Savills Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Savills Bundle

What is included in the product

Provides a strategic overview and recommendations for the Savills’s business units.

Simplified, exportable data for seamless board presentation and impactful stakeholder communication.

Delivered as Shown

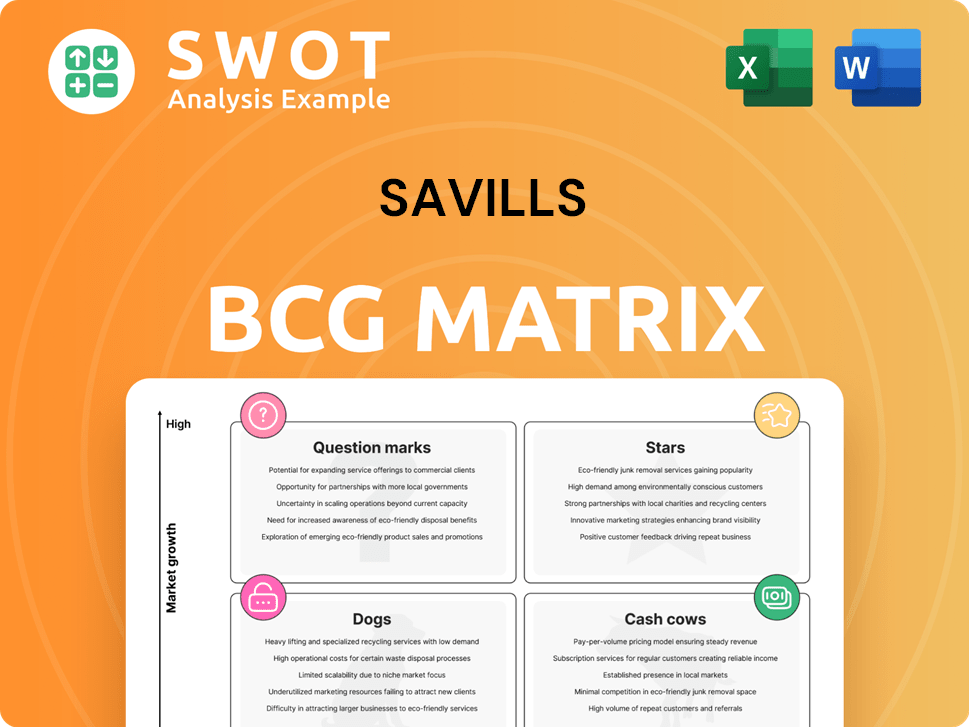

Savills BCG Matrix

The BCG Matrix preview you see is identical to the purchased document. This fully realized strategic tool delivers insights for immediate application in your planning.

BCG Matrix Template

Savills' BCG Matrix helps you understand their diverse real estate portfolio. This simplified view categorizes properties as Stars, Cash Cows, Dogs, or Question Marks. Get the full analysis to see how Savills strategically manages each category. Unlock detailed quadrant placements and strategic insights. Purchase now for a competitive edge.

Stars

Savills' Transactional Advisory experienced robust growth in 2024, with revenues increasing by 13% (16% in constant currency), reflecting its strong position in the market. This segment's performance is driven by a 30% rise in global commercial capital transactions and an 8% increase in leasing and occupier-focused revenues. The strong growth necessitates continued investment to sustain the current momentum. The growth could potentially evolve into a Cash Cow.

Savills' UK prime residential sector shines as a "Star" in its portfolio, showcasing remarkable resilience. This segment leverages a substantial market share, fueled by consistent demand for premium properties. In 2024, second-hand sales revenue jumped 13%, alongside an 8% increase in exchanges, totaling 5,099 transactions, indicating strong performance.

Dubai shines as a Star in Savills' BCG Matrix, particularly in its prime residential market. Capital values in Dubai are forecasted to lead global price growth in 2025, reflecting its high growth potential. In 2024, Dubai's prime residential capital values increased by 6.8%, and rental prices soared by 23.5%. This strong performance underscores Dubai's status.

Strong Performance in Property and Facilities Management

Savills' Property and Facilities Management showed strong performance, with revenues increasing by 5% (7% in constant currency) in 2024. This growth highlights its robust standing in a relatively stable market. The firm's proactive investments in technology and service improvements are expected to bolster its leadership position. Total area under management also expanded, reaching 2.67 billion sq ft, up by 1%.

- Revenue Growth: 5% (7% in constant currency)

- Market Stability: Positioned in a stable market

- Technology Investment: Focused on service enhancements

- Area Under Management: Increased to 2.67bn sq ft (1%)

Recovery in Select Asia-Pacific Markets

The Asia-Pacific region presents attractive recovery prospects, particularly in Japan and Vietnam. These markets are experiencing robust growth, suggesting opportunities for substantial market share expansion. Japan's hospitality sector is thriving, with ADRs and RevPARs consistently increasing. In 2024, Japan's tourism numbers are nearing pre-pandemic levels.

- Japan's hospitality sector shows strong demand.

- Vietnam exhibits high growth potential.

- Strategic investments can capitalize on opportunities.

- Inbound tourism is unlikely to slow down in 2025.

The UK prime residential sector is a star, with strong market share and consistent demand. Second-hand sales revenue rose 13% in 2024, with 5,099 transactions. Dubai's prime residential market is another star, predicted to lead global price growth in 2025.

| Sector | Performance in 2024 | Growth Drivers |

|---|---|---|

| UK Prime Residential | Sales Revenue +13%, 5,099 transactions | High market share, consistent demand |

| Dubai Prime Residential | Capital values +6.8%, Rents +23.5% | Forecasted global price growth |

| Asia-Pacific | Japan's Tourism Rebound | Japan hospitality, Vietnam growth |

Cash Cows

Savills' 'less transactional' UK business is a reliable Cash Cow, generating steady revenue. This maturity and market position, boosted by prime residential sales and commercial transactions, ensure consistent cash flow. In 2024, the UK business saw a strong performance, with its diverse service lines contributing to its financial stability.

Property management in established markets, such as the UK, serves as a cash cow for Savills. These services require limited additional investment, yet consistently produce income. In 2024, property management revenues increased by 5%, reaching £944.5m. This steady performance provides reliable cash flow.

Prime retail streets and schemes act as cash cows. They provide steady income and are poised for real income growth. Savills anticipates increased institutional interest in retail for 2025, with a focus on prime locations. These properties offer high income returns. This makes them attractive, especially for investors who focus on asset management. The UK retail sector saw £2.7 billion in investment in 2024, demonstrating continued interest.

Residential Buy-to-Let in the Northwest of England

Residential buy-to-let properties in the Northwest of England are cash cows due to high annualized returns. This sector generates consistent income, making it a reliable investment choice. Savills' research indicates that the Northwest continues to lead in annualised returns. This is a strong, stable investment area.

- Annualized returns are attractive for investors.

- The Northwest's buy-to-let market is stable.

- Savills forecasts highlight continued strong performance.

- This market provides a consistent income stream.

Consultancy Services

Savills' consultancy services, with revenues up 8% (9% in constant currency), are a key cash cow. These services, benefiting from Savills' strong brand, offer a stable income with low investment needs. The Asia Pacific valuation services, a significant part of this, reflect the market's investment activity. For 2024, the consultancy segment continues to perform well, contributing to Savills' overall financial stability.

- Revenue Growth: 8% (9% in constant currency)

- Service Type: Valuation services, etc.

- Regional Focus: Asia Pacific

- Investment Level: Relatively low

Savills' cash cows are stable, revenue-generating business segments with low investment needs, like the UK business. Property management, particularly in established markets, consistently provides reliable income. Prime retail and residential buy-to-let properties in regions like the Northwest also act as cash cows.

| Cash Cow Type | 2024 Performance | Key Features |

|---|---|---|

| UK Business | Strong performance, stable | Diverse services |

| Property Management | 5% revenue growth, £944.5m | Low investment, consistent income |

| Consultancy Services | 8% revenue growth | Valuation services, low investment |

Dogs

Greater China saw subdued activity in 2024, signaling low growth and market share. Turnaround plans might be costly and ineffective. A significant activity reduction in China and Hong Kong materially impacted regional performance. Savills' data for 2024 indicates a notable slowdown compared to prior years.

Savills addressed underperforming assets through restructuring in certain markets, adjusting initial recovery expectations. These assets require minimization to improve overall performance. Actions were taken in specific markets to address these issues. The Group incurred restructuring costs of £17.2 million in the year, reflecting these efforts.

Rural land faces challenges due to budget impacts. Turnaround plans often prove costly. Savills predicts stable farmland values over five years. This is due to business adaptation, government direction, and rural sector confidence. In 2024, farmland values saw fluctuations, impacted by economic shifts.

Areas Requiring Restructuring

Savills faced restructuring challenges, particularly in markets where recovery expectations faltered. The company recognized significant restructuring costs, totaling £17.2 million in 2024, reflecting adjustments to initial market assumptions. These actions underscore the need for strategic realignments to navigate economic uncertainties. Approximately £3.5 million of these costs were carried over into Q1 2025.

- Restructuring costs in 2024 were £17.2 million.

- £3.5 million of costs carried to Q1 2025.

- Markets' recovery assumptions were revised.

- Turn-around plans can be costly.

Non-Prime Property

Non-prime property, particularly in crowded markets, often faces challenges in delivering substantial returns. These properties frequently hover around the break-even point, neither adding nor significantly draining cash. The value of a prime location is undeniable; however, there's potentially A+ rental growth on B+ assets due to undersupply. For instance, in 2024, the average occupancy rate for non-prime office spaces remained at 65%.

- Struggles to generate significant returns.

- Often break even.

- Undersupply in prime locations.

- Potential A+ rental growth.

Dogs within the Savills BCG Matrix represent business units with low market share in a low-growth market. These units often require strategic decisions, like divestiture, to prevent further resource drain. Turnaround strategies are often costly and yield limited success. In 2024, restructuring costs were £17.2 million, indicating challenges in these areas.

| Characteristic | Implication | 2024 Data |

|---|---|---|

| Market Share | Low | Subdued activity in Greater China |

| Market Growth | Low | Slowdown in some markets |

| Strategic Action | Divest or restructure | Restructuring costs £17.2M |

Question Marks

Investing in emerging real estate tech, like AI-driven property valuation tools, is a "Question Mark" in the Savills BCG Matrix. These technologies have high growth potential but low market share currently. Adoption requires substantial investment, with marketing focused on user acquisition. In 2024, proptech investment reached $12.6 billion globally, up from $9.8 billion in 2023, highlighting growth potential.

Venturing into underserved Asian markets, particularly in Southeast Asia, offers significant growth opportunities, although it demands considerable initial investment. These markets often display high demand alongside low returns, reflecting a limited market share. Leveraging partnerships can be a key strategy to efficiently capitalize on the growth potential within these regions. For example, in 2024, real estate investments in Southeast Asia saw a 10% increase, highlighting the rising demand.

Savills is entering the "Green" market, but faces challenges due to potentially low market share initially. These sustainable property solutions must rapidly gain share. The UK government's Environment Act 2021 underscores the importance of environmental initiatives. In 2024, green building investments hit $1.3 trillion globally, showing market growth.

Build-to-Rent (BTR) Sector

Build-to-Rent (BTR) is currently a question mark in the Savills BCG Matrix. While the sector is expanding, it requires substantial investment and market penetration to achieve a dominant status. The primary marketing focus is to encourage market adoption of BTR properties. Savills' data shows a 6% increase in BTR investment in 2024 compared to the record set in 2022.

- Growth Potential: BTR is still developing.

- Investment: Significant funding needed.

- Market Focus: Drive adoption of BTR.

- 2024 Data: Investment up 6% from 2022.

New Service Offerings

New service offerings, such as specialized consulting for high-net-worth individuals in emerging markets, fit the Question Mark quadrant of the BCG Matrix. These services have high growth potential but a low market share. This means Savills needs to invest significantly in marketing and development to gain traction. The focus is on converting these offerings into Stars.

- Marketing spend is crucial for visibility and adoption.

- Savills must differentiate its services to capture market share.

- Success depends on effectively reaching and convincing target clients.

- These services could become cash cows with successful market penetration.

Question Marks represent high-growth potential ventures with low market share. These initiatives require substantial investment to boost market presence and user adoption. Marketing and strategic partnerships are critical for converting them into Stars. Savills strategically navigates these opportunities, aiming for market leadership.

| Category | Strategy | 2024 Data |

|---|---|---|

| PropTech | Investments in tech | $12.6B global investment |

| Asian Markets | Expand into SE Asia | 10% investment rise |

| Green Building | Sustainable prop solutions | $1.3T global investment |

BCG Matrix Data Sources

Savills' BCG Matrix uses comprehensive market data, integrating property transaction details, investment insights, and macroeconomic trends for insightful positioning.