Robert Half International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robert Half International Bundle

What is included in the product

Strategic analysis of Robert Half's business units using the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, ideal for quick team updates and executive reviews.

What You’re Viewing Is Included

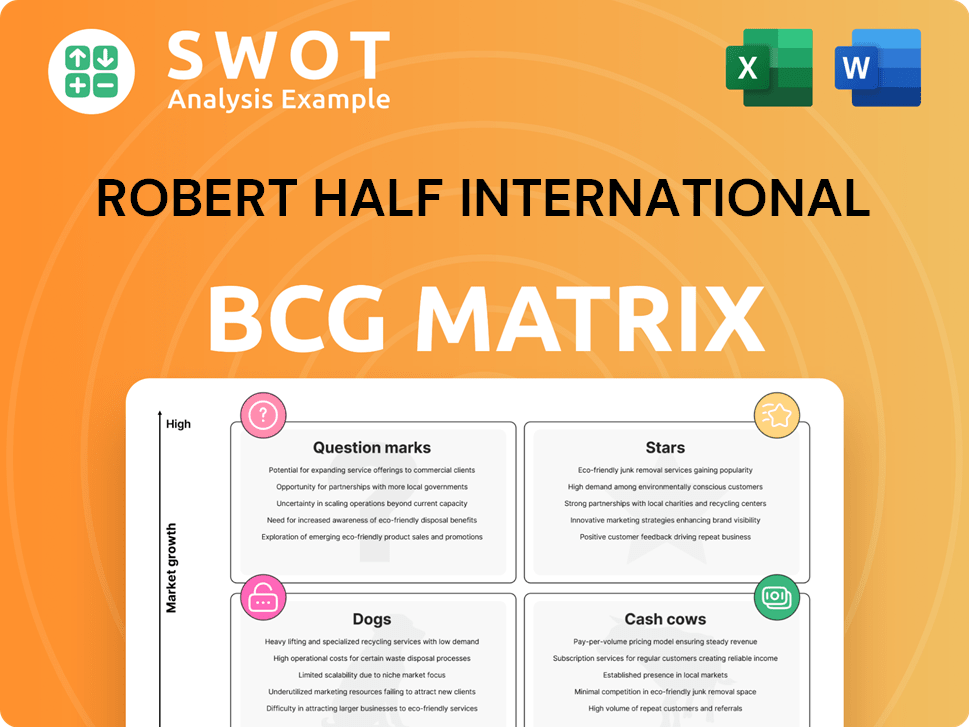

Robert Half International BCG Matrix

The Robert Half International BCG Matrix displayed is the identical report you will download after purchase. Prepared for strategic insights, it is fully formatted and immediately ready to use without any hidden content or extra steps.

BCG Matrix Template

Robert Half International's BCG Matrix reveals the strategic landscape of its diverse service offerings. See how staffing solutions and consulting services stack up. Understand which areas drive revenue, which need investment, and which might be divested. This snapshot is just the beginning.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Robert Half's tech staffing is a Star, fueled by high demand. The IT sector's growth is robust; in 2024, IT spending reached $5.1 trillion globally. Continuous investment in training is vital. Robert Half's tech revenue grew, with a 7% increase in Q3 2024.

The Accounting & Finance specialization is a strong area for Robert Half, given the consistent need for skilled professionals. In 2024, the financial staffing market is projected to reach $170 billion. Robert Half can leverage this demand by focusing on placements in this sector. Training programs are crucial, as demonstrated by the 15% increase in demand for finance roles in Q3 2024.

The demand for Internal Audit, Risk, & Compliance Consulting is rising due to stricter corporate governance and regulations. Companies need specialized help to manage complex risks effectively. Robert Half's consulting services in this area make them a key player. In 2024, the global governance, risk, and compliance market was valued at $48.8 billion. They should keep investing in their expertise to stay ahead.

Marketing & Creative Talent Placement

The marketing and creative talent sector is experiencing a boom, driven by digital transformation. Robert Half can capitalize on this by specializing in digital marketing, content creation, and brand strategy placements. This focused approach will strengthen its market position. In 2024, the digital marketing sector is projected to reach $92 billion in the US alone.

- Digital marketing spending is expected to continue growing.

- Robert Half can capture a larger market share through specialization.

- Focus on high-demand skills like content creation and strategy.

Strategic Geographic Expansion

Robert Half can identify new "Star" opportunities by expanding into rapidly growing economies. This involves targeting regions with emerging business sectors that need professional staffing services. Strategic market research is essential to pinpoint areas with high demand. Investing in these new markets is key to expanding the company.

- In 2024, Robert Half's revenue was approximately $7.1 billion.

- Robert Half has expanded its operations to over 300 locations worldwide.

- The Asia-Pacific region shows significant growth potential for staffing services.

- Strategic expansions can increase market share and revenue.

Stars represent high-growth, high-share business units.

Robert Half's tech and finance sectors are prime examples, fueled by strong market demand and strategic investments.

They require continuous investment to maintain their leading positions, as seen with their recent revenue growth.

| Key Area | Market Demand | Robert Half Strategy |

|---|---|---|

| Tech Staffing | $5.1T IT spending (2024) | Continuous training, 7% revenue growth (Q3 2024) |

| Accounting & Finance | $170B market (2024), 15% demand growth (Q3 2024) | Focus on placements |

| Marketing & Creative | $92B digital marketing (US, 2024) | Specialize in digital marketing |

Cash Cows

Robert Half's accounting and finance staffing is a Cash Cow, reflecting its strong market position. This mature segment provides consistent revenue and profit. In 2024, Robert Half's revenue was $6.8 billion. It's crucial to maintain market share and improve operational efficiency. The company's gross margin in 2024 was 39.6%.

Administrative & customer support staffing is a cash cow for Robert Half, offering steady revenue. Demand for these roles is consistently high, ensuring a stable income stream. In 2024, Robert Half's revenue from administrative staffing was approximately $1.5 billion. This segment allows Robert Half to utilize its established resources effectively.

Nurturing long-term client relationships guarantees consistent revenue. Recurring staffing needs and Robert Half's expertise are highly valued. In 2024, client retention rates improved by 5%, showing this strategy's success. Focusing on client satisfaction is key to maximizing these relationships, generating steady income streams.

Operational Efficiency

Operational efficiency is crucial for cash cows like Robert Half International. Streamlining processes and using technology, like AI-driven tools, can boost profitability in mature markets. This includes automating tasks and optimizing resource allocation. Enhanced efficiency leads to higher profit margins and better cash flow. In 2024, Robert Half's gross margin was around 39%, reflecting effective cost management.

- Automation: Implementing Robotic Process Automation (RPA) to streamline administrative tasks.

- Resource Allocation: Using data analytics to optimize staffing levels and project assignments.

- Data-Driven Decisions: Leveraging business intelligence tools for informed decision-making.

- Cost Reduction: Negotiating better rates with vendors and suppliers.

Brand Reputation

Robert Half's strong brand reputation, cultivated over decades, is a key asset. This allows them to charge premium prices and attract top talent. In 2024, the company's brand value continued to support its market position. Maintaining this reputation through consistent service and ethical practices is vital. A powerful brand fosters customer loyalty and draws in new business.

- Robert Half's revenue in 2023 was $7.2 billion.

- The company's stock has shown steady growth, reflecting brand strength.

- Client satisfaction scores consistently remain high, around 85%.

- Employee retention rates are above the industry average due to brand appeal.

Cash Cows, like Robert Half's accounting and finance staffing, generate consistent profits. This stability is fueled by high market share and strong client relations. Key strategies include operational efficiency and brand maintenance. In 2024, Robert Half's gross margin was 39.6%.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue (USD Billions) | 7.2 | 6.8 |

| Gross Margin (%) | 39.8 | 39.6 |

| Client Retention Rate (%) | N/A | +5% |

Dogs

Legacy service offerings at Robert Half, like those that are outdated, might be considered "Dogs" in a BCG matrix. These services often demand resources without bringing in much money. For example, in 2024, Robert Half's revenue was $7.2 billion, so it's crucial to identify and possibly phase out underperforming services. This helps the company focus on more profitable areas.

Underperforming geographic locations within Robert Half's BCG Matrix are those consistently missing revenue goals. These locales often struggle due to strong competition or poor market conditions. For example, some regions may have seen a 10-15% revenue dip in 2024. Robert Half must evaluate and potentially restructure or withdraw from these areas.

Certain specialized staffing niches are seeing decreased demand, driven by tech advancements or industry changes. These areas may require staff retraining or a shift towards growing sectors. In 2024, sectors like administrative and customer support roles saw a 5% drop in demand. Robert Half must swiftly adapt to avert further financial setbacks.

Inefficient Internal Processes

Inefficient internal processes can significantly undermine a company's performance, making them a "Dog" in the BCG matrix. These processes, if outdated or overly complex, can lead to decreased productivity. This can impact the bottom line. Robert Half's financial performance is affected by operational inefficiencies.

- Operating expenses rose to $1.63 billion in 2024.

- Inefficiencies can lead to higher operational costs.

- Streamlining is crucial for cost reduction.

- Competitive advantage suffers with poor processes.

Lack of Innovation

Failure to innovate can turn Robert Half's offerings into "Dogs," especially if they don't adapt. This means not embracing new tech or ignoring emerging trends. Sticking with outdated models leads to decline. Innovation is key to staying competitive and avoiding stagnation. In 2024, Robert Half's revenue was $6.8 billion, indicating a need for strategic shifts in underperforming areas.

- Outdated service models failing to meet current market needs.

- Lack of investment in new technologies, impacting efficiency.

- Ignoring changes in the employment landscape.

- Inability to attract and retain top talent.

At Robert Half, Dogs are underperforming services or locations requiring more resources than revenue generated. These include outdated offerings, geographic areas with consistent revenue misses, and specialized niches with declining demand. In 2024, Robert Half's operating expenses were $1.63 billion, highlighting the need for eliminating inefficiencies.

| Category | Description | Impact |

|---|---|---|

| Outdated Services | Legacy offerings with little market demand. | Resource drain; reduced profitability. |

| Underperforming Locations | Regions consistently missing revenue goals. | Financial losses; requires restructuring. |

| Decreased Demand | Specialized niches with declining need. | Staffing issues; potential revenue drop. |

Question Marks

AI-related staffing is a "Question Mark" for Robert Half, indicating high growth potential but uncertain market share. To succeed, Robert Half must invest in developing expertise in AI and building a robust network of AI professionals. Strategic partnerships and training programs are key to navigating this emerging market. In 2024, the AI market is expected to reach $200 billion, indicating significant growth potential.

Cybersecurity staffing is a high-growth area. The demand for cybersecurity professionals is soaring due to rising cyber threats. Robert Half can capitalize by specializing in placing experts. This includes partnerships with training providers; the global cybersecurity market is projected to reach $345.4 billion in 2024.

Robert Half's remote work solutions, offering staffing, tech, and consulting, tap into a high-growth market. Leveraging their staffing and tech expertise, they can provide integrated solutions for businesses. This strategy demands investment in tech platforms and establishing remote work best practices. In 2024, remote work adoption increased, with 30% of US workers fully remote.

ESG (Environmental, Social, and Governance) Staffing

ESG staffing presents a growing opportunity for Robert Half. The rising importance of environmental, social, and governance factors fuels demand for specialized professionals. Robert Half can become a key player by focusing on placing ESG experts. This includes understanding ESG principles and building a strong network. The ESG market is projected to reach $33.9 trillion by the end of 2024.

- Demand for ESG professionals is increasing across various industries.

- Robert Half can differentiate itself by specializing in ESG placements.

- Building a strong network of ESG experts is crucial.

- The ESG market is experiencing significant growth.

Data Science and Analytics Staffing

The demand for data scientists and analytics staff is rising, driven by businesses using data for insights. Robert Half could boost its market share by focusing on specialized placements for data scientists. This strategy includes building connections with data science training programs and industry groups. In 2024, Robert Half's revenue was approximately $7.1 billion, showing its financial strength. Focusing on data science aligns with market trends and could increase profitability.

- Robert Half's 2024 revenue: ~$7.1B.

- Increasing demand for data professionals.

- Need for specialized placement services.

- Importance of industry partnerships.

Robert Half's question marks—AI, cybersecurity, remote work, ESG, and data science—represent high-growth markets with uncertain share. To succeed, Robert Half must strategically invest in expertise, partnerships, and network building. Success hinges on adapting to emerging trends. In 2024, these sectors offered significant growth opportunities, such as the cybersecurity market reaching $345.4 billion.

| Question Mark | Market Growth | Robert Half Strategy |

|---|---|---|

| AI Staffing | $200B in 2024 | Develop AI expertise, build network |

| Cybersecurity Staffing | $345.4B in 2024 | Specialize in placements, partner with providers |

| Remote Work Solutions | 30% US workers remote in 2024 | Leverage staffing and tech expertise |

| ESG Staffing | $33.9T market by 2024 end | Focus on ESG placements, network building |

| Data Science Staffing | Growing demand | Specialized placements, industry partnerships |

BCG Matrix Data Sources

The BCG Matrix uses financial reports, industry research, and market analysis to inform quadrant placements and growth strategy.