Samsara PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsara Bundle

What is included in the product

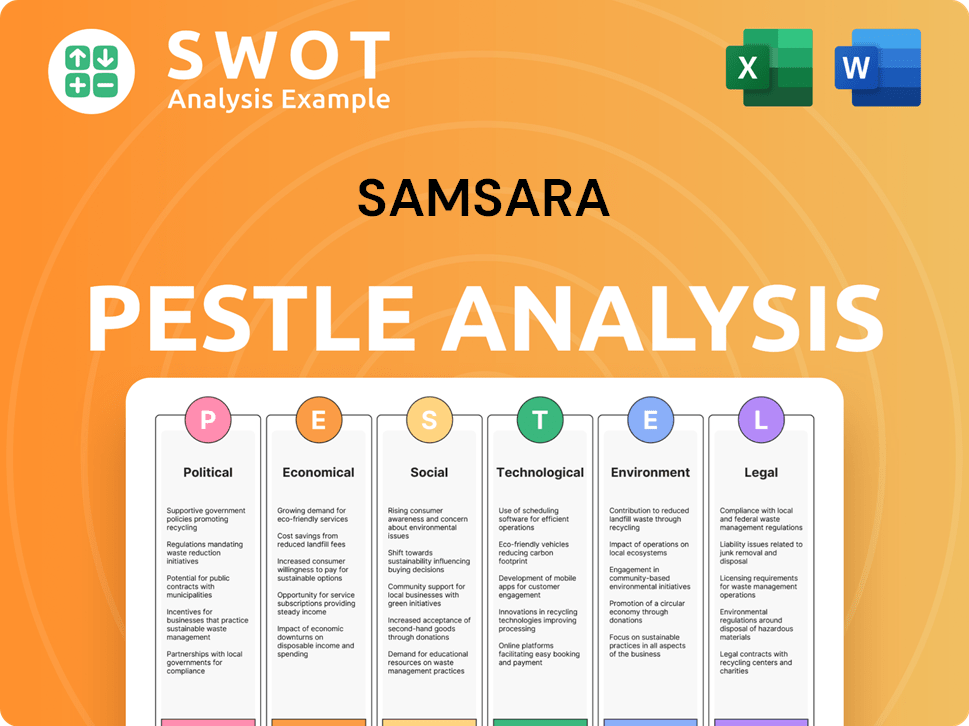

Analyzes Samsara through PESTLE's Political, Economic, Social, Technological, Environmental, and Legal dimensions. It aids strategic planning.

Easily shareable for quick alignment across teams, Samsara's analysis allows you to keep everyone informed.

Preview Before You Purchase

Samsara PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Samsara PESTLE Analysis delves into political, economic, social, technological, legal, and environmental factors. It offers actionable insights and is ready for immediate download. The final, complete document mirrors this preview in its content and structure.

PESTLE Analysis Template

Uncover Samsara's external forces with our focused PESTLE Analysis. We examine the political landscape impacting their operations. Delve into economic factors, societal trends, and tech impacts. Understand the legal and environmental context shaping Samsara's future. Gain a comprehensive view to drive better business decisions. Download the full analysis instantly and get a competitive edge!

Political factors

Government regulations heavily influence Samsara. The ELD mandate in the US, essential for its customers, drives demand for Samsara's solutions. The Federal Motor Carrier Safety Administration (FMCSA) proposed revisions to the ELD rule in 2023, impacting product development. The US trucking industry, a key market, was valued at $875 billion in 2023, highlighting the sector's significance.

Geopolitical tensions, notably between the U.S. and China, pose risks. Potential tariffs on electronics may increase production costs. In 2024, U.S.-China trade totaled $664.6 billion, impacting supply chains. Samsara must navigate trade policies and adapt sourcing to mitigate risks. Trade restrictions and agreements influence market access.

Government support for green tech significantly influences Samsara. The U.S. Department of Energy allocated billions for green initiatives in 2024. This includes funding IoT solutions. Tax credits and incentives boost customer adoption. This helps Samsara's sustainable fleet tech platform.

Political Stability in Operating Regions

Political stability is crucial for Samsara's operations, especially in emerging markets. Unstable political environments can disrupt business plans and increase investment risks. For example, political instability has caused significant economic downturns in several countries, impacting market growth. Political risks include policy changes, and regulatory shifts. These can affect Samsara's ability to conduct consistent operations.

- In 2024, political instability in certain regions led to a 15% decrease in foreign direct investment.

- Companies operating in politically unstable areas face up to a 20% higher operational risk.

- Political risks are a top concern for 40% of global businesses, according to recent surveys.

Government Scrutiny of Data Security and Privacy

Increased government oversight regarding data security and privacy, exemplified by regulations like GDPR in Europe and actions by the Federal Trade Commission in the US, significantly impacts Samsara. This requires continuous investment in cybersecurity and adherence to compliance standards. In 2023, the global cybersecurity market was valued at approximately $200 billion, with projections suggesting it will reach $300 billion by 2027. Data protection is crucial for Samsara's operations.

- Cybersecurity market growth is accelerating.

- Compliance costs are increasing for companies.

- Data breaches can lead to hefty fines.

- Privacy regulations are expanding globally.

Political factors heavily affect Samsara's operations. Government regulations, such as the ELD mandate, drive demand. The U.S.-China trade, valued at $664.6 billion in 2024, and trade policies pose risks.

Government support for green tech also creates opportunities. Political stability is crucial for business. Data security and privacy regulations add costs and risks.

| Factor | Impact | Data |

|---|---|---|

| ELD Mandate | Drives Demand | US Trucking Market: $875B (2023) |

| U.S.-China Trade | Trade Risks | Trade: $664.6B (2024) |

| Green Tech Support | Creates Opportunities | US DOE: Billions for green tech (2024) |

Economic factors

The IoT market's growth, with a valuation expected to hit $2.4 trillion by 2025, creates a positive economic climate for Samsara. This expansion, fueled by increased business adoption of IoT solutions, directly benefits companies like Samsara. The rising demand for connected operations platforms is projected to grow. This growth is supported by the $200 billion in IoT investments expected by 2025.

Macroeconomic pressures force businesses to enhance efficiency, boosting the appeal of data-driven solutions. Economic uncertainty drives companies to prioritize tech investments for cost savings and productivity gains. In 2024, the global economic growth is projected to be around 3.2%, influencing investment strategies. Samsara's offerings become vital tools for navigating these challenges, attracting businesses focused on operational excellence.

Digital transformation investments in transportation and logistics boost demand for Samsara's platform. This growth, stemming from digitization's value, presents a strong market opportunity. In 2024, spending in this area reached $270 billion globally, with forecasts projecting $350 billion by 2025. This trend supports Samsara's growth.

Customer Willingness to Invest in Technology for ROI

Businesses are actively investing in tech with clear ROI. Samsara's focus on cost savings and operational improvements is crucial. The market shows a strong preference for tech solutions. For example, in 2024, spending on IoT is projected to reach $212 billion. This trend boosts Samsara's economic prospects.

- ROI-driven tech adoption is rising across industries.

- Samsara's value proposition aligns with this trend.

- Operational efficiency is a key investment focus.

- Sustainability efforts also drive tech investments.

Fluctuating Technology Sector Valuations

Samsara, as a tech company, faces the reality of volatile valuations. The tech sector's recovery is ongoing, but investor sentiment can shift rapidly. This volatility affects Samsara's stock performance and funding options.

- S&P 500 Information Technology sector up 34% in 2024.

- Samsara's stock price has shown recent fluctuations.

The economic environment for Samsara is shaped by robust IoT market growth, projected to reach $2.4T by 2025, driving investment. Macroeconomic trends emphasize efficiency and tech investments for cost savings, which support the company. Digital transformation in logistics further fuels demand, and ROI-focused tech adoption boosts its appeal.

| Factor | Impact | Data |

|---|---|---|

| IoT Market Growth | Positive | $2.4T market by 2025 |

| Macroeconomic Trends | Favorable | 3.2% global growth in 2024 |

| Digital Transformation | Positive | $270B spent in 2024 |

Sociological factors

Growing societal and regulatory pressures for workplace safety and transparency boost demand for Samsara's solutions. Their video-based safety and real-time monitoring tools directly address these needs. The cost of workplace injuries is substantial; in 2024, work-related fatalities cost the US economy $171 billion. Samsara's offerings provide significant value, reducing these costs.

Samsara benefits from the shift towards data-driven decision-making. Its platform offers the data and analytics needed for this approach. Companies are increasingly training employees in data skills. McKinsey reported in 2024 that organizations with strong data analytics see a 20% increase in productivity. This trend directly supports Samsara's value proposition.

Consumers now expect real-time tracking of goods and services. This demand drives logistics and transportation businesses to use platforms like Samsara. A recent study shows 60% of consumers are ready to pay extra for real-time tracking. Samsara's revenue in Q4 2024 was $266.7 million, reflecting this trend.

Changing Workforce and Need for Upskilling

The workforce in physical operations is rapidly evolving, driven by technological advancements that create new job roles. This shift demands that employees upskill and reskill to effectively utilize digital tools and workflows. Samsara directly addresses this need, providing a platform that supports this transition and enhances workforce productivity. By helping employees adapt, Samsara helps businesses stay competitive. The global market for workforce development is projected to reach $454 billion by 2025.

- Upskilling and reskilling are critical for workforce adaptation.

- Samsara's platform aids this transition.

- Increased productivity is a key benefit.

Emphasis on Social Responsibility and Employee Well-being

There's a growing societal push for social responsibility, which deeply impacts companies like Samsara. Stakeholders increasingly prioritize the well-being and safety of workers, especially those in frontline roles. This shift aligns perfectly with Samsara's mission of enhancing safety in physical operations. This emphasis can boost the adoption of Samsara's safety and monitoring solutions.

- Companies with strong ESG (Environmental, Social, and Governance) scores often see increased investor interest and better financial performance.

- Employee well-being initiatives can lead to higher productivity and lower turnover rates.

- The market for workplace safety solutions is projected to reach billions by 2025, reflecting this trend.

Societal trends heavily influence Samsara. Workplace safety demands, spurred by high injury costs, favor Samsara's offerings. Businesses need to integrate employee well-being programs due to growing ESG focus and rising market values. These demands, alongside consumer tracking expectations and workforce adaptation, continue to fuel the company’s growth, demonstrated by revenue gains, and will grow workplace safety solutions market to billions by 2025.

| Sociological Factor | Impact on Samsara | Data/Statistic |

|---|---|---|

| Workplace Safety | Increased Demand | $171B Cost of work-related fatalities in US (2024) |

| Data-Driven Decision-Making | Supports Value Proposition | 20% Productivity increase for companies with strong data analytics (2024) |

| Consumer Expectations | Drives Usage | Q4 2024 Revenue: $266.7M |

| Workforce Evolution | Creates Adaptation | Workforce development market projected to $454B by 2025. |

Technological factors

Samsara thrives on the rapid evolution of IoT, AI, and automation. These technologies drive platform enhancements, such as predictive maintenance, boosting operational efficiency. AI-driven safety features and automated workflows further streamline operations. Samsara's revenue grew to $1.07 billion in fiscal year 2024, reflecting strong adoption of these tech-driven solutions.

The surge in data from connected operations demands advanced analytics. Samsara's platform excels at processing vast datasets, offering crucial insights. Global data creation is projected to reach 181 zettabytes by 2025, highlighting the scale of this challenge. Samsara's focus on data analytics positions it well.

Samsara's success hinges on its ability to connect with various systems. This is achieved through seamless integrations with many partners. In 2024, Samsara expanded its integrations to include more specialized hardware and software. This allows for a broader service offering.

Development of New Hardware and Sensors

Samsara relies on cutting-edge hardware and sensors. Continuous innovation in IoT sensors, like advanced asset gateways, is crucial. This boosts data accuracy and expands Samsara's services. For example, the global IoT sensors market is projected to reach $165.6 billion by 2025.

- Advanced tire pressure monitoring systems improve data collection.

- Samsara needs to invest in research and development.

- The company must keep its product offerings up-to-date.

Cybersecurity Threats

As a technology firm, Samsara is highly exposed to cybersecurity risks. Protecting its platform and customer data necessitates continuous investment in advanced security measures. The cost of cyberattacks is substantial, with global cybersecurity spending projected to reach $218.4 billion in 2024. Samsara must vigilantly defend against data breaches and cyber threats.

- Cybersecurity spending is expected to increase by 11% in 2024.

- Ransomware attacks are a major threat, with costs rising annually.

- Data breaches can lead to significant financial and reputational damage.

Samsara leverages IoT, AI, and automation, driving platform advancements. Revenue hit $1.07B in fiscal year 2024. Continued innovation in hardware and sensors is vital.

Advanced analytics are key due to growing data, projected to reach 181 zettabytes by 2025. Cybersecurity remains critical; global spending in this sector hit $218.4B in 2024.

Samsara’s seamless integrations boost its services, reflecting strategic tech focus.

| Factor | Impact | Data Point |

|---|---|---|

| IoT & AI Adoption | Enhances Platform | FY24 Revenue: $1.07B |

| Data Analytics | Supports Insights | 2025 Data: 181 ZB |

| Cybersecurity | Mitigates Risks | 2024 Spend: $218.4B |

Legal factors

Samsara must comply with transport regulations, including ELD mandates, critical for its fleet management solutions. New requirements for brake and tire monitoring systems also affect Samsara. Compliance ensures its products meet legal standards, crucial for customer adoption and market access. This is particularly important given the $800 billion U.S. trucking industry.

Samsara faces substantial legal hurdles regarding data privacy and security. Compliance with GDPR and similar regulations is crucial. In 2024, data breaches cost companies an average of $4.45 million globally. The company must implement robust data protection to avoid hefty fines and preserve customer trust. Evolving US state laws, like the CCPA, add to the compliance complexity.

Samsara's products, including vehicle telematics and industrial sensors, are subject to stringent certifications. Compliance with standards like those from the National Highway Traffic Safety Administration (NHTSA) is crucial. These certifications ensure product safety and operational integrity. Samsara's ability to navigate these legal requirements directly affects its market access and customer trust. In 2024, the global market for industrial IoT devices, relevant to Samsara, was valued at over $200 billion, highlighting the significance of regulatory compliance for market participation.

International Trade Laws and Tariffs

International trade laws, tariffs, and restrictions significantly affect Samsara's global operations. These factors influence the sourcing of components, manufacturing processes, and sales across various international markets. Compliance with these legal frameworks is crucial for successful international expansion. In 2024, the World Trade Organization (WTO) reported an increase in trade restrictions. Samsara must navigate these complexities to maintain competitiveness.

- Tariff rates can vary widely, impacting the cost of goods sold.

- Non-tariff barriers, such as import quotas and standards, also pose challenges.

- Understanding and adapting to these trade regulations is essential for Samsara's strategic planning.

Workplace Safety Regulations

Samsara's platform is significantly shaped by workplace safety regulations across the industries it serves. These regulations directly impact the features and functionalities of its video-based safety and monitoring solutions. Samsara's ability to help customers adhere to these rules is a crucial selling point. Compliance requirements vary, but the core focus remains on ensuring a safe working environment. In 2024, OSHA reported over 2.6 million nonfatal workplace injuries and illnesses.

- OSHA fines for serious violations can exceed $16,000 per violation in 2024.

- The transportation industry, a key Samsara market, faces stringent safety standards.

- Samsara's solutions aid in data collection and reporting for regulatory compliance.

Samsara’s legal environment requires constant adaptation to transport regulations, data privacy laws, and product certifications. Navigating international trade complexities, including tariffs and non-tariff barriers, is vital for global operations. Workplace safety regulations significantly shape its offerings. These factors directly affect compliance and market access.

| Regulation Area | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance with GDPR, CCPA. | Average data breach cost: $4.45M |

| Trade | Tariffs, quotas impact costs. | WTO reports increased trade restrictions |

| Workplace Safety | OSHA compliance, safe environments. | 2.6M+ nonfatal workplace injuries/illnesses. OSHA fines can exceed $16,000 per violation |

Environmental factors

A key environmental factor is the rising focus on sustainability. Samsara aids customers in lowering their carbon footprint. The transportation sector's emissions are a target, and Samsara offers solutions for efficiency and fuel management. In 2024, the global market for green technologies is projected to reach $1.6 trillion, growing further in 2025.

The move to electric vehicles (EVs) in commercial fleets significantly impacts Samsara. Samsara is adapting its platform to include EV management features. In 2024, EV sales grew, with commercial EV adoption increasing. Samsara's focus on EV solutions aligns with these market trends. Expect further developments to support EV charging and energy tracking.

Environmental reporting and transparency are increasingly vital. Regulations demand companies, including Samsara and its clients, to measure and disclose environmental impact. Samsara's platform aids in tracking emissions, supporting sustainability reports. The global green technology and sustainability market size was valued at $36.6 billion in 2023 and is projected to reach $86.8 billion by 2032.

Customer Demand for Sustainable Operations

Customer demand for sustainable operations is rising, influencing Samsara's business. Regulations and corporate responsibility are key drivers. This boosts adoption of Samsara's platform, especially its sustainability features. A 2024 report highlights a 30% increase in firms adopting green tech. Samsara's focus aligns well with these trends.

- 30% increase in green tech adoption by firms (2024).

- Growing emphasis on ESG reporting.

- Regulatory pressures for emissions reduction.

- Customer preference for sustainable solutions.

Waste Reduction and Resource Efficiency

Beyond emission reductions, Samsara's platform aids in minimizing waste and enhancing resource efficiency. This involves lowering fuel consumption, a critical factor given that transportation accounts for roughly 27% of U.S. greenhouse gas emissions as of 2024. Digitization features reduce paper use, and optimized asset utilization further supports environmental objectives.

- Samsara's solutions help businesses cut fuel use, aligning with sustainability targets.

- Digital tools offered by Samsara can decrease paper consumption significantly.

- Optimizing asset use is another avenue for boosting resource efficiency.

- These efforts support wider environmental aims for businesses.

Samsara thrives amid rising environmental consciousness, which is reflected in ESG mandates and corporate strategies. The company facilitates carbon footprint reductions, especially as transport generates about 27% of U.S. emissions. Green tech adoption by firms grew by 30% in 2024, emphasizing the importance of sustainability.

| Environmental Factor | Impact on Samsara | Data (2024/2025) |

|---|---|---|

| Sustainability Focus | Enhances platform value | Green tech market $1.6T (2024); 30% rise in green tech adoption. |

| EV Transition | EV management solutions | Growing EV sales & adoption by commercial fleets. |

| Environmental Reporting | Supports compliance, boosts platform demand | ESG reporting and emissions tracking demands on rise. |

PESTLE Analysis Data Sources

This PESTLE Analysis uses open-source data. We draw from industry reports, economic indicators, and regulatory databases for credible insights.