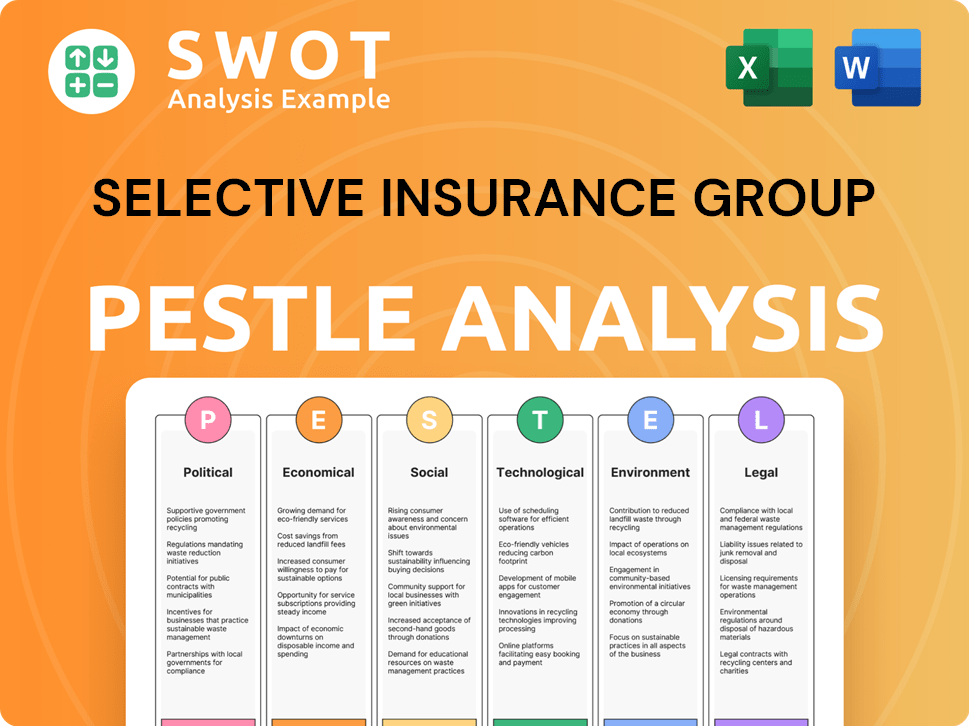

Selective Insurance Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Selective Insurance Group Bundle

What is included in the product

Analyzes macro factors impacting Selective across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version for immediate inclusion in strategic documents.

What You See Is What You Get

Selective Insurance Group PESTLE Analysis

This preview is the complete PESTLE Analysis for Selective Insurance Group. The insights and structure you see here are exactly what you will download. Get immediate access to this professionally researched document after purchase. It is fully formatted, and ready to use immediately.

PESTLE Analysis Template

Explore the external factors influencing Selective Insurance Group with our PESTLE analysis. Uncover political, economic, social, technological, legal, and environmental impacts. Our analysis delivers actionable insights for strategic planning and risk assessment. Get the full PESTLE analysis now for a comprehensive understanding.

Political factors

Selective Insurance Group faces substantial government regulation at both state and federal levels, which significantly affects its operational scope. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) actively updated model laws, impacting how insurers like Selective manage risk and capital. Regulatory shifts can alter policy offerings and pricing strategies. Selective must comply with evolving rules to maintain its market position. The company's ability to navigate and adapt to these changes is critical for its success.

Political stability is crucial for Selective Insurance Group's operations, especially in regions where it offers services. Geopolitical events and changes in government policies can indirectly influence the economic climate. This, in turn, affects insurance demand and investment markets. For example, a stable political environment often supports stronger economic growth. In 2024, the global political landscape continues to evolve, impacting financial markets.

Changes in U.S. trade policies and tariffs can cause inflation. In 2024, the U.S. trade deficit widened, potentially impacting insurance costs. Increased inflation affects loss costs and premiums. Selective must monitor trade policies' financial effects.

Government Spending and Fiscal Policy

Government spending and fiscal policies are crucial for Selective Insurance Group. These policies directly impact economic growth, interest rates, and inflation. For example, in 2024, the U.S. federal budget deficit was around $1.7 trillion, influencing market dynamics. These shifts affect Selective's investment income and customer insurance affordability.

- Federal spending in 2024 was approximately $6.1 trillion.

- The Federal Reserve's monetary policy decisions impact interest rates.

- Inflation rates directly affect insurance claim costs.

- Changes in tax policies can alter disposable income.

Political Contributions and Lobbying

Selective Insurance Group, like other major players in the insurance sector, engages in political contributions and lobbying efforts. These activities are strategic, designed to shape legislation and regulations impacting the insurance industry. A significant portion of these efforts focuses on areas like risk management and financial services. In 2024, the insurance industry spent over $170 million on lobbying.

- Lobbying: $170M (2024)

- Focus: Risk management, financial services.

- Goal: Influence legislation/regulations.

Selective Insurance Group operates under extensive government regulation, adapting to the evolving rules set by bodies like the NAIC. Political stability impacts economic factors. Changes in trade policies affect insurance costs. These political elements critically influence operations.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulation | Influences compliance and strategy | NAIC model law updates ongoing. |

| Political Stability | Indirect economic influence | Geopolitical risks. |

| Trade Policies | Affects costs and inflation | Trade deficit widened. |

Economic factors

Inflation remains a key economic factor, particularly social inflation, which boosts loss costs. Selective Insurance Group faces challenges from rising claims expenses. The company adjusts pricing and underwriting to manage these trends. In 2024, the US inflation rate was around 3.1%.

Fluctuations in interest rates significantly impact Selective's investment income. For instance, in Q4 2023, the Federal Reserve held rates steady, influencing investment returns. Higher rates can boost income; lower rates have the reverse effect. Selective's financial health is closely tied to these rate shifts. As of late 2024, analysts watch rate changes closely.

Economic growth and recession risks are crucial for Selective Insurance Group. Strong economic growth typically boosts demand for insurance products. However, a recession could decrease business activity and personal spending. For instance, in Q4 2023, U.S. GDP growth was 3.4%, but forecasts for 2024 vary. This impacts premium volumes.

Financial Market Performance

The performance of financial markets directly affects Selective Insurance Group. Fluctuations in public debt, equity, and private investment markets influence the value of Selective's investment portfolio and statutory surplus. For example, in 2024, the S&P 500 experienced significant volatility, impacting insurance company investments. Changes in interest rates also affect investment returns and the cost of capital.

- S&P 500 volatility in 2024: +/- 10-15%

- Interest rate impact on investment returns

- Impact on statutory surplus

Supply Chain Disruption

Supply chain disruptions, intensified by global events, can significantly impact Selective Insurance Group. Inflation, often worsened by supply chain issues, directly affects insurance loss costs and premiums. These disruptions can lead to higher prices for materials and labor, increasing the expenses related to claims. For example, the cost of auto parts has risen, impacting claims settlements.

- Inflation in the U.S. reached 3.5% in March 2024, impacting various sectors.

- Supply chain pressures have caused a 10-20% increase in material costs.

- Global conflicts continue to strain supply routes.

Economic factors play a crucial role in Selective Insurance's performance. Inflation, particularly social inflation, influences loss costs and premium adjustments, with the U.S. rate at 3.3% as of May 2024. Interest rate fluctuations significantly impact investment income and investment returns; for example, the 10-year Treasury yield moved between 4.0-4.5% in early 2024. Economic growth forecasts and recession risks also affect demand for insurance, with varying GDP predictions influencing premium volumes.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| Inflation | Boosts loss costs & premiums | 3.3% (May 2024) |

| Interest Rates | Affects investment income | 10-year Treasury yield: 4.0-4.5% |

| Economic Growth | Impacts insurance demand | GDP growth varied, influencing premiums |

Sociological factors

Social inflation, fueled by rising litigation and jury awards, has increased casualty insurance costs. Selective Insurance Group faces higher loss costs due to this trend, requiring pricing adjustments. For example, in 2024, the average jury award in the US hit a record high of $8.8 million, up 12% from 2023. This necessitates strategic reserving practices.

Customer expectations are shifting, with a greater emphasis on digital and seamless service experiences. Selective Insurance is actively adapting to these changes. They are investing in technology to improve both customer and agent interactions. In 2024, digital sales in the insurance sector increased by approximately 15%. Selective aims to meet these demands through an omnichannel strategy.

Demographic shifts significantly impact Selective Insurance. Population growth, aging populations, and migration patterns alter insurance demand. For instance, the U.S. population grew to 334.8 million by 2023. Aging populations increase healthcare and life insurance needs. These trends directly influence risk profiles and product offerings.

Risk Perception and Awareness

Public perception of risks significantly shapes insurance demand and underwriting. Climate change awareness, for example, is rising; in 2024, 68% of U.S. adults believe climate change is a problem. Cybersecurity threats are also a growing concern. Selective Insurance must adapt to these perceptions.

- Climate change-related losses reached $250 billion in 2023.

- Cybersecurity insurance premiums increased by 30% in 2024.

- Public concern about data breaches affects insurance choices.

Workforce and Talent Availability

The insurance sector's success hinges on a skilled workforce. Selective Insurance Group must focus on attracting and keeping top talent. A highly engaged workforce is vital for operational efficiency and future expansion. In 2024, the insurance industry faced a talent shortage, with 40% of companies reporting difficulties in filling key positions.

- Talent shortages impact operational efficiency.

- Employee engagement is crucial for retention rates.

- Competition for talent is intense.

- Investment in training and development is necessary.

Social factors significantly influence Selective Insurance Group’s operations. Customer demand shifts toward digital, reflecting a 15% increase in digital insurance sales in 2024. Demographic changes impact risk profiles; the U.S. population reached 334.8 million by 2023. Public perception of risks shapes insurance needs, with climate change awareness and cybersecurity concerns growing rapidly.

| Factor | Impact | Data (2024/2023) |

|---|---|---|

| Digital Adoption | Customer expectations drive tech investment. | Digital sales up 15% (2024). |

| Demographics | Changes influence product demand. | U.S. population: 334.8M (2023). |

| Risk Perception | Alters underwriting. | Climate losses: $250B (2023); cyber premiums up 30% (2024). |

Technological factors

Technology significantly impacts Selective Insurance Group. Data analytics, AI, and machine learning are transforming insurance. Selective is investing in tech to improve efficiency. In 2024, the insurance tech market is expected to reach $10.1 billion. This investment aims to scale operations and enhance customer service.

Data analytics and predictive modeling are crucial for Selective's risk assessment. They analyze data to improve pricing strategies and manage claims efficiently. For 2024, the insurance industry saw a 7% increase in AI adoption for risk assessment. Selective's use of these tools supports better financial outcomes. This approach is critical for staying competitive in the evolving insurance market.

Artificial Intelligence (AI) and Machine Learning (ML) are transitioning from experimental phases to widespread adoption within the insurance sector, focusing on streamlining operations, cutting expenses, and enhancing underwriting precision. Selective Insurance Group is actively involved in developing and implementing AI applications. The global AI in insurance market is projected to reach $5.8 billion by 2025, according to recent reports.

Cybersecurity

Selective Insurance Group faces growing cybersecurity risks due to its reliance on technology. Protecting sensitive customer data is paramount, as data breaches can lead to significant financial and reputational damage. The insurance industry saw a 40% rise in cyberattacks in 2024, highlighting the urgency for robust defenses. Selective must invest in advanced cybersecurity to safeguard its operations and maintain customer trust.

- Cybersecurity breaches cost the insurance industry an average of $5 million per incident in 2024.

- The global cybersecurity market is projected to reach $345 billion by the end of 2025.

- Data privacy regulations, such as GDPR and CCPA, impose strict compliance requirements.

Technology Infrastructure and Consolidation

Selective Insurance Group is likely influenced by the trend of consolidating technology infrastructure. This move aims to streamline operations and enhance data integration across various platforms. Insurers are increasingly adopting integrated platforms to tackle challenges efficiently. For example, the global InsurTech market is projected to reach $1.4 trillion by 2030.

- Consolidation aims for operational efficiency.

- Integrated platforms are key to data management.

- InsurTech market is growing rapidly.

Selective Insurance Group is navigating rapid tech advancements in the insurance sector. They are focusing on AI, data analytics, and cybersecurity. The insurtech market is poised to reach $1.4 trillion by 2030. Cybersecurity breaches cost an average $5 million per incident in 2024, and the global cybersecurity market will reach $345 billion by the end of 2025.

| Technological Factor | Impact on Selective | Data & Stats (2024/2025) |

|---|---|---|

| AI and Machine Learning | Improves efficiency and precision. | Global AI in insurance market projected to reach $5.8B by 2025. |

| Cybersecurity | Protecting data from breaches. | Insurance industry cyberattacks rose 40% in 2024, costs avg $5M/incident. |

| Tech Infrastructure | Streamlining operations and data. | InsurTech market forecast $1.4T by 2030. |

Legal factors

Selective Insurance Group faces rigorous insurance regulations at both state and federal levels, covering licensing, financial health, and how they treat customers and set prices. These rules are crucial for maintaining market integrity. For example, in 2024, the National Association of Insurance Commissioners (NAIC) updated its model laws to address emerging risks. Changes in these regulations can significantly affect Selective’s operational costs and strategies.

Evolving data privacy laws like GDPR and CCPA significantly impact insurance companies' data handling. Selective Insurance Group must ensure compliance to avoid penalties. In 2024, GDPR fines reached €1.1 billion, emphasizing the importance of robust data protection. Compliance costs are rising, with companies investing heavily in data security.

Adverse legal and judicial rulings can significantly affect Selective Insurance Group. These rulings, particularly those related to liability, can increase loss costs. Social inflation, driven by such rulings, influences reserve adequacy. For instance, in 2024, the insurance industry faced increased litigation costs, impacting profitability. Recent rulings on coverage interpretations have led to higher payouts.

Contract Law and Policy Interpretation

Contract law significantly impacts Selective Insurance Group's operations, especially in interpreting insurance policies. Disputes often arise over policy terms, conditions, and exclusions, influencing coverage and defense obligations. Recent legal trends show increased scrutiny of insurance contracts, potentially affecting claim settlements. In 2024, insurance litigation costs rose, with policy interpretation a key factor.

- 2024 saw a 7% increase in insurance litigation.

- Policy interpretation disputes account for 30% of all insurance lawsuits.

- Selective Insurance allocated $150 million for litigation in 2024.

Tax Laws and Financial Regulation

Changes in tax laws and federal financial regulations are significant for Selective Insurance Group. For example, the 2017 Tax Cuts and Jobs Act significantly impacted corporate tax rates, which directly affected insurers' profitability. Future adjustments to corporate tax rates or tax deductions could alter Selective's financial results. Regulatory reforms, such as those related to capital requirements or cybersecurity, also present challenges and opportunities.

- Corporate tax rate changes can directly impact insurers' net income.

- Regulatory changes, like those from the National Association of Insurance Commissioners (NAIC), affect compliance costs.

- Cybersecurity regulations are increasingly important for protecting sensitive client data.

Selective Insurance Group faces extensive legal challenges. Insurance litigation increased by 7% in 2024. Contractual disputes and interpretations continue to affect financial outcomes. These elements are important to their fiscal health.

| Legal Aspect | Impact | Data (2024) |

|---|---|---|

| Litigation Costs | Financial Strain | $150M allocation |

| Contract Disputes | Coverage Challenges | 30% of lawsuits |

| Regulatory Compliance | Operational Costs | GDPR fines: €1.1B |

Environmental factors

Climate change fuels unpredictable weather, boosting catastrophe frequency and severity. This elevates risks for property and casualty insurers. In 2023, insured losses from U.S. severe storms hit $60 billion. Selective Insurance Group faces rising payouts.

Changes in environmental regulations significantly influence Selective Insurance Group's operations, particularly in commercial insurance. New regulations can redefine insurable risks and introduce liabilities for businesses. For instance, stricter clean-up standards for pollution could increase claims. In 2024, environmental liability claims saw a 15% rise.

Selective Insurance Group faces rising claims costs due to natural disasters and extreme weather. In 2024, insured losses from these events reached $100 billion in the US. Increased frequency of hurricanes and severe storms, as reported by NOAA, directly affects their underwriting. This necessitates higher premiums and stricter risk assessments.

Sustainability Considerations

Sustainability is increasingly important for Selective Insurance Group. Rating agencies and the public are paying closer attention to environmental factors. Selective's handling of environmental risks impacts its reputation and financial ratings. A strong commitment to environmental responsibility is crucial. In 2024, environmental, social, and governance (ESG) assets reached $40.5 trillion globally.

- ESG assets grew by 15% in 2023.

- Companies with high ESG ratings often have lower cost of capital.

- Selective's ESG performance can affect its stock valuation.

- Regulatory changes are increasing ESG reporting requirements.

Risk Mitigation and Adaptation

Selective Insurance Group actively addresses environmental factors by focusing on risk mitigation and adaptation strategies. The company aims to understand and lessen environmental risks, offering customers solutions to mitigate these challenges. Selective is currently adapting its strategies to deal with climate change. In 2024, the insurance industry saw a 15% increase in claims due to severe weather events.

- Risk Assessment: Enhanced models to evaluate climate-related risks.

- Product Innovation: Development of insurance products tailored to climate impacts.

- Customer Support: Providing resources and tools for loss prevention.

- Strategic Adaptation: Adjusting business operations to manage climate risks.

Environmental factors pose significant risks to Selective Insurance Group due to climate change-related disasters and rising claims costs. The industry faced a surge in losses, with insured losses in 2024 reaching $100 billion in the US, according to recent reports. ESG factors are crucial, with global ESG assets at $40.5 trillion, impacting reputation and financial ratings.

| Factor | Impact on Selective | Data (2024/2025) |

|---|---|---|

| Climate Change | Increased claims, higher premiums | US insured losses from disasters: $100B |

| Regulations | Changes insurable risks & liabilities | Environmental liability claims up 15% |

| ESG | Affects reputation, financial ratings | Global ESG assets: $40.5T |

PESTLE Analysis Data Sources

Selective Insurance Group's analysis draws data from financial reports, insurance industry studies, and government regulatory databases. This includes SEC filings, and relevant industry-specific publications.