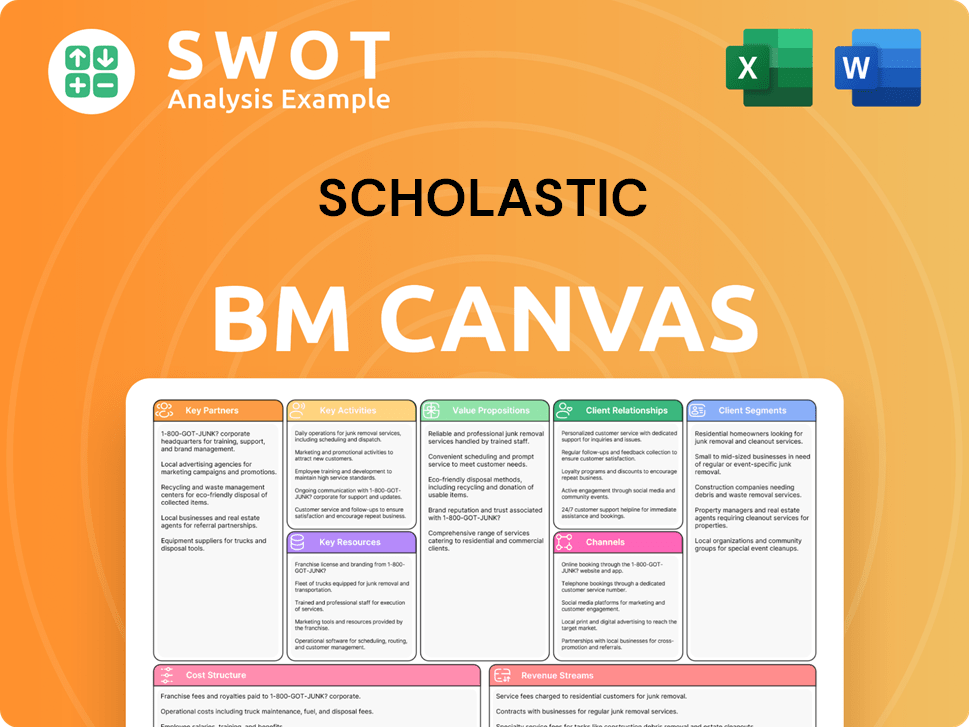

Scholastic Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Scholastic Bundle

What is included in the product

Designed for making informed decisions; organized into 9 blocks with insights.

Quickly identify core components with a one-page business snapshot.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas previewed here is the complete package. Upon purchase, you'll download the same document, including all content and sections, formatted identically. There are no hidden layouts; it's ready for immediate use. What you see is precisely what you get, for seamless integration.

Business Model Canvas Template

Analyze Scholastic's business model with a detailed Business Model Canvas. Uncover its core value propositions, customer segments, and revenue streams. This invaluable tool provides insights into their key activities and resources. Ideal for investors, analysts, and strategists. Download the full version for a complete strategic breakdown.

Partnerships

Scholastic's success hinges on key partnerships with publishers, providing a rich selection of books and educational resources. These collaborations are essential for broadening its reach and offering diverse content. In 2024, Scholastic's revenue reached $1.8 billion, partly due to these partnerships. Managing rights and acquiring content through these relationships is vital.

Partnering with educational institutions is core to Scholastic. These partnerships enable direct distribution of books and resources. Scholastic supports educators and parents to promote reading. In 2024, Scholastic's revenue was approximately $1.6 billion, reflecting its strong educational ties. They invested $30 million in literacy programs.

Scholastic collaborates with media companies to bring its books to life on screen and online. These partnerships expand the reach of its content, engaging kids across different platforms. The 9 Story Media Group acquisition in June 2024 boosted these efforts. This strategic move enables integrated content development and production.

Retailers

Scholastic depends on retailers to sell its books and products, including bookstores and online platforms. These partnerships are crucial for reaching a wide consumer base and boosting trade sales. In 2024, trade sales accounted for a significant portion of Scholastic's revenue. Retail collaborations also help in expanding market reach.

- Trade sales are vital for revenue.

- Retail partnerships boost market access.

- Online platforms are key.

- Bookstores are important.

Philanthropic Organizations

Scholastic partners with philanthropic groups to boost literacy and deliver books to those in need. These alliances bolster Scholastic's goal of aiding children's education and nurturing a reading passion. Such collaborations improve Scholastic's social impact and brand image, resonating with values-driven stakeholders. In 2024, Scholastic donated over 2 million books through various programs.

- 2024 Book Donations: Exceeded 2 million books.

- Partnership Goals: Expand literacy initiatives.

- Impact: Enhanced brand reputation.

- Strategic Benefit: Access to underserved markets.

Scholastic relies on diverse partnerships. These include publishers, educational institutions, media companies, retailers, and philanthropic groups. This network supports content, distribution, and social impact. In 2024, strategic alliances generated approximately $1.8 billion in revenue.

| Partnership Type | Key Benefit | 2024 Impact |

|---|---|---|

| Publishers | Content Acquisition | Revenue of $1.8B |

| Educational Institutions | Direct Distribution | Revenue of $1.6B |

| Media Companies | Content Expansion | 9 Story Media Group |

Activities

Content development is central to Scholastic's business. They create and acquire books, educational materials, and media. This includes writing, editing, and illustrating. Scholastic invests in diverse content. In 2024, children's book sales were up 5%.

Scholastic's publishing and distribution network is multifaceted, encompassing book fairs, clubs, retail, and digital platforms. In fiscal year 2024, Scholastic's trade publishing segment saw revenues of $577.8 million, showcasing robust retail sales. Their school-based channels remain key, fostering a love for reading and accounting for a significant portion of their revenue. This multi-channel approach is vital for broad market reach and sales optimization.

Sales and marketing are pivotal for Scholastic's success. They promote and sell products through targeted campaigns. This involves advertising and direct sales to schools and consumers. Strategic marketing maintains Scholastic's bestseller presence. In 2024, Scholastic's marketing spend was approximately $150 million, supporting its sales efforts.

Educational Program Development

Scholastic's core involves creating literacy programs and products for schools, designed to support teachers and enhance student reading and literacy. They continually develop new resources to meet the needs of their school partners. This includes offering a variety of programs, from early literacy to advanced reading comprehension. The programs are vital for academic success.

- In 2024, Scholastic reported that its Education Solutions segment saw a revenue increase.

- Scholastic's focus on literacy programs is supported by data showing improved reading scores in schools using their resources.

- The company invests significantly in research and development to create effective and up-to-date educational materials.

- Scholastic's educational products are used in over 90% of U.S. schools.

Media Production

Media production is a critical activity for Scholastic, especially with the 9 Story Media Group acquisition. This involves adapting Scholastic's books into various media formats. Content creation for platforms like streaming services and YouTube is a major focus. In the last month, Scholastic content had nearly 10 million YouTube views.

- Content Production: Adaptation of books into films, TV shows, and digital media.

- Platform Distribution: Developing content for streaming services and YouTube.

- YouTube Growth: Scholastic content views increased significantly.

- Strategic Acquisitions: Integration of 9 Story Media Group.

Key Activities for Scholastic include content creation, publishing, and sales. They also focus on creating literacy programs and media production. These activities are supported by data, like the Education Solutions segment revenue increase in 2024.

| Activity | Description | 2024 Metrics |

|---|---|---|

| Content Development | Creating books and educational materials. | Children's book sales up 5% |

| Publishing & Distribution | Book fairs, clubs, retail, and digital platforms. | Trade publishing revenue: $577.8M |

| Sales & Marketing | Promoting and selling products. | Marketing spend: ~$150M |

Resources

Scholastic's intellectual property, like "Dog Man" and "The Hunger Games," is a crucial asset. They hold perpetual US publishing rights for "Harry Potter" and "Hunger Games." This enables content creation and revenue generation. In 2024, Scholastic's revenue was significantly driven by these properties.

Scholastic’s brand reputation is a critical asset. It is a trusted source for children's books and educational materials. This strong brand recognition helps attract customers and partners. In 2024, Scholastic's revenue was approximately $1.7 billion, showing the brand's continued strength.

Scholastic's distribution network is a key resource, encompassing book fairs, clubs, and retail partnerships. This broad network ensures efficient product delivery to schools, homes, and libraries. The impact of Scholastic Book Fairs is significant, with schools booking the most fall fairs since the pandemic. In 2024, Scholastic reported strong revenue growth, driven in part by its robust distribution capabilities. This distribution network enhances Scholastic's market reach and accessibility.

Content Library

Scholastic's extensive content library is a cornerstone of its business model. This includes a vast collection of books, educational materials, and media assets. The company strategically repurposes this content across various formats. The acquisition of 9 Story Media Group in 2024 significantly boosted this resource.

- Over 1.5 billion books have been sold by Scholastic globally.

- 9 Story Media Group added over 4,000 half-hours of content to the library.

- Scholastic's digital content offerings saw a 20% increase in usage in 2024.

- The company's revenue from digital resources reached $150 million in 2024.

Financial Resources

Scholastic's financial resources, crucial for its business model, include a revolving credit facility and cash reserves. These resources are vital for investments in new content, strategic acquisitions, and overall growth. A robust financial position allows Scholastic to secure more liquidity. This supports debt reduction and enhances shareholder returns, demonstrating financial health.

- Revolving credit facility upsized to $400 million.

- Supports investment in content and acquisitions.

- Enhances shareholder returns through strategic financial management.

- Provides financial flexibility for strategic initiatives.

Scholastic's intellectual property and brand are key assets, driving significant revenue. The distribution network, including book fairs, efficiently delivers products to customers. An extensive content library and strong financial resources, like a $400 million credit facility, further support growth.

| Resource | Description | Impact in 2024 |

|---|---|---|

| Intellectual Property | "Dog Man," "Hunger Games," "Harry Potter" publishing rights. | Revenue driven by these properties. |

| Brand Reputation | Trusted source for children's books and educational materials. | Approx. $1.7B revenue reflecting brand strength. |

| Distribution Network | Book fairs, clubs, retail partnerships. | Strong revenue growth; Fall fairs bookings increased. |

| Content Library | Books, educational materials, and media assets. | Digital content usage up 20%; $150M digital revenue. |

| Financial Resources | Revolving credit facility & cash reserves. | Upsized credit facility to $400M; supports growth. |

Value Propositions

Scholastic's value proposition centers on trusted educational content, crucial for literacy. Their materials cater to teachers, parents, and students, fostering a love for reading. In 2024, the children's book market saw $1.7 billion in sales, underscoring demand. Stories and characters empower kids to become lifelong learners.

Scholastic's diverse product range, encompassing books, educational materials, and media, meets varied learning needs. This wide selection supports children's education effectively. They provide resources for literacy from early childhood to adolescence. In 2024, Scholastic's revenue was approximately $1.6 billion, driven by its extensive product offerings.

Scholastic's value proposition centers on convenient access via multiple channels. In 2024, Scholastic's book fairs and clubs reached millions of students. This omnichannel approach simplifies purchasing and resource access for customers. The focus on affordability, especially through book clubs, supports reading habits. For instance, in Q3 2024, Scholastic reported a 15% increase in book club participation.

Engaging Learning Experiences

Scholastic's value lies in creating engaging learning experiences. They foster a love for reading and inspire children to learn through interactive books, digital platforms, and media. The company aims to instill a lifelong learning love in children. Scholastic's revenue for fiscal year 2024 was $1.7 billion.

- Interactive books and digital platforms.

- Inspiring children to learn.

- Revenue of $1.7 billion (2024).

- Promoting lifelong learning.

Support for Educators

Scholastic's value proposition for educators is substantial. They provide resources for professional development, and materials for classrooms, which are all designed to help students succeed. This support is essential for teachers as they build effective learning environments. Scholastic collaborates with educators and organizations to promote reading and offer teacher training.

- Scholastic's revenue in fiscal year 2023 was $1.68 billion.

- The company has a wide reach, with its products and services used in over 90% of U.S. schools.

- Scholastic's focus on literacy is evident in their distribution of over 320 million books annually.

- They offer over 200 professional development workshops.

Scholastic's value proposition includes trusted educational content and a wide product range, supporting various learning needs and fostering a love for reading. They offer convenient access through multiple channels, reaching millions of students via book fairs and clubs. In 2024, Scholastic's revenue was around $1.7 billion, driven by its focus on literacy and engaging learning experiences.

| Value Proposition Elements | Key Features | 2024 Data Points |

|---|---|---|

| Content & Resources | Books, educational materials, media | $1.7B revenue |

| Access & Reach | Book fairs, clubs, digital platforms | 15% increase in book club participation (Q3) |

| Engagement & Learning | Interactive experiences, promoting literacy | 320M+ books distributed annually |

Customer Relationships

Scholastic fosters customer relationships via personal assistance. This includes sales reps, customer service, and direct interactions at book fairs. In 2024, Scholastic reported a revenue of $1.67 billion, indicating the scale of its customer base. They are constantly re-evaluating strategies, aiming to enhance customer engagement. This focus is reflected in their strategic initiatives to boost sales and satisfaction.

Scholastic cultivates customer relationships through online platforms, social media, and events, building a community and gathering feedback. This engagement helps Scholastic understand customer needs and preferences, which is vital for product development. In 2024, Scholastic's digital engagement efforts saw a 15% increase in social media followers. Customer feedback directly influenced 10% of new product releases.

Scholastic leverages automated services via its digital platforms for easy product access and purchases. This boosts customer experience and operational efficiency. The company's digital sales increased by 12% in fiscal year 2024. New releases maintain its top bestseller status.

Book Clubs and Fairs

Scholastic builds customer connections through book clubs and fairs, making reading fun and engaging for kids. These events create excitement, driving repeat purchases. The company's book fairs are rebounding strongly. Schools booked the highest number of fall fairs since the pandemic.

- Scholastic Book Fairs saw a resurgence with increased bookings.

- These events create a direct interaction channel with young readers.

- Book clubs and fairs foster brand loyalty and repeat business.

- The strategy effectively taps into the educational market.

Digital Platforms

Scholastic utilizes digital platforms to foster customer relationships, providing personalized recommendations and exclusive content. These platforms boost engagement, contributing to customer loyalty. Scholastic's digital strategy has driven revenue, especially in children's book publishing and educational solutions. Strategic digital expansion has significantly enhanced its market position.

- Digital revenue growth is a key focus for Scholastic, with increases reported in 2024.

- Personalized content and recommendations are crucial for driving customer engagement.

- Interactive experiences on digital platforms aim to enhance customer loyalty.

- Scholastic's digital footprint expansion is a strategic priority.

Scholastic uses personal assistance, like sales reps, to connect with customers, reflected in its $1.67 billion revenue in 2024. Online platforms and events build community, gathering feedback to improve products and reported a 15% increase in social media followers in 2024. Automated digital services and book clubs boost customer experience and sales, with a 12% digital sales increase in 2024, reinforcing customer relationships.

| Customer Relationship Type | Method | 2024 Result |

|---|---|---|

| Personal Assistance | Sales reps, book fairs | $1.67B Revenue |

| Digital Engagement | Online platforms, events | 15% rise in followers |

| Automated Services | Digital platforms, book clubs | 12% digital sales increase |

Channels

Scholastic's book fairs serve as a key distribution channel, connecting directly with students and schools. These fairs are designed to be fun and engaging, fostering a love for reading among children. In fiscal year 2024, Scholastic hosted approximately 88,000 book fairs, showcasing their continued importance. The company projects around 90,000 fairs for fiscal year 2025, demonstrating their commitment to this channel.

Scholastic's Book Clubs provide discounted books via schools, fostering home reading. In fiscal 2024, Scholastic refocused on a core, profitable Book Club business. The company is actively strategizing to re-engage customers, adapting to market dynamics. Despite challenges, Book Clubs remain a part of Scholastic’s revenue strategy.

Scholastic's retail sales involve selling books and products via bookstores and online retailers. This strategy broadens consumer access beyond book fairs. In 2024, retail book sales faced pressure due to constrained consumer spending. According to NPD BookScan, total U.S. print unit sales decreased by 1.7% in 2023.

Online Platforms

Scholastic leverages its online platforms for direct sales and distribution, offering easy access to its products. These platforms, including the website and digital learning tools, are crucial for reaching customers. In 2024, Scholastic's digital sales continued to grow, contributing significantly to its revenue. Their adaptability and brand recognition ensure financial stability and growth.

- Digital sales contributed over 20% of total revenue in 2024.

- Scholastic.com saw a 15% increase in unique visitors in Q4 2024.

- Digital learning platform subscriptions grew by 10% in 2024.

- Online platforms generated $200 million in revenue in FY24.

Education Solutions

Scholastic's Education Solutions division delivers educational programs straight to schools and districts. They focus on literacy solutions for educators. New structured literacy programs and supplemental products are in development, with launches planned for next summer. This channel is vital for reaching schools. In fiscal year 2024, Education Solutions contributed significantly to Scholastic's revenue.

- Education Solutions provides literacy programs directly to schools.

- They are developing new programs for the upcoming summer launch.

- This channel is key for reaching schools and educators.

- Education Solutions played a significant role in Scholastic's 2024 revenue.

Scholastic employs multiple channels to distribute its products and services, with each playing a specific role in reaching its target audience. Book fairs remain a cornerstone, offering direct engagement with students and schools, with approximately 88,000 events hosted in fiscal year 2024. Online platforms and digital learning tools expanded access and generated significant revenue, contributing over 20% of total revenue. Education Solutions provide essential literacy programs directly to schools, further broadening their reach.

| Channel | Description | 2024 Data |

|---|---|---|

| Book Fairs | Direct sales to students and schools. | ~88,000 fairs hosted. |

| Online Platforms | Direct sales via website & digital tools. | 20%+ of revenue. |

| Education Solutions | Programs delivered to schools. | Significant revenue contribution. |

Customer Segments

Elementary school students represent a key customer segment, benefiting from Scholastic's books and educational programs. These resources support their literacy development, a critical aspect of their education. Scholastic provides a vast selection of books and materials tailored for this age group. In 2024, the children's book market saw revenues of approximately $6.7 billion, highlighting the significance of this segment.

Scholastic provides middle and high school students with books, educational content, and media. These resources address their academic and social needs. In 2024, educational publishing revenue reached $356.7 million. Books cover social and emotional issues. The company's focus on these areas helps students.

Teachers and educators are a crucial customer segment for Scholastic, leveraging its resources to enhance classroom instruction and boost student achievements. Scholastic supports educators by providing professional development opportunities and essential classroom materials. The company offers diverse educational tools, including classroom magazines, digital learning platforms, and teacher training programs. In 2024, Scholastic's educational products and services reached over 100,000 schools.

Parents and Families

Parents and families represent a key customer segment for Scholastic, driving demand for educational resources. They buy books and products to support their children's learning and reading at home. Scholastic Book Clubs and Book Fairs offer affordable reading options, encouraging home and school engagement. This segment's spending significantly impacts Scholastic's revenue.

- In 2024, the global children's book market was valued at approximately $40 billion, with a projected growth.

- Scholastic Book Clubs and Fairs generate substantial revenue, with millions of families participating annually.

- Parents' focus on early literacy continues to drive demand for Scholastic's products.

- Scholastic's direct-to-consumer sales, heavily influenced by parent purchases, show consistent growth.

Libraries and Institutions

Libraries and educational institutions form a significant customer segment for Scholastic, purchasing books and educational resources. These institutions depend on Scholastic for quality content to serve their patrons and students. Scholastic collaborates with educators and organizations to foster reading programs and offer teacher training.

- In 2024, the library market in the US was estimated at $10.5 billion, with a substantial portion spent on books and educational materials.

- Scholastic's revenue from institutional sales, including libraries, accounted for about 30% of its total revenue in fiscal year 2024.

- Scholastic's partnerships with educational bodies have expanded by 15% in 2024, highlighting its commitment to literacy initiatives.

Scholastic's diverse customer segments span from elementary school students to libraries and educational institutions. These customers drive significant revenue through book sales, educational programs, and institutional purchases. Parent and family purchases are key, boosting direct-to-consumer sales.

| Customer Segment | Products/Services | 2024 Revenue/Market Data |

|---|---|---|

| Elementary Students | Books, educational programs | Children's book market: $6.7B |

| Teachers/Educators | Classroom materials, training | Educational products to 100,000+ schools |

| Parents/Families | Book Clubs, Book Fairs | Book Clubs/Fairs: millions participating |

Cost Structure

Content development costs are a key part of Scholastic's expenses. These costs cover author advances, editing, and licensing. Scholastic spent $1.4 billion on content in 2024. They also invest in diverse and inclusive content.

Scholastic's cost structure includes publishing and printing expenses, vital for producing books and educational materials. These costs cover paper, ink, and printing services, significantly impacted by production volume and material quality. In 2024, Scholastic's revenue was $1.66 billion, with a significant portion allocated to these direct costs. The school-based channels remain crucial for distribution.

Scholastic's distribution costs cover getting books to different channels like book fairs, clubs, and online. These costs involve moving, storing, and fulfilling orders for products. The company's book fairs are still popular, with schools booking the most fall fairs since the pandemic. Scholastic's distribution network is vital for its business model. The company manages these costs to maintain profitability and reach a wide audience.

Sales and Marketing Expenses

Scholastic allocates resources to sales and marketing. These costs cover advertising, promotions, and sales team compensations. Effective marketing keeps Scholastic's products visible and competitive. In fiscal year 2024, the company reported $534.3 million in selling, general, and administrative expenses.

- Advertising and promotional activities drive product awareness.

- Sales commissions incentivize the sales team.

- Marketing salaries support strategic initiatives.

- Maintaining bestseller list presence requires investment.

Technology and Infrastructure Costs

Scholastic invests in technology and infrastructure to support its digital offerings and internal operations. These expenses cover website upkeep, digital learning platforms, and IT support, including software development and maintenance. In fiscal year 2024, Scholastic reported a total revenue of $1.6 billion, with a significant portion allocated to these technological advancements. The company's strategic investments in technology enable it to adapt to evolving market demands.

- Software development and maintenance costs account for a sizable portion of the technology budget.

- IT support staff salaries and related expenses are ongoing costs.

- Infrastructure investments include servers, data storage, and network equipment.

Scholastic's cost structure includes significant expenses for content development, publishing, and distribution. Content costs, encompassing author advances and licensing, totaled $1.4 billion in 2024. Distribution and sales/marketing are crucial for reaching audiences. These cost drivers impact profitability and market reach, as seen in their 2024 revenue of $1.66 billion.

| Cost Category | Description | 2024 Costs |

|---|---|---|

| Content Development | Author advances, editing, licensing | $1.4B |

| Publishing/Printing | Paper, ink, printing services | Significant portion of revenue |

| Distribution | Shipping, storage, fulfillment | Varied based on channel |

Revenue Streams

Scholastic's core revenue comes from book sales, a key part of its business model. Sales channels include book fairs, clubs, retail, and online platforms. These sales are major revenue generators. The "Dog Man" series drove sales, becoming number one in the U.S., Canada, and children's books in the UK and Australia, boosting Scholastic's revenue.

Scholastic's Education Solutions revenue stream focuses on selling educational programs to schools. These include literacy programs, supplemental materials, and professional development. In fiscal 2024, Scholastic's Education Solutions segment generated $578.7 million in revenue. The company is expanding Book Fairs and Clubs while innovating services for schools in fiscal 2025.

Scholastic taps into media licensing, allowing its content to appear in movies, TV, and digital platforms. In 2024, Scholastic Entertainment and 9 Story Media Group drove revenue through content production. This includes digital growth and expanding IP reach on ad-supported platforms. This strategy generated a revenue of $255.6 million in 2024, up from $233.5 million in 2023.

Subscription Services

Scholastic's subscription services, including digital learning platforms and classroom magazines, generate recurring revenue. These subscriptions provide access to extensive educational resources for schools and families. The company has seen record revenue, especially in children's book publishing and educational solutions. This model provides a stable income stream, contributing to Scholastic's financial health.

- Subscription revenue is a significant and growing part of Scholastic's overall revenue.

- Digital subscriptions offer scalable growth opportunities due to their online nature.

- Scholastic's educational solutions are seeing increased demand.

- The subscription model supports long-term customer relationships.

Rights and Licensing

Scholastic's revenue streams include rights and licensing, which involves selling foreign rights and licensing intellectual property. This approach expands the company's reach and generates extra income from its content. In 2024, Consolidated Trade revenues saw a 2% increase, largely due to stronger foreign rights sales. This indicates the effectiveness of this revenue stream in boosting overall financial performance.

- Foreign rights sales contribute significantly to Scholastic's revenue.

- Licensing intellectual property is another key component of this revenue stream.

- Consolidated Trade revenues increased in 2024, driven by rights and licensing.

- This strategy broadens Scholastic's market presence.

Scholastic's revenue streams are diverse, including book sales, education solutions, and media licensing. Education Solutions brought in $578.7 million in fiscal 2024. Rights and licensing, notably foreign rights, saw a 2% rise in revenue.

| Revenue Stream | 2024 Revenue (USD million) | Key Highlights |

|---|---|---|

| Book Sales | Significant | Driven by book fairs, clubs, and series like "Dog Man." |

| Education Solutions | $578.7 | Focus on programs and materials for schools. |

| Media Licensing | $255.6 | Growth in content production and digital platforms. |

Business Model Canvas Data Sources

Scholastic's Business Model Canvas uses company reports, educational market analysis, and industry publications.