Salesforce Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Salesforce Bundle

What is included in the product

Tailored exclusively for Salesforce, analyzing its position within its competitive landscape.

Get actionable insights with a dynamic scoring system and color-coded visualizations.

What You See Is What You Get

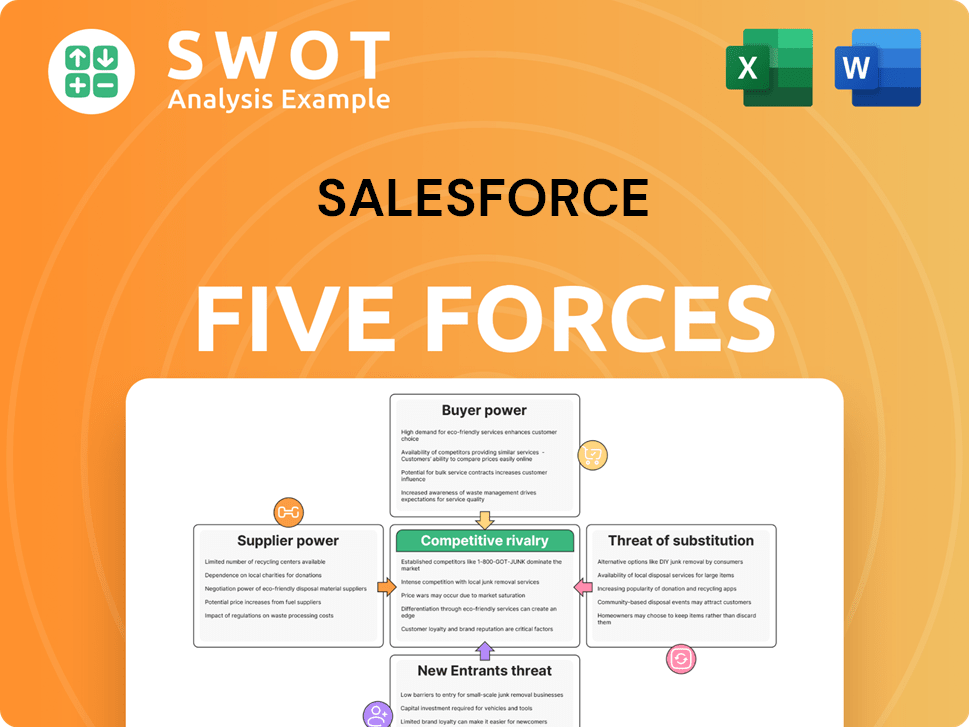

Salesforce Porter's Five Forces Analysis

This is the complete Salesforce Porter's Five Forces Analysis you'll receive. The preview you see reflects the final, fully formatted document—ready for immediate use. Analyze competitive forces like rivalry, new entrants, and suppliers. Understand Salesforce's market position and strategic challenges. Get insights to inform your decisions; all are in the preview.

Porter's Five Forces Analysis Template

Salesforce navigates a complex market shaped by powerful forces. Buyer power, fueled by diverse CRM options, keeps Salesforce competitive. Supplier leverage, particularly for tech resources, presents challenges. The threat of new entrants, though moderated by high barriers, is ever-present. Substitute products, like in-house solutions, pose a risk. Intense rivalry with competitors like Microsoft and Oracle further defines the landscape.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of Salesforce’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Salesforce's supplier power is moderate. The company heavily depends on third-party data centers and cloud infrastructure. In 2024, the global cloud infrastructure market was valued at approximately $250 billion. Price hikes or service issues from suppliers could affect Salesforce's financials. Diversification and contract negotiations are vital.

Salesforce heavily relies on skilled software developers and engineers for its innovation. The demand for these professionals is high, potentially increasing labor costs, a significant operational expense. In 2024, Salesforce's R&D spending was approximately $8.5 billion, reflecting its investment in talent. Employee training programs are crucial to retain talent and reduce reliance on expensive external hiring.

Salesforce's supplier power is moderate, influenced by its reliance on third-party integrations. In 2024, Salesforce's ecosystem included over 3,000 apps on AppExchange. Changes in pricing or support from these partners pose a risk. For Q3 2024, Salesforce's revenue was $8.72 billion, a 11% increase year-over-year. Maintaining strong partner relationships is crucial.

Supplier Power 4

Salesforce relies heavily on internet bandwidth to deliver its cloud services, making it vulnerable to supplier power. The cost and availability of bandwidth directly impact service quality and accessibility for Salesforce customers. In 2024, the average cost of bandwidth varied significantly, with prices ranging from $0.50 to $2.00 per Mbps depending on location and provider. This highlights the importance of managing supplier relationships.

- Bandwidth costs can fluctuate substantially, affecting Salesforce's operational expenses.

- Service disruptions from internet providers can directly impact Salesforce's service availability.

- Investing in redundant network infrastructure mitigates risks.

- Optimizing data transfer protocols is crucial for efficiency.

Supplier Power 5

Salesforce's supplier power is moderate due to its reliance on software vendors. These vendors supply tools for internal use and product development, influencing costs. Price hikes or altered licensing terms can impact Salesforce. Mitigating this involves exploring alternatives and in-house development.

- Software and IT services spending is projected to reach $1.08 trillion in 2024.

- Cloud computing spending globally is forecast to hit $679 billion in 2024.

- Salesforce spent $1.95 billion on research and development in 2023.

- The global SaaS market size was valued at $172.9 billion in 2023.

Salesforce faces moderate supplier power across different areas. Reliance on cloud infrastructure and bandwidth providers exposes it to cost fluctuations and service disruptions. In 2024, the cloud computing market saw significant growth, with global spending reaching approximately $679 billion. Strong supplier relationships are vital for Salesforce's operational stability.

| Supplier Category | Impact | Mitigation Strategies |

|---|---|---|

| Cloud Infrastructure | Cost fluctuations, service disruptions | Diversification, contract negotiation |

| Software Vendors | Cost increases, licensing changes | Explore alternatives, in-house dev. |

| Bandwidth Providers | Service availability, cost | Redundant infrastructure, optimization |

Customers Bargaining Power

Salesforce faces substantial buyer power from large enterprise clients, who negotiate favorable terms due to their contract size. These clients can successfully demand discounts and tailored service packages. In 2024, Salesforce's gross margin was approximately 76.2%, a key area impacted by pricing pressures from major accounts. Salesforce must carefully manage its pricing to retain these clients and maintain profitability.

The bargaining power of Salesforce's customers is significantly shaped by the availability of alternative CRM solutions. Competitors like Microsoft Dynamics 365 and HubSpot offer viable options, increasing customer leverage. For instance, in 2024, Microsoft's Dynamics 365 saw a revenue increase, indicating strong competition. To retain customers, Salesforce must continually innovate and differentiate its offerings.

Customers' ability to integrate Salesforce with other systems impacts their bargaining power. Complex or costly integrations make switching difficult. In 2024, Salesforce invested heavily in integration tools. This aims to boost customer retention. Simplify integrations to increase competitiveness.

Buyer Power 4

Customer bargaining power in the CRM market hinges on their knowledge. Customers with CRM expertise can negotiate better deals. Salesforce should prioritize customer education to boost loyalty. In 2024, CRM spending hit $69.5 billion, showing customer influence.

- Customer knowledge directly impacts negotiation strength.

- Educated customers can demand better pricing and terms.

- Salesforce invests in support to retain customers.

- CRM market growth reflects customer power.

Buyer Power 5

SMBs typically have less individual bargaining power. Their combined demand, though, is substantial, making them a key segment for Salesforce. In 2024, SMBs accounted for roughly 30% of Salesforce's revenue. Tailored solutions and pricing are thus crucial for attracting and keeping these clients. Salesforce offers various plans, including Essentials and Sales Cloud, to suit SMB needs.

- SMBs: Roughly 30% of Salesforce's 2024 revenue.

- Solutions: Essentials and Sales Cloud targeted at SMBs.

Salesforce's buyer power dynamics vary. Large clients gain leverage due to contract size, impacting margins. The market's competitive landscape, including Microsoft's growth in 2024, further shapes customer bargaining. Educated customers with CRM expertise drive better terms. SMBs are a significant segment with tailored needs.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Large Enterprise | Negotiate terms | Gross margin ~76.2% |

| Competition | Customer leverage | Microsoft Dynamics 365 growth |

| SMBs | Key revenue segment | ~30% of Salesforce's revenue |

Rivalry Among Competitors

The CRM market is fiercely competitive, featuring giants such as Microsoft Dynamics 365, Oracle, and SAP. This rivalry intensifies due to constant pressure on pricing and innovation. Salesforce must continuously differentiate its services. For example, in 2024, Salesforce's revenue reached $34.8 billion.

Competitive rivalry in the cloud-based business application market is intensifying. Competitors like Microsoft and Oracle are challenging Salesforce's market position. Salesforce must broaden its suite of applications and improve integration to stay competitive. In 2024, Salesforce's revenue reached $34.8 billion, reflecting the ongoing competition.

Competitive rivalry in the CRM market is intense, with emerging vendors targeting specific industries, pressuring Salesforce. Salesforce faces the challenge of meeting diverse customer needs. In 2024, Salesforce's revenue reached $34.8 billion, yet it must invest in industry-specific solutions. Acquisitions and partnerships are key strategies for expansion.

Competitive Rivalry 4

Competitive rivalry in the CRM market is intense, with Salesforce facing pressure from open-source alternatives. These solutions offer a lower-cost entry point. To maintain its market position, Salesforce must emphasize the value of its platform, focusing on features and support. This includes showcasing its innovation, like its AI capabilities. Salesforce's revenue in 2024 was approximately $34.5 billion.

- Open-source CRM solutions offer cost-effective alternatives.

- Salesforce's value proposition focuses on features and support.

- Salesforce's 2024 revenue was around $34.5 billion.

- Innovation is crucial for maintaining market share.

Competitive Rivalry 5

Aggressive marketing and sales tactics characterize the intense competitive rivalry in the CRM market. Competitors like Microsoft and Oracle constantly challenge Salesforce's market share, leading to promotional offers and targeted campaigns. Salesforce must maintain its strong brand presence and leverage effective marketing strategies to stay ahead. The cloud CRM market, valued at $69.4 billion in 2023, is expected to reach $145.7 billion by 2029, illustrating the stakes.

- Intense competition among major CRM vendors.

- Aggressive marketing and sales strategies.

- Pressure to maintain market share.

- Constant need for innovative marketing.

Competitive rivalry in the CRM market is intense, with key players like Microsoft and Oracle challenging Salesforce. Price wars and innovative offerings characterize the competition. Salesforce must continually evolve to maintain market share. The global CRM market was valued at $69.4 billion in 2023.

| Aspect | Description | Data |

|---|---|---|

| Key Competitors | Microsoft, Oracle, SAP | Significant market presence |

| Market Dynamics | Constant pressure on pricing and innovation. | Rapid technological advancements |

| Salesforce Revenue (2024) | Estimated | $34.8 billion |

SSubstitutes Threaten

Spreadsheet software like Microsoft Excel poses a threat as a basic substitute for CRM systems, especially for small businesses. These alternatives offer a low-cost way to manage customer data, even if they lack advanced CRM features. In 2024, the global CRM market was valued at approximately $65 billion, indicating the scale of the competition. Salesforce must highlight its platform's superior scalability and functionality to stay ahead.

Email marketing platforms, like Mailchimp, present a threat to Salesforce, offering similar features such as segmentation. These can substitute CRM systems for businesses prioritizing email marketing. In 2024, Mailchimp's revenue reached $800 million, highlighting the competition. Salesforce must integrate email marketing tools to stay competitive.

Help desk software poses a threat to Salesforce. These solutions are more specialized in customer service. Salesforce needs to enhance its features. In Q3 2024, the customer service software market grew by 15%, indicating strong demand. Salesforce's focus should be on integration.

Threat of Substitution 4

The threat of substitutes for Salesforce arises from project management software increasingly managing customer interactions. These tools, though not CRM-focused, serve as viable alternatives, especially for project-based customer relationships. Salesforce must enhance its CRM platform by integrating project management functionalities to maintain its competitive edge. This strategic move will help retain customers and attract new ones.

- 2024: The global project management software market is valued at approximately $7 billion.

- 2024: CRM software market is valued at $120 billion.

- 2024: Salesforce holds about 24% of the CRM market share.

Threat of Substitution 5

The threat of substitutes for Salesforce, like manual processes, is real, especially for businesses with basic needs. Paper-based systems or spreadsheets can serve as a substitute, though they are less efficient. In 2024, many small businesses still rely on these methods due to cost concerns and simplicity. Salesforce counters this by emphasizing its platform's efficiency and cost-effectiveness.

- Manual systems are a low-cost alternative, but inefficient.

- Salesforce must highlight its value proposition to overcome this threat.

- Cost savings and efficiency are key selling points.

- Many small businesses still use manual or basic systems.

Substitutes like project management tools and manual systems present challenges to Salesforce. These alternatives, though less comprehensive, can meet basic customer relationship needs, especially for cost-conscious businesses. In 2024, the CRM software market was valued at $120 billion. Salesforce must highlight its platform's superior features to counter these threats and maintain its market share, which stood at approximately 24% in 2024.

| Substitute | Description | Impact on Salesforce |

|---|---|---|

| Spreadsheet Software | Basic customer data management | Lowers cost, less features. |

| Email Marketing Platforms | Segmentation and automated emails | Direct feature competition. |

| Manual Processes | Paper-based or basic systems | Cost-effective, but less efficient. |

Entrants Threaten

The threat of new entrants is moderate due to high barriers. New cloud services need substantial investment in infrastructure. Salesforce's existing scale gives it a cost advantage. In 2024, Salesforce's revenue was $34.5 billion, showing its strong market position.

Salesforce's strong brand recognition and customer loyalty significantly deter new entrants. Switching costs are high, as customers are reluctant to move away from established CRM providers. Salesforce's brand and reputation provide a substantial competitive advantage. In 2024, Salesforce held a significant market share, with 23.8% in the CRM market, showing its stronghold.

Salesforce benefits from proprietary tech and IP, shielding its market position. Innovation and patents create entry barriers, but require sustained R&D investment. In 2024, Salesforce's R&D spending was approximately $8 billion. This strategy helps fend off new competitors in the CRM space.

Threat of New Entrants 4

The CRM market faces a moderate threat from new entrants due to significant barriers. Extensive regulatory compliance, including data privacy laws like GDPR and CCPA, adds costs and complexity. Salesforce's established infrastructure and experience in navigating these regulations give it an edge. New entrants must invest heavily in compliance, increasing the financial burden and time to market. This advantage limits new competitors.

- Regulatory compliance costs can reach millions.

- Salesforce's revenue in 2024 was approximately $34.5 billion.

- Market entry requires substantial investment in security and data protection.

- Compliance costs can impact smaller companies more severely.

Threat of New Entrants 5

The threat of new entrants in the CRM market is moderate for Salesforce. Established sales and marketing channels give them an edge, as building a strong sales team takes significant time and money. Salesforce's vast network of partners and sales reps further protects its market position. This extensive infrastructure makes it harder for new competitors to gain a foothold.

- Salesforce reported $34.5 billion in revenue for fiscal year 2024.

- Salesforce has over 35% market share in the CRM market.

- Building a sales team can cost millions.

- Salesforce has over 150,000 customers.

The threat of new entrants to Salesforce is moderate, primarily due to high barriers. These include significant investment needs and extensive regulatory compliance. Despite the challenges, Salesforce’s 2024 revenue of $34.5 billion shows its strong market position.

| Barrier | Impact | Salesforce Advantage |

|---|---|---|

| High Initial Investment | Infrastructure, tech, sales | Established scale and resources |

| Regulatory Compliance | GDPR, CCPA, costs | Experience and existing framework |

| Sales and Marketing Channels | Building a sales team, brand | Extensive network and brand recognition |

Porter's Five Forces Analysis Data Sources

This analysis leverages financial statements, market share data, and industry reports for a robust assessment.