RiseSun Real Estate Development PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RiseSun Real Estate Development Bundle

What is included in the product

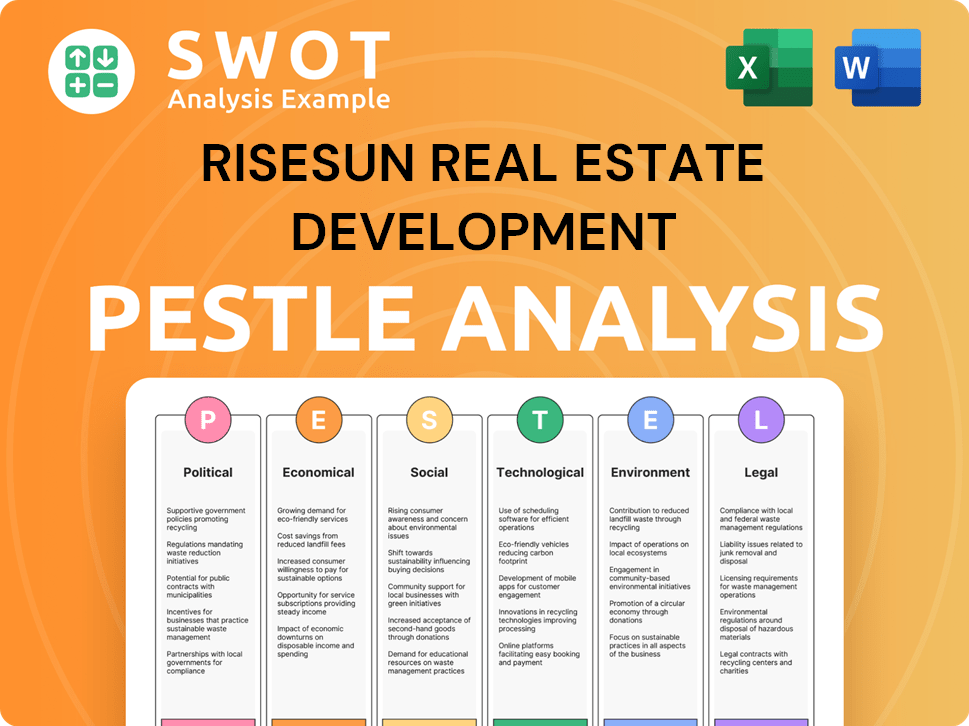

A PESTLE analysis of RiseSun explores how external factors affect its development across six areas.

A concise version ready for PowerPoints or quick group planning, simplifying strategy.

What You See Is What You Get

RiseSun Real Estate Development PESTLE Analysis

The RiseSun Real Estate Development PESTLE analysis you see here is the actual file you’ll get—fully formatted and ready for download after purchase. This in-depth document, providing a comprehensive assessment. It includes the same insights, analyses, and formatting. You will receive this as your document after completing the payment process.

PESTLE Analysis Template

Analyze RiseSun Real Estate Development's market position with our insightful PESTLE Analysis.

Explore how political stability and economic conditions affect its operations.

Understand the impact of social trends, technological advancements, and environmental regulations.

Uncover the legal landscape and its influence on RiseSun's strategies and profitability.

This detailed report provides essential insights for investors and stakeholders.

Download the full version to strengthen your investment decisions and get the whole breakdown now.

Political factors

The Chinese government actively shapes the real estate market. Recent policies aim to stabilize the sector, easing restrictions to boost activity. For instance, in 2024, the government adjusted mortgage rates and down payment ratios. These interventions, including efforts to aid developer financing, impact market dynamics. In 2024, stimulus measures aimed to aid developers and address financial challenges, were implemented.

The Chinese government aims to stabilize property and stock markets. They are focusing on stabilizing housing prices, especially in major cities. Local policy easing and adjusting property restrictions are being implemented city by city. In 2024, new home prices in 70 major cities saw modest gains. Data from April 2024 showed a 0.6% increase in new home prices in these cities.

China's urbanization drive, encouraging rural-to-urban migration, is a key political factor. This push aims to boost domestic demand and stimulate real estate investment. In 2024, approximately 65% of China's population lived in urban areas, a trend expected to continue. This could translate to increased demand for housing and commercial spaces. By 2025, urbanization is projected to reach 66%, creating new opportunities.

Local Government Debt and Fiscal Pressure

Local governments are grappling with fiscal strain, partly from reduced land sales, a key revenue stream. This can hinder their ability to finance public services and infrastructure, potentially impacting urban development and real estate. For instance, in 2024, several cities reported significant drops in land sale revenues, affecting planned projects.

- Land sales declines have been a major issue in 2024, impacting local government finances.

- Reduced funding can lead to delays in infrastructure projects.

- Real estate development may face challenges due to funding constraints.

Shift Towards State-Owned Developers

State-owned developers are becoming more prominent in land and real estate, especially in key cities. This is part of a government strategy to stabilize the market. The shift could result in a less debt-reliant property sector. However, it might also bring about lower efficiency.

- In 2024, state-owned enterprises (SOEs) accounted for over 60% of new construction projects in major Chinese cities.

- Government policies aim to increase SOE involvement to reduce market volatility and control land prices.

- This transition is expected to be largely complete by the end of 2025, reshaping the market landscape.

The Chinese government's influence includes mortgage rate adjustments and aims to stabilize property and stock markets, with new home prices in 70 major cities increasing modestly in 2024, as shown by April 2024's 0.6% rise.

China's urbanization drive, expected to reach 66% by 2025, fuels demand, however, local government fiscal strains from reduced land sales hinder infrastructure and development.

State-owned developers, accounting for over 60% of new construction in major cities during 2024, reshape the market under government stabilization strategies by the end of 2025.

| Factor | Description | Impact |

|---|---|---|

| Government Policies | Adjustments to mortgage rates and down payments; focus on stabilizing housing prices. | Influences market dynamics, impacting new home prices and developer activities; stabilization measures. |

| Urbanization | 65% urban population in 2024, projected to reach 66% by 2025. | Increased demand for housing and commercial spaces, supporting real estate investment. |

| Local Government Finances | Reduced land sales impact fiscal capabilities; affects public services and infrastructure. | Potential delays in infrastructure projects; may constrain real estate development. |

Economic factors

The Chinese property market faced a downturn, with property investment decreasing and prices falling in some regions. Unsold inventory levels remained high. To counter this, the government introduced significant fiscal stimulus. These measures have shown slight positive effects on sales and price stabilization in specific cities. In 2024, new home prices in 70 major cities fell by 0.6% year-on-year.

Weak domestic demand and low consumer confidence are crucial issues for China's economy, impacting real estate significantly. Job security concerns and falling home prices deter potential buyers. Consumer confidence hit a low of 88.8 in December 2023, reflecting economic anxieties. New home sales in 2024 are expected to be 10-15% lower than in 2023.

China's GDP growth has slowed, with expectations around 5% for 2024. The real estate sector's decline is impacting overall growth. The shift towards a digital economy is underway. However, weak domestic demand is a challenge.

Access to Financing and Developer Liquidity

Access to financing remains a significant hurdle for real estate developers, impacting investment and increasing default risks. The 'White List' program is a government initiative designed to boost liquidity. However, challenges persist, as evidenced by the 2024 slowdown in property investment. The sector faces ongoing financial strain.

- China's property sector saw a 9.6% year-on-year decline in investment during the first quarter of 2024.

- The 'White List' program aims to support around 3,000 projects, but its impact is still unfolding.

- Developers face rising debt levels and tighter lending conditions.

Interest Rates and Monetary Policy

In 2025, the central bank might cut interest rates to boost local demand. A relaxed monetary policy and fiscal stimulus are anticipated to stabilize the economy and real estate. These moves aim to counter economic slowdowns. The property market often responds to these shifts.

- The Federal Reserve held rates steady in early 2024, but future cuts are expected.

- Inflation and economic growth forecasts will guide these decisions.

- Lower rates generally make mortgages more affordable, potentially increasing property demand.

China's real estate market faced a decline with falling investment and prices. Consumer confidence remained weak, affecting demand and sales. The government implemented stimulus measures, but challenges such as financing persist.

| Key Metric | 2024 Data | Impact |

|---|---|---|

| Property Investment Decline | 9.6% YoY (Q1 2024) | Reduced new project starts |

| New Home Price Change (70 Cities) | -0.6% YoY | Reflects market weakness |

| GDP Growth Forecast (China) | ~5% | Slower growth impacting Real Estate |

Sociological factors

Younger Chinese face high housing costs, impacting the traditional homeownership view. In 2024, average home prices in major cities rose, reflecting this challenge. Developer issues further erode trust, potentially changing property ownership attitudes. The shift could influence investment choices and market dynamics.

China's aging population presents a major demographic challenge, potentially decreasing new housing demand long-term. This demographic shift may drive increased demand for elderly care real estate and related services. Data from 2024 show over 20% of China's population is aged 60+, impacting housing needs. This could reshape the real estate market structure.

Urban-rural migration and urbanization are key. China aims to improve urban spaces, drawing rural workers to cities to boost domestic demand. However, the slow urban hukou reform may limit this, influencing housing demand. In 2024, approximately 297 million migrant workers were in China's urban areas.

Consumer Confidence and Expectations

Consumer confidence significantly impacts real estate. Weak confidence stems from worries about developer reliability and economic instability. For instance, in Q1 2024, housing starts declined by 5.7% due to these concerns. Homebuyer trust is vital for market growth. Restoring this confidence is key to boosting sales and project success.

- Q1 2024 housing starts fell 5.7%.

- Concerns include developer stability and economic uncertainty.

- Homebuyer confidence is crucial for market recovery.

Preference for Quality and Environment

Homebuyers increasingly prioritize community environment and building quality as housing prices stabilize. This trend reflects evolving residential preferences, with a focus on green spaces and sustainable construction. Recent surveys show that over 60% of potential homebuyers consider environmental factors in their decision-making process. This shift impacts real estate development, pushing for eco-friendly projects.

- 62% of homebuyers prioritize green spaces.

- Demand for sustainable buildings increased by 15% in 2024.

- Environmentally friendly projects are valued 10% higher.

High housing costs challenge young Chinese, impacting homeownership attitudes. China's aging population potentially decreases housing demand, increasing demand for elderly care real estate. Urbanization and consumer confidence significantly shape the real estate market, reflecting critical factors like developer reliability.

| Factor | Impact | Data |

|---|---|---|

| Homeownership | Reduced desire | 2024 prices up in major cities |

| Aging Population | Shifting needs | 20%+ of China over 60 in 2024 |

| Urbanization | Demand shifts | 297M+ migrant workers in 2024 |

Technological factors

PropTech is directly influencing building operations, enhancing tenant experiences, promoting environmental sustainability, and improving financial outcomes. The global PropTech market is projected to reach $61.2 billion by 2025. The decreasing costs and increased accessibility of PropTech solutions are accelerating adoption rates. This includes smart building technologies and data analytics, leading to operational efficiencies.

The digital economy's growth is reshaping China's economic landscape, diminishing its reliance on real estate. In 2024, the digital economy contributed over 40% to China's GDP. Investments in digital infrastructure are surging, with a projected $200 billion allocated in 2025. This shift impacts property, creating new demands for data centers and smart-city developments.

Technological innovation is rapidly integrating with industrial advancements, fueled by AI and other new productive forces. Breakthroughs in semiconductors and operating systems are opening new possibilities. In 2024, the global AI market was valued at approximately $200 billion, and is projected to reach $1.5 trillion by 2030. This growth directly impacts real estate through smart buildings and automated construction.

Impact of AI on Real Estate

Generative AI is poised to significantly reshape the real estate sector. This includes a notable impact on data centers, driven by increasing computational demands. AI's influence may extend to workforce dynamics and building operations, optimizing efficiency. The global data center market is projected to reach $62.3 billion in 2024.

- Data center market size by 2030 is expected to reach $143.5 billion.

- AI-driven automation in building management could reduce operational costs by up to 20%.

- AI could increase real estate investment by 15% within five years.

Data Centers and E-commerce Growth

Technological advancements significantly impact real estate, particularly through data centers and e-commerce. The growth of e-commerce boosts demand for logistics and warehousing spaces, which directly correlates with the need for data centers to support online transactions. This trend is evident in the increasing investment in data center infrastructure. For example, in 2024, data center spending is projected to reach $200 billion globally, reflecting the sector's expansion. This in turn, increases the value of industrial properties.

- E-commerce sales are projected to reach $7.3 trillion by 2025 globally.

- Data center real estate investment trusts (REITs) saw a 15% increase in value in 2024.

- Industrial property vacancy rates are at a historic low of 4.5% in major markets.

PropTech's expansion, set to hit $61.2B by 2025, is pivotal, enhancing operations and tenant experiences. The digital economy's surge, contributing over 40% to China's GDP in 2024, impacts real estate demands. Generative AI reshapes sectors, with the data center market projected at $62.3B in 2024.

| Metric | 2024 Value | 2025 Projected |

|---|---|---|

| Global PropTech Market | N/A | $61.2 billion |

| China's Digital Economy Contribution | Over 40% GDP | Ongoing Growth |

| Global Data Center Market | $62.3 billion | $70 billion (est.) |

Legal factors

In 2024 and 2025, China's government introduced regulatory adjustments to stabilize the real estate sector, including easing purchase restrictions. These changes aim to boost market activity. The government is also optimizing lending conditions, offering fiscal relief and incentives. The goal is to counteract the market's downturn and restore investor trust. These measures are crucial given the 2023 property sales drop of 6.5%.

China's foreign investment laws, under the Foreign Investment Law of 2020, mandate security reviews for foreign investments gaining control in key sectors. These reviews, impacting real estate, can delay or block deals. In 2024, the Ministry of Commerce (MOFCOM) and the National Development and Reform Commission (NDRC) oversee these reviews, ensuring compliance. Any changes will be updated by April 2025.

Land use regulations and policies significantly influence real estate development. Local governments are implementing policies for land sales and acquisition to manage the market. State-owned entities are playing a more significant role in land acquisition. In 2024, regulations aimed to streamline land approvals. This affected project timelines and costs.

Property Law and Tenant Protections

China's property laws have historically favored homeownership, with limited tenant protections. This has created a market dynamic where owning property is often seen as more secure than renting. However, there's a shift underway, with potential impacts on the rental market. The government is gradually introducing measures to enhance tenant rights, which could influence investment strategies. This evolving legal landscape demands careful monitoring for real estate developers.

- In 2024, rental yields in major Chinese cities averaged between 1.5% and 2.5%.

- Recent policies aim to improve tenant rights, but implementation varies across regions.

- The legal framework's evolution impacts the attractiveness of rental properties for investment.

Debt Restructuring and Developer Defaults

Legal factors significantly influence how developer debt and defaults are handled. The legal framework provides mechanisms to manage these issues, particularly through restructuring processes. Consent solicitations and schemes of arrangement are key tools for offshore debt restructuring. In 2024, the real estate sector saw a 15% increase in restructuring activities.

- Restructuring activities increased by 15% in 2024.

- Consent solicitations are used to restructure offshore debt.

Legal changes in China's real estate are focused on stabilizing the market. Government actions include easing purchase restrictions and optimizing lending. These efforts, coupled with an increased focus on tenant rights, shape the sector. 2024 saw a 15% rise in debt restructuring.

| Aspect | Details | Impact |

|---|---|---|

| Regulatory Adjustments | Easing purchase restrictions and optimizing lending. | Boosts market activity and investor trust. |

| Foreign Investment Laws | Security reviews by MOFCOM and NDRC. | Can delay or block deals. |

| Land Use Policies | Streamlining land approvals and state-owned entity roles. | Affects project timelines and costs. |

Environmental factors

Decarbonization is a key environmental factor. It affects real estate significantly. ESG criteria are now central to investment decisions. In 2024, green building investments hit $1.3 trillion globally. This trend is expected to grow by 10% annually through 2025.

Climate risk, underscored by extreme weather, poses a major environmental challenge for real estate. The sector is increasingly focused on sustainability. In 2024, insured losses from weather events in the U.S. hit $60 billion. This pushes developers toward eco-friendly practices.

The appeal of green spaces significantly boosts property values, with homes near parks often commanding a 5-10% premium. A 2024 study revealed that communities with well-maintained green spaces experience higher resident satisfaction. These areas also attract a diverse demographic, enhancing the overall desirability. This trend is projected to continue through 2025.

Sustainable Building Practices

Sustainable building practices are becoming more important in real estate. However, their effect on significant change is still developing. Pilot projects by larger firms could help ease this transition. For example, in 2024, green building certifications increased by 15% in major cities. Investing in sustainable materials and designs can enhance property value.

- Green building certifications increased by 15% in major cities in 2024.

- The adoption of sustainable materials and designs enhances property value.

Environmental Regulations and Standards

Environmental regulations and standards are crucial for RiseSun. They affect construction practices and costs. Stricter rules can increase expenses, while looser ones might offer flexibility. For instance, the U.S. Green Building Council reported that in 2024, green building investments reached $81.3 billion. Compliance with these standards is essential for sustainable development.

- Green building investments in 2024: $81.3 billion.

- Increased costs due to stricter environmental rules.

- Need for compliance for sustainable development.

Environmental factors significantly influence RiseSun's real estate ventures.

Green building and ESG considerations, like the $1.3T global investment in 2024, drive demand for sustainable projects, potentially increasing property values.

Regulations and compliance are crucial, given that U.S. green building investments hit $81.3B in 2024, to avoid rising expenses.

| Factor | Impact | Data (2024) |

|---|---|---|

| Decarbonization | Central to investment decisions | Green building investment: $1.3T globally |

| Climate Risk | Focus on sustainability | U.S. weather event losses: $60B |

| Green Spaces | Boosts property values | Homes near parks: 5-10% premium |

PESTLE Analysis Data Sources

RiseSun's PESTLE relies on data from government statistics, industry reports, and economic databases.