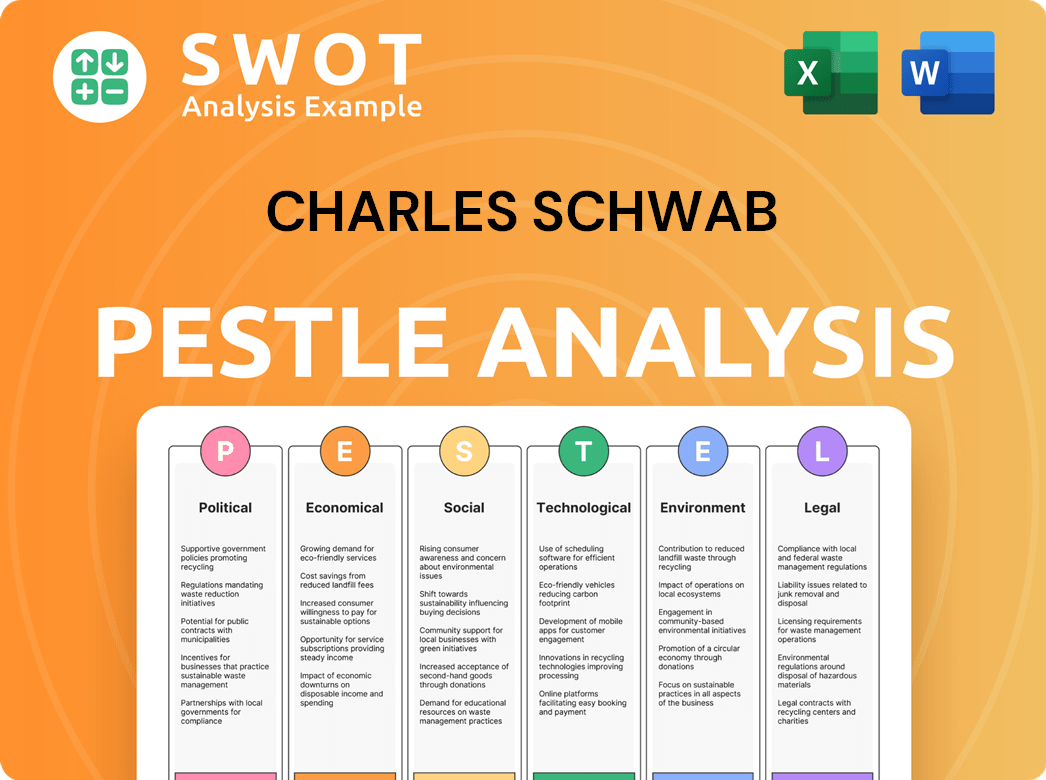

Charles Schwab PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles Schwab Bundle

What is included in the product

Examines how Charles Schwab is shaped by external macro factors, covering Political, Economic, Social, Tech, Environmental, & Legal aspects.

Helps facilitate a cohesive discussion around macroeconomic trends that can impact Charles Schwab.

Same Document Delivered

Charles Schwab PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This Charles Schwab PESTLE Analysis offers a comprehensive look at their business environment. See how various factors impact strategic decision-making. You'll get this expertly crafted analysis.

PESTLE Analysis Template

Uncover Charles Schwab's strategic landscape with our PESTLE Analysis. This report dissects the external factors influencing its performance. Gain insights into political, economic, social, technological, legal, and environmental impacts. This analysis equips you with essential market intelligence, enabling smarter decisions and strategies. Download the full PESTLE Analysis today for in-depth, actionable insights.

Political factors

Government policies and regulations are critical for Charles Schwab. The incoming U.S. administration may alter tax policies, tariffs, and deregulation, impacting the economy and investor actions. The financial industry is highly regulated, requiring Schwab to adapt. In 2024, regulatory compliance costs for financial firms rose by 7%, reflecting the ongoing need to navigate evolving rules.

Uncertainty in trade policy, like tariff hikes, fuels market volatility. Geopolitical conflicts also elevate political risk, impacting global trade. For example, in 2024, trade tensions between major economies led to fluctuating stock prices. Financial firms like Schwab must adapt to these shifts and potential supply chain disruptions.

In 2025, expect significant tax policy shifts as parts of the 2017 tax cuts end. This could reshape investment strategies and financial planning. Investors and firms like Charles Schwab will need to adapt. The focus will be on wealth management adjustments. A 2024 study showed 60% of investors are concerned about tax changes.

Political Stability and Social Unrest

Political instability, social unrest, and rising populism pose challenges. These factors can affect market sentiment and economic conditions globally, impacting financial services. For instance, in 2024, several regions experienced increased political volatility. This can lead to market fluctuations and shifts in investor behavior. Charles Schwab, as a global player, must monitor these trends.

- Political instability can lead to market volatility.

- Social unrest impacts investor confidence.

- Populism can shift economic policies.

- Global economic conditions are affected by these factors.

Government Spending and Debt Ceiling

Government spending cuts and the debt ceiling are major political issues for 2025. Historically, debt ceiling debates have caused market volatility. The U.S. national debt hit $34 trillion in early 2024, highlighting the stakes. Fiscal policy decisions significantly impact markets and investors.

- Debt ceiling standoffs can lead to market uncertainty.

- Potential for reduced government spending affects various sectors.

- These policies directly influence economic growth and investor confidence.

Political factors significantly influence Charles Schwab's operations. Tax policy changes, particularly those expected in 2025, are crucial for investment strategies. Increased regulatory compliance costs, which rose by 7% in 2024 for financial firms, also shape their financial plans.

| Political Aspect | Impact on Schwab | 2024/2025 Data |

|---|---|---|

| Tax Policy Changes | Alters investment strategies | 60% of investors concerned about 2025 tax changes. |

| Regulatory Compliance | Increases operational costs | 7% increase in compliance costs (2024). |

| Government Spending | Affects market and investor confidence | U.S. national debt reached $34T (early 2024). |

Economic factors

The anticipated drop in interest rates in 2025 could significantly affect the banking sector. Lower rates might boost loan demand, especially for mortgages, potentially increasing profitability. However, they could also squeeze banks' net interest income if deposit costs stay elevated. Charles Schwab's banking division has already experienced the effects of rate changes. For example, the Federal Reserve held rates steady in May 2024.

Inflationary pressures have eased, yet elevated costs persist, impacting investor sentiment. Economic growth is projected to slow in 2025, with the U.S. GDP growth estimated around 1.5% to 2%. These dynamics significantly influence market trends. Investor confidence and portfolio adjustments are directly linked to inflation and growth forecasts.

Market volatility is expected to increase in 2025 due to policy shifts and economic conditions. Elevated stock valuations, especially in specific sectors, are a concern for investors. This volatility can significantly influence trading volumes and client assets. For example, the CBOE Volatility Index (VIX) has fluctuated significantly in 2024, reflecting ongoing market uncertainty.

Consumer Spending and Debt Levels

Consumer spending and debt levels are critical economic factors for 2025. The strength of the American consumer will be tested, particularly as high consumer debt levels potentially impact spending. This could slow economic growth and influence investor confidence.

- U.S. consumer debt reached $17.29 trillion in Q4 2024.

- The personal savings rate fell to 3.7% in December 2024.

- Credit card debt hit $1.13 trillion by the end of 2024.

Global Economic Conditions

Global economic conditions pose challenges. Slower-than-average growth and corporate earnings may hinder stock performance and increase volatility. While growth is expected to improve, uncertain trade policies and tighter fiscal policies could affect international markets. The International Monetary Fund (IMF) projects global growth at 3.2% in 2024 and 3.2% in 2025.

- IMF projects global growth at 3.2% in 2024.

- IMF projects global growth at 3.2% in 2025.

Economic factors in 2025 present mixed signals for Charles Schwab. Projected slowing U.S. GDP growth, possibly 1.5%-2%, coupled with potential rate cuts, creates banking sector uncertainty. High consumer debt, hitting $17.29 trillion in Q4 2024, could temper spending, impacting investor sentiment.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Interest Rates | Loan demand, profitability | Fed held rates steady May 2024; Possible cuts in 2025 |

| Inflation | Investor sentiment | Persisting elevated costs |

| Consumer Debt | Spending, growth | $17.29T Q4 2024, credit card debt $1.13T end-2024 |

Sociological factors

The investor landscape is shifting, and Charles Schwab must adjust. Millennials and Gen Z are growing in wealth management importance. These younger clients prioritize tech and personalized services. Schwab reported 34.8 million active brokerage accounts by Q1 2024, reflecting this shift. They need to tailor offerings to these segments.

The demand for financial advice is surging. Americans are getting wealthier, and their financial needs, particularly retirement planning, are becoming more intricate. This trend creates a significant opportunity for companies like Charles Schwab. In 2024, the wealth management industry saw assets under management (AUM) grow by approximately 10%, reflecting this increased demand.

Financial literacy remains a key focus, with programs targeting youth to boost budgeting and investing knowledge. Increased access to investment platforms and options boosts financial confidence. In 2024, around 59% of Americans feel confident managing their finances. The rise in accessible financial tools continues to shape how people engage with financial services.

Workforce Trends and Advisor Shortage

The aging U.S. workforce is significantly impacting the financial industry, including Charles Schwab. A substantial portion of financial advisors are nearing retirement, exacerbating an existing advisor shortage. This demographic shift creates both challenges and opportunities for firms like Schwab.

Attracting and retaining skilled advisors is paramount for Schwab to maintain its competitive edge and meet rising client demands. The need for new talent is intensified by the increasing complexity of financial products and client needs.

- Around 37% of financial advisors are aged 55 or older (2024).

- The industry needs to hire approximately 300,000 advisors in the next decade (2024).

- Demand for financial advice is projected to increase by 10-15% annually (2024-2025).

Societal Attitudes Towards ESG

Societal attitudes toward ESG (Environmental, Social, and Governance) are crucial. There's growing recognition that sustainability affects long-term investment returns. Charles Schwab, along with peers, faces evolving ESG investor expectations. In 2024, ESG assets reached $40.5 trillion globally. This reflects a shift towards socially responsible investing.

- ESG assets hit $40.5T globally in 2024.

- Investors increasingly value sustainability.

- Charles Schwab adapts to ESG trends.

Societal shifts, like aging populations and demand for ESG investments, influence Charles Schwab. A growing emphasis on ESG impacts investment choices, with global ESG assets hitting $40.5 trillion in 2024. Adapting to these societal trends is essential. This ensures Schwab remains relevant and attractive to diverse investor preferences.

| Factor | Details | Impact on Schwab |

|---|---|---|

| ESG Investing | $40.5T in ESG assets (2024) | Need to offer ESG investment options. |

| Advisor Demographics | 37% of advisors over 55 (2024) | Requires attracting & training new advisors. |

| Client Demands | Rising demand for financial advice (10-15% growth, 2024-2025). | Adapt to different financial needs and trends. |

Technological factors

Digital transformation is reshaping financial services. Charles Schwab must enhance its digital platforms due to the growing use of online channels by investors. In 2024, Schwab reported over 36 million active brokerage accounts, reflecting the importance of digital access. The company's tech investments are crucial for competitiveness. Schwab's mobile app saw record usage in 2024.

Artificial Intelligence (AI) is growing in financial services. AI boosts efficiency and customer service. Charles Schwab uses AI for research and investing. Schwab's AI integration aims to improve operations. In 2024, AI spending in finance hit $15.3 billion.

Robo-advisory services, leveraging AI algorithms, are becoming popular for their low-cost, automated portfolio management. Charles Schwab capitalizes on this trend by offering personalized investment advice digitally. In Q1 2024, Schwab reported $900 billion in digital assets, reflecting strong adoption. This approach aligns with the increasing demand for accessible, personalized digital solutions.

Cybersecurity Risks

Cybersecurity is a major technological factor for Charles Schwab, given its reliance on digital platforms. Protecting client data and financial transactions is paramount; any breach could severely damage trust and lead to substantial financial losses. The financial sector faces a constant barrage of cyberattacks; in 2024, cybercrime costs are projected to reach $9.2 trillion globally. Schwab invests heavily in cybersecurity, including advanced threat detection systems and employee training programs.

- Cybersecurity spending in the financial services sector is expected to increase by 10-15% annually.

- The average cost of a data breach in the financial industry is around $5.9 million.

- Schwab's cybersecurity budget is estimated to be in the hundreds of millions of dollars annually.

Innovation in Financial Technology (FinTech)

The FinTech landscape is rapidly evolving, reshaping the financial services industry. Charles Schwab must embrace innovation to stay competitive. This involves exploring new technologies and initiatives to meet client expectations and maintain its market position. In 2024, FinTech investments reached approximately $171 billion globally.

- Mobile banking and digital wallets adoption continues to grow, with over 70% of Americans using digital payment methods in 2024.

- AI and machine learning are increasingly used for fraud detection and personalized investment advice.

- Blockchain technology is gaining traction in areas like securities trading and cross-border payments.

Technological advancements are central to Charles Schwab’s operations and success. Digital transformation is critical; investments in technology and AI are key to enhance customer experiences and stay competitive. Cybersecurity spending is increasing to protect assets, with the FinTech landscape also rapidly evolving in 2024/2025.

| Technology Area | Impact on Schwab | 2024/2025 Data |

|---|---|---|

| Digital Platforms | Enhance customer access & service | 36M+ brokerage accounts in 2024, record mobile app usage |

| Artificial Intelligence | Improve operations & research | $15.3B AI spending in finance in 2024 |

| Cybersecurity | Protect data & finances | $9.2T global cybercrime cost projection in 2024 |

Legal factors

Charles Schwab faces intense regulatory scrutiny, with the financial services sector under constant change. The firm must stay compliant with trading rules, fee structures, and client protection laws. For example, in 2024, the SEC proposed rule changes impacting broker-dealer standards. These changes and potential new ones, like those for crypto, require constant adaptation. Staying compliant is crucial for avoiding penalties and maintaining investor trust.

Anticipated shifts in tax policies for 2025 will affect financial planning and wealth management. Charles Schwab and its clients must adapt to new tax codes to stay compliant. For example, potential adjustments to capital gains rates could influence investment strategies. In 2024, the top capital gains tax rate is 20%.

Charles Schwab faces legal hurdles from evolving sanctions and trade regulations. The firm must adapt to rapidly changing export controls impacting international dealings. This includes staying current with U.S. Treasury's OFAC sanctions, which have increased in scope. Recent data shows that financial institutions paid $2.4 billion in penalties for sanctions violations in 2023. Schwab must maintain compliance.

Anti-Money Laundering (AML) and Fraud Prevention

Charles Schwab, like all financial institutions, faces intense scrutiny regarding Anti-Money Laundering (AML) compliance and fraud prevention. Regulatory enforcement remains robust, with significant penalties for AML failures. In 2024, the Financial Crimes Enforcement Network (FinCEN) issued over $1 billion in penalties for AML violations across the financial sector. Schwab must maintain robust controls to comply with these regulations and prevent illicit activities.

- FinCEN issued over $1 billion in penalties in 2024.

- Robust AML controls are essential for compliance.

Data Privacy and Security Regulations

Charles Schwab faces increasing scrutiny regarding data privacy and security. Compliance with regulations like GDPR and CCPA is crucial for protecting client data. These regulations require robust security measures and transparent data handling practices. Failure to comply can result in hefty fines and reputational damage, impacting customer trust and financial performance. In 2024, data breaches cost financial institutions an average of $5.9 million each.

- GDPR and CCPA compliance are essential for Schwab.

- Data breaches cost financial institutions millions.

- Schwab must prioritize data security to maintain trust.

- Stringent regulations are emerging globally.

Charles Schwab navigates a complex legal landscape. Regulatory changes in 2024/2025, including those from the SEC, require constant adaptation. Data privacy, AML, and sanctions compliance demand robust measures. FinCEN's penalties in 2024 exceeded $1 billion.

| Legal Area | Regulatory Bodies | Key Concerns |

|---|---|---|

| Trading & Compliance | SEC, FINRA | Evolving broker-dealer rules, fee structures |

| Taxation | IRS | Adjustments to capital gains, income tax rates |

| AML & Fraud | FinCEN, OFAC | Anti-Money Laundering compliance and data security |

Environmental factors

Charles Schwab focuses on environmental sustainability. They manage energy use in buildings and data centers. In 2024, they invested $5 million in green initiatives. This aims to cut carbon emissions.

Charles Schwab actively promotes waste reduction, especially e-waste, through recycling and refurbishing initiatives. In 2024, Schwab's efforts led to a significant decrease in landfill waste. Employee-led recycling drives further support these sustainability goals. These programs align with growing environmental regulations, impacting operational costs and brand perception.

Charles Schwab prioritizes sustainable sourcing by partnering with vendors committed to recycled and sustainable products. The company is actively reducing its environmental impact. They are aiming for paperless processes. In 2024, the company's ESG initiatives included efforts to reduce waste and promote responsible consumption, aligning with broader industry trends.

Climate Change Impact

Climate change poses indirect yet significant challenges for financial services, influencing investment strategies and risk assessments. Sustainable finance is gaining traction, with ESG assets projected to reach $50 trillion by 2025. Banks are increasingly assessing climate-related risks in their portfolios. This includes the potential for stranded assets and increased insurance claims due to extreme weather events.

- ESG assets are expected to reach $50 trillion by 2025.

- Banks are integrating climate risk assessments into their portfolios.

- Climate change may increase insurance claims.

Employee Engagement in Environmental Responsibility

Employee engagement significantly influences Charles Schwab's environmental initiatives. Employee interest groups drive sustainability efforts, fostering a culture of responsibility. Activities like park clean-ups and gardening projects boost engagement. In 2024, companies with strong employee environmental programs saw a 15% increase in positive brand perception. Schwab's commitment to these activities can enhance its reputation and attract talent.

- Employee-led initiatives enhance corporate sustainability goals.

- Activities boost morale and company image.

- Strong programs increase positive brand perception.

- Attracts and retains talent.

Charles Schwab’s environmental efforts focus on sustainability, waste reduction, and sustainable sourcing, reflected in green investments and initiatives. In 2024, investments reached $5 million, supporting waste reduction through recycling and promoting responsible consumption. The company aligns with the $50 trillion ESG asset projection by 2025, incorporating climate risk assessments into their practices.

| Environmental Aspect | Charles Schwab Actions | 2024/2025 Impact |

|---|---|---|

| Sustainability | Investments in green initiatives, managing energy use. | $5M invested in 2024; aiming to cut carbon emissions, aligning with broader industry trends. |

| Waste Reduction | Promoting waste reduction, particularly e-waste, through recycling, refurbishing, and employee-led recycling drives. | Significant decrease in landfill waste; boosting company's reputation, 15% increase in positive brand perception with strong programs. |

| Sustainable Sourcing | Partnering with vendors to source sustainable products and aiming for paperless processes. | Focusing on efforts to reduce waste and promote responsible consumption, anticipating a rise in climate-related insurance claims. |

PESTLE Analysis Data Sources

This PESTLE Analysis integrates information from financial reports, economic indicators, government publications, and industry-specific data. The sources ensure a grounded, multi-faceted perspective.