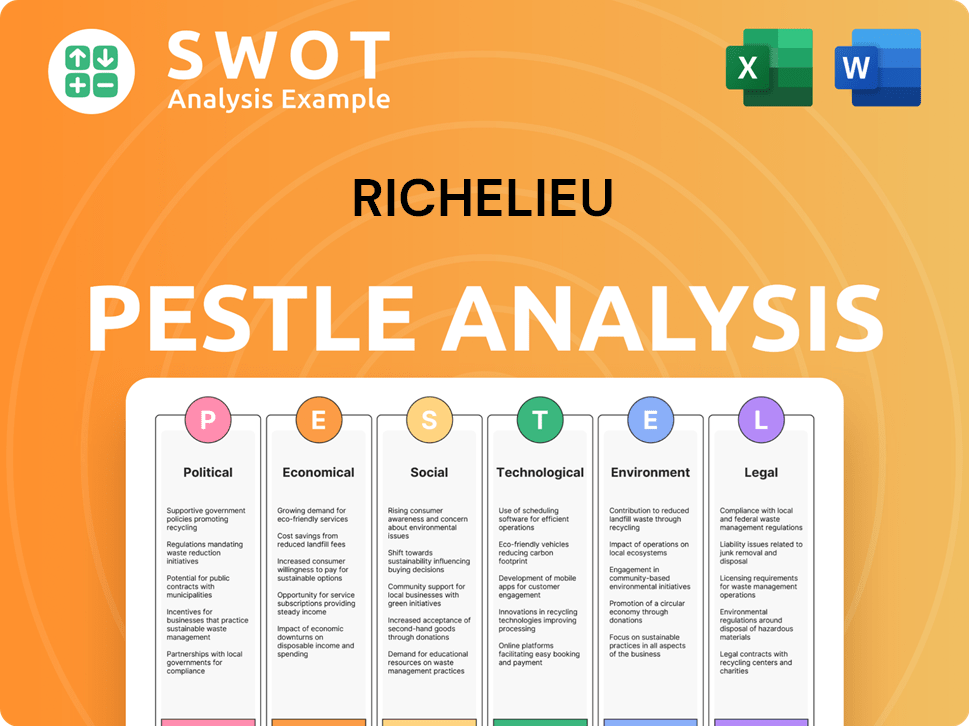

Richelieu PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richelieu Bundle

What is included in the product

Identifies how external factors impact Richelieu across six dimensions: Political, Economic, Social, etc.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

Richelieu PESTLE Analysis

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. This preview showcases the full Richelieu PESTLE Analysis document.

It's formatted with the complete analysis. The downloadable version matches this presentation.

Every section, point, and detail are present. Your instant download will provide this comprehensive tool.

Start working on this insightful study right away. Expect quality and ease of use with your purchase.

Get a ready-to-use assessment tool now!

PESTLE Analysis Template

Uncover Richelieu's future with a deep dive PESTLE analysis. We explore political, economic, social, technological, legal, and environmental factors impacting the company. Get actionable insights, not just theory, to boost your strategic planning. Enhance your decision-making by understanding key market trends. The full analysis offers complete, ready-to-use intelligence—available instantly for download!

Political factors

Changes in building codes and safety standards significantly affect Richelieu's products. For instance, updated fire safety regulations might require adjustments to cabinet hardware. Import/export rules also matter; in 2024, NAFTA region trade totaled over $1.5 trillion. Compliance ensures continued market access and avoids costly penalties.

Richelieu's North American presence exposes it to political risks in Canada and the U.S. Policy shifts impacting infrastructure, housing, or trade could affect its operations. For instance, in 2024, U.S. infrastructure spending is projected to reach $1.5 trillion, potentially influencing Richelieu's market. Changes in trade policies, such as tariffs, could also impact its supply chain and costs.

Government stimulus, like the Infrastructure Investment and Jobs Act, boosts construction. This increases demand for Richelieu's products. For example, the US plans $1.2 trillion in infrastructure spending. Housing initiatives also drive demand, potentially increasing Richelieu's sales. Tracking government plans is crucial; in 2024, infrastructure spending grew by 8%.

Trade Agreements and Tariffs

Changes in trade agreements, like those between Canada and the U.S., are crucial for Richelieu. Tariffs and altered trade barriers directly impact the costs of imported materials and the pricing of their products. The United States-Mexico-Canada Agreement (USMCA) is currently in effect. For instance, in 2023, the U.S. imported $39.1 billion in furniture from Canada. These factors influence Richelieu's profitability and market positioning.

Political Influence on the Construction Sector

Political factors significantly shape the construction sector, a crucial customer segment for Richelieu. Government decisions on interest rates, such as the Federal Reserve's moves in 2024 and 2025, directly affect borrowing costs for construction projects. Changes in lending practices, influenced by regulations, also impact project feasibility and funding availability. Housing affordability policies, including tax incentives or subsidies, can boost or hinder renovation and new construction markets.

- Interest rates: The Federal Reserve held rates steady in early 2024 but signaled potential cuts later in the year and 2025, impacting construction loan costs.

- Lending practices: Regulatory changes in 2024, like those related to bank capital requirements, could tighten construction loan availability.

- Housing affordability: Government programs in 2024, such as first-time homebuyer credits, could stimulate renovation demand.

Political elements impact Richelieu. Trade deals such as USMCA, influence costs, with U.S. furniture imports from Canada at $39.1B in 2023. Government policies, including the Fed's interest rate moves in early 2024/2025, alter construction costs. Regulatory shifts in lending and housing incentives, affect Richelieu's sales too.

| Political Factor | Impact on Richelieu | Data |

|---|---|---|

| Interest Rates (2024/2025) | Affect construction loan costs | Federal Reserve held steady then cut rates |

| Lending Practices (2024) | Impact loan availability | Regulatory changes potentially tightened loans |

| Housing Affordability | Stimulate/Hinder Demand | Incentives can drive renovation |

Economic factors

The housing market significantly impacts Richelieu's sales. New housing starts in the US are projected to be around 1.4 million in 2024. Existing home sales saw fluctuations, with about 4.09 million units sold in February 2024, a slight increase from the previous month. Renovation activity also contributes, with spending expected to remain robust. A positive housing market outlook supports Richelieu's growth.

Overall economic growth and consumer confidence levels directly affect spending on home renovations and furniture, impacting sales for Richelieu. High consumer confidence, as seen in early 2024, usually boosts discretionary spending. Conversely, economic downturns, like the projected slowdown in late 2024, can decrease demand, potentially affecting Richelieu's revenue streams. Retail sales in the home improvement sector, up 2.7% in March 2024, indicate the current market trends.

Interest rate fluctuations impact Richelieu's borrowing costs, influencing investments. Inflation, at 3.5% in March 2024, affects material costs. Higher rates could slow expansion plans. Rising inflation (if any) might erode profit margins, impacting pricing strategies.

Currency Exchange Rates

Fluctuations in currency exchange rates significantly affect Richelieu's financial performance, given its operations in Canada and the United States. A stronger Canadian dollar relative to the US dollar can decrease the value of US sales when converted back to Canadian dollars, potentially reducing reported revenue. Conversely, a weaker Canadian dollar can increase the cost of US-sourced materials and components, impacting profitability margins.

- In 2024, the CAD/USD exchange rate has shown volatility, fluctuating between approximately 1.33 and 1.38.

- A 1% change in the exchange rate can impact Richelieu's revenue by millions.

- Hedging strategies are crucial to mitigate exchange rate risks.

Supply Chain Costs and Disruptions

Richelieu faces supply chain challenges impacting costs and efficiency. Volatility in raw material prices, like those for wood and hardware, directly affects production costs. Transportation expenses, including shipping and logistics, are also subject to fluctuations. Disruptions, whether due to geopolitical issues or natural disasters, can further complicate supply chain management.

- In 2024, global shipping costs increased by 15% due to geopolitical tensions.

- Raw material prices for wood rose by 8% in the first half of 2024.

- Richelieu's Q1 2024 earnings showed a 5% decrease in gross profit margin due to increased supply chain costs.

Economic factors heavily influence Richelieu's financial results. Fluctuating interest rates and inflation directly affect borrowing costs and material prices. In March 2024, inflation was 3.5%, influencing Richelieu's profit margins. Exchange rates between CAD and USD also impact revenue, as demonstrated by recent volatility.

| Factor | Impact | 2024 Data |

|---|---|---|

| Inflation | Material Costs & Pricing | 3.5% (March) |

| Interest Rates | Borrowing & Investments | Fed Rate ~5.25-5.50% |

| CAD/USD | Revenue | 1.33-1.38 volatility |

Sociological factors

Consumer preferences significantly shape the home design market. Demand for specific styles, materials, and smart home tech directly impacts hardware needs. Richelieu must adapt to these trends. In 2024, smart home tech spending reached $21.7 billion, a 10% increase.

Demographic shifts significantly influence building material and hardware demand. The aging population and changing household sizes drive specific product needs. North America faces a housing shortage, creating a growth opportunity. In 2024, housing starts in the US are projected around 1.4 million units, indicating strong demand. Population migration patterns are also a factor.

The rise of remote work continues, with around 30% of U.S. workers working from home as of early 2024. This shift fuels demand for home office setups and renovations. Spending on home improvement is expected to reach $480 billion in 2024, reflecting lifestyle adjustments. These changes impact consumer spending and housing preferences.

Awareness of Sustainable and Healthy Building Materials

Consumer awareness of sustainable and healthy building materials is increasing, potentially boosting demand for eco-friendly products. Richelieu, to capitalize on this, might need to broaden its sustainable product range. The global green building materials market is projected to reach $480.2 billion by 2028. This shift reflects a preference for healthier indoor environments and reduced environmental impact.

- Market growth: The green building materials market is set to grow significantly.

- Consumer preference: Rising interest in eco-friendly materials is evident.

- Richelieu's strategy: Expansion of sustainable offerings is a potential move.

Labor Availability and Skills in the Construction Sector

The construction sector's labor pool significantly influences project timelines and hardware demand. Skilled labor shortages can stall projects, impacting supply needs. The U.S. construction industry faces a skilled labor deficit, with an estimated 546,000 unfilled jobs in 2024. This shortage drives up labor costs, potentially affecting project budgets and hardware sales.

- Construction employment in the US reached 8.1 million in April 2024.

- The average hourly earnings for construction workers were $36.22 in April 2024.

- The industry's labor productivity grew by 1.6% in Q1 2024.

Societal trends like remote work and evolving family structures influence home renovation choices. Increased demand for home offices, as cited in 2024 data, drives spending towards remodeling efforts. Consumer demand for sustainable materials rises. Green building materials market expected to reach $480.2 billion by 2028.

| Sociological Factor | Impact on Richelieu | Data Point (2024) |

|---|---|---|

| Remote Work | Increased demand for home office solutions | ~30% US workers WFH |

| Eco-Consciousness | Demand for sustainable products rises | Green building materials market growth |

| Aging population, changing demographics | Demand for accessibility and convenience | Rising need for adaptable products |

Technological factors

Advancements in manufacturing, like 3D printing and robotics, are reshaping hardware production. Automation boosts efficiency, potentially lowering costs. For instance, the global automation market is projected to reach $214.3 billion by 2025. This impacts Richelieu's production capabilities and product offerings. New technologies allow for innovative designs and functionalities.

E-commerce is crucial for Richelieu. Online platforms drive sales of building materials and hardware. Richelieu must boost its digital presence. In 2024, online retail sales in the building materials sector reached $85 billion. Effective digital strategies are vital for growth.

Technological advancements significantly influence Richelieu's product offerings. Innovation in hardware design introduces new features, enhances functionality, and improves aesthetics. For example, in 2024, the smart home market grew to $150 billion, highlighting the demand for technologically advanced furniture. Richelieu must incorporate these advancements to remain competitive and meet evolving consumer expectations, especially as the market is projected to reach $200 billion by 2025.

Supply Chain Technology and Logistics

Technology is pivotal in Richelieu's supply chain, enhancing inventory control and logistics. Modern supply chain tech can boost efficiency, cutting expenses. The global supply chain software market is projected to reach $21.4 billion by 2025. Richelieu leverages tech for real-time tracking and automated warehousing. This ensures quicker delivery and stock management.

- Supply chain software market projected at $21.4B by 2025.

- Real-time tracking improves delivery.

- Automated warehousing optimizes stock.

Adoption of Technology by Customers

The technological landscape significantly shapes Richelieu's operations. Increased tech adoption by manufacturers and retailers, including design software and inventory systems, impacts interactions and service demands. This includes the need for digital catalogs and e-commerce integration. For instance, the global e-commerce furniture market is projected to reach $685.5 billion by 2024. Furthermore, 78% of woodworkers use digital tools for design.

- E-commerce furniture market expected to reach $685.5 billion in 2024.

- 78% of woodworkers use digital design tools.

Richelieu faces tech-driven shifts in production and design, highlighted by 3D printing advancements and design software adoption, with 78% of woodworkers using such tools.

E-commerce growth and smart home demand drive the need for digital strategies and technologically advanced products; the smart home market is forecasted at $200 billion by 2025.

Supply chain tech optimizes operations, with the software market projected at $21.4 billion by 2025; real-time tracking and automated warehousing streamline logistics.

| Aspect | Impact | Data |

|---|---|---|

| Manufacturing Tech | Hardware production efficiency | Automation market projected at $214.3B by 2025 |

| E-commerce | Boosts online sales of building materials | E-commerce furniture market at $685.5B in 2024 |

| Product Innovation | Incorporates advanced functionalities | Smart home market to hit $200B by 2025 |

Legal factors

Richelieu must adhere to Canadian and U.S. building codes for product safety. This includes compliance with mandatory safety standards and certifications. Any alterations to these codes necessitate changes to Richelieu's products, potentially involving extra testing. The construction industry in both countries is heavily regulated, and updates are frequent. For example, in 2024, the U.S. saw a 3% increase in building code revisions.

Richelieu must navigate import/export rules for international trade. Compliance with customs, trade laws, and restrictions is crucial. In 2024, global trade faced challenges like supply chain disruptions. The World Trade Organization (WTO) reported a 3% increase in merchandise trade volume for 2024. Understanding these regulations is vital for Richelieu's success.

Richelieu must adhere to labor laws, wage regulations, and employment standards. This includes compliance with minimum wage laws; for example, the U.S. federal minimum wage is $7.25 per hour, unchanged since 2009. In 2024, several states and cities have higher minimum wages. Non-compliance can lead to legal penalties and reputational damage. Understanding and adapting to these regulations is crucial for Richelieu's operational continuity.

Product Liability and Safety Regulations

Richelieu faces legal obligations regarding product safety and liability. Compliance with regulations is crucial to prevent lawsuits and maintain consumer trust. Failure to meet standards can lead to recalls and financial penalties. For example, in 2024, product liability insurance costs increased by 10-15% for manufacturers.

- Product recalls cost companies an average of $8 million in 2024.

- Richelieu's legal team should stay updated on evolving safety standards.

- Regular product testing and quality control are essential.

Environmental Regulations and Compliance

Richelieu faces environmental regulations that affect its manufacturing, sourcing, and disposal practices. Compliance with these laws is crucial for maintaining its operational license and brand image. In 2024, the global environmental compliance market was valued at $15.7 billion, expected to reach $22.3 billion by 2029. Non-compliance can lead to fines, legal battles, and reputational damage, impacting investor confidence. Richelieu must invest in sustainable practices to mitigate these risks.

Richelieu's legal compliance involves navigating building codes, import/export laws, and labor regulations. Product safety and liability compliance is essential to prevent financial losses. Environmental regulations add further complexity, with the global compliance market reaching $15.7B in 2024.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Building Codes | Compliance costs, revisions | US code revisions up 3% |

| Trade Laws | Import/Export challenges | WTO merchandise trade +3% |

| Product Liability | Recalls, Insurance costs | Avg recall cost: $8M, Insurance costs increased 10-15% |

Environmental factors

Environmental factors significantly impact the availability and cost of raw materials. Resource scarcity, driven by environmental concerns, affects metal and wood supplies. For example, the price of copper, essential for hardware, rose by 15% in 2024 due to supply chain disruptions and environmental regulations. Conservation efforts and extraction regulations further influence these costs, adding to the expenses in 2025.

Richelieu faces stricter environmental rules. These affect how it makes products, what it uses, and how it packages them. New rules mean companies must be more sustainable. For example, in 2024, the EU's Ecodesign Directive for Sustainable Products came into effect, pushing for longer-lasting and repairable products. Compliance is key now.

Climate change heightens extreme weather risks, potentially disrupting Richelieu's supply chains and construction activities. The World Bank estimates climate change could push 100 million into poverty by 2030. Increased severe weather events like floods and storms could damage infrastructure, impacting Richelieu. This could lead to increased costs and operational challenges.

Waste Management and Recycling

Richelieu must consider environmental impacts of waste management and recycling. This includes waste from manufacturing and packaging. Effective recycling programs are crucial for sustainability. The global recycling rate for plastics was only about 9% in 2024. Richelieu needs to align with these trends.

- Implement robust recycling programs.

- Reduce packaging waste.

- Explore sustainable materials.

- Comply with environmental regulations.

Energy Consumption and Efficiency

Environmental factors significantly shape Richelieu's operations. Energy efficiency in manufacturing and distribution is crucial, influenced by environmental concerns and regulations regarding energy consumption and greenhouse gas emissions. Companies face increasing pressure to reduce their carbon footprint. This impacts supply chain management and operational costs. In 2024, the industrial sector accounted for approximately 33% of total U.S. energy consumption.

- Government regulations, like those promoting renewable energy, can affect Richelieu's energy costs.

- Investing in energy-efficient technologies is vital for cost savings and compliance.

- Consumers increasingly favor environmentally responsible brands, impacting Richelieu's brand image.

- Embracing sustainable practices can lead to improved operational efficiency and cost savings.

Environmental factors strongly affect Richelieu's operations, from sourcing to waste management. Increased costs from environmental regulations and supply chain disruptions are prominent. Focus on sustainability and reducing environmental impact to maintain profitability.

| Aspect | Impact | Data |

|---|---|---|

| Raw Materials | Scarcity and Cost | Copper price +15% in 2024 due to supply issues. |

| Regulations | Compliance Costs | EU Ecodesign Directive in effect, requiring sustainable products. |

| Climate Risks | Supply Chain Disruption | Severe weather linked to higher infrastructure costs. |

PESTLE Analysis Data Sources

We use sources like the IMF, World Bank, government publications, and industry reports to compile a Richelieu PESTLE. Accurate insights are drawn from diverse and credible sources.