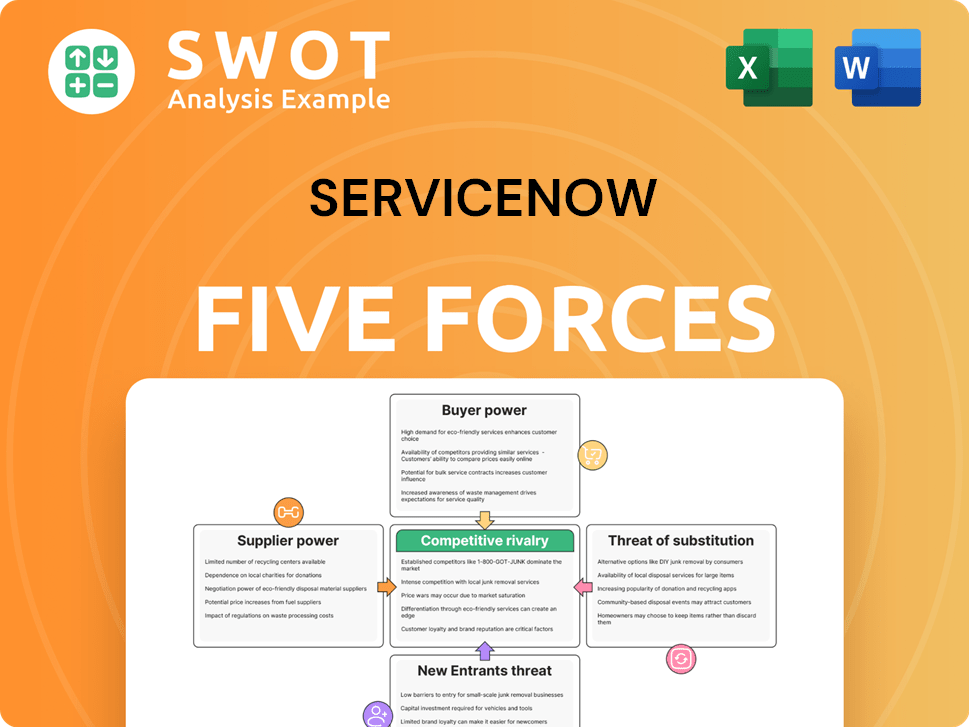

ServiceNow Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ServiceNow Bundle

What is included in the product

Tailored exclusively for ServiceNow, analyzing its position within its competitive landscape.

A clear, one-sheet summary of all five forces—perfect for quick decision-making.

Full Version Awaits

ServiceNow Porter's Five Forces Analysis

This ServiceNow Porter's Five Forces analysis preview mirrors the complete document. It offers a comprehensive look at competitive forces. You'll receive this same analysis instantly upon purchase. The document is fully formatted and ready for immediate use. No changes needed!

Porter's Five Forces Analysis Template

ServiceNow navigates a dynamic industry, influenced by key forces. Buyer power, shaped by enterprise IT demands, exerts considerable influence. Supplier concentration, particularly of skilled talent, impacts operations. The threat of new entrants, while moderate, keeps ServiceNow innovating. Substitute solutions, like low-code platforms, present a challenge. Finally, competitive rivalry is intense within the IT service management (ITSM) space.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ServiceNow’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ServiceNow's reliance on cloud providers like AWS, Azure, and Google Cloud gives these suppliers some bargaining power. This dependency can influence ServiceNow's infrastructure costs. In 2024, AWS, Azure, and Google Cloud controlled a significant portion of the cloud market. For example, AWS held about 32% of the market share in Q4 2024.

ServiceNow's alliances, such as those with Nvidia, Microsoft, and Google, are vital for integrating AI and other technologies. These partnerships are essential for their service offerings. However, ServiceNow's dependency on these suppliers for critical components could strengthen the bargaining power of these suppliers. In 2024, the global AI market is projected to reach $200 billion, which can create a competitive environment for ServiceNow.

ServiceNow depends on specialized software licenses and hardware. For example, in 2024, software costs represented a significant portion of IT budgets. If these suppliers, such as those providing cloud infrastructure, consolidate or increase prices, ServiceNow's operational expenses will rise. This can squeeze profit margins, impacting their financial performance and potentially, their competitive pricing.

Talent Acquisition

The bargaining power of suppliers in talent acquisition significantly impacts ServiceNow. The availability of skilled developers and IT professionals specializing in the ServiceNow platform is crucial for project success. A scarcity of qualified personnel could lead to increased labor costs, affecting project budgets and timelines. According to a 2024 survey, the demand for ServiceNow specialists has increased by 20% year-over-year. This rise puts upward pressure on salaries and consulting fees.

- High Demand: ServiceNow skills are in high demand, creating supplier power.

- Cost Impact: Shortages increase labor costs, affecting project economics.

- Competitive Market: Firms compete for talent, influencing contract terms.

- Strategic Importance: Skilled staff are key to implementation success.

Cybersecurity and Compliance Vendors

ServiceNow's cybersecurity and compliance tools heavily depend on third-party vendors. The rising complexity of cyber threats and changing regulations can boost these vendors' influence. This reliance potentially elevates their bargaining power, impacting ServiceNow's costs and operational flexibility. As of 2024, the cybersecurity market is projected to reach $300 billion, reflecting the significance of these vendors.

- Market size: The global cybersecurity market is estimated to reach $300 billion in 2024.

- Regulatory changes: Increased compliance demands strengthen vendor leverage.

- Threat landscape: Sophisticated threats drive reliance on specialized vendors.

- Cost implications: Higher vendor power can lead to increased costs for ServiceNow.

ServiceNow's suppliers, including cloud providers and tech partners, hold considerable bargaining power. This influence affects ServiceNow's infrastructure costs and operational flexibility. As of Q4 2024, AWS held approximately 32% of the cloud market share, highlighting the significant vendor impact.

| Supplier Type | Impact | 2024 Data |

|---|---|---|

| Cloud Providers | Infrastructure Costs | AWS holds ~32% cloud market share in Q4 2024 |

| AI Partners | Integration and Costs | Global AI market projected at $200B in 2024 |

| IT Talent | Labor Costs, Project Timelines | Demand for ServiceNow specialists up 20% YoY in 2024 |

Customers Bargaining Power

ServiceNow's customer base includes many large enterprises, with a significant presence in the Fortune 500. These major clients wield considerable bargaining power, especially when negotiating large contracts. For example, in 2024, contracts with Fortune 500 clients accounted for a substantial portion of ServiceNow's revenue. This power stems from their ability to influence pricing and service terms.

Customers of ServiceNow possess significant bargaining power due to the availability of alternatives. Competitors such as Salesforce, BMC, and Atlassian offer ITSM and cloud-based workflow solutions. This competitive landscape gives customers choices, increasing their ability to negotiate better terms. For instance, Salesforce reported $9.1 billion in revenue for Q4 2023, demonstrating the scale of competition ServiceNow faces.

Switching costs are a significant factor in ServiceNow's market position. Migrating data and retraining staff to a new platform is expensive. This complexity reduces buyer power, as customers are somewhat locked in. ServiceNow's subscription model, as of Q4 2023, generated $2.44 billion in revenue, showing customer stickiness.

Pricing and Customization

Customers of ServiceNow have considerable bargaining power due to their ability to negotiate pricing and customization. Larger clients, in particular, can leverage their scale to influence pricing and tailor solutions to their specific needs. This power is amplified by the availability of alternative software solutions, which gives customers leverage in price discussions. For example, in 2024, ServiceNow's enterprise solutions saw average contract values fluctuate, with larger clients often securing more favorable terms.

- Negotiated Pricing: Large clients often negotiate discounts.

- Customization: Tailoring solutions increases bargaining power.

- Market Alternatives: Competition provides customers leverage.

- Contract Values: Fluctuated in 2024 based on client size.

Impact on Business Operations

ServiceNow's platform is crucial for many companies' IT, HR, and customer service operations. This reliance can lessen customers' price sensitivity, thereby reducing their bargaining power. However, the increasing availability of alternative solutions could shift this dynamic. In 2024, ServiceNow's revenue grew by 24%, reflecting strong customer retention.

- High customer dependency lessens bargaining power.

- Availability of alternatives could increase customer power.

- ServiceNow's 2024 revenue growth: 24%.

- Customer retention remains strong.

ServiceNow's customer power is influenced by factors like contract sizes and market competition. Large enterprises, especially Fortune 500 clients, can negotiate favorable terms, impacting pricing. The presence of competitors like Salesforce gives customers leverage, affecting ServiceNow's revenue.

| Factor | Impact | Data |

|---|---|---|

| Large Contracts | Increased Bargaining Power | 2024: Contract values fluctuated. |

| Market Alternatives | More Customer Options | Salesforce Q4 2023 Revenue: $9.1B |

| Customer Dependency | Reduced Bargaining Power | 2024 Revenue Growth: 24% |

Rivalry Among Competitors

ServiceNow faces fierce competition in the cloud-based solutions market. Competitors like BMC, Salesforce, Microsoft, and Atlassian challenge its market position. The competitive landscape is dynamic, with constant innovation and pricing pressures. In 2024, Microsoft's cloud revenue reached $120 billion, intensifying the rivalry.

In the cloud-based service management sector, innovation is swift. ServiceNow rivals invest heavily; in 2024, R&D spending hit $1.6 billion. Constant feature updates and AI integration are critical. Failing to innovate means losing market share. Companies like Atlassian also push innovation.

ServiceNow faces intense price competition, especially from rivals like Salesforce. Aggressive pricing strategies are common in the SaaS market, which is designed to attract and retain customers. This puts pressure on ServiceNow's pricing models. For instance, in 2024, Salesforce offered discounts to win clients, impacting ServiceNow's ability to maintain high profit margins.

AI Integration

The integration of AI and machine learning is intensifying competitive rivalry. ServiceNow and its competitors are fiercely investing in AI to boost platform features like predictive analytics and virtual agents. This race aims to improve automation and user experience. The market for AI in enterprise software is projected to reach $170 billion by 2027, indicating significant growth.

- ServiceNow's AI-powered features include virtual agents and predictive intelligence.

- Competitors like Microsoft and Salesforce are also heavily investing in AI.

- The AI market in enterprise software is expected to grow rapidly.

- Investments in AI aim to enhance automation and user experience.

Expansion into CRM

ServiceNow's foray into the CRM market directly challenges Salesforce, intensifying competition. Both companies are now battling for market share in the enterprise solutions sector, driving up the stakes. This expansion has led to a more aggressive environment, impacting pricing and innovation. The rivalry is evident in their strategic moves and product offerings, aiming for customer acquisition and retention.

- Salesforce's revenue in FY2024 was $34.86 billion, while ServiceNow's was $9.7 billion.

- The CRM market is estimated to reach $120 billion by 2025, increasing the importance of this rivalry.

- ServiceNow's CRM growth rate is around 25% annually, indicating a strong push.

- Salesforce and ServiceNow have both increased their R&D spending by over 15% to maintain their competitive edge.

Competitive rivalry for ServiceNow is intense, with major players like Microsoft and Salesforce vying for market share. Innovation, particularly in AI, is a key battleground, with significant R&D investments. Pricing pressures and CRM market expansion further fuel this rivalry.

| Aspect | Details | Data |

|---|---|---|

| Key Competitors | Major rivals | Microsoft, Salesforce, Atlassian |

| R&D Spending (2024) | Investment in innovation | ServiceNow $1.6B, Salesforce +15% |

| CRM Market | Projected size | $120B by 2025 |

SSubstitutes Threaten

Organizations face the threat of substitute ITSM solutions, including BMC, Atlassian (Jira Service Management), and Freshservice. These competitors offer comparable service management capabilities, potentially attracting customers seeking alternatives. In 2024, Atlassian's revenue grew by 24%, showing strong market presence. This indicates a real threat to ServiceNow's market share.

Some organizations might stick with manual processes like spreadsheets instead of ServiceNow. This is a substitute, particularly for smaller businesses. However, manual methods often lead to inefficiencies and errors. The global market for business process automation was valued at $11.78 billion in 2024. This figure highlights the growing adoption of automated solutions.

Low-code/no-code platforms pose a threat to ServiceNow by enabling the creation of custom solutions. These platforms allow businesses to build apps and automate workflows. The market for low-code development is projected to reach $29.6 billion by 2024. This could reduce ServiceNow's market share.

Cloud-Based Solutions

Cloud-based solutions pose a significant threat to ServiceNow. Competitors like Microsoft Dynamics 365 and Salesforce Service Cloud offer similar features. These alternatives can fulfill some of the functions that ServiceNow provides. This competition pressures ServiceNow to innovate and maintain competitive pricing.

- Microsoft's cloud revenue reached $35.1 billion in Q1 2024.

- Salesforce generated $9.13 billion in revenue in Q1 FY2025.

- ServiceNow's Q1 2024 revenue was $2.5 billion.

AI-Driven Automation

The rise of AI-driven automation poses a threat to ServiceNow. Advancements in AI could offer alternatives for automating tasks, potentially reducing reliance on ServiceNow's platform. For example, the AI market is projected to reach $200 billion by 2025. This could lead to some companies opting for specialized AI tools instead of ServiceNow.

- AI-powered automation tools are rapidly evolving.

- Specialized AI solutions may offer cost advantages.

- Companies might choose point solutions over integrated platforms.

- The market for AI automation is expected to grow significantly.

The threat of substitutes for ServiceNow is considerable, with numerous alternatives vying for market share. Competitors such as BMC, Atlassian, and Freshservice offer similar ITSM capabilities, impacting ServiceNow. Low-code platforms and cloud-based solutions like Microsoft Dynamics 365 and Salesforce also provide viable alternatives. AI-driven automation further intensifies this threat landscape.

| Substitute Type | Examples | Market Impact (2024) |

|---|---|---|

| ITSM Competitors | BMC, Atlassian (Jira), Freshservice | Atlassian revenue growth: 24% |

| Manual Processes | Spreadsheets, Manual workflows | Business Process Automation Market: $11.78B |

| Low-Code/No-Code | Appian, Mendix | Market projection: $29.6B |

| Cloud Solutions | Microsoft Dynamics 365, Salesforce Service Cloud | Microsoft cloud revenue (Q1): $35.1B, Salesforce (Q1 FY25): $9.13B |

| AI-Driven Automation | Specialized AI tools | AI Market projection: $200B (by 2025) |

Entrants Threaten

High capital needs are a significant barrier. ServiceNow faces this as new entrants need substantial funds. In 2024, cloud infrastructure spending reached nearly $300 billion globally. Newcomers must match ServiceNow's investment in R&D, which was over $2 billion in 2023, to compete effectively.

ServiceNow's strong brand and large customer base, including over 80% of the Fortune 500, present a significant barrier. New entrants face an uphill battle in gaining customer trust and market share. For example, in 2024, ServiceNow's revenue reached $9.5 billion, illustrating its established market presence. This dominance makes it difficult for new competitors to quickly establish themselves.

The software industry, like ServiceNow's, faces high technological and compliance hurdles. New entrants often require substantial R&D investments to compete. In 2024, tech companies spent billions on R&D, with some, like Google, allocating over $30 billion. This high barrier limits the number of new competitors.

Network Effects

ServiceNow's robust network effects and strategic partnerships significantly deter new competitors. The established ecosystem, including numerous integrations and a vast user base, creates a substantial barrier to entry. New entrants face the challenge of replicating ServiceNow's extensive network and existing relationships to gain market share. This advantage is reflected in ServiceNow's financial performance, showing its resilience against new competitors.

- ServiceNow's revenue for 2023 was $9.53 billion, a 24% increase year-over-year, highlighting its strong market position.

- The company has over 7,700 customers, demonstrating a wide user base that enhances its network effects.

- ServiceNow's strategic partnerships with major tech companies further strengthen its competitive advantage.

- The platform's high customer retention rate (around 99%) indicates the difficulty for new entrants to displace ServiceNow.

Specialized Expertise

Success in the ServiceNow market hinges on specialized expertise. New entrants need deep knowledge of cloud computing, AI, and business processes to compete effectively. The barrier to entry is high due to the complexity of these technologies. Startups often struggle to match the incumbent's expertise, giving them a competitive edge.

- Cloud computing market size was valued at USD 545.8 billion in 2023 and is projected to reach USD 1,698.7 billion by 2029.

- The global AI market is expected to reach USD 1.81 trillion by 2030.

- ServiceNow's revenue in 2023 was approximately $9.5 billion.

New entrants to ServiceNow's market face significant obstacles. High capital requirements, such as those for R&D, pose a major hurdle. Established brands, like ServiceNow, with $9.5 billion in revenue in 2024, further complicate market entry. Technical and compliance challenges demand substantial investment, limiting new competitors.

| Barrier | Description | Impact |

|---|---|---|

| Capital Needs | High initial investments in infrastructure, R&D | Limits the number of potential entrants |

| Brand Recognition | ServiceNow's strong brand and customer base | Makes it difficult for new entrants to gain trust |

| Tech & Compliance | Significant investment in R&D and compliance | Increases entry costs and time |

Porter's Five Forces Analysis Data Sources

We leverage diverse data sources including ServiceNow's financial reports, market research, and industry analysis publications for a comprehensive assessment.