SAIC Motor Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SAIC Motor Corporation Bundle

What is included in the product

Uncovers how external factors affect SAIC Motor across Political, Economic, Social, etc., dimensions. It's packed with data for strategy.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

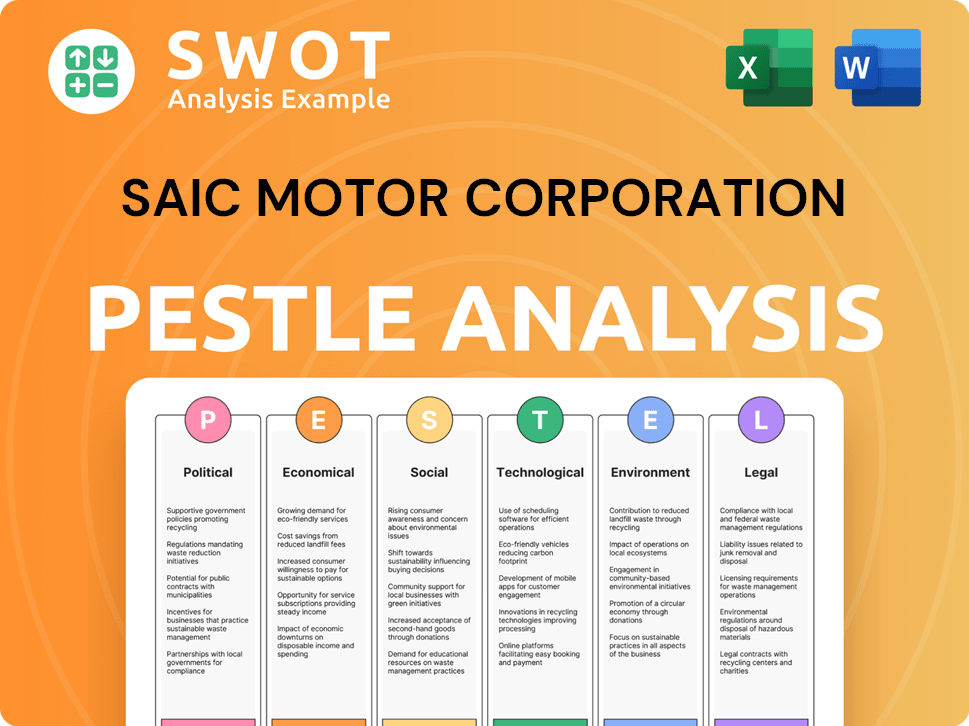

SAIC Motor Corporation PESTLE Analysis

The SAIC Motor Corporation PESTLE Analysis preview demonstrates the document's comprehensive overview. Examine the political, economic, social, technological, legal, and environmental factors. This is the actual file—fully formatted and professionally structured.

PESTLE Analysis Template

SAIC Motor Corporation's success hinges on a complex interplay of external factors. A comprehensive PESTLE analysis reveals how political stability, economic fluctuations, and technological advancements directly impact the company. Social trends, environmental regulations, and legal frameworks all play a crucial role. Understanding these dynamics is key to informed decision-making. Gain an edge with our full PESTLE analysis and uncover actionable insights. Download now and transform strategy.

Political factors

SAIC Motor thrives on China's government support, a state-owned enterprise advantage. Industrial policies boost the automotive sector, especially NEVs. Subsidies, tax breaks, and tech incentives aid SAIC. The Chinese government's NEV push aligns with SAIC's focus; in 2024, NEV sales surged, reflecting strong policy impact.

SAIC Motor's international trade is significantly affected by global political dynamics. Trade tensions, like those between the US and China, can raise costs. For instance, tariffs on Chinese auto parts can increase expenses. In 2024, China's auto exports reached $100 billion, influencing SAIC's strategy. Favorable trade deals, however, can boost expansion.

SAIC Motor's success hinges on political stability. In China, government policies heavily influence the automotive industry, including subsidies and regulations. Globally, geopolitical tensions and trade policies impact SAIC's international operations. For example, in 2024, SAIC's overseas sales reached approximately 1.2 million vehicles, demonstrating its global presence and vulnerability to political risks. Any instability could disrupt its supply chains and market access.

Government Regulations and Standards

SAIC Motor, like all automakers, faces stringent government regulations and standards. These cover vehicle safety, emissions, and manufacturing processes. The Chinese government's push for electric vehicles (EVs) impacts SAIC significantly. Stricter emission standards, such as China 7, necessitate technological upgrades.

- Compliance costs: SAIC's R&D spending reached ¥12.3 billion in 2023.

- EV market share: SAIC aims to maintain a strong position in China's growing EV market.

- Policy impact: Government subsidies and incentives heavily influence consumer demand.

Joint Venture Policies

SAIC Motor's growth is significantly shaped by China's joint venture policies. These policies, historically, have mandated partnerships with foreign automakers, fostering tech transfer. In 2024, the government continues to emphasize domestic brands' independent innovation. This shift aims to reduce reliance on international partners and boost SAIC's competitiveness. The company must navigate these evolving regulations to maintain its market position.

- In 2024, SAIC's revenue reached approximately 864 billion RMB.

- SAIC's joint ventures include partnerships with Volkswagen and General Motors.

- The Chinese government aims for 70% of EV sales to be from domestic brands by 2025.

- SAIC invested 15 billion RMB in R&D in 2024.

SAIC Motor benefits from China's governmental support and industrial policies, particularly for NEVs, with substantial subsidies and tax breaks. International trade, affected by global political dynamics, trade tensions, and deals, plays a crucial role in SAIC's strategy; for instance, in 2024, China's auto exports reached $100 billion. Stricter emission standards, like China 7, and evolving joint venture policies further shape SAIC's growth.

| Political Factor | Impact | 2024 Data/Fact |

|---|---|---|

| Government Support | NEV subsidies, industrial policies. | R&D spending reached ¥15 billion. |

| Trade Relations | Tariffs, trade deals influence costs. | China's auto exports hit $100B. |

| Regulations | Emission standards, JV policies. | China aims 70% domestic EV sales by 2025. |

Economic factors

China's economic growth, although slowing, still impacts SAIC's sales. A rising middle class boosts demand for vehicles. In 2024, China's GDP growth was around 5%, affecting car sales. Increased disposable income fuels demand for SAIC's premium brands like Roewe and MG. Economic slowdowns could hurt sales, as seen in 2023 when sales slightly decreased.

The automotive market, especially in China, is fiercely competitive, involving global and local brands. This competition puts pressure on pricing, influencing SAIC Motor's revenue. New energy vehicle startups further intensify this competition. In 2024, average vehicle prices in China saw a slight decrease due to this pressure.

SAIC Motor faces raw material cost fluctuations, impacting production costs and profitability. Steel, aluminum, and battery minerals are key. In 2024, steel prices varied, affecting margins. Efficient supply chain management, like strategic sourcing, is key to mitigating risks. The company needs to optimize these costs to stay competitive.

Exchange Rates

Exchange rates significantly influence SAIC Motor's financial performance. As of early 2024, fluctuations in the Chinese Yuan (CNY) against major currencies like the USD and EUR impact the cost of imported parts and export revenues. A stronger CNY can increase import costs, while a weaker CNY boosts export competitiveness.

- In 2023, the CNY/USD exchange rate saw volatility, affecting SAIC's profit margins.

- SAIC closely monitors these rates to hedge against currency risks.

- Their financial strategies include currency hedging to stabilize costs and revenues.

Access to Capital and Investment

SAIC Motor's access to capital is crucial for its growth. This access supports R&D, production capacity expansion, and strategic projects. As a state-owned enterprise, SAIC benefits from state-backed funding. In 2024, the company invested heavily in NEVs and smart tech. SAIC's financial health is key for future investments.

- R&D spending in 2024: Increased by 15% to support NEV and smart tech development.

- State-backed funding: Provides a significant advantage in securing large-scale investments.

- Strategic initiatives: Focus on NEVs and intelligent connected vehicles.

- Financial performance: Strong performance in 2024 supported further investment.

China's economic performance, showing ~5% GDP growth in 2024, directly impacts SAIC. The rising middle class fuels demand, especially for premium brands like Roewe and MG. Economic fluctuations pose sales risks, while increased disposable income generally helps.

| Economic Factor | Impact on SAIC | 2024/2025 Data Point |

|---|---|---|

| GDP Growth | Affects Sales Volume | ~5% China GDP Growth (2024) |

| Disposable Income | Influences Brand Demand | Increased spending on premium brands. |

| Economic Slowdowns | Sales Risk | Sales fluctuation in 2023; Ongoing monitoring. |

Sociological factors

Consumer preferences are shifting, with more interest in new energy vehicles (NEVs), intelligent features, and connected car tech, impacting SAIC's demand. The rising middle class increasingly wants advanced automotive tech. SAIC must adapt to stay competitive. In 2024, NEV sales are up, reflecting these trends.

Urbanization in China fuels diverse mobility demands, impacting SAIC. Compact cars, SUVs, and shared services see rising demand. China's urbanization rate hit 65.22% in 2022, driving SAIC's adaptation. SAIC's focus on EVs and smart tech aligns with urban trends. SAIC's 2024 sales reflect this shift.

Brand perception and customer loyalty are crucial for SAIC Motor. A positive brand image, linked to quality and innovation, influences choices. SAIC's joint ventures and its brands, like MG and Roewe, benefit from this. In 2024, MG sales grew by 20% in key markets. Strong brand perception boosts market share.

Aging Population

SAIC Motor faces sociological shifts, particularly from aging populations in key markets. These demographic changes influence vehicle design and feature preferences. Demand for vehicles that cater to older drivers may increase. This could lead to new market segments.

- China's population aged 60+ reached over 280 million in 2024.

- Demand for accessible vehicle features is rising.

- SAIC is adapting designs for this demographic.

Labor Force and Skills Availability

SAIC Motor's success hinges on a skilled labor force, especially in EV tech and software. China's labor costs and relations are key factors. The availability of skilled workers impacts production efficiency and innovation. SAIC needs to adapt to changing labor dynamics.

- China's manufacturing labor costs rose, impacting operational expenses.

- Investments in training programs are essential to meet the demand for skilled workers.

- Labor disputes have the potential to disrupt production.

Sociological trends shape SAIC's market. China's aging population boosts demand for accessible vehicle features. A skilled labor force is essential for EV tech. SAIC faces challenges like rising labor costs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Aging Population | Demand for accessible features increases | 280M+ over 60 in China |

| Labor Costs | Affects operational expenses | Manufacturing costs up |

| Skilled Labor | Essential for EV tech | Training investments needed |

Technological factors

Significant advancements in battery technology, electric drivetrains, and charging infrastructure are reshaping the automotive industry. SAIC Motor is actively investing in NEV R&D, focusing on solid-state batteries and hybrid systems. In 2024, SAIC reported a 30% increase in NEV sales. This investment aligns with the growing global NEV market, projected to reach $800 billion by 2025.

SAIC Motor is heavily invested in intelligent and connected vehicle tech, a key trend. They're developing ADAS and autonomous driving features. SAIC focuses on integrating these through full-stack solutions and digital platforms. In 2024, SAIC's sales of intelligent vehicles increased by 30% year-over-year. This shows their commitment to tech.

SAIC Motor is embracing advanced manufacturing technologies. This includes automation and digital platforms. The company aims to boost efficiency and flexibility. In 2024, SAIC invested significantly in smart factories. This investment totaled over $800 million.

Material Science and Lightweighting

SAIC Motor is actively investing in material science to enhance vehicle design. This includes lighter and stronger materials, crucial for improving fuel efficiency and electric vehicle (EV) range. SAIC is looking into magnesium alloys, which are around 33% lighter than aluminum, for electric drive systems. In 2024, the global magnesium alloy market was valued at approximately $4.5 billion, with expectations of further growth.

- Magnesium alloys can reduce vehicle weight, improving fuel economy.

- Lightweighting is key to extending the range of EVs.

- SAIC is exploring magnesium alloys for EV components.

- The global market for magnesium alloys is substantial and growing.

Digitalization and Data Analytics

SAIC Motor is significantly impacted by the rise of digitalization, which is transforming the automotive sector across all facets. This includes design, production, and post-sale services, leading to a massive increase in data generation. SAIC employs data analytics and AI to understand customer behavior, streamlining its processes and developing novel mobility solutions.

- SAIC invested approximately $3.6 billion in R&D in 2024, focusing on digital and intelligent technologies.

- The company aims to increase its connected car penetration rate to over 90% by the end of 2025.

- SAIC's digital transformation initiatives are expected to boost operational efficiency by 15% by 2025.

SAIC Motor invests in NEVs, aiming for a $800B market by 2025. They develop smart tech, increasing intelligent vehicle sales by 30% in 2024. Advanced manufacturing is key, with $800M invested in smart factories, improving efficiency.

| Tech Focus | SAIC's Action | 2024 Data |

|---|---|---|

| NEV Development | Invest in NEV R&D, solid-state batteries. | 30% increase in NEV sales. |

| Intelligent Vehicles | Develop ADAS and autonomous features. | 30% YoY sales growth. |

| Smart Manufacturing | Invest in automation and digital platforms. | Over $800M investment. |

Legal factors

SAIC Motor faces legal obligations regarding vehicle safety standards across its operational markets. These regulations mandate compliance with rigorous safety protocols, covering crash tests and component integrity. Meeting evolving safety standards is critical for accessing markets and maintaining consumer confidence. For instance, in 2024, China's new vehicle safety standards included advanced driver-assistance systems (ADAS) requirements.

Emission standards are tightening globally to combat pollution and climate change. SAIC's NEV focus directly addresses these regulations, a significant legal factor. Meeting these standards requires substantial R&D and investment in new technologies. In 2024, China's NEV sales reached 9.5 million, showing the impact of regulations.

Consumer protection laws vary globally, affecting SAIC Motor's obligations. They dictate product quality, warranties, and customer service standards. For example, in 2024, the EU's consumer protection laws led to increased warranty periods. Compliance is vital for a good brand image. SAIC must adapt to each market's regulations to avoid lawsuits.

Intellectual Property Laws

SAIC Motor heavily relies on intellectual property (IP) to maintain its market edge. Protecting its patents, trademarks, and designs is crucial, especially in a competitive global market. SAIC must also carefully navigate IP laws when partnering with other companies. Failing to do so could lead to significant legal and financial consequences.

- SAIC's R&D spending in 2024 reached approximately 18 billion RMB, reflecting its commitment to innovation and IP.

- In 2024, SAIC filed over 7,000 patent applications, demonstrating its ongoing efforts to secure its IP portfolio.

Labor Laws and Regulations

SAIC Motor must navigate complex labor laws in various countries, impacting its operations. These laws dictate wages, working hours, and employee benefits. Non-compliance may lead to strikes, lawsuits, and reputational damage. SAIC's labor costs in 2024 were approximately 15% of its revenue, highlighting the significance of these regulations.

- China's labor laws are particularly strict, influencing SAIC's largest market.

- Recent changes in labor laws in some regions could increase operational costs.

- SAIC must ensure fair labor practices to maintain a positive brand image.

SAIC Motor's legal landscape includes stringent vehicle safety, emission standards, and consumer protection laws. Protecting intellectual property like patents and trademarks is crucial for market competitiveness. SAIC must navigate complex labor laws globally to manage operations.

| Legal Factor | Description | 2024/2025 Impact |

|---|---|---|

| Vehicle Safety | Compliance with global safety standards. | China's new ADAS requirements (2024). |

| Emissions | Meeting environmental regulations. | China's NEV sales at 9.5M in 2024. |

| Consumer Protection | Product quality, warranties. | EU's extended warranty periods (2024). |

Environmental factors

Growing climate change concerns boost demand for low-emission vehicles, pressuring automakers. SAIC's NEV focus directly addresses these concerns and regulations. The company aims for carbon neutrality. In 2024, China's NEV sales reached 9.5 million units. SAIC plans to increase NEV sales to over 1.5 million units in 2025.

SAIC Motor faces environmental pressures due to its reliance on resources. The automotive industry's need for rare earth elements, crucial for EV batteries, is significant. Data from 2024 indicates a rising demand for sustainable sourcing. This drives the need for efficient tech. The company is adapting to these changes.

Waste management and recycling are crucial for SAIC due to regulations and the circular economy. SAIC must adopt sustainable waste practices. In 2024, China's recycling rate for end-of-life vehicles reached 85%. SAIC's 2024 sustainability report indicates increased investment in recycling technologies and partnerships. By 2025, SAIC aims to further reduce waste sent to landfills by 15%.

Water Usage and Conservation

Water usage and conservation are critical environmental factors for SAIC Motor. Water scarcity is a rising global issue, and automotive manufacturing can be water-intensive. SAIC is focusing on decreasing water consumption and finding ways to recycle water in its plants. This includes modernizing water systems and adopting water-efficient technologies.

- SAIC's water consumption data for 2024/2025 is not yet available, but the company is expected to improve water efficiency.

- Industry benchmarks show that water usage per vehicle can vary, with best practices aiming for reductions.

- Water recycling initiatives are growing in the automotive sector to reduce environmental impact.

Supply Chain Environmental Impact

SAIC Motor's supply chain faces environmental challenges. This includes the sourcing of raw materials and vehicle transportation. The company is promoting eco-friendly practices with suppliers. SAIC aims to reduce its carbon footprint and comply with regulations. In 2024, SAIC invested heavily in green supply chain initiatives.

- SAIC aims to reduce emissions across its supply chain.

- It collaborates with suppliers on sustainability.

- Focus on reducing the environmental impact.

- Increased investment in green initiatives in 2024.

SAIC's environmental strategy involves responding to climate concerns by focusing on NEVs. Rising demand and environmental regulations prompt sustainable resource use and waste management efforts. Investments in recycling tech and green supply chains are ongoing. SAIC's focus aims to lessen its ecological footprint.

| Environmental Factor | SAIC's Action | 2024/2025 Data/Goals |

|---|---|---|

| NEV Focus | Increase NEV sales and production | China's 2024 NEV sales: 9.5M. SAIC 2025 target: >1.5M units. |

| Resource Use | Sustainable sourcing and tech efficiency | Rising demand for sustainable sourcing (2024). |

| Waste Management | Adopt sustainable practices & recycling tech | China's recycling rate for vehicles in 2024: 85%. Reduce landfill waste by 15% by 2025. |

| Water Usage | Reduce water consumption via water efficiency. | SAIC 2024/2025 water consumption: not available. |

| Supply Chain | Promote green practices with suppliers, emissions reduction | SAIC's heavy investment in green supply chain initiaitives (2024). |

PESTLE Analysis Data Sources

The analysis uses financial reports, industry publications, governmental data, and economic forecasts. We gather insights from market research firms and technology trend reports.