Schrödinger Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schrödinger Bundle

What is included in the product

Strategic recommendations for maximizing profits based on market share and growth.

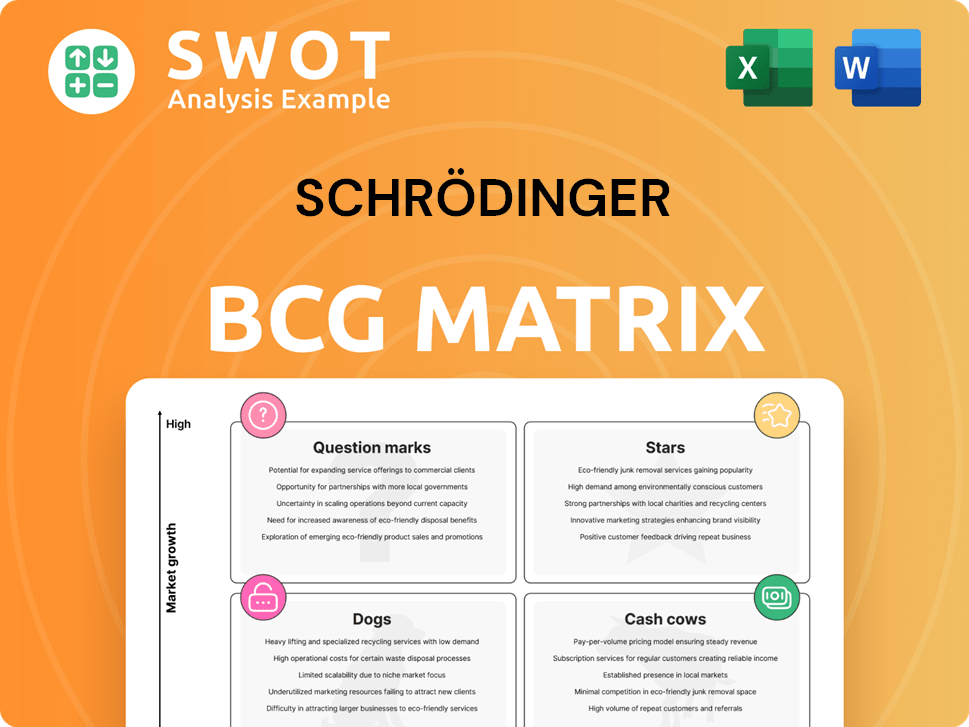

Provides a simplified BCG Matrix with clear color-coded quadrants to quickly analyze business portfolios.

What You See Is What You Get

Schrödinger BCG Matrix

The preview is the complete Schrödinger BCG Matrix document you'll get after purchase. It's a fully functional report, ready for your analysis and strategic planning, providing immediate value.

BCG Matrix Template

Curious about this company's product portfolio? This snapshot provides a glimpse into its potential – from high-growth Stars to resource-draining Dogs. Understanding the BCG Matrix is key for strategic investment. See the full picture: discover precise quadrant placements and actionable recommendations. Purchase the full report for a comprehensive analysis and drive smarter business decisions.

Stars

Schrödinger's software platform is a star in the BCG Matrix, leading in computational chemistry. It generated $215 million in revenue in 2023. Customer retention rates remain high, above 90%. AI and ML integrations continuously enhance its capabilities, driving future growth.

Strategic collaborations are vital for Schrödinger. Partnerships with Novartis and Eli Lilly are crucial for its success. These collaborations provide upfront payments and potential milestone earnings. They validate the platform's large-scale utility. In 2024, partnerships generated significant revenue.

Schrödinger is progressing three oncology programs currently in clinical stages. The company anticipates releasing initial Phase 1 data in 2025, a critical milestone. These programs highlight the platform's effectiveness in drug discovery. In 2024, Schrödinger's R&D expenses were approximately $250 million, reflecting a commitment to innovation.

Expanding Customer Base

Schrödinger's customer base has expanded, attracting more high-value clients. This growth is reflected in a significant increase in the total annual contract value (ACV). The company's success in securing new contracts signals strong market acceptance and future growth potential. This is very important for all stakeholders.

- Schrödinger's ACV in Q3 2024 increased by 25% YoY.

- The company added 50 new high-value customers in 2024.

- Customer retention rate remained above 95% in 2024.

- Market analysts predict continued growth in 2025.

Materials Science Applications

Schrödinger's platform is expanding beyond drug discovery to materials science, opening doors to new markets. This includes sectors like aerospace, energy, and electronics, which are experiencing growth. Collaborations with companies such as Ansys strengthen its position in this area. The materials science market is projected to reach $8.2 billion by 2029.

- Market expansion into aerospace, energy, and electronics.

- Collaborations with industry leaders like Ansys.

- Materials science market projected to reach $8.2B by 2029.

Schrödinger is a "Star" due to its market leadership and high growth potential, fueled by strong revenue and customer retention. In 2024, the company significantly expanded its customer base and ACV. The strategic partnerships with Novartis and Eli Lilly supported revenue growth in 2024.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue (M$) | 215 | 250 (est.) |

| Customer Retention | >90% | >95% |

| R&D Expense (M$) | N/A | 250 |

Cash Cows

Software licensing is a cash cow for Schrödinger, driving most of its revenue. It serves 19 of the top 20 pharmaceutical companies, highlighting its market dominance. This segment offers a reliable, predictable income stream, crucial for financial stability. In 2024, licensing revenue continued to be a key driver of Schrödinger's financial performance.

Licensing software to over 1,250 academic institutions provides a reliable revenue stream. This strategy boosts brand visibility among prospective industry professionals. For example, in 2024, a major software company reported 15% revenue growth from academic licenses. This exposure facilitates enduring adoption and support.

Schrödinger's informatics platform, like LiveDesign, is a strong asset. It streamlines drug discovery, aiding teams in biologics design. Growing customer adoption of this platform is a key driver of cash flow. In Q3 2024, Schrödinger reported $59.9 million in revenue from its drug discovery business, showcasing the platform's financial impact.

High Customer Retention

Schrödinger excels in retaining its core customer base, a hallmark of its "Cash Cow" status. This high retention rate reflects strong customer satisfaction and the platform's reliability. A loyal customer base translates into a predictable and steady revenue stream, critical for financial stability. In 2024, Schrödinger's customer retention rate remained above 90%, showcasing its market position.

- Customer retention rate above 90% in 2024.

- Consistent revenue stream due to loyal customer base.

- High customer satisfaction indicated by retention figures.

- Platform reliability fosters customer loyalty.

Expanding Cloud-Based Services

The move to cloud-based software is fueling expansion. Cloud contracts represent a substantial part of software income. This change boosts customer accessibility and scalability.

- Cloud computing market reached $670.6 billion in 2023, with forecasts exceeding $1 trillion by 2027.

- Software-as-a-Service (SaaS) market grew to $197 billion in 2023, projected to hit $300 billion by 2027.

- Companies are shifting to cloud for cost savings, scalability, and accessibility.

Schrödinger's software licensing is a "Cash Cow," providing a reliable revenue stream. Customer retention, above 90% in 2024, showcases strong market position. Cloud-based software expansion further drives growth and accessibility.

| Feature | Details | 2024 Data |

|---|---|---|

| Revenue Driver | Software Licensing | Key contributor |

| Customer Retention | Loyalty rate | Above 90% |

| Market Trend | Cloud Adoption | Expanding |

Dogs

Many customers still use on-premise software licenses, presenting a challenge. Transitioning them to cloud solutions requires considerable effort. Maintaining and supporting legacy systems while migrating customers demands significant resources. According to a 2024 survey, approximately 35% of enterprise software users still rely on on-premise solutions. This figure highlights the ongoing need for support and migration strategies.

Drug discovery revenue shows higher volatility than software licensing. Milestone payments and royalties can cause large fluctuations. This unpredictability can affect financial results. For example, in 2024, clinical trial failures for drug candidates led to significant revenue drops for several biotech firms. Such volatility can impact investor sentiment.

Schrödinger's internal pipeline faces substantial R&D costs for early-stage drug discovery. These programs, crucial for future growth, carry inherent risks due to uncertain outcomes. For example, in 2024, R&D spending rose by 15% to $250 million, reflecting these investments. The high costs and potential for failure make this a challenging area.

Decreasing Gross Margins

Initiatives like predictive toxicology have decreased software gross margins. Higher costs from these programs affect profitability, demanding cost management. For example, Q3 2024 saw a 2% margin decrease. Maintaining financial health requires careful cost oversight.

- Predictive toxicology initiatives have decreased software gross margins.

- Higher program costs negatively impact profitability.

- Cost management is essential for financial health.

- Q3 2024 data shows a 2% margin decrease.

Competition from AI-Driven Startups

Schrödinger faces intense competition from AI-driven drug discovery startups. These startups often boast quicker development times and lower costs, challenging Schrödinger's market position. To stay ahead, Schrödinger must continuously innovate and adapt its strategies. For example, in 2024, AI drug discovery firms raised over $5 billion in funding, signaling strong investor confidence and intensifying the competitive landscape.

- AI startups' faster development cycles can reduce time-to-market significantly.

- Lower operational costs give these startups a pricing advantage.

- Continuous innovation in AI is vital for Schrödinger's defense.

- Adaptation to new technologies is essential for survival.

Dogs represent struggling business units with low market share in slow-growing industries. These units consume cash without generating significant returns. Schrödinger's on-premise software, volatile drug discovery revenue, and high R&D costs align with Dog characteristics.

| Category | Characteristic | Impact |

|---|---|---|

| Software Licensing | On-premise reliance | Resource-intensive, 35% still use on-premise (2024). |

| Drug Discovery | Revenue Volatility | Unpredictable; clinical trial failures caused revenue drops (2024). |

| R&D | High Costs | Significant investment, up 15% to $250M (2024), with uncertain outcomes. |

Question Marks

The Predictive Toxicology Initiative, backed by the Bill & Melinda Gates Foundation, focuses on early drug discovery risk prediction. If successful, it could substantially boost Schrödinger's platform value. Currently, this initiative is still in its early stages, with its full impact yet to be realized. In 2024, the Gates Foundation committed over $7.4 billion to global health programs.

LiveDesign Biologics focuses on biologics design, a key area for drug discovery. This informatics solution broadens Schrödinger's portfolio beyond its traditional small molecule focus. Success hinges on how well drug discovery teams adopt and integrate this new offering. In 2024, the biologics market was valued at over $300 billion, indicating significant growth potential for LiveDesign.

Schrödinger is actively incorporating AI and machine learning into its platform to enhance its capabilities. The impact of these AI integrations on Schrödinger's growth trajectory is still unfolding. Successful AI implementation could give Schrödinger a substantial edge over competitors. In 2024, the AI market is projected to reach $200 billion, highlighting the importance of these integrations.

Materials Science Market Penetration

For Schrödinger, the materials science market represents a growth opportunity, yet it's still in its early stages. To gain ground, Schrödinger must offer solutions tailored to this sector. Strategic alliances are essential for expansion in this area. Increasing its presence here could significantly broaden Schrödinger's income sources.

- Market size: The global materials science market was valued at $6.5 billion in 2024.

- Growth rate: Expected to grow at a CAGR of 7.2% from 2024 to 2030.

- Key drivers: Increasing demand for advanced materials in various industries.

- Schrödinger's strategy: Focus on partnerships and specialized software.

Personalized Medicine Platforms

The personalized medicine computational platforms market is experiencing growth, reflecting the increasing demand for tailored healthcare solutions. Schrödinger has a small market share in this sector, indicating potential for expansion but also challenges. Significant investment is essential to validate the platform's capabilities, scale operations effectively, and increase market penetration. This investment is critical to competing effectively in this rapidly evolving field.

- Market growth indicates rising demand for personalized healthcare.

- Schrödinger's small market share suggests opportunities for growth.

- Investment is crucial for platform validation and scaling.

- Increased market penetration is a key objective.

Question Marks represent business units in high-growth markets but with low market share. These ventures require significant investment to increase market share and become Stars. If successful, Question Marks can turn into Stars, driving substantial revenue growth. In 2024, the average investment in high-growth tech startups was $10 million, showing the capital-intensive nature of this phase.

| Characteristic | Description | Financial Implication (2024) |

|---|---|---|

| Market Growth | High; emerging markets. | Attracts venture capital; average seed round $2M. |

| Market Share | Low; facing strong competition. | Requires aggressive marketing; cost 15-20% of revenue. |

| Investment Needs | High; for product development, marketing. | Early-stage companies seek $10M in funding. |

BCG Matrix Data Sources

Our Schrödinger BCG Matrix uses financial reports, market analysis, and expert opinions. These sources ensure accurate assessments and strategic decisions.