Seadrill Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Seadrill Bundle

What is included in the product

Tailored analysis for Seadrill's rig portfolio, with insights into investments, holds, and divestments.

Visualizes Seadrill's business units, offering a clear snapshot of the portfolio for strategic decisions.

What You See Is What You Get

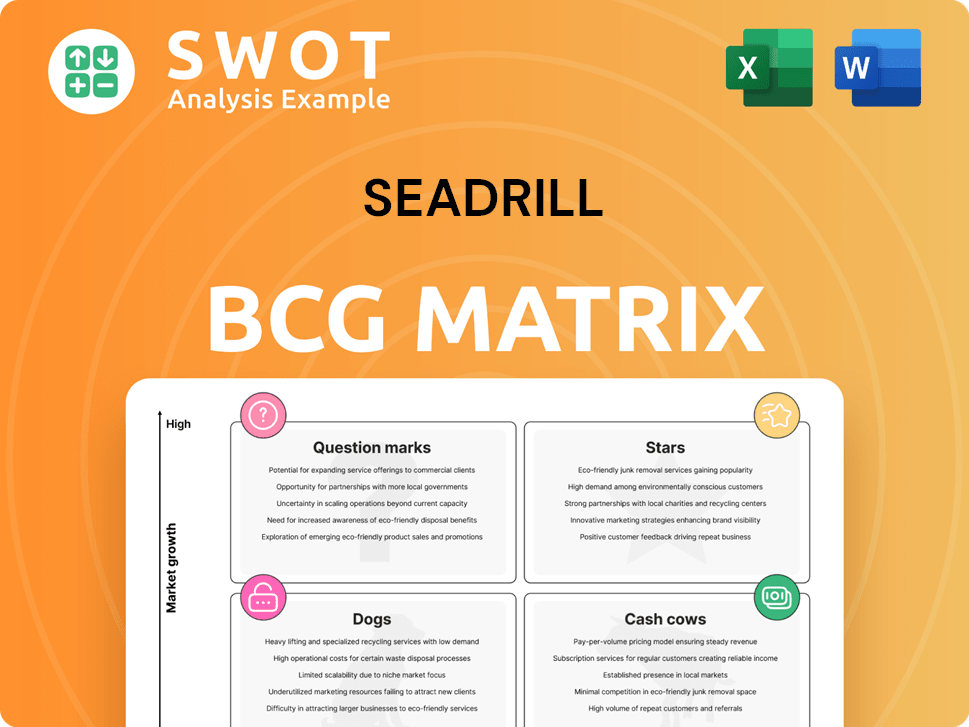

Seadrill BCG Matrix

What you see is the complete Seadrill BCG Matrix report delivered after purchase. Download the full, actionable strategic analysis instantly—no editing required. This is the final version, offering clear insights for your investment planning.

BCG Matrix Template

Seadrill's BCG Matrix offers a snapshot of its diverse portfolio. It helps assess growth potential and resource allocation. Understanding the "Stars," "Cash Cows," "Dogs," and "Question Marks" is crucial.

This preview barely scratches the surface. The full BCG Matrix report unlocks detailed quadrant insights. Gain strategic recommendations for smarter investment decisions.

Stars

Seadrill's "Strong Backlog" in the BCG Matrix reflects its financial health. The company had a solid backlog of around $3.0 billion as of February 2025, providing a clear revenue outlook. This includes long-term contracts for drillships like West Jupiter and West Tellus, ensuring high utilization rates. These contracts extend operations into 2029.

Seadrill's strategic emphasis on deepwater drilling is a key aspect of its business model. This focus allows the company to leverage its expertise and assets in a market experiencing growth. In 2024, deepwater projects saw significant investment, with several major offshore discoveries announced. This positions Seadrill to benefit from increased exploration and production activities.

Seadrill's modern fleet includes advanced drillships and semi-submersibles, boosting operational efficiency. Upgrades, like MPD on the West Neptune, sharpen competitiveness. The company's commitment to its fleet resulted in $1.2 billion in revenue in Q1 2024. This focus helps secure valuable contracts.

Strategic Acquisitions

Seadrill's strategic acquisitions, particularly the Aquadrill merger in April 2023, have been a key move. This expanded Seadrill's fleet, boosting its presence in crucial regions. This strategic move has generated significant synergies, estimated at $70 million per annum, by eliminating rig management contracts.

- Merger with Aquadrill expanded fleet.

- Increased presence in key markets.

- Synergies estimated at $70 million annually.

- Eliminated rig management contracts.

Share Repurchase Program

Seadrill's share repurchase program is a key strategy. The company has returned about $792 million to shareholders since September 2023. This has led to a 22% reduction in outstanding shares, boosting shareholder value. This action signals management's belief in Seadrill's future.

- $792 million returned to shareholders (since September 2023).

- 22% reduction in issued shares.

In the BCG Matrix, Stars represent high-growth, high-market-share business units. Seadrill's modern fleet and deepwater focus position it as a Star. Revenue for Q1 2024 was $1.2 billion, indicating strong market presence and growth potential.

| Category | Details | Financials (2024) |

|---|---|---|

| Revenue (Q1) | Generated by the fleet | $1.2 billion |

| Deepwater Focus | Strategic business emphasis | Increased investment in projects |

| Share Repurchase | Returning value to shareholders | $792 million (since Sept 2023) |

Cash Cows

Seadrill's high contract coverage for 2025, about 75% of rig days, positions it as a "Cash Cow." This strong coverage offers a predictable revenue stream, shielding against market fluctuations. This stability is crucial for consistent financial performance. In 2024, the company's contracted backlog stood at around $3.5 billion, showcasing robust future earnings.

Operational efficiency is crucial for Seadrill's success. The West Vela's early well completion, securing 40 extra work days, added about $20 million to its backlog. This efficiency boosts revenue and pleases clients. In Q3 2023, Seadrill reported a 13% increase in revenue, highlighting the impact of efficient operations.

Seadrill's cash cow status is supported by its strong presence in vital offshore drilling areas like the U.S. Gulf of Mexico, Brazil, and Angola. These locations are crucial for oil and gas exploration. In 2024, the Gulf of Mexico saw significant drilling activity. Seadrill's established relationships with major operators secure consistent contract flow.

Divestment of Non-Core Assets

Seadrill strategically divested non-core assets, such as the West Prospero, for $45 million in 2024, focusing on core strengths. This move aligns with maximizing returns by concentrating on high-margin deepwater drilling. The divestment strategy allows for better resource allocation and a streamlined operational focus. This is a key move in the company's portfolio optimization.

- Divestment of West Prospero for $45 million.

- Focus on higher-margin deepwater drilling.

- Strategic resource allocation.

- Streamlined operational focus.

Strong Financial Performance

Seadrill's financial performance in 2024 reflects its status as a Cash Cow within the BCG matrix. The company demonstrated robust financial health, achieving a net income of $446 million and an Adjusted EBITDA of $378 million. This strong profitability is supported by a solid balance sheet, which includes a cash balance of $505 million. This financial strength allows Seadrill to manage market uncertainties and explore growth opportunities.

- Net income of $446 million in 2024.

- Adjusted EBITDA of $378 million in 2024.

- Cash balance of $505 million.

Seadrill functions as a Cash Cow due to its robust, predictable revenue and strong market presence. Its 2025 contract coverage is approximately 75%, ensuring stable income. The company's 2024 net income was $446 million and an Adjusted EBITDA of $378 million.

| Financial Metric | 2024 Value | Comment |

|---|---|---|

| Contracted Backlog | $3.5 Billion | Demonstrates future earnings stability. |

| Net Income | $446 Million | Reflects strong profitability. |

| Adjusted EBITDA | $378 Million | Highlights operational efficiency. |

Dogs

Seadrill's "Dogs" include cold-stacked rigs like the West Eclipse. These underused assets need costly reactivation. As of Q3 2023, Seadrill had $1.1 billion in cash, but reactivation costs are high. Market competition further challenges profitability.

Seadrill sold West Prospero, exiting the benign jack-up market. This move reflects a strategic pivot. The jack-up segment may offer limited growth compared to deepwater. In Q3 2023, Seadrill's revenue was $375 million, focusing on higher-margin areas.

The semi-submersible market is showing signs of weakness. Westwood's projections indicate a decrease in marketed committed utilization rates for 2025. This could pose difficulties for Seadrill's semi-submersible fleet. Securing contracts and sustaining dayrates might become harder. In 2024, the global floating rig count averaged around 150 units.

Potential Rig Attrition

Rig attrition is expected to rise, especially for semi-submersibles, potentially affecting Seadrill's older rigs. This could force Seadrill to retire or sell less competitive assets. The need to optimize its fleet is critical for Seadrill's financial health. Data from 2024 indicates that the average age of offshore rigs in operation is increasing.

- Westwood anticipates increased rig attrition.

- Semi-submersibles are particularly at risk.

- Seadrill might need to retire older rigs.

- Fleet optimization is essential.

Market Downturn Impact

Seadrill's history underscores its susceptibility to market downturns, as evidenced by its bankruptcy filings. These were precipitated by the COVID-19 pandemic and the subsequent oil price crash. The company's strategic focus must include robust debt management and financial prudence. This will help navigate future economic uncertainties.

- Seadrill emerged from Chapter 11 in 2022.

- The company's debt restructuring significantly altered its financial structure.

- Oil price volatility remains a key risk factor.

- Maintaining a strong balance sheet is crucial for long-term survival.

Seadrill's "Dogs" consist of underperforming, cold-stacked rigs requiring substantial reactivation investments. These assets face profitability challenges due to market competition. The semi-submersible market's projected downturn and increasing rig attrition further complicate matters.

| Category | Details | Data |

|---|---|---|

| Cash Position (Q3 2023) | Seadrill's available cash | $1.1 billion |

| Q3 2023 Revenue | Seadrill's revenue | $375 million |

| 2024 Floating Rig Count | Average global count | ~150 units |

Question Marks

Seadrill's move to upgrade rigs with tech like MPD signifies growth potential. Successful tech adoption may attract contracts. In 2024, MPD adoption is up 15% in the North Sea. This tech could be a key differentiator. It might boost profitability, too!

Seadrill's strategic move into emerging markets like Namibia and Guyana positions it as a "Question Mark" in its BCG Matrix. These regions present high-growth potential with substantial risks. Securing contracts could significantly boost Seadrill's revenue, potentially transforming it into a "Star." In 2024, offshore drilling in Guyana saw increased activity, with several discoveries.

Seadrill sees a rebound in harsh environment drilling, especially in Norway. This could lift earnings and rig use. In Q3 2023, Seadrill's revenue hit $392 million, up from $326 million the year before. Improved utilization rates are expected.

Whitespace in 2025/2026

Seadrill faces whitespace in 2025 and 2026, despite a strong backlog. This uncommitted capacity presents an opportunity for new contracts to boost revenue. The ability to fill this capacity directly impacts cash flow generation. Securing these contracts is vital for Seadrill’s financial performance.

- Uncommitted capacity creates opportunities.

- Contract success is vital for cash flow.

- 2024 average dayrates for harsh environment rigs were around $350,000.

- Seadrill's backlog as of Q4 2023 was approximately $2.8 billion.

Consolidation Opportunities

In the Question Marks quadrant of the BCG Matrix, Seadrill faces opportunities through potential consolidation in the rig contractor market. Strategic acquisitions could allow Seadrill to grow its fleet and increase its market share, enhancing its competitive standing. This approach could be particularly beneficial, given the industry's cyclical nature and the need for scale. Identifying and executing these acquisitions is critical for future growth.

- Consolidation in the offshore drilling market presents opportunities for Seadrill.

- Strategic acquisitions can expand Seadrill's fleet and market share.

- Enhanced competitive position through targeted acquisitions.

- Focus on identifying and executing strategic acquisitions.

Seadrill's "Question Mark" status in the BCG Matrix highlights its high-growth, high-risk ventures in new markets. These ventures include regions like Namibia and Guyana, which have significant growth potential. Success hinges on securing profitable contracts. In Q4 2023, dayrates for new contracts averaged $380,000.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Entry | Namibia, Guyana | Guyana offshore discoveries up 20% |

| Risk | High growth, high risk | Contract risk remained significant |

| Opportunity | Potential for "Star" status | Dayrates Q4 averaging $380,000 |

BCG Matrix Data Sources

The Seadrill BCG Matrix relies on financial reports, market data, and industry analyses. This provides accurate, trustworthy quadrant positioning.