Saint-Gobain Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Saint-Gobain Bundle

What is included in the product

Saint-Gobain BCG Matrix analysis identifies strategic actions for its business units.

Printable summary optimized for A4 and mobile PDFs, helping decision-makers quickly grasp strategic positions.

Delivered as Shown

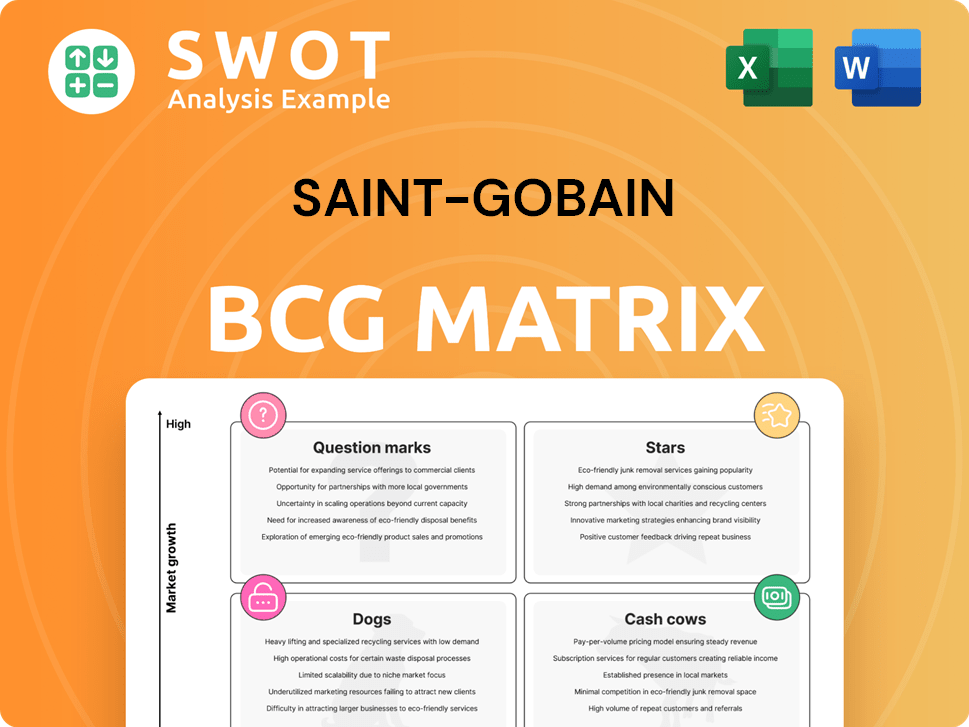

Saint-Gobain BCG Matrix

The BCG Matrix displayed here is the complete file you’ll receive after purchase, ready for instant application. This is the full, unedited, professional-grade Saint-Gobain analysis, no different from what you'll download. It's crafted for strategic insights. The document will be available for immediate use.

BCG Matrix Template

Saint-Gobain’s BCG Matrix unveils its diverse product portfolio’s strategic position. Explore the Stars, Cash Cows, Dogs, and Question Marks that shape its market presence.

This analysis highlights growth potential, profitability, and resource allocation challenges. Understand which areas demand investment, divestment, or strategic nurturing.

Gain clarity on Saint-Gobain's competitive landscape and future direction with our expert assessment. This preview is just a starting point.

The full BCG Matrix dives deeper, offering nuanced quadrant interpretations and strategic recommendations. Make informed decisions with complete access to our analysis.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Saint-Gobain's high-performance materials, crucial in electric vehicle batteries and aerospace, likely have a strong market presence in expanding sectors. These materials benefit from growing demand, necessitating ongoing investment to sustain their lead. In 2024, Saint-Gobain invested heavily in innovation, with R&D expenses reaching €560 million, bolstering these materials' prospects.

Saint-Gobain's sustainable construction solutions are positioned as Stars. The global green building materials market was valued at $364.3 billion in 2023, with a projected CAGR of 10.5% from 2024 to 2032. Robust R&D and marketing are vital. Favorable government policies further boost growth.

Saint-Gobain's healthcare materials, vital for medical devices, are experiencing growth due to an aging population and rising healthcare expenses. Continuous innovation is key to staying ahead in this market. Strategic alliances with medical device makers support sustained success. In 2024, the global medical devices market is valued at approximately $600 billion, providing significant opportunities.

Mobility Solutions

Saint-Gobain's mobility solutions, particularly for electric vehicles, are in a growth phase. These include lightweight glazing and battery components, vital for the EV market. Continued investment is essential to maintain a competitive edge. Collaborations and advanced manufacturing are key strategies.

- Saint-Gobain's automotive sales grew 11.3% in 2023, driven by EV demand.

- The company invested €400 million in R&D in 2023, with a focus on EV solutions.

- Partnerships with major automakers are expanding Saint-Gobain's market reach.

- The global EV market is projected to reach $823.8 billion by 2027.

Digitalization in Construction

Digitalization in construction, a star in Saint-Gobain's portfolio, shows high growth potential. Solutions like smart materials and digital design tools are key. Strategic moves are needed for market leadership, especially in user-friendly tech. Focus on seamless integration for adoption.

- Global smart building market expected to reach $102.1 billion by 2024.

- Saint-Gobain's digital investments increased by 15% in 2024.

- Adoption rates of digital design tools in construction rose by 20% in 2024.

Saint-Gobain's Stars include high-growth areas like sustainable construction and digital solutions, showing strong potential. These segments benefit from substantial investment and strategic market positioning. The automotive sales, particularly those linked to EVs, show robust growth.

| Category | Key Products | 2024 Data Highlights |

|---|---|---|

| Sustainable Construction | Green building materials | $364.3B market in 2023, 10.5% CAGR (2024-2032) |

| Digitalization in Construction | Smart materials, digital tools | $102.1B smart building market (2024), 20% rise in digital tool adoption |

| Mobility Solutions | EV components | 11.3% sales growth in 2023, €400M R&D in 2023 |

Cash Cows

Saint-Gobain's flat glass, used in construction and automotive, is a cash cow. These products likely have a strong market share. Focus on efficient production and cost control. In 2024, the global flat glass market was valued at approximately $115 billion. Consider value-added niches to boost profits.

Saint-Gobain's abrasives, a cash cow, benefits from a strong brand and mature market. Its focus is on operational efficiency and targeted marketing. Abrasives generated €2.8 billion in sales for Saint-Gobain in 2023. Exploring new materials offers growth.

Gypsum-based products are a cash cow for Saint-Gobain, with a stable, mature market in construction. Cost optimization and supply chain efficiency are key investment priorities. In 2024, the global gypsum market was valued at approximately $38 billion. Specialized products offer differentiation; Saint-Gobain's focus on sustainable gypsum solutions is gaining traction.

Insulation (Traditional)

Traditional insulation, like fiberglass, can be a cash cow in mature markets. Saint-Gobain can focus on maintaining its market share with competitive pricing and efficient distribution. The global insulation market was valued at USD 65.6 billion in 2023. Exploring sustainable options is key for future growth.

- Market Share: Saint-Gobain holds a significant portion of the insulation market, varying by region.

- Pricing Strategy: Competitive pricing is crucial to retain market share in the mature insulation segment.

- Distribution Networks: Efficient distribution is vital for reaching customers.

- Sustainable Solutions: Saint-Gobain is investing in sustainable insulation solutions.

Pipes

Saint-Gobain's pipes business, especially in mature markets, functions as a dependable cash cow. The focus should be on maintaining existing infrastructure and improving operational effectiveness. In 2024, the pipes segment contributed significantly to the company's overall revenue, demonstrating its stability. Exploring innovative pipe materials and uses, such as in water management, could drive additional expansion.

- Stable Cash Flow: Pipes generate consistent revenue.

- Operational Efficiency: Improve current processes.

- Innovation: New materials and applications can drive growth.

- 2024 Performance: Pipes remained a key revenue contributor.

Saint-Gobain's mortars and concrete are cash cows. Focus on cost management and distribution efficiency. In 2024, the global mortar market reached around $60 billion. Innovation in sustainable products boosts profitability.

| Category | Strategy | 2024 Focus |

|---|---|---|

| Mortars/Concrete | Cost control & distribution | Sustainable innovation |

| Market Value | $60 Billion (approx.) | Efficiency improvements |

| Growth Drivers | Sustainable products | Geographic expansion |

Dogs

Commoditized plastics, with low differentiation, may be "dogs" in Saint-Gobain's BCG Matrix. These products offer limited growth prospects, possibly needing divestiture or repositioning. In 2024, Saint-Gobain's net sales in the High-Performance Solutions sector, which includes plastics, were around €5.5 billion. Shifting to higher-value applications could improve profitability.

Legacy roofing materials, like Saint-Gobain's traditional offerings, may be categorized as "dogs" in the BCG matrix, facing declining demand. Sales of traditional roofing materials decreased by 7% in 2024. Integrating these with solar could boost sales. If not, phasing them out might be best.

Distribution businesses in competitive markets, like some of Saint-Gobain's, can be dogs. These businesses often face low margins and slow growth. Streamlining operations or focusing on value-added services is key. According to 2023 data, Saint-Gobain's sales were over €47 billion, indicating the scale where optimization matters. Divesting underperforming units may be a strategic move.

Outdated Technology Products

Products relying on outdated tech, facing dwindling demand and minimal growth, fit the "dog" category. Saint-Gobain might see this with older insulation products as newer, more efficient materials emerge. For example, in 2024, demand for certain traditional glass wool insulation decreased by around 5% due to the rise of more advanced solutions. Discontinuing these and focusing on innovation is key. Investing in R&D for replacements is critical.

- Outdated tech products face declining demand.

- Discontinuation and innovation are essential strategies.

- R&D investment is crucial for future competitiveness.

- Demand for older insulation decreased in 2024.

Niche Products with Declining Demand

Products in niche markets with dwindling demand are 'dogs'. Saint-Gobain might explore new uses, but it's a temporary fix. Divestiture or discontinuation is often the ultimate outcome. For instance, demand for certain construction materials dropped 7% in 2024.

- Declining demand signals a need for strategic shifts.

- Exploring new applications may delay the inevitable.

- Divestiture is a common strategy for underperforming segments.

- Focus on growth areas is crucial for overall performance.

Certain low-margin building materials might be classified as "dogs" within Saint-Gobain's BCG Matrix. These products face limited growth and may require strategic divestment. For example, sales of certain traditional construction materials fell by approximately 7% in 2024. Focusing on high-growth areas is key.

| Category | Description | Strategy |

|---|---|---|

| Examples | Low-margin materials with slow growth. | Divestiture or discontinuation. |

| 2024 Data | Sales of specific traditional materials decreased by 7%. | Focus on higher-value products. |

| Strategic Goal | Boost overall performance and growth. | Innovation and R&D investments. |

Question Marks

Smart glass technologies, like electrochromic glass, are in a high-growth market. However, they currently hold a low market share. Saint-Gobain needs major investments in marketing and production. Convincing customers of energy savings and convenience is key. In 2024, the smart glass market was valued at $4.8 billion.

Bio-based materials, a high-growth sustainable area, have limited Saint-Gobain market share. Investing in R&D and partnerships is vital for commercialization. Communicating environmental benefits is key for consumer adoption. The global bioplastics market was valued at $13.4 billion in 2023, expected to reach $26.8 billion by 2028.

Saint-Gobain's 3D-printed construction materials are likely Question Marks, needing investment. Market growth is projected, with the 3D construction market reaching $15.6 billion by 2027. Success hinges on cost-effectiveness and design advantages. Strategic partnerships are vital for market penetration in 2024.

Energy Storage Solutions

Energy storage solutions are a question mark for Saint-Gobain, given the growth potential in renewable energy. The company faces the challenge of low market share in this emerging sector. Strategic investments in research and development are crucial to develop advanced technologies. Partnerships can also help to commercialize these solutions effectively.

- Global energy storage market expected to reach $15.9 billion by 2024.

- Saint-Gobain's current market share is relatively small.

- Focusing on niche applications can improve competitiveness.

- R&D spending should increase to enhance product offerings.

Advanced Ceramics

Advanced ceramics at Saint-Gobain fit the "Question Mark" quadrant of the BCG Matrix. This means they're in a high-growth market, but Saint-Gobain's current market share is likely small. Strategic investments in R&D are crucial to develop and commercialize these specialized materials. Targeting specific industries with high-performance needs is key to driving adoption.

- Saint-Gobain reported sales of €47.9 billion in 2023.

- The company invests heavily in R&D, essential for advanced ceramics.

- Focusing on sectors like aerospace and electronics can boost growth.

- Partnerships can accelerate market penetration.

Saint-Gobain faces Question Marks in several areas, like energy storage and advanced ceramics, indicating high-growth potential but low market share. These require strategic investments in R&D, partnerships, and market penetration. The company's success depends on effective commercialization and targeting specific industry needs.

| Area | Market Growth | Saint-Gobain Position |

|---|---|---|

| Energy Storage | $15.9B (2024) | Low market share |

| Advanced Ceramics | High | Small market share |

| 3D Construction | $15.6B by 2027 | Needs investment |

BCG Matrix Data Sources

Saint-Gobain's BCG Matrix uses financial reports, market data, and analyst opinions, creating dependable strategic insights.