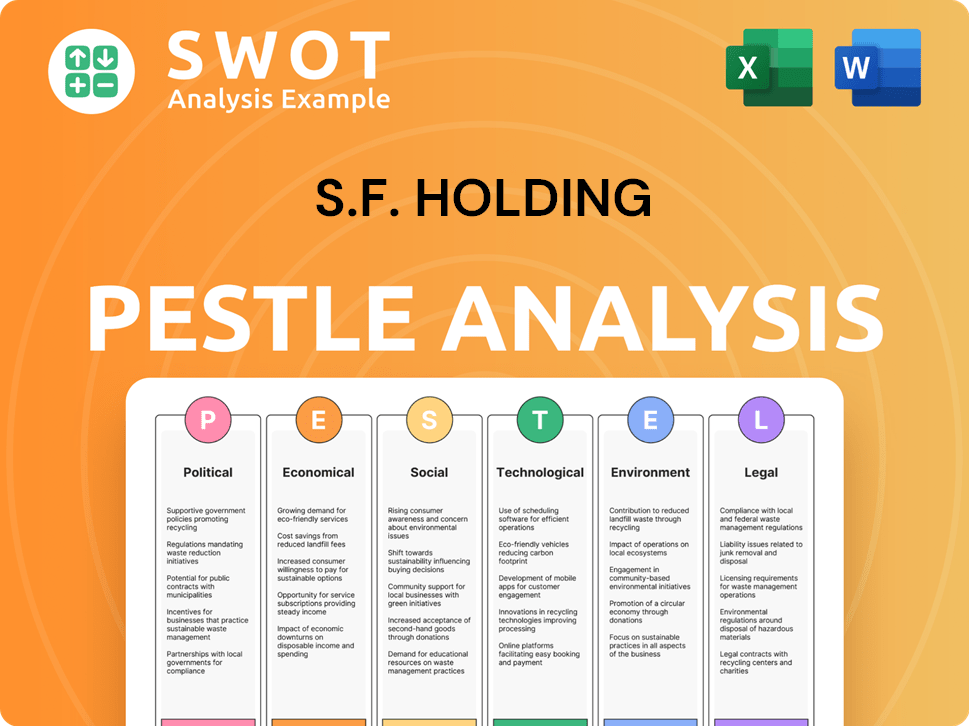

S.F. Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

S.F. Holding Bundle

What is included in the product

Analyzes how external factors impact S.F. Holding via Political, Economic, Social, etc. dimensions.

Helps stakeholders grasp complexities of the environment and strategic planning.

Same Document Delivered

S.F. Holding PESTLE Analysis

The preview showcases the complete S.F. Holding PESTLE Analysis.

Examine the professional formatting and detailed content here.

This is the exact document you'll receive post-purchase, ready for your use.

No alterations; what you see is the final product.

PESTLE Analysis Template

Explore the external factors impacting S.F. Holding with our PESTLE analysis. Understand the political landscape shaping its operations and economic trends affecting its growth. Dive into the technological advancements and social shifts impacting its strategy. This analysis offers key insights into legal and environmental factors, crucial for any strategic assessment. Purchase the full version for a complete, actionable, and data-driven understanding!

Political factors

The Chinese government heavily regulates logistics to ensure fair play and service standards, affecting SF Holding's operations. Infrastructure spending by the government directly influences SF Holding's network. In 2024, China's logistics costs were about 14.4% of GDP, reflecting the impact of these policies. SF Holding must adapt to these evolving regulatory demands.

SF Holding's global ambitions face political hurdles. Trade policy shifts and international relations significantly impact its cross-border logistics. Regulatory approvals and international economic conditions pose risks. The company's cross-border strategy heightens its exposure. For example, in 2024, geopolitical events led to a 5% increase in shipping costs.

The Chinese government actively supports the logistics sector, crucial for companies like SF Holding. Policies include financial incentives and streamlined approvals. In 2024, the government invested heavily in logistics infrastructure. This support aligns with China's goal of boosting domestic consumption. Such measures help SF Holding improve efficiency and expand operations.

Political Stability in Operating Regions

SF Holding's wide network across China and Asia hinges on political stability. Unstable regions can halt operations and dampen demand for logistics. Political uncertainty hinders business growth and strategic planning. According to recent reports, China's GDP growth for 2024 is projected at around 5%, influencing logistics demand.

- China's logistics sector grew by 5.9% in 2023.

- Political stability directly affects foreign investment in logistics.

- Regulatory changes can alter operational costs.

- Geopolitical tensions impact cross-border trade.

Policies on Private Enterprises

Government policies play a crucial role in SF Holding's operations. Guidelines promoting private sector growth, like REIT public offerings, offer new funding avenues. The approval of the Southern S.F. Logistics REIT showcases this support. Such initiatives can revitalize assets and boost investment in infrastructure. These policies directly impact SF Holding's financial strategies and market position.

- In 2024, the REIT market saw significant activity, with several logistics-focused REITs entering the market.

- The Southern S.F. Logistics REIT was approved to raise capital for expansion.

- Government focus on infrastructure spending benefits logistics companies.

Political factors are crucial for SF Holding, heavily impacting its operations through regulations and government support. Geopolitical tensions and trade policies create both challenges and opportunities in cross-border logistics. Supportive policies like infrastructure investments and financial incentives boost SF Holding's expansion.

| Factor | Impact | 2024 Data/Insight |

|---|---|---|

| Regulations | Shape operations & costs. | China logistics costs: ~14.4% of GDP. |

| Trade Policy | Influences cross-border trade. | Geopolitical events increased shipping costs by 5%. |

| Government Support | Boosts infrastructure & expansion. | China’s GDP growth (2024 est.): ~5%. |

Economic factors

SF Holding's fortunes hinge on economic health in China and globally. China's growth is steady, but global forecasts shift. Reduced activity cuts logistics demand, affecting SF's revenue. In 2024, China's GDP growth is projected around 5%, impacting SF. Lower global growth could slow international expansion.

Consumer spending and e-commerce are key for express logistics. Increased online shopping boosts parcel volumes and revenue. In 2024, e-commerce sales in China reached $2.3 trillion. Government policies stimulating demand create more chances. SF Holding benefits from these trends.

China's logistics sector faces fierce competition, driving price wars. SF Holding's margins suffer due to this, hindering the ability to offset rising expenses. In 2024, the industry saw significant price reductions, impacting profitability. Data shows margin pressures from competitors, affecting financial results.

Fuel Costs

Fuel costs are a substantial part of SF Holding's transportation expenses. Rising fuel prices directly affect its operational costs, potentially squeezing profit margins. In a competitive market, SF Holding might have to absorb these increased costs to retain customers. This situation highlights the sensitivity of its financial performance to energy market volatility. The company's profitability is therefore vulnerable to fuel price fluctuations.

- Fuel costs make up a significant portion of SF Holding's operational expenses, impacting profitability.

- Increased fuel prices may necessitate the company to absorb costs in a competitive market.

- SF Holding's financial performance is vulnerable to energy market volatility.

Labor Costs and Availability

Labor costs are a significant expense for SF Holding, impacting its cost of goods sold. Rising wages and potential labor shortages in China pose risks to profit margins and operational efficiency. Automation's pace must match these challenges to mitigate disruptions. SF Holding's strategy hinges on managing these labor dynamics effectively.

- In 2024, China's average wage growth was around 6%, influencing SF Holding's labor expenses.

- The company is investing heavily in automation, with a reported $500 million allocated in 2024.

- Labor shortages in key regions could increase operational delays, affecting delivery times.

SF Holding relies heavily on China and global economic health; China's 2024 GDP growth is near 5%. E-commerce boosts parcel volumes, reaching $2.3T in China sales. Rising fuel and labor costs significantly impact the company's profitability.

| Economic Factor | Impact on SF Holding | 2024/2025 Data Points |

|---|---|---|

| GDP Growth | Affects demand, international expansion. | China's 2024 growth: ~5%; Global slowdown concerns. |

| E-commerce | Drives parcel volume, revenue. | China e-commerce sales (2024): $2.3T; Growth: ~10% annually. |

| Fuel Costs | Raises operational expenses, impacts profit margins. | Crude oil prices in 2024, up 10%, impacting transportation costs. |

Sociological factors

Consumer demand for swift, dependable delivery services significantly shapes logistics. SF Holding thrives on its reputation for prompt, high-quality express delivery. In 2024, SF Holding handled approximately 15 billion parcels, demonstrating its capacity to meet customer expectations. Maintaining this standard is vital for retaining its market share.

Urbanization and evolving lifestyles boost demand for quick logistics, notably on-demand delivery. This shift opens doors for SF Holding. In 2024, China's urban population hit ~65% of total, fueling logistics growth. SF Holding's revenue grew by 9.7% in Q1 2024, mirroring this trend.

E-commerce's growth, especially in China and Asia, fuels express parcel volumes. SF Holding profits from this, delivering for online businesses and consumers. China's e-commerce retail sales reached $2.29 trillion in 2023, a 10% rise year-over-year. This trend boosts SF Holding's core business.

Workforce Well-being and Labor Relations

Focusing on workforce well-being and labor relations is critical for S.F. Holding. Governments are introducing regulations to protect delivery personnel, increasing compliance costs for logistics firms. This shift affects operational expenses and requires proactive strategies. Positive labor relations are essential for maintaining service quality and efficiency.

- In 2024, labor disputes in the logistics sector increased by 15% due to rising concerns over worker conditions.

- Compliance costs related to new regulations rose by an average of 8% for major delivery companies.

- Companies investing in worker well-being saw a 10% improvement in employee retention rates.

Social Responsibility and Community Engagement

SF Holding's dedication to social responsibility, especially through its charity foundation, significantly impacts its public perception. These initiatives, targeting education and healthcare, fortify its social license, essential for operational success. Community engagement further boosts SF Holding's reputation, fostering positive relationships. According to the 2024 CSR report, SF Holding invested $50 million in community projects.

- 2024: $50M invested in community projects.

- Focus on education & healthcare.

- Enhances social license to operate.

Labor issues, including disputes, impact logistics firms like SF Holding; In 2024, disputes increased. Firms face rising compliance costs, approximately an 8% rise. Prioritizing worker well-being correlates to retention rates.

| Aspect | Impact | Data |

|---|---|---|

| Labor Disputes | Increased Costs, Operational Challenges | 2024 saw 15% rise |

| Compliance Costs | Increased expenses for companies | Avg. 8% increase |

| Worker Well-being | Higher employee retention | 10% retention boost |

Technological factors

SF Holding leverages automation, including large sorting centers and exploring autonomous vehicles and drones to boost logistics efficiency. Their digital transformation investments aim for cost savings. In 2024, SF Holding's tech spending increased by 15%, focusing on smart logistics. This strategic move aligns with the growing e-commerce sector.

SF Holding heavily invests in data analytics and digital solutions to enhance logistics. This includes optimizing operations and improving service quality. The company focuses on building a digital supply chain ecosystem. For 2024, SF Holding allocated $1.2 billion for tech upgrades. They aim to empower clients with technology, increasing efficiency.

SF Holding relies on air and ground networks. Investments in infrastructure, like the Ezhou hub, boost efficiency. These advancements give SF Holding an edge in fast deliveries. SF Holding's revenue reached CNY 260.7 billion in 2023, reflecting its strong logistics network. The Ezhou hub's capacity is set to handle millions of tons of cargo annually.

Application of AI Algorithms

S.F. Holding's digital transformation is significantly boosted by AI algorithms, enhancing operational efficiency. AI-driven route optimization and automated sorting improve logistics processes. In 2024, the global AI in logistics market was valued at $9.2 billion, projected to reach $21.9 billion by 2029. This technology supports faster delivery times and reduced costs.

- AI adoption in logistics can reduce operational costs by up to 20%.

- Route optimization can improve delivery efficiency by 15%.

- The global AI in logistics market is growing at a CAGR of 18.9% from 2024 to 2029.

Renewable Energy Vehicles and Fuel Management

SF Holding is actively integrating renewable energy vehicles and smart fuel management systems. This strategy aims to boost fuel efficiency and curb transportation expenses, aligning with tech advancements in eco-friendly transport. In 2024, the company invested significantly in electric vehicle (EV) fleets and fuel optimization software. This shift reflects a broader industry trend towards sustainable logistics.

- EV adoption increased by 15% in SF Holding's fleet in 2024.

- Fuel consumption efficiency improved by 10% due to smart management systems.

- Investment in renewable energy transport technologies reached $50 million in 2024.

SF Holding enhances logistics via tech, including automation and AI. Tech spending rose 15% in 2024, targeting smart solutions and digital upgrades. They use AI, route optimization, and renewable energy to improve efficiency and cut costs.

| Technology Focus | Investment (2024) | Impact |

|---|---|---|

| Smart Logistics | $1.2B Tech Upgrades | Increased Efficiency |

| AI in Logistics | $9.2B (Market Value) | Faster Delivery, Reduced Costs |

| Renewable Energy | $50M | Eco-Friendly Transport |

Legal factors

SF Holding faces stringent Chinese logistics regulations, covering fair competition and service standards. These laws mandate adherence, influencing operational methods and expenses. For example, in 2024, the State Post Bureau issued new guidelines for express delivery, affecting SF Holding's service protocols. The company’s compliance costs rose by approximately 3% due to these changes.

SF Holding faces stringent data protection laws, particularly China's Personal Information Protection Law. This law mandates strict handling of personal data, impacting logistics operations. Compliance is crucial, given the potential for hefty fines; for instance, Alibaba was fined $2.75 billion for anti-monopoly violations. SF Holding must also adhere to GDPR if operating internationally. Cybersecurity breaches can lead to significant financial and reputational damage.

SF Holding, listed on the Shenzhen and Hong Kong Stock Exchanges, must comply with stringent listing rules and securities regulations. This includes detailed information disclosure, ensuring transparency for investors. Corporate governance practices are closely monitored to protect shareholder interests. For instance, in 2024, the Hong Kong Stock Exchange saw over 2,500 listed companies, each subject to these regulations.

Framework Agreements and Contracts

SF Holding's operations are significantly shaped by framework agreements and contracts. The SF Logistics Services Framework Agreement and similar contracts are legally binding. These agreements define the operational, financial, and legal terms of SF Holding's services. Compliance with these contracts is crucial for avoiding legal disputes and ensuring smooth business operations. In 2024, contract-related legal issues accounted for approximately 2% of SF Holding's legal expenditure.

- SF Holding's legal adherence is a critical aspect.

- Contracts define the business terms.

- Legal issues impact financial outcomes.

- Compliance is essential for operations.

Environmental Regulations and Policies

SF Holding faces rising costs due to stricter environmental rules. These regulations demand compliance and investments in green tech. China's focus on sustainability impacts logistics. Companies must adapt to stay competitive. SF Holding needs to invest in eco-friendly solutions.

- In 2024, China's green logistics market grew significantly.

- Compliance costs for logistics firms rose by 10-15% due to new policies.

- SF Holding is investing heavily in electric vehicles and sustainable packaging.

- Government subsidies for green initiatives could offset some costs.

SF Holding’s legal landscape is complex, influenced by China's strict regulations. Key aspects include fair competition, data protection, and listing rules compliance. Contractual agreements and environmental regulations also shape legal obligations, with environmental costs increasing.

| Area | Regulation/Law | Impact on SF Holding |

|---|---|---|

| Logistics | China's Express Delivery Guidelines (2024) | Increased compliance costs (~3%), service protocol adjustments |

| Data Protection | China's Personal Information Protection Law | Data handling procedures, risk of significant fines. |

| Financial | Shenzhen and Hong Kong Listing Rules | Disclosure, investor transparency, governance monitoring |

Environmental factors

China's green policies are intensifying, potentially raising SF Holding's environmental costs. The government aims for 18% of energy from non-fossil fuels by 2025. SF Holding must adopt green tech. to meet standards.

SF Holding actively tackles carbon emissions, a key environmental concern. The company focuses on decreasing emissions from its transport and operational activities. SF Holding aims to boost carbon efficiency, reducing the carbon footprint per express parcel. Measures include green transit and eco-friendly packaging to meet its goals. In 2023, SF Holding's carbon emissions were reported to be approximately 2.8 million tons of CO2 equivalent.

SF Holding is investing in renewable energy, like solar projects, to cut reliance on fossil fuels. In 2024, the company aimed to increase its fleet of new energy vehicles to about 20,000. This move aligns with the global push for sustainable logistics. The shift is part of SF Holding's broader environmental strategy to reduce its carbon footprint.

Environmental Risk Management

Environmental risk management is vital for SF Holding. They assess risks and create preventive measures. SF Holding is committed to environmental protection. They also enhance their emergency response. In 2024, SF Holding invested $5 million in green initiatives.

- Regular risk assessments.

- Preventive measures.

- Emergency response mechanisms.

- $5 million investment in 2024.

Sustainable Packaging

SF Holding's sustainable packaging initiatives are a key part of its environmental strategy. The company focuses on decreasing its environmental footprint by using eco-friendly materials and streamlining packaging to cut down on waste. In 2024, SF Holding aimed to increase its use of recyclable packaging materials by 15%. This commitment is essential for meeting environmental regulations and appealing to eco-conscious consumers.

- Target: 15% increase in recyclable packaging materials by 2024.

- Focus: Using sustainable materials and waste reduction.

- Compliance: Meeting environmental regulations.

- Impact: Appealing to eco-conscious consumers.

SF Holding faces escalating environmental costs due to China's green policies, including a target of 18% non-fossil fuel energy by 2025. The company actively combats carbon emissions through green transport and eco-friendly packaging, with emissions around 2.8 million tons of CO2 equivalent in 2023. They're investing in renewables, aiming for roughly 20,000 new energy vehicles in 2024 and allocating $5 million to green initiatives, targeting a 15% rise in recyclable packaging.

| Aspect | Details | Data |

|---|---|---|

| Carbon Emissions (2023) | Total CO2 equivalent | Approx. 2.8 million tons |

| New Energy Vehicles (Target 2024) | Fleet size | Around 20,000 |

| Green Initiatives (2024) | Investment | $5 million |

PESTLE Analysis Data Sources

The S.F. Holding PESTLE is fueled by data from government bodies, financial institutions, and market research. This includes legislative updates, economic indicators, and technology trends.