Scout24 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Scout24 Bundle

What is included in the product

Strategic evaluation of Scout24 units, using BCG Matrix to guide investment, hold, or divest decisions.

Export-ready design for quick drag-and-drop into PowerPoint, allowing seamless presentation integration.

What You See Is What You Get

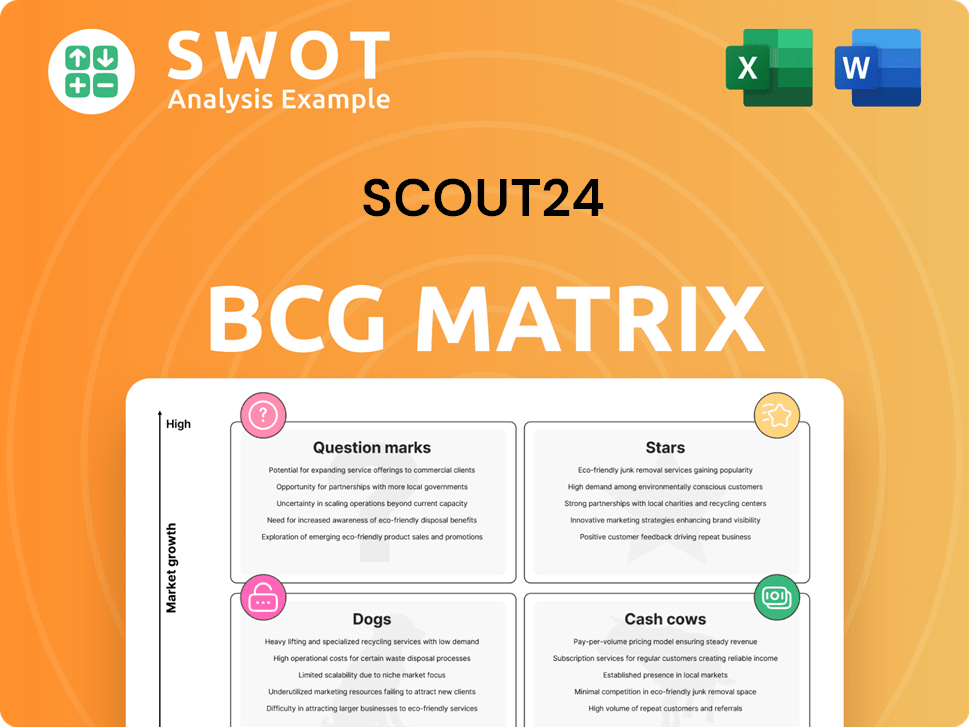

Scout24 BCG Matrix

The Scout24 BCG Matrix preview is identical to the downloadable document. You'll receive the complete, ready-to-use analysis upon purchase—no hidden content or alterations. Designed for strategic insights, the full report is instantly available.

BCG Matrix Template

Explore Scout24's strategic landscape! Discover where its products truly stand within the BCG Matrix framework: Stars, Cash Cows, Dogs, or Question Marks. This glimpse into their portfolio offers valuable insights, but there's more to uncover.

The full BCG Matrix report reveals detailed quadrant placements and data-backed recommendations. Gain a clear view of Scout24's market positioning and unlock actionable strategic takeaways.

With a complete analysis, you'll understand the specific challenges and opportunities. Ready to make smarter investment and product decisions? Purchase the full BCG Matrix now!

Stars

ImmobilienScout24 dominates the German and Austrian real estate markets. It holds a leading position with a substantial market share and a large user base, creating significant revenue. In 2024, the platform saw over 17 million visits monthly. Investing in platform enhancements is crucial for continued leadership.

AutoScout24 dominates the pan-European online car market. It boasts a strong presence in major European countries, attracting a vast user base. This makes it a prime platform for car dealers and private sellers. In 2024, its revenue reached approximately €600 million.

Scout24's B2C subscription revenues are booming, fueled by robust demand for premium offerings. This reflects user readiness to pay for advanced features. In 2023, subscription revenue rose, showing strong user engagement. Continued innovation in subscription models is key to sustained growth. The B2C segment is a significant growth driver.

Strategic Acquisitions

Scout24's strategic acquisitions, including Sprengnetter, neubau kompass, and bulwiengesa, are key. These companies offer data and services, boosting its B2B offerings. Effective integration and synergy create considerable value for Scout24. In 2024, Scout24's revenue reached approximately €500 million, reflecting the impact of these strategic moves.

- Sprengnetter, neubau kompass, and bulwiengesa acquisitions enhance Scout24's real estate sector offerings.

- These acquisitions strengthen Scout24's B2B core.

- Integration and synergy are key to value creation.

- Scout24's 2024 revenue was around €500 million.

Interconnectivity Strategy

Scout24's interconnectivity strategy merges data with classifieds for efficient matchmaking, boosting revenue and margins. This approach offers relevant data and digital solutions to all real estate stakeholders, creating a valuable platform. Successful execution strengthens its competitive edge and supports long-term growth. In 2024, Scout24's revenue increased by 9.5%.

- Revenue Growth: 9.5% increase in 2024.

- Focus: Merging data with classifieds.

- Goal: Efficient matchmaking.

- Impact: Driving margin expansion.

Stars in Scout24's portfolio represent high-growth market leaders. ImmobilienScout24 and AutoScout24 exemplify this, dominating their respective markets. These segments drive significant revenue and user engagement, essential for Scout24's overall success.

| Category | Segment | 2024 Revenue (approx.) |

|---|---|---|

| Star | ImmobilienScout24 | Over €17M monthly visits |

| Star | AutoScout24 | €600 million |

| Growth Driver | B2C Subscriptions | Increased in 2023 |

Cash Cows

Scout24's professional segment, primarily serving real estate agents, is a significant cash cow, generating substantial subscription revenues. This recurring revenue stream offers a stable and predictable income source. In 2024, this segment contributed significantly to Scout24's overall revenue, with subscriptions being a key driver. Maintaining customer satisfaction through excellent service is vital for preserving this cash cow status.

Scout24's transaction enablement revenues, crucial for cash flow, stem from real estate transaction services. These encompass lead generation and marketing tools. In 2024, optimizing and expanding these services is key to boosting revenue. They contribute significantly to the financial health of the company.

ImmoScout24, a key part of Scout24, leads the German real estate market. It benefits from high digital use and steady property values. This strong position lets Scout24 make reliable profits. In 2024, Scout24's revenue grew, showing its market strength. The focus is on keeping its market share and running efficiently.

Operating Leverage

Scout24's operating leverage is a key strength, fueled by its scalable tech and efficient model. This setup allows profits to grow quicker than revenues, boosting cash flow from current operations. Continuous tech investment and optimization further enhance profitability. The company reported a 46% adjusted EBITDA margin in 2023.

- High Operating Leverage: Profits grow faster than revenues.

- Cash Flow Generation: Significant cash flow from existing operations.

- Efficiency: Scalable technology and operating model.

- 2023 Financials: Adjusted EBITDA margin of 46%.

Dividend Payouts

Scout24, classified as a cash cow, has a history of rewarding shareholders with dividends, showcasing its robust financial health and cash flow. A reliable dividend strategy can draw in and keep investors, boosting its standing as a dependable investment. For 2024, the company suggested a 10% dividend increase, highlighting its dedication to shareholder returns.

- 2024 dividend proposal: 2.00 EUR per share.

- Payout ratio: Approximately 60% of net profit.

- Dividend yield: Roughly 2.5% based on recent stock prices.

- Total dividend paid out in 2023: 1.82 EUR per share.

Scout24, a cash cow, excels in its professional segment, with steady subscription revenues. ImmoScout24 dominates the German real estate market due to high digital use. Its high operating leverage boosts profit growth. In 2024, Scout24 planned a 10% dividend increase.

| Metric | Description | Value/Data |

|---|---|---|

| Revenue Growth (2024) | Year-over-year growth | Approx. 10% |

| Adjusted EBITDA Margin (2023) | Profitability Measure | 46% |

| Dividend per Share (2024) | Proposed dividend | 2.00 EUR |

Dogs

If Scout24 struggles with emerging tech like AI or blockchain, this could become a dog. These disrupt the usual online real estate model. For instance, in 2024, AI in real estate saw investments surge by 45%. Monitoring tech and investing proactively is vital to avoid this.

Scout24 faces challenges due to limited cross-border synergies in the online real estate market, potentially making international ventures "dogs" in the BCG Matrix. This lack of synergy could hinder its global expansion, as seen with similar platforms struggling to replicate success across borders. Strategic partnerships and targeted acquisitions are crucial to overcome these challenges and drive international growth. In 2024, cross-border real estate transactions represented only a small fraction of overall market activity, highlighting the difficulty.

If Scout24 doesn't innovate, it risks losing its market edge. Stagnation can lead to a decline in revenue, potentially turning its core business into a "Dog" in the BCG matrix. In 2024, Scout24's revenue was approximately €470 million, emphasizing the need to invest in R&D. Continuous innovation is vital to maintain this revenue stream and avoid becoming a low-growth, low-share business.

Economic Downturn Impact (Potential)

A severe economic downturn poses a risk to Scout24, particularly affecting its real estate and automotive classifieds businesses. Reduced market activity could slash revenue and profitability, possibly downgrading segments to "dogs" in its BCG matrix. For example, in 2023, the European real estate market saw a slowdown, impacting online portals. Scout24 needs to diversify its revenue sources and focus on cost management to stay resilient.

- Real estate market slowdown in Europe during 2023 impacted portal revenues.

- Diversification of revenue streams is a key strategy.

- Cost control measures are crucial for mitigating downturn risks.

Increased Competition (Potential)

The online marketplace sector faces escalating competition, with both new entrants and established firms broadening their services. Scout24 must differentiate itself to retain its market position and profitability. Failure to adapt could result in decreased market share. Continuous monitoring is essential. In 2024, the real estate market saw a 5% rise in competitors.

- Increased competition leads to price wars and reduced margins.

- Innovation and differentiation are vital for survival.

- Monitoring competitor strategies is crucial.

- Adaptation to market changes is necessary.

In the BCG matrix, "Dogs" are low-growth, low-share businesses. Scout24's segments can become Dogs if they struggle with tech, international expansion, or economic downturns. This includes AI, cross-border issues, and market stagnation. In 2024, strategic actions are key to avoid this status.

| Risk Factor | Impact | Mitigation |

|---|---|---|

| Tech Disruption | Loss of market share | AI/blockchain investment |

| Limited Cross-Border | Hindered global growth | Partnerships, acquisitions |

| Economic Downturn | Revenue decline | Diversification, cost control |

Question Marks

Scout24's new offerings, like AI tools, are question marks in its BCG matrix. Their market share and future success are currently unknown. Marketing investments are vital for adoption. Scout24's revenue in 2024 was approximately €570 million.

Scout24's Austrian venture, ImmoScout24.at, is a question mark. Its market position is evolving, requiring investment in marketing and product development. The IMMOunited acquisition boosts its presence and data capabilities. In 2024, Scout24's revenue was approximately €470 million.

Scout24's move into commercial real estate data, via bulwiengesa, is a strategic shift. This expansion is relatively new, with its market success still developing. In 2024, the commercial real estate sector saw fluctuating values, impacting valuation accuracy. The firm needs focused investment and partnerships to excel. The European commercial real estate market was valued at approximately €2.5 trillion in 2023.

Car Subscription Services

AutoScout24's collaboration with Casi to introduce a car subscription marketplace positions it in the Question Marks quadrant of the BCG Matrix. This segment is characterized by high growth potential but uncertain market share. The success hinges on how well AutoScout24 can capture market share in this evolving space. Continuous monitoring of customer demand and market dynamics is crucial for strategic adjustments.

- The global car subscription market was valued at $4.6 billion in 2023.

- Projected to reach $11.8 billion by 2028, indicating significant growth.

- However, profitability can be challenging, with some providers facing losses.

- Success depends on efficient operations and customer retention.

AI-Driven Matchmaking

Scout24 is strategically investing in AI to enhance its platform's matchmaking capabilities, aiming to connect property seekers and providers more efficiently. This initiative has the potential to significantly improve user experience and platform effectiveness. However, the actual impact on market share and user engagement remains uncertain, requiring continuous assessment and optimization. The success of this AI-driven approach hinges on its ability to accurately match needs and preferences.

- Investment in AI aims for improved user experience.

- Uncertain impact on market share.

- Continuous testing and optimization are crucial.

- Focus on accurate matching of needs.

Question Marks for Scout24 represent high-growth areas with uncertain market positions. These include AI tools and ventures in commercial real estate. Marketing, product development, and strategic partnerships are key for success.

Scout24’s move into commercial real estate data is strategic but new. Commercial real estate in Europe was valued at €2.5 trillion in 2023. The firm is investing in AI to boost its platform and user engagement.

| Area | Focus | Status |

|---|---|---|

| AI Tools | Matchmaking | Uncertain Market Impact |

| Commercial Real Estate | Data Expansion | New, Developing |

| Car Subscription | Marketplace | High Growth, Risky |

BCG Matrix Data Sources

The Scout24 BCG Matrix uses financial statements, market analysis, and industry publications for dependable positioning.