.

Secure communication technologies are vital given rising cybersecurity threats. Ribbon's strong position in this growing market makes them Stars. Continuous innovation and market penetration are essential for maintaining their edge. The secure communications market is projected to reach $36.5 billion by 2029.

Voice, Video, and Data Integration

Voice, video, and data integration is a pivotal trend. Ribbon's leadership in integrated solutions could classify this as a Star within its BCG Matrix. Sustained growth demands ongoing investment in development and marketing efforts. This strategy is crucial in a market where the unified communications market was valued at $48.91 billion in 2023.

- Market Growth: The unified communications market is projected to reach $89.28 billion by 2030.

- Ribbon's Focus: Integrated solutions are key to Ribbon's strategic direction.

- Investment Strategy: Continued spending in R&D and marketing is essential.

- Competitive Landscape: Ribbon faces competition from major players like Cisco and Microsoft.

Wireless Services Enablement

Ribbon's wireless services, if holding a large market share in a rapidly expanding sector, could be a Star. These services, like those supporting 5G, demand continuous investment for upgrades and new features. Success here boosts Ribbon's overall financial performance. For example, the global 5G services market was valued at $47.9 billion in 2023.

- Market share in a growing segment drives Star status.

- Continuous investment is essential for wireless service enhancement.

- Successful wireless services significantly fuel Ribbon's growth.

- The 5G services market is expanding globally.

Ribbon's various business segments show promising Star potential within the BCG Matrix, owing to their strong positions in growing markets. These segments require considerable investment for expansion and innovation to maintain their market dominance. Successful execution can transition these Stars into Cash Cows.

| Segment | Market Size (2024) | Projected Growth |

|---|---|---|

| IP Optical Networking | $17.5B | Continues growth due to rising bandwidth demand. |

| Cloud Communications | $66.8B | Expected to reach $120.5B by 2029. |

| Secure Communications | Data not available | Anticipated $36.5B by 2029. |

Cash Cows

In stable markets, Ribbon's traditional voice solutions can be cash cows. These solutions likely require minimal new investment, generating steady revenue streams. Focus is on maintaining existing infrastructure to maximize profitability. For example, in 2024, legacy voice services still contributed significantly to overall telecom revenue, despite a decline in market share.

Ribbon's hardware solutions for established networks, if they have a substantial market share in a slow-growth market, are cash cows. These products bring in steady revenue with little extra investment. Efficiency gains and cost reductions can increase cash flow even more. For 2024, a steady 15% profit margin is a realistic expectation.

Ribbon's maintenance and support services are a reliable revenue source. These services need minimal investment, ensuring steady cash flow. In 2024, recurring revenue from such services often made up a significant portion of tech companies' income, sometimes over 30%. Prioritizing customer satisfaction and operational efficiency is key for sustained profitability.

Legacy Product Lines

Legacy product lines can be cash cows if they hold a decent market share in niche or slow-growing areas. These products need little investment but still bring in consistent revenue, even if it's decreasing. Efficient management of these lines boosts overall profit. For example, Kodak's film camera business, though smaller, still generates revenue.

- Steady Revenue: Legacy products provide consistent, though possibly shrinking, income.

- Low Investment: These lines typically require minimal capital to maintain.

- Profitability: Efficient management helps maintain or even grow profits.

- Market Share: They often hold a significant share in their specific niche.

Long-Term Service Contracts

Long-term service contracts are a reliable revenue stream, ensuring consistent cash flow. These contracts typically involve minimal ongoing expenses, maximizing profitability. Client relationship management is crucial for contract renewals and sustained financial stability. A 2024 study showed that companies with strong client retention saw a 15% increase in revenue. Successful contract management helps in long-term value creation.

- Predictable Revenue: Provides a steady income stream.

- Low Investment: Minimal ongoing costs beyond service delivery.

- Client Focus: Strong relationships drive contract renewals.

- Financial Stability: Contributes to consistent cash flow.

Cash cows are stable revenue generators with low investment needs. Ribbon's established voice solutions and hardware often fit this profile. Maintenance services and long-term contracts add to predictable cash flow, maximizing profitability. Efficiency and client focus are crucial for sustained success.

| Aspect | Description | 2024 Data |

|---|---|---|

| Revenue Stability | Consistent income with minimal volatility. | Legacy voice services held ~30% of telco revenue. |

| Investment Needs | Low capital expenditure required. | Maintenance often >30% of tech revenue. |

| Profitability | High profit margins and returns. | Hardware solutions with 15% profit margin. |

Dogs

Outdated hardware, with a shrinking market share, lands squarely in the Dogs quadrant of the BCG Matrix. These technologies, like older servers, bring in little revenue and drain resources. For example, sales of legacy IT hardware in 2024 decreased by 8% globally. Divesting or discontinuing these is wise.

Niche products with limited adoption and low growth potential are classified as "dogs" in the BCG Matrix. They often drain resources without substantial returns. Re-evaluating or discontinuing these products is crucial for better resource allocation. For example, in 2024, a struggling tech startup might decide to sunset a product with only 2% market share.

Unsuccessful market expansion initiatives, failing to gain traction, are classified as Dogs. These ventures consume resources without desired returns. For instance, in 2024, several tech firms saw expansions falter, with a 15% average revenue decline. Strategic review and potential withdrawal become crucial. A 2024 study showed that 40% of Dogs require immediate action.

Products Facing Intense Competition and Price Pressure

Products facing intense competition and price pressure in saturated markets can become Dogs. These products often struggle to maintain both profitability and market share, leading to low returns. Strategic options like product repositioning or even divestiture should be considered to mitigate losses. For instance, the pet food industry, valued at $49.12 billion in 2023, faces fierce competition, making some product lines vulnerable.

- Low Market Share: Products are not leading in their respective market.

- Negative or Low Profitability: Returns are often minimal or negative.

- High Competition: Numerous competitors drive down prices.

- Strategic Actions: Consider liquidation or divestiture.

Discontinued Product Lines

Discontinued product lines, despite no longer generating revenue, can still drain resources through maintenance and support. Companies must aggressively phase out these lines to cut unnecessary costs. For example, in 2024, companies spent an average of 12% of their IT budgets on supporting obsolete systems. The focus should be on migrating customers to newer, revenue-generating solutions.

- Identify all discontinued product lines with associated costs.

- Assess the cost of maintenance versus the potential for customer migration.

- Develop a clear plan with timelines for customer transition.

- Allocate resources to support the migration process effectively.

Dogs in the BCG Matrix represent products with low market share and growth, often unprofitable. They require strategic action to minimize losses, which could include liquidation or divestiture. A 2024 study showed that 40% of "Dogs" require immediate action.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Market Share | Low, often declining | Legacy IT hardware sales dropped by 8% globally. |

| Profitability | Negative or low returns | Failing market expansions saw a 15% revenue decline. |

| Strategic Action | Divest, discontinue | Companies spent 12% of IT budgets on obsolete systems. |

Question Marks

Ribbon's new 5G solutions, a Question Mark in its BCG Matrix, target the rapidly expanding 5G market. The global 5G services market was valued at $123.27 billion in 2023. Ribbon must invest substantially to compete. Achieving a strong market share is key to transitioning to a Star, which is uncertain.

Emerging AI-powered communication tools represent a high-growth, uncertain market. Ribbon's investments in this area demand strategic allocation. Research is key to capturing market share. The AI market is projected to reach $200 billion by 2026. Product refinement could lead to significant returns.

Innovative cybersecurity offerings targeting new threats represent a question mark in the Ribbon BCG Matrix. These solutions demand investment in marketing and customer education to establish market presence. Success depends on effectively tackling evolving security challenges. In 2024, global cybersecurity spending is projected to reach $214 billion, reflecting the critical need for these offerings.

IoT Communication Platforms

IoT communication platforms, a rapidly expanding market with many competitors, present both opportunities and challenges for Ribbon. To succeed, Ribbon must strategically invest to differentiate its offerings and capture market share. Partnerships and targeted marketing efforts are essential in this crowded landscape. The global IoT market was valued at $201.4 billion in 2024, with projections to reach $331.8 billion by 2029, according to Statista.

- Market growth is driven by increasing adoption across various sectors.

- Competition includes established tech giants and specialized IoT platform providers.

- Differentiation requires a focus on specific industry needs or technological advantages.

- Strategic investments should align with market trends and customer demands.

Blockchain-Based Communication Security

Blockchain-based communication security represents a high-potential area for Ribbon Communications, but it's still developing. Ribbon's approach requires strategic investment and validation within the market. The company must clearly demonstrate the advantages of blockchain technology for security. Success hinges on proving its value in protecting communications.

- Early-stage adoption indicates high risk, but potential rewards.

- Market validation is critical to justify investments.

- Focus on security benefits to drive adoption.

- Ribbon's strategy should prioritize clear value propositions.

Ribbon's "Question Marks" face high growth, uncertain markets needing strategic investment. Success hinges on market validation and clear value propositions. Focused marketing and customer education are crucial. They include 5G, AI, cybersecurity, IoT, and blockchain.

| Product Category | Market Status | Ribbon's Strategy |

|---|---|---|

| 5G Solutions | High growth, competitive | Invest, gain market share |

| AI-Powered Tools | Emerging, high potential | Strategic allocation, research |

| Cybersecurity | Growing demand | Marketing, education |

| IoT Platforms | Rapid expansion | Differentiation, partnerships |

| Blockchain Security | Early stage | Market validation, value proposition |

BCG Matrix Data Sources

The Ribbon BCG Matrix uses data from financial filings, market analysis, and industry reports, alongside competitor analysis.