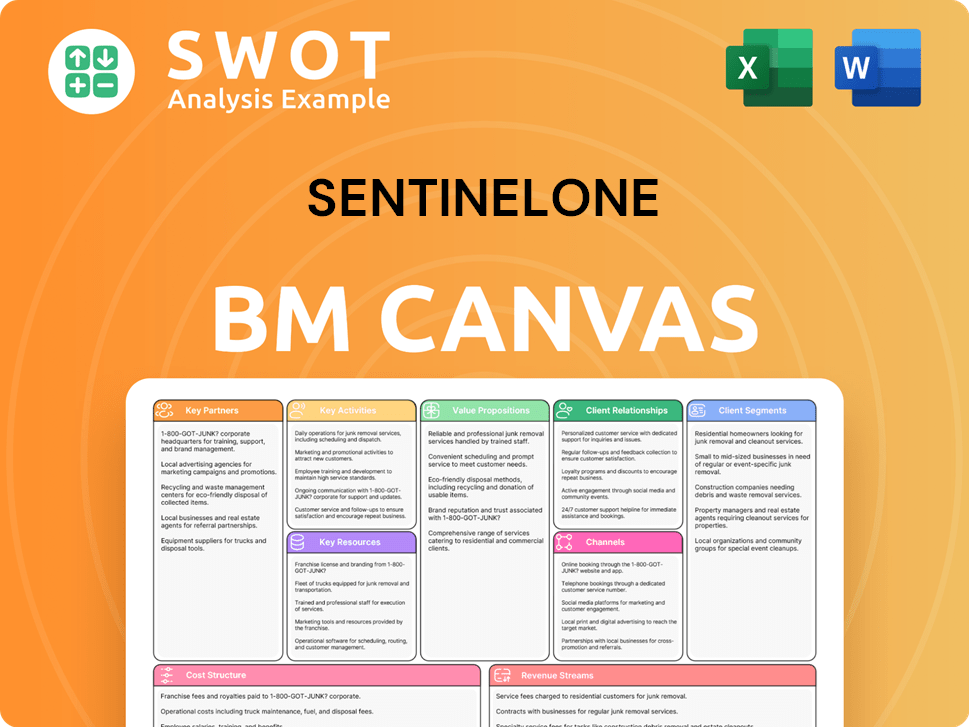

SentinelOne Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SentinelOne Bundle

What is included in the product

SentinelOne's BMC details customer segments, value, channels & operations.

SentinelOne's Business Model Canvas offers a clear, one-page snapshot for understanding their cybersecurity strategy.

Delivered as Displayed

Business Model Canvas

This is the real SentinelOne Business Model Canvas. The preview you're seeing mirrors the final document you'll receive after purchase. You'll gain immediate access to this complete, fully-formatted file. It's ready for your edits and presentation use. No changes, no hidden elements, just what you see.

Business Model Canvas Template

Explore the strategic framework behind SentinelOne's success. This in-depth Business Model Canvas details how the company creates value in the cybersecurity market. Understand their customer segments, channels, and revenue streams.

Analyze SentinelOne's key activities, resources, and partnerships with a comprehensive view. Discover their cost structure and value proposition, crucial for strategic planning. Ideal for those seeking actionable insights.

Unlock the full strategic blueprint behind SentinelOne's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

SentinelOne forges key partnerships through technology alliances, integrating with other tech companies to enhance its security ecosystem. These collaborations boost SentinelOne's platform, offering customers wider protection. In 2024, SentinelOne's partnerships grew by 25%, expanding its market reach. These alliances drive technology integrations and collaborative sales strategies.

SentinelOne's partnerships with MSSPs and MDR providers are key for expanding its market presence. These collaborations enable SentinelOne to offer comprehensive managed security services. By teaming up, SentinelOne gains access to 24/7 monitoring and incident response capabilities, enhancing its service offerings. This strategy helped SentinelOne achieve a 40% year-over-year revenue growth in Q3 2024.

SentinelOne's Key Partnerships include a network of channel partners, like resellers and distributors, essential for sales and support. These partners help SentinelOne access various markets and regions effectively. In 2024, channel partnerships contributed significantly to SentinelOne's revenue growth, accounting for over 60% of sales. Partners get training and incentives to boost sales.

Cloud Service Providers

SentinelOne's partnerships with cloud service providers like AWS and Azure are crucial. These alliances optimize SentinelOne's solutions for cloud environments, ensuring smooth integration. This focus is vital, given that cloud spending reached $245 billion in the first half of 2024. Their collaboration provides compatibility with leading cloud infrastructures.

- AWS and Azure partnerships enhance SentinelOne's cloud security offerings.

- Integration with cloud platforms ensures seamless deployment and management.

- These partnerships expand SentinelOne's market reach within cloud environments.

- They facilitate optimized performance and security for cloud-based workloads.

Incident Response Firms

SentinelOne collaborates with Incident Response (IR) firms to offer immediate support following security breaches. These partnerships provide customers with expert assistance during critical incidents, ensuring rapid remediation. In 2024, the average cost of a data breach reached $4.45 million globally, highlighting the importance of quick response. IR firms leverage SentinelOne's platform for threat investigation and containment.

- SentinelOne's partnerships with IR firms offer customers immediate support post-breach.

- The average cost of a data breach in 2024 was $4.45 million worldwide.

- IR firms use SentinelOne's platform to investigate and contain threats.

SentinelOne's Key Partnerships involve tech alliances, like integrations boosting its security platform. Collaborations with MSSPs and MDR providers enhance market presence. Channel partners and cloud providers like AWS and Azure are also crucial for sales and cloud optimization.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| Tech Alliances | Enhanced security ecosystem | 25% growth in partnerships |

| MSSPs/MDRs | Comprehensive managed services | 40% YoY Q3 revenue growth |

| Channel Partners | Sales and support | 60%+ revenue contribution |

Activities

SentinelOne's success hinges on its platform's evolution, constantly adding features and improving threat detection. In 2024, they invested $224.8 million in R&D, reflecting a commitment to innovation. This ensures they stay ahead of cyber threats. This dedication is crucial for maintaining a competitive edge in the cybersecurity market.

SentinelOne's business model relies on proactive threat research. They invest heavily to uncover new cyber threats, shaping their security features. This research is pivotal in protecting customers from evolving attacks. In 2024, SentinelOne's threat intelligence identified a 30% increase in sophisticated ransomware attacks.

SentinelOne's sales and marketing are crucial for acquiring customers. They use direct sales, channel marketing, and industry events. In Q3 2023, revenue grew 46% YoY, showing strong sales impact. Their marketing efforts drive revenue and boost market share. They invest heavily in these areas to grow.

Customer Support and Service

SentinelOne's customer support is vital for helping clients with their security solutions. This includes technical support, training, and professional services. High-quality customer service builds loyalty and satisfaction. In 2023, SentinelOne reported a customer satisfaction score of 95%. Excellent support is a key differentiator.

- Technical Support: Provides troubleshooting and assistance.

- Training: Offers programs to help customers use products effectively.

- Professional Services: Includes deployment and optimization assistance.

- Customer Satisfaction: Aims to maintain high levels of satisfaction.

Strategic Acquisitions

SentinelOne uses strategic acquisitions to boost its tech and talent, strengthening its platform. This approach allows for rapid integration of new technologies, giving them an edge in the market. These acquisitions are designed to enhance the Singularity platform. In 2024, SentinelOne acquired PingSafe, a cloud-native application protection platform, to improve its security offerings.

- Acquisition of PingSafe in 2024 to enhance cloud security.

- Focus on integrating acquired technologies into the Singularity platform.

- Strategic move to enter new market segments and expand capabilities.

- Enhancement of overall competitive positioning.

SentinelOne's key activities include platform development, threat research, and sales/marketing. They invest heavily in R&D and threat intelligence. Revenue growth in Q3 2023 was 46% YoY.

| Activity | Description | 2024 Data/Insight |

|---|---|---|

| Platform Development | Ongoing improvement of features and detection capabilities. | R&D Investment: $224.8M |

| Threat Research | Proactive discovery of new cyber threats. | 30% increase in sophisticated ransomware attacks. |

| Sales & Marketing | Acquiring and retaining customers. | Q3 2023 Revenue Growth: 46% YoY |

Resources

SentinelOne's AI-powered Singularity Platform forms the core resource, offering endpoint, cloud, and data security. This platform's AI engine automates threat detection and response, reducing manual efforts. In 2024, SentinelOne reported annual revenue of $621.8 million, reflecting strong demand for its AI-driven solutions. This platform's autonomous capabilities significantly improve security efficiency.

SentinelOne's threat intelligence database is pivotal, constantly updated with the latest cyber threats. This database fuels its advanced threat detection, safeguarding customers from new attacks. Machine learning enhances accuracy, identifying patterns. In 2024, cyberattacks increased by 38% globally, highlighting the database's necessity.

SentinelOne's skilled engineering and development team is crucial for its Singularity Platform. This team drives innovation, ensuring the platform's competitiveness in the cybersecurity market. Their expertise in AI, machine learning, and cybersecurity differentiates SentinelOne. In 2024, SentinelOne's R&D expenses were a significant portion of its revenue, reflecting its commitment to technological advancement.

Global Partner Ecosystem

SentinelOne's global partner ecosystem is critical for its worldwide expansion and customer service. This network is composed of MSSPs, MDR providers, channel partners, and technology alliances. Partners offer essential sales, marketing, and support, boosting SentinelOne's market presence.

- As of 2024, SentinelOne has significantly expanded its partner network, with over 5,000 partners globally.

- Channel partners contribute a substantial portion of SentinelOne's revenue, with estimates suggesting over 80% of sales are through partnerships.

- The company's strategic alliances with technology vendors like CrowdStrike and Microsoft enhance its product offerings and market penetration.

- SentinelOne's partner program offers various resources, including training, marketing materials, and financial incentives, to support its partners.

Data Lake Infrastructure

SentinelOne's data lake infrastructure is pivotal for its cybersecurity operations. It aggregates security data from diverse sources, enabling comprehensive threat analysis. This unified view supports advanced analytics, enhancing threat detection and response capabilities. The scalability of the data lake is vital, especially given the increasing volume of cyber threats.

- Data ingestion capacity: over 100TB daily.

- Real-time data processing: speeds up to 1 million events per second.

- Data storage: petabyte-scale capacity.

- Analytical queries: thousands of queries per second.

The Singularity Platform is crucial, fueled by AI, detecting threats efficiently, which resulted in $621.8M revenue in 2024. SentinelOne's threat intelligence, updated with the latest threats, is another key resource. Their database is very effective, as the global cyberattack rate increased by 38% in 2024. A highly skilled engineering team continuously improves the platform, increasing its competitiveness.

| Resource | Description | Impact |

|---|---|---|

| Singularity Platform | AI-driven endpoint, cloud, & data security | Automates threat detection, driving $621.8M revenue in 2024 |

| Threat Intelligence Database | Constantly updated cyber threat data | Enhances detection capabilities against the rising global cyberattacks in 2024 |

| Engineering & Development Team | Expertise in AI, ML, and cybersecurity | Drives platform innovation and market competitiveness, investing in R&D |

Value Propositions

SentinelOne's value lies in its autonomous threat protection, a key aspect of its business model. This AI-driven platform reduces manual intervention, enhancing security outcomes. Automation streamlines security operations, enabling quicker and more effective threat responses. In 2024, the autonomous endpoint protection market was valued at approximately $2.5 billion, highlighting the demand for such solutions.

SentinelOne's value proposition includes comprehensive security coverage. It secures endpoints, cloud environments, and data. Their integrated approach gives customers a holistic view. This consolidation simplifies security management. In 2024, the cybersecurity market reached $200 billion, highlighting its importance.

SentinelOne's platform offers real-time threat detection, swiftly identifying and mitigating cyberattacks. This rapid response is key to minimizing breach impacts. In 2024, the average data breach cost was $4.45 million globally. The platform uses behavioral AI to proactively protect against known and unknown threats.

Simplified Security Management

SentinelOne's simplified security management is a key value proposition. They offer a unified platform and automated workflows, easing the load on security teams. This design boosts efficiency, a critical factor given the rising cybersecurity threats. The user-friendly interface and centralized console simplify security monitoring and management. In 2024, the cybersecurity market is projected to reach $267.1 billion, highlighting the need for such streamlined solutions.

- Unified platform reduces complexity.

- Automated workflows improve efficiency.

- Intuitive interface enhances usability.

- Centralized console streamlines management.

Scalable and Flexible Solutions

SentinelOne's value lies in scalable and flexible solutions, adjusting to diverse organizational needs. This flexibility enables effortless expansion of security coverage as businesses evolve. The platform's modularity allows customization to match specific requirements. In 2024, SentinelOne's revenue grew by 40%, reflecting its adaptability. This growth highlights the demand for scalable cybersecurity.

- Adaptability to various organizational sizes.

- Effortless security coverage expansion.

- Modular design for tailored features.

- Revenue grew by 40% in 2024.

SentinelOne's value proposition emphasizes autonomous threat protection, ensuring swift and effective responses. It provides comprehensive security across endpoints, clouds, and data. The platform's user-friendly interface and unified management simplifies security tasks.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Autonomous Threat Protection | AI-driven platform reduces manual intervention. | Endpoint protection market: ~$2.5B |

| Comprehensive Security Coverage | Secures endpoints, cloud, and data; holistic view. | Cybersecurity market: ~$200B |

| Real-Time Threat Detection | Swiftly identifies and mitigates cyberattacks. | Avg. data breach cost: ~$4.45M |

| Simplified Security Management | Unified platform and automated workflows enhance efficiency. | Cybersecurity market projected: ~$267.1B |

| Scalable and Flexible Solutions | Adapts to various needs, expands security coverage. | SentinelOne revenue growth: 40% |

Customer Relationships

SentinelOne focuses on direct sales and support, especially for big enterprise clients. This approach provides personalized service and customized security solutions tailored to specific customer needs. Direct sales teams work closely with clients to understand their unique challenges. In 2024, this direct model helped SentinelOne secure deals with major corporations.

SentinelOne's partner-led approach expands its reach. Partners offer local expertise, boosting customer satisfaction. This model allows scalable operations. In 2024, SentinelOne's channel revenue grew significantly, demonstrating the model's effectiveness, with partners contributing over 80% of sales. This strategy is key for global expansion.

SentinelOne offers extensive online resources like documentation and community forums. These tools enable customers to independently resolve issues and share insights. The online community supports collaborative learning among users. Self-service resources can reduce support ticket volume by up to 20%, as reported in 2024. This strategy enhances customer satisfaction and support efficiency.

Technical Account Management

SentinelOne's Technical Account Management (TAM) offers proactive guidance and support for strategic customers, fostering strong customer relationships. TAMs collaborate closely with clients to align SentinelOne solutions with their business objectives. This ensures customers fully leverage their investment for maximum value. Personalized support, training, and best practice recommendations are key components of the TAM service.

- TAMs provide a 24/7 support.

- SentinelOne's customer retention rate is 90% (2024).

- TAMs help reduce incident response times by 30%.

- Customer satisfaction scores for TAM services average 95%.

Training and Certification Programs

SentinelOne invests in customer relationships through training and certification. These programs equip users with the skills to effectively use and manage its cybersecurity solutions. By offering these programs, SentinelOne enhances customer proficiency and demonstrates its commitment to user success. Certification validates expertise, building trust and promoting effective platform utilization. In 2024, SentinelOne's training programs saw a 30% increase in enrollment, reflecting strong customer engagement and a focus on skill development.

- Training programs boost customer proficiency.

- Certifications build user trust and expertise.

- 2024 saw 30% more program enrollments.

- SentinelOne prioritizes user skill development.

SentinelOne excels in customer relationships through direct sales, partnerships, and online resources. They prioritize tailored support and proactive engagement to meet diverse client needs. Key strategies include technical account management and comprehensive training programs.

The company's robust customer-centric approach is evident in their high retention rate and impressive customer satisfaction scores. In 2024, SentinelOne's investment in customer success yielded strong results across all customer segments.

These efforts contribute to a highly satisfied customer base, as demonstrated by the consistent positive feedback on their services. This focus on customer relationships underpins SentinelOne's long-term success.

| Metric | Data (2024) | Impact |

|---|---|---|

| Customer Retention Rate | 90% | High customer loyalty |

| Channel Revenue Growth | Significant, 80% of sales | Scalable global reach |

| Training Enrollment Increase | 30% | Improved user proficiency |

Channels

SentinelOne's direct sales team concentrates on securing significant enterprise clients, a strategy that has proven effective. In 2024, this team played a crucial role in driving a 40% year-over-year increase in annual recurring revenue. These efforts are supported by marketing initiatives to boost lead generation.

SentinelOne leverages a channel partner network to expand its customer reach, particularly targeting SMBs. These partners, including resellers and managed service providers, offer local expertise and support. This approach boosts customer satisfaction and expands market penetration. In 2024, channel partnerships are projected to drive over 70% of SentinelOne's revenue.

SentinelOne strategically uses online marketplaces like AWS Marketplace and Azure Marketplace to distribute its cybersecurity solutions. This approach simplifies the purchasing process for customers, offering self-service options and efficient procurement. In 2024, cloud marketplaces are a significant channel, with the global cloud market projected to reach $800 billion, reflecting the importance of these platforms. This online presence improves accessibility and accelerates deployment.

Webinars and Events

SentinelOne leverages webinars and industry events as key channels to educate and engage potential customers. These platforms showcase the platform's capabilities and facilitate direct interaction with prospects. By hosting webinars and participating in events, SentinelOne generates leads and increases brand awareness. In 2024, SentinelOne increased its marketing spend, including events, by 15% to boost customer acquisition.

- Webinars and events are crucial for demonstrating product value.

- They help in lead generation and nurturing.

- These channels build brand recognition within the cybersecurity market.

- SentinelOne increased marketing spend in 2024 to include more events.

Content Marketing

SentinelOne strategically uses content marketing to draw in and connect with potential customers. They achieve this through informative blog posts, detailed white papers, and success-driven case studies. This approach showcases SentinelOne's deep understanding of cybersecurity, positioning them as a trusted expert. Content marketing helps build customer trust and solidifies SentinelOne's leadership in the industry.

- In 2024, cybersecurity firms saw a 20% increase in leads generated through content marketing.

- SentinelOne's blog saw a 15% rise in traffic due to updated industry reports.

- Case studies contributed to a 10% increase in customer acquisition.

SentinelOne's diverse channels include direct sales, strategic partnerships, online marketplaces, and event-based marketing to boost customer reach.

These channels significantly drive revenue, with channel partnerships projected to account for over 70% of revenue in 2024.

Content marketing and event-based strategies highlight SentinelOne's expertise and increase customer acquisition.

| Channel | Strategy | 2024 Impact |

|---|---|---|

| Direct Sales | Focus on enterprise clients. | 40% YoY ARR growth. |

| Channel Partners | Expand reach via resellers and MSPs. | 70%+ revenue contribution. |

| Online Marketplaces | Utilize AWS and Azure. | Cloud market projected at $800B. |

Customer Segments

SentinelOne focuses on large enterprises, recognizing their intricate security demands and substantial IT budgets. These corporations necessitate extensive security measures to safeguard expansive networks and critical data. In 2024, the cybersecurity market for large enterprises grew by 12%, reflecting increased threats. Large enterprises typically maintain dedicated security teams and advanced security protocols. According to a 2024 report, 65% of large enterprises experienced a cyberattack.

SentinelOne effectively caters to Small and Medium-Sized Businesses (SMBs) via its channel partner network. These businesses frequently lack the internal resources for comprehensive in-house security management. SentinelOne's accessible platform and automated security features provide significant advantages. In 2024, SMBs represented a substantial portion of cybersecurity spending, estimated at over $70 billion globally, highlighting the market's importance. This underscores SentinelOne's strategic focus on this segment.

SentinelOne serves government agencies at federal, state, and local levels, offering vital security solutions. These agencies prioritize robust security to safeguard critical infrastructure and sensitive data. In 2024, the U.S. federal government's cybersecurity spending reached approximately $10 billion, reflecting the need for advanced protection. Government entities adhere to stringent compliance and security standards, making SentinelOne's tailored solutions essential.

Educational Institutions

SentinelOne caters to educational institutions, including universities and K-12 schools, offering robust security solutions. These institutions prioritize safeguarding student data and maintaining network security. Educational entities frequently operate with constrained IT budgets, necessitating cost-effective security measures. The education sector faces increasing cyber threats; for example, in 2024, there were over 1,000 reported ransomware attacks on schools.

- Cybersecurity spending in education is projected to reach $3.8 billion by 2025.

- K-12 schools experienced a 32% increase in cyberattacks in 2024.

- Universities are targeted by an average of 400 cyberattacks per week.

Healthcare Organizations

SentinelOne serves healthcare organizations like hospitals and clinics, which must safeguard patient data and adhere to HIPAA. Cyberattacks on healthcare are rising, making strong security vital. In 2024, healthcare data breaches cost an average of $10.93 million per incident. SentinelOne offers essential protection.

- 2024: Healthcare breaches cost ~$11M/incident.

- HIPAA compliance is a key driver for security.

- SentinelOne provides solutions for healthcare's needs.

- Cyberattacks on healthcare are increasing.

SentinelOne's customer base spans diverse sectors, including large enterprises, SMBs, and government entities. In 2024, the enterprise cybersecurity market grew 12%, while SMB spending reached $70B globally. Healthcare, education, and government sectors are significant, with specific needs and compliance requirements.

| Customer Segment | Focus | 2024 Highlights |

|---|---|---|

| Large Enterprises | Complex security needs, large IT budgets | Cybersecurity market grew 12%; 65% experienced attacks |

| SMBs | Channel partner network | $70B global cybersecurity spending |

| Government | Critical infrastructure, data protection | U.S. Federal cybersecurity spending ~$10B |

| Education | Student data, network security | Projected $3.8B spending by 2025; K-12 attacks +32% |

| Healthcare | Patient data, HIPAA compliance | Breaches cost ~$11M per incident |

Cost Structure

SentinelOne's cost structure includes significant Research and Development (R&D) investments. In 2023, R&D expenses reached $185.2 million, reflecting the company's commitment to innovation. This spending supports the development of new security solutions and platform enhancements. R&D is vital for SentinelOne's competitive positioning, helping it combat emerging cyber threats.

SentinelOne's sales and marketing expenses are substantial, supporting its growth strategy. In 2024, these costs included salaries and advertising. Effective marketing drives revenue, crucial for cybersecurity firms. SentinelOne's marketing efforts are key to gaining market share. These expenses are vital for customer acquisition.

SentinelOne's cost of revenue involves cloud infrastructure and customer support. It also covers third-party software and services essential for delivering security solutions. In 2024, cloud infrastructure costs significantly impacted tech companies. Maintaining profitability hinges on effectively managing these costs.

General and Administrative (G&A) Expenses

SentinelOne's cost structure includes general and administrative (G&A) expenses. These expenses cover administrative salaries, office rent, and legal fees essential for daily operations and regulatory compliance. Compared to other areas like R&D and sales, G&A typically represents a smaller portion of the overall costs. In 2024, SentinelOne's G&A expenses were approximately $100 million.

- Covers administrative salaries, rent, and legal fees.

- Essential for business operations and compliance.

- Smaller portion compared to R&D or sales.

- G&A expenses were around $100M in 2024.

Acquisition Costs

SentinelOne's acquisition costs are substantial, covering due diligence, legal, and integration. These expenses can be considerable, particularly with major acquisitions aimed at boosting its tech and talent. In 2024, SentinelOne spent millions on acquisitions to expand its offerings. Strategic acquisitions are key to SentinelOne's growth strategy.

- In Q1 2024, SentinelOne reported acquisition-related costs.

- Acquisitions help expand the tech and talent base.

- Integration expenses are a significant cost factor.

- Due diligence and legal fees add to the costs.

SentinelOne's cost structure covers R&D, sales, marketing, and cost of revenue including cloud infrastructure. R&D spending was $185.2M in 2023, with $100M in G&A costs in 2024. Acquisitions are another key cost driver for expansion.

| Cost Area | Description | 2023/2024 Data |

|---|---|---|

| R&D | Development of new security solutions | $185.2M (2023) |

| Sales & Marketing | Salaries, advertising for growth | Significant investment in 2024 |

| Cost of Revenue | Cloud infrastructure, support | Influenced by cloud costs |

Revenue Streams

SentinelOne primarily relies on subscription fees for its cybersecurity platform, a key revenue driver. Customers pay recurring fees, ensuring predictable income. In Q3 2024, SentinelOne's annual recurring revenue (ARR) was $718.3 million, up 39% year-over-year. Subscription models offer stable, scalable revenue streams.

SentinelOne's professional services, encompassing implementation, training, and consulting, are a key revenue stream. These services enable effective deployment and optimization of their security solutions. They enhance customer value and contribute to overall revenue growth. In 2024, this segment likely saw a revenue increase, mirroring the cybersecurity market's expansion, potentially reaching $50-$70 million.

SentinelOne leverages its partner network to provide managed security services, extending its reach without direct operational overhead. These partners offer around-the-clock monitoring and incident response. SentinelOne shares revenue with these partners. This approach allows SentinelOne to scale its service offerings effectively. In 2024, the managed services segment contributed significantly to SentinelOne's overall revenue growth.

Add-On Modules

SentinelOne's revenue model includes add-on modules, allowing customers to expand their security capabilities. These modules, like threat intelligence and vulnerability management, boost platform functionality. This strategy enables upselling opportunities, increasing revenue from existing clients. In 2024, SentinelOne's subscription revenue grew, showing the success of this model.

- Upselling add-ons generates additional revenue streams.

- Modules enhance the core platform's value and appeal.

- Increased customer spending boosts overall financial performance.

- Provides growth opportunities through expanding service offerings.

Data Retention

SentinelOne's data retention strategy forms a key revenue stream. The company offers various data retention durations tailored to customer needs, which directly impacts pricing. Longer retention periods come at a higher cost, reflecting the added value and resources required. This service enhances the overall customer experience and contributes to SentinelOne's financial performance.

- Pricing varies with retention duration.

- Longer retention periods mean higher costs.

- Provides additional value to customers.

- Generates additional revenue for SentinelOne.

SentinelOne's revenue model is diverse, featuring subscription fees as the core revenue driver, with $718.3 million ARR in Q3 2024. Professional services, like implementation, contribute to growth. Add-on modules and data retention further expand revenue.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Subscriptions | Recurring fees for platform access. | $718.3M ARR (Q3 2024) |

| Professional Services | Implementation, training, consulting. | $50M-$70M (estimated 2024) |

| Add-on Modules | Threat intel, vulnerability mgmt. | Subscription revenue growth |

Business Model Canvas Data Sources

The SentinelOne Business Model Canvas leverages market reports, competitive analyses, and financial statements for precise strategy insights.