Securitas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Securitas Bundle

What is included in the product

Strategic overview: Securitas business units classified by growth rate and market share.

Export-ready design for quick drag-and-drop into PowerPoint, saving valuable time.

What You’re Viewing Is Included

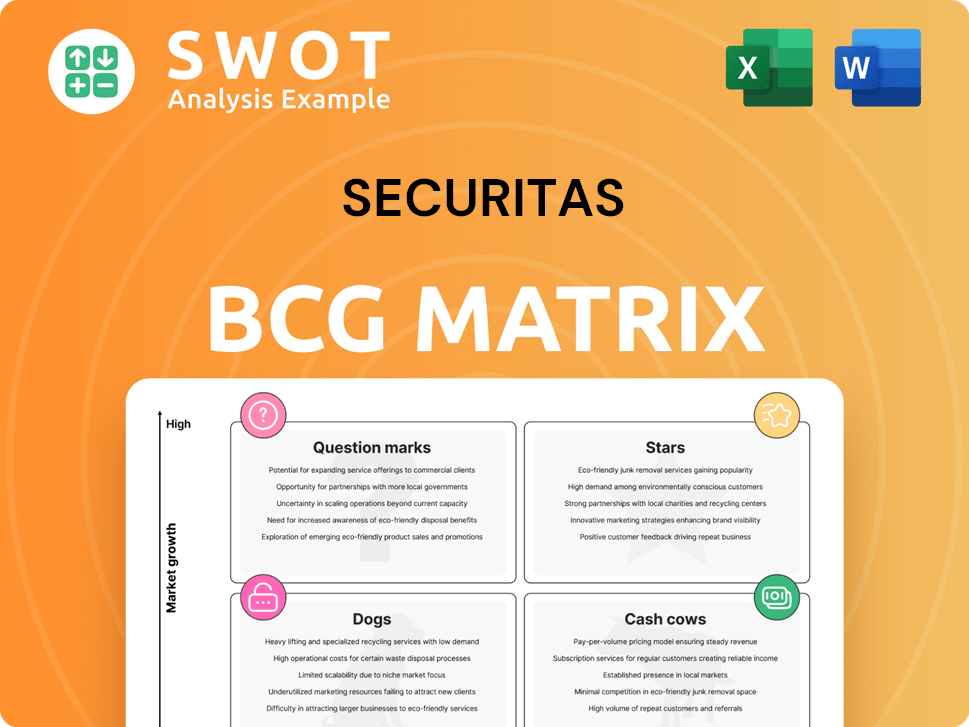

Securitas BCG Matrix

The BCG Matrix preview you see is the complete document you'll receive. After purchase, download the full, ready-to-analyze report, perfectly formatted for strategic decision-making.

BCG Matrix Template

See Securitas's product portfolio through the lens of the BCG Matrix. This framework categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions reveals strategic opportunities and challenges. Knowing this is the key to the success.

This preview is just a glimpse. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Securitas' Technology and Solutions segment showed robust real sales growth, hitting 6% in Q4 2024, boosting higher-margin business. This growth supports Securitas' goal of 8-10% annual average real sales growth in this area. The company aims to be a leading intelligent security solutions partner. Securitas leverages tech and expertise to achieve this.

Securitas' North American security services, a key part of its portfolio, boosted overall performance and operating margins. While there was a minor dip due to an aviation contract ending, the region is still vital for Securitas. The company prioritizes strategic adjustments and quality, not just quantity, in this market. In 2024, North America's organic sales growth was positive, showing resilience.

Securitas' European security services are a "Star" in its BCG matrix due to their strong performance. This segment significantly boosted the company's operating margin. Securitas is actively cutting costs, targeting MSEK 200 in annual savings by late 2025. The company foresees continued growth and improvement in this key region.

STANLEY Security Integration

Securitas' integration of STANLEY Security is a pivotal move, boosting its tech and sharpening its focus on commercial growth. This integration birthed Securitas Technology, a new division poised for expansion. In 2024, Securitas saw organic sales growth of 8%, reflecting the impact of strategic moves like this. The company is now geared towards operational excellence and client satisfaction.

- STANLEY Security integration enhances tech capabilities.

- Securitas Technology division is created for growth.

- Focus shifts to operational delivery and client engagement.

- Securitas' organic sales grew by 8% in 2024.

Sustainability Initiatives

Securitas shines as a "Star" in the BCG Matrix due to its strong sustainability focus. They are recognized as a climate leader, aiming to cut greenhouse gas emissions by 42% by 2030. This commitment places them at the forefront of the electronic security industry. Sustainability is a growing priority for clients, making Securitas' initiatives even more valuable. This strategic move helps to secure their leading position.

- Target: Reduce greenhouse gas emissions by 42% by 2030.

- Industry: Electronic security.

- Client Focus: Sustainability is becoming a top priority.

- Strategic Impact: Strengthens market position.

Securitas excels as a "Star" in the BCG Matrix due to its sustainability efforts. Securitas is a climate leader aiming to reduce greenhouse gas emissions by 42% by 2030. Sustainability is a growing client priority. These moves reinforce Securitas' market position.

| Metric | Details | Impact |

|---|---|---|

| Emission Reduction Target | 42% by 2030 | Strengthens sustainability profile |

| Industry Position | Electronic security leader | Enhances market leadership |

| Client Focus | Sustainability increasingly important | Attracts and retains clients |

Cash Cows

Traditional guarding services are a cash cow for Securitas, generating steady revenue. These services, though not high-growth, are supported by Securitas' strong market position. In 2024, guarding services accounted for a substantial portion of Securitas' revenue, ensuring a reliable income. Securitas enhances these services with technology and specialized options.

Securitas' mobile patrol services provide adaptable, on-demand security responses, enhancing standard security methods. These services enable quick incident intervention, boosting overall security management. Mobile patrols are key to Securitas' broad security offerings. In 2024, Securitas' revenue reached approximately $13.5 billion, with mobile services contributing significantly.

Securitas' alarm monitoring services offer consistent revenue from home and business surveillance. These services leverage the company's security infrastructure and tech expertise. In 2024, Securitas's revenue reached approximately $14.3 billion, with a significant portion from recurring services. They are enhancing services with advanced tech.

Aviation Security Services

Aviation security services were previously part of Securitas' offerings. Securitas divested its airport security business in France. The focus has shifted to higher-growth areas. Securitas aims for long-term sustainability in its strategic objectives. The company's 2024 financial reports reflect these strategic shifts.

- Divestment in France due to limited growth.

- Focus on higher-growth security segments.

- Emphasis on long-term sustainable business practices.

- Strategic realignment reflected in recent financial data.

Risk Management and Consulting Services

Securitas, via Pinkerton, provides enterprise security risk management services, offering a detailed approach to analyze operations and evaluate risk strategies. These services help organizations decrease risk exposure, focusing on asset protection and addressing vulnerabilities. In 2024, the global security services market was valued at approximately $300 billion, showing consistent growth. Securitas partners with organizations for comprehensive management.

- Comprehensive Risk Analysis: Pinkerton conducts thorough assessments.

- Strategic Policy Development: They help create and implement security policies.

- Risk Mitigation: Services reduce exposure to various threats.

- Market Position: Securitas is a major player in this sector.

Securitas' cash cows include traditional guarding, mobile patrols, and alarm monitoring, generating stable revenue. These services benefit from Securitas' strong market presence, providing reliable income streams. In 2024, these segments contributed significantly to Securitas' revenue of approximately $14.3 billion, supporting their financial stability.

| Service | Description | 2024 Revenue Contribution (Approx.) |

|---|---|---|

| Traditional Guarding | Steady, established security services. | Significant portion of overall revenue |

| Mobile Patrols | On-demand security solutions. | Contributed substantially |

| Alarm Monitoring | Recurring revenue from surveillance. | Significant portion of revenue |

Dogs

Securitas divested its French airport security business. This move, announced in 2024, aligns with its strategy. The decision, due to limited growth prospects, aims to boost financial health. The divested unit underperformed, impacting margins negatively. Securitas anticipates a positive margin impact post-divestment.

Securitas is streamlining its operations by exiting low-performing, non-core markets. This strategic move aims to boost profitability and redirect resources. In 2024, Securitas's focus includes market assessments to improve its competitive standing. Exits and restructuring in 2024 impacted about SEK 1.1 billion. This approach strengthens the company's focus on growth areas.

Some security services, like guarding, are commoditized, facing price drops and slim profits. Securitas combats this by using tech and specialized services. They prioritize quality over quantity, especially in Europe. For instance, in 2024, Securitas aimed to boost tech-driven sales, showing their shift.

Regions with Limited Growth Potential

Some geographic areas show restricted growth for Securitas due to specific market issues or strong competition. The company constantly evaluates its business portfolio and footprint to tackle these hurdles. Securitas focuses on achieving its organizational goals while ensuring long-term viability. In 2024, Securitas reported a revenue of approximately SEK 139 billion, demonstrating its scale.

- Market Conditions: Certain regions may face economic downturns.

- Competitive Pressures: Strong local competitors can limit expansion.

- Strategic Adjustments: Securitas adapts to maintain profitability.

- Sustainability: Long-term focus on operational efficiency.

Services Facing Integration Challenges

Securitas' services facing integration hurdles, like the Pinkerton acquisition in 2024, could see short-term underperformance. The firm is prioritizing new systems to fuel growth, anticipating enhancements by 2025. Securitas is dedicated to boosting client services and expanding its technology and solutions division. In 2024, Securitas' organic sales growth was approximately 7%.

- Integration challenges can temporarily impact financial performance.

- New systems are crucial for long-term growth.

- Client service and tech solutions are key focus areas.

- Organic sales growth was about 7% in 2024.

Dogs in the BCG matrix represent business units with low market share in a slow-growth market. These units often require significant investment just to maintain their position. Securitas had divested underperforming units to optimize its portfolio. The aim is to focus on more profitable areas, improving overall financial performance.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Share | Low relative to competitors | Divested French airport security |

| Market Growth | Slow or stagnant | Focus on tech-driven sales |

| Investment Needs | High to maintain position | Restructuring impacted SEK 1.1B |

| Strategic Focus | Divest or reposition | Organic sales growth ~7% |

Question Marks

Securitas is leveraging AI for innovation. AI optimizes security officer routes and boosts efficiency. This creates a balanced security approach. The company is building data-driven innovation. Securitas's revenue in 2023 was approximately SEK 133 billion.

Securitas' cybersecurity services represent a "Question Mark" in its BCG Matrix. The convergence of physical and digital threats creates growth potential. These services help organizations manage digital risks. In 2024, cybersecurity spending is projected to reach $215 billion globally. Securitas is evolving to meet the changing threat environment.

Data centers face immense pressure to ensure secure, continuous operations as digital service demand surges. Securitas can offer comprehensive security solutions, including physical and technological integration for data centers. The company actively analyzes 2025 trends in data center security. In 2024, the global data center security market was valued at $18.7 billion. It's growing rapidly.

Remote Monitoring Services

Securitas is focusing on remote monitoring services, a key area for growth. These services offer clients both cost savings and environmental benefits by reducing energy use and travel. The shift to digital tools enhances security operations, making them more efficient. This move supports sustainability goals and provides effective security solutions.

- Securitas aims to increase recurring revenue from technology and solutions.

- In 2023, Securitas's operating margin reached 6.1%.

- Digital investments are a core component of their strategy.

- Remote services provide client cost savings.

Specialized Security Solutions

Securitas strategically positions its specialized security solutions within its portfolio, recognizing their importance in addressing complex client needs. This focus on specialized services allows Securitas to offer tailored, high-value solutions. The company is actively transforming to become a leading security solutions provider, emphasizing its commitment to innovation. This transformation includes expanding its specialized service offerings to meet evolving market demands.

- Securitas is redefining its security services with a comprehensive offering of specialized services.

- These services are designed to meet the evolving needs of clients.

- The company provides tailored solutions to meet specific client requirements.

- Securitas is transforming into a world-leading security solutions company.

Securitas views cybersecurity as a "Question Mark" due to high growth potential yet uncertain returns. Cybersecurity spending globally is projected to hit $215 billion in 2024. Securitas is evolving to meet this evolving threat.

| Category | Details | 2024 Projection |

|---|---|---|

| Cybersecurity Market | Global Spending | $215 billion |

| Securitas Focus | Evolving to offer cybersecurity solutions | |

| Market Trend | Convergence of physical & digital threats |

BCG Matrix Data Sources

Securitas's BCG Matrix leverages financial reports, market analysis, and expert opinions, offering strategic precision.