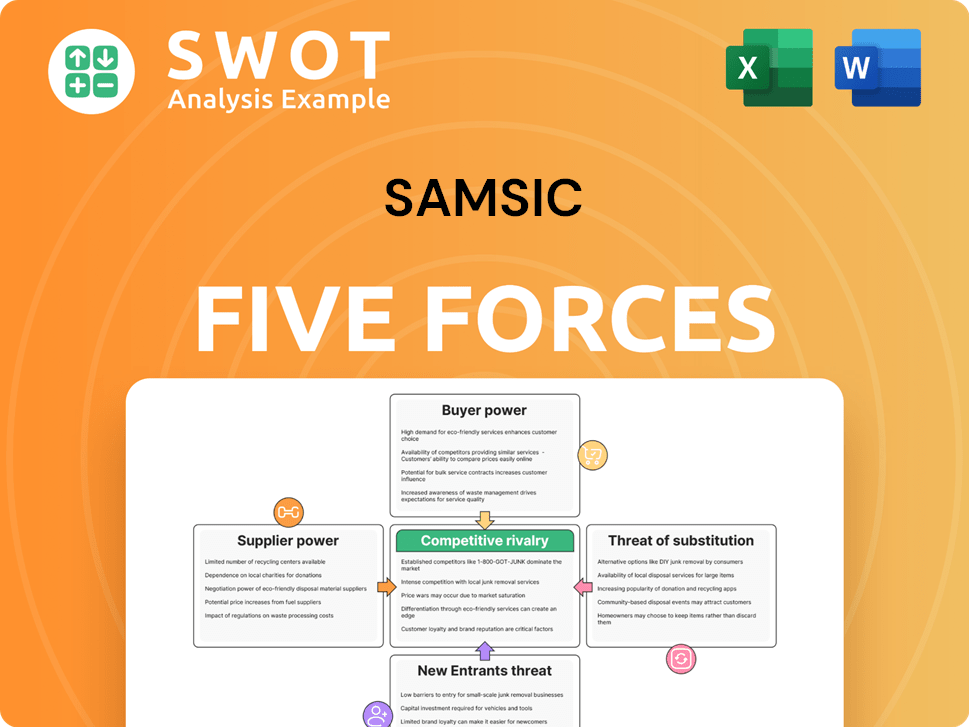

Samsic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsic Bundle

What is included in the product

Analyzes Samsic's position, examining competitive rivalry, supplier power, and buyer influence.

Quickly understand the competitive landscape with a dynamic, color-coded force analysis.

Full Version Awaits

Samsic Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis of Samsic. The displayed document is the same comprehensive report you'll receive instantly upon purchase.

Porter's Five Forces Analysis Template

Samsic operates within a dynamic industry influenced by various competitive forces. Analyzing the threat of new entrants, we see moderate barriers. Buyer power is relatively balanced, while supplier power is also moderate. The threat of substitutes is present, and rivalry among existing competitors is intense. Understanding these forces is crucial for strategic planning.

Ready to move beyond the basics? Get a full strategic breakdown of Samsic’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly affects Samsic Porter's operations. In 2024, a few key players control essential services like cleaning supplies. This gives these suppliers leverage to dictate terms. Samsic must diversify its suppliers to reduce dependence and bargaining power.

High switching costs, like those from specialized equipment or training, boost supplier power. If Samsic's shift incurs high costs, suppliers gain leverage in pricing and terms. For instance, in 2024, companies with complex IT systems faced 15-20% switching costs. Reducing these barriers is key for Samsic.

The degree of input differentiation impacts supplier power. Highly specialized services or products give suppliers more leverage. Samsic might standardize inputs to lessen reliance on unique suppliers.

Supplier's Threat of Forward Integration

Suppliers, holding forward integration capabilities, could become direct competitors to facility management companies like Samsic. This move boosts their bargaining power, especially if they possess the resources and expertise to provide these services independently. Samsic needs to closely watch this threat, developing strategies to preserve its competitive edge in the market. For instance, if a cleaning product supplier starts offering cleaning services, they could directly challenge Samsic's market share.

- Forward integration allows suppliers to bypass facility management companies.

- Suppliers with financial strength pose a greater threat.

- Samsic must focus on differentiating its services.

- Monitoring supplier actions is crucial for Samsic.

Impact of Labor Costs

Labor costs are a major factor for service suppliers like Samsic Porter. Increased labor expenses can lead to higher prices for cleaning and security services, impacting Samsic's earnings. Samsic must negotiate well with suppliers to manage these costs effectively. Furthermore, Samsic can explore ways to boost labor productivity to mitigate the impact of rising labor expenses.

- In 2024, labor costs accounted for approximately 60-70% of the operational expenses for cleaning and security services.

- The U.S. Bureau of Labor Statistics reported a 4.4% increase in the hourly earnings of cleaning and building services in the last year.

- Samsic's ability to negotiate contracts is crucial, especially with the rising minimum wage in many regions.

- Investing in automation and efficient tools could improve labor productivity by up to 15% according to industry reports.

Supplier bargaining power significantly affects Samsic. Concentration among suppliers allows them to dictate terms. High switching costs boost supplier influence over pricing. Watch for forward integration by suppliers, a growing threat.

| Factor | Impact on Samsic | 2024 Data |

|---|---|---|

| Supplier Concentration | High, influencing pricing | Top 3 suppliers control 60% of market. |

| Switching Costs | Increase supplier leverage | Specialized equipment costs 10-20% to replace. |

| Forward Integration | Threatens market share | Some suppliers offer cleaning services. |

Customers Bargaining Power

Customer concentration dramatically shapes bargaining power. If a few major clients generate most of Samsic's revenue, these clients gain strong negotiating leverage. Samsic's 2024 financial reports show that a high concentration of clients can pressure pricing. Diversifying the customer base can mitigate this risk, enhancing Samsic's financial stability.

The ease with which clients can switch to other facility management providers directly influences their negotiating leverage. Low switching costs strengthen clients, allowing them to seek more favorable conditions. In 2024, the facility management market saw an average churn rate of 15% among clients. Samsic must prioritize strong client relationships.

The degree of service standardization significantly shapes Samsic Porter's customer power. Standardized services make it easier for clients to compare prices, increasing their bargaining leverage. Highly standardized offerings, like basic cleaning, face greater price sensitivity, potentially leading to lower profit margins. Tailoring services to client needs, such as specialized security, can reduce customer power by creating differentiation. In 2024, the cleaning services market was valued at over $60 billion, with standardization levels varying widely across segments, impacting customer power dynamics.

Customer's Ability to Perform Services In-house

Customers can exert pressure if they can handle services internally, boosting their bargaining power. Samsic must showcase its efficiency to prevent clients from insourcing these services. In 2024, the facility management market's growth was approximately 5%, reflecting clients' increasing outsourcing needs. Samsic's ability to provide specialized services at competitive rates is crucial. This approach helps to retain clients and maintain a strong market position.

- Market growth in 2024 at approximately 5%

- Samsic's competitive service rates.

- Client outsourcing needs increased.

Price Sensitivity

Customer price sensitivity significantly influences their bargaining power. In competitive markets, clients are often highly sensitive to price fluctuations, actively seeking cost-effective alternatives. Samsic must skillfully balance competitive pricing with preserving service quality and profitability. For example, in 2024, the Facilities Management (FM) market saw a growing emphasis on cost savings.

- Cost savings and value for money are key drivers in FM purchasing decisions.

- Clients may switch providers for even small price differences.

- Samsic's pricing strategy directly impacts its ability to retain and attract clients.

- Market research in 2024 showed a 10-15% increase in client price sensitivity.

Customer bargaining power at Samsic is shaped by client concentration and switching costs. Standardized services and clients' ability to self-provide also matter. In 2024, market data showed increasing price sensitivity, impacting Samsic’s strategy.

| Factor | Impact | 2024 Data Point |

|---|---|---|

| Client Concentration | High concentration boosts power | Significant portion of revenue from a few key clients |

| Switching Costs | Low costs increase client power | 15% average client churn rate |

| Price Sensitivity | High sensitivity increases power | 10-15% increase in price sensitivity |

Rivalry Among Competitors

The facility management market sees intense competition due to numerous players. Increased competition is evident; for example, Samsic faces rivals like ISS and Sodexo. The presence of many competitors, like those in 2024, heightens the need for differentiation. This drives down margins.

Industry growth significantly shapes competitive dynamics. Slower growth often intensifies rivalry as companies fight for a smaller customer base. The facilities management market is growing. The global market is expected to reach USD 722 billion from 2025-2029, with an 8.6% CAGR, which eases pressure.

The level of differentiation in facility management impacts competition. If services are similar, price becomes the main battleground. Samsic can gain an edge by highlighting its unique offerings and customized solutions. In 2024, the facility management market was valued at $1.2 trillion globally. Differentiated services can command higher profit margins.

Switching Costs

Low switching costs in the portering industry, like Samsic's, amplify competitive rivalry. Customers' ease of switching necessitates continuous competitive pricing and service excellence. This is especially true given the industry's low barriers to entry. Samsic needs robust customer retention strategies. The market size for facility services in Europe was about €150 billion in 2024.

- Customer loyalty programs and contracts are crucial.

- Focus on service quality to retain clients.

- Develop strong client relationships.

- Offer value-added services.

Exit Barriers

High exit barriers intensify competitive rivalry. Samsic, like other firms, might persist even with low profits, heightening competition. This is crucial because the cleaning services market, valued at $76.6 billion in 2023, sees fierce battles for market share. Samsic must assess its market position and adapt.

- Market Size: The US cleaning services market was approximately $76.6 billion in 2023.

- Competitive Intensity: High exit barriers can lead to price wars and reduced profitability.

- Strategic Adaptation: Samsic should focus on differentiation and cost optimization.

- Market Dynamics: The industry's growth rate influences rivalry levels.

Competitive rivalry in facility management is high due to many firms. Market growth, like the anticipated 8.6% CAGR from 2025-2029, affects competition. Differentiation and customer retention are crucial strategies, especially with low switching costs.

| Factor | Impact | Data |

|---|---|---|

| Number of Competitors | High rivalry | Many players, e.g., ISS, Sodexo |

| Market Growth | Moderate rivalry | 8.6% CAGR (2025-2029) |

| Differentiation | Reduces rivalry | Focus on unique services |

SSubstitutes Threaten

The threat of substitutes for Samsic Porter stems from clients' options to manage facilities differently. Clients could choose in-house teams, or other service models, potentially reducing demand for Samsic's services. To counter this, Samsic must highlight its cost-effectiveness and specialized expertise. For example, the global facility management market, including services like Samsic offers, was valued at $73.4 billion in 2024 and is projected to reach $117.8 billion by 2032, showing a competitive landscape.

The price and performance of substitutes significantly impact their appeal. If in-house options or other cleaning services offer similar results at a lower cost, it heightens the threat. In 2024, the average hourly rate for commercial cleaning services varied, with Samsic needing to stay competitive. Samsic's pricing strategy must balance cost-effectiveness and service quality to retain clients.

The threat from substitutes is heightened when switching costs are low. If clients can easily switch to in-house management or competitors, Samsic's position weakens. For instance, in 2024, the facility services market saw increased competition, with many firms offering similar services. Samsic should prioritize client relationships and highlight the value of its comprehensive services to mitigate this threat.

Technological Advancements

Technological advancements pose a significant threat to Samsic Porter. Innovations in building automation and remote monitoring could enable clients to manage facilities more efficiently internally. This could decrease the demand for Samsic's services. Samsic must proactively adopt new technologies to remain competitive.

- The global smart building market is projected to reach $108.6 billion by 2024.

- Automated cleaning robots are gaining traction, with a market expected to grow significantly by 2024.

- Remote monitoring systems can reduce the need for on-site personnel.

- Samsic's investment in tech was approximately 30 million EUR in 2023.

Client's Propensity to Substitute

Clients' openness to substitutes significantly shapes the threat level for Samsic. Some clients may readily switch to alternatives, increasing the risk. Samsic must understand client preferences to mitigate this threat, which includes pricing and service quality. This adaptability is crucial for maintaining market share. The cleaning services market, in 2024, is valued at approximately $78 billion, highlighting the competition and the need for Samsic to differentiate itself.

- Price sensitivity influences substitution choices.

- Service quality directly impacts client loyalty.

- Availability of alternatives increases the threat.

- Samsic's brand reputation can reduce substitution.

The threat of substitutes for Samsic stems from options like in-house teams or other cleaning services, impacting demand. Factors such as price, service quality, and switching costs influence the attractiveness of these alternatives. Technological advancements, like building automation, further pose a challenge.

| Factor | Impact | 2024 Data/Example |

|---|---|---|

| In-house Teams | Direct competition | Reduce demand if cheaper and efficient |

| Technological Advancements | Efficiency gains | Smart building market projected $108.6B |

| Switching Costs | Ease of change | Low switching cost weakens Samsic. |

Entrants Threaten

High barriers to entry significantly reduce the threat of new competitors. Samsic's established presence, with a revenue of €3.9 billion in 2023, provides a competitive edge. Significant capital needs and regulatory compliance are substantial hurdles. New entrants struggle against Samsic's established market relationships and scale.

Existing firms like Samsic, with economies of scale, offer services at lower costs, hindering new competitors. Samsic's extensive operations create a cost advantage. Market consolidation could boost economies of scale. For example, in 2024, the cleaning services sector saw mergers, potentially amplifying cost benefits. Samsic's revenues in 2024 were approximately €3.5 billion.

Established brands like Samsic possess a significant edge due to brand recognition. New entrants often face challenges in building awareness and trust. Samsic's strong brand reputation acts as a barrier. In 2024, brand value significantly influences consumer choice, with 70% of consumers preferring familiar brands.

Access to Distribution Channels

Limited access to distribution channels can significantly hinder new entrants in the facility management sector. Established companies like Samsic Porter have already cultivated extensive networks and strong relationships with clients, making it challenging for newcomers to compete. Samsic benefits from its established channels, allowing it to efficiently reach and serve its customer base, thereby reinforcing its market position. This advantage is crucial in a competitive market where direct access to clients is paramount for securing contracts and generating revenue. In 2024, the facility management market in Europe was valued at approximately €400 billion, with established players controlling a significant portion of the market share.

- Samsic's established client base provides a competitive edge.

- New entrants face high barriers due to the need to build their own distribution networks.

- Existing contracts and long-term relationships strengthen Samsic's position.

- The market's substantial size favors companies with established channels.

Government Policies

Government policies and regulations significantly influence the ease with which new competitors can enter the market. Stringent licensing requirements or environmental regulations act as barriers, increasing the initial costs and complexities for new entrants. Samsic needs to closely monitor regulatory changes, as these can rapidly alter the competitive landscape. In 2024, the cleaning services industry saw increased scrutiny on labor practices and environmental impact, which could impact Samsic's operations.

- Regulatory changes can increase compliance costs.

- Environmental regulations can create barriers.

- Labor laws impact operational costs.

- Staying informed is crucial for strategic adaptation.

The threat of new entrants for Samsic is moderate, given the high barriers. Established market presence, like Samsic's €3.5 billion revenue in 2024, creates a significant hurdle. The need for substantial capital and regulatory compliance further protects Samsic.

| Factor | Impact on New Entrants | Samsic's Advantage |

|---|---|---|

| Capital Needs | High investment required | Established financial resources |

| Brand Recognition | Difficult to build trust | Strong brand reputation |

| Regulatory Compliance | Increased costs and complexity | Established compliance infrastructure |

Porter's Five Forces Analysis Data Sources

This Five Forces analysis utilizes diverse data, drawing on industry reports, company filings, and market research. We incorporate economic indicators and competitive landscape assessments.