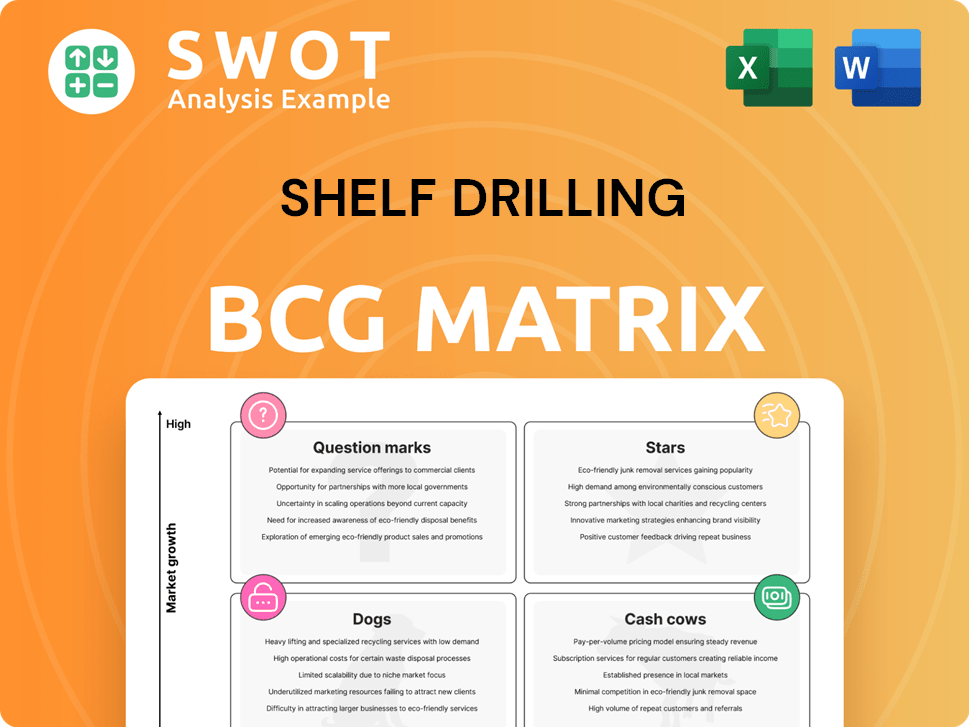

Shelf Drilling Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shelf Drilling Bundle

What is included in the product

Strategic analysis of Shelf Drilling's units using BCG Matrix. Identifies investment, holding, and divestiture opportunities.

Easily switch color palettes for brand alignment. Quickly adapt the matrix's look to match any presentation's theme.

What You’re Viewing Is Included

Shelf Drilling BCG Matrix

The BCG Matrix preview you see is the complete document you'll receive. This version is formatted professionally and is ready to use immediately after your purchase. There are no differences between the preview and the final file you will download.

BCG Matrix Template

Explore Shelf Drilling's product portfolio through the lens of the BCG Matrix, revealing key insights into their strategic positioning. Discover which areas are thriving, which are in need of investment, and where caution is advised. Understand the growth potential and resource allocation challenges facing the company.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Shelf Drilling's alliance with Arabian Drilling is a potential star in its BCG Matrix. This partnership, aiming to deploy jack-up rigs globally, opens new markets. It capitalizes on combined strengths, enhancing its market position. In Q3 2023, Shelf Drilling's revenue was $191.5 million, showing growth potential.

Shelf Drilling's premium jack-up rigs, especially those in harsh environments, are stars. These rigs secure high day rates and boast strong utilization. In 2024, day rates for premium jack-ups averaged around $100,000-$150,000. Maintaining uptime and securing long-term contracts is key for continued growth.

Shelf Drilling's Nigerian operations are crucial. The company has secured multiple contracts and extensions there. For example, the Shelf Drilling Achiever has a three-year contract. Success in Nigeria is vital for overall performance. In Q3 2023, Shelf Drilling reported $15.5 million in revenue from Nigeria.

Shelf Drilling Barsk Contract

The Shelf Drilling Barsk is a star asset, operating under contract with Equinor in Norway. This jack-up rig, one of the world's largest, enjoys a strong contract and benefits from North Sea market conditions. Securing extensions for this rig is crucial for Shelf Drilling's earnings. In 2024, the North Sea saw increased drilling activity.

- Contract Value: Approximately $150 million per year.

- Utilization Rate: Consistently above 95% in 2024.

- Operational Excellence: High safety and efficiency ratings.

- Market Outlook: Positive, with potential for further contract extensions.

Strong Contract Backlog

Shelf Drilling's "Strong Contract Backlog" is a crucial factor in its BCG Matrix assessment. As of December 31, 2024, the company's contract backlog stood at a substantial $2.1 billion, signaling strong future revenue potential. This backlog reflects Shelf Drilling's success in securing long-term client commitments, providing stability. Effective execution is key to maximizing the backlog's value.

- Backlog Value: $2.1 billion (December 31, 2024)

- Revenue Visibility: Provides clear revenue projections.

- Contract Duration: Typically involves multi-year agreements.

- Operational Focus: Efficient execution is critical.

Shelf Drilling's stars include partnerships like the Arabian Drilling alliance, boosting market reach and leveraging combined strengths. Premium jack-up rigs, especially those with high day rates ($100K-$150K in 2024), are also key performers. Operations in Nigeria contributed $15.5 million in Q3 2023, indicating growth potential. The Shelf Drilling Barsk with its $150 million/year contract, shows strong performance.

| Asset | Key Metrics (2024) | Performance |

|---|---|---|

| Premium Jack-up Rigs | Day Rates: $100K-$150K | High utilization and profitability |

| Shelf Drilling Barsk | Contract Value: $150M/year, Utilization: 95%+ | Strong revenue generation |

| Contract Backlog | $2.1 billion (Dec 31, 2024) | Future revenue security |

Cash Cows

Rigs with long-term contracts and stable clients are cash cows. These offer predictable revenue and low investment needs. Focus on efficiency and minimal downtime to maximize returns. In 2024, Shelf Drilling's long-term contracts generated a steady income stream. These contracts support the company's financial stability.

Shelf Drilling's strong foothold in Southeast Asia, especially in Thailand, is a cash cow, particularly due to its relationship with Chevron. Extensions for rigs such as Shelf Drilling Chaophraya and Shelf Drilling Krathong ensure steady income. Recent data shows Shelf Drilling's revenue in 2024 reached $680 million, highlighting the region's financial stability. Maintaining client relations and operational efficiency is key.

Shelf Drilling's operational efficiency is key to its cash cow status. The company focuses on cost management to boost profits. High uptime, like 99.3% in 2024, is a key factor. Improving processes continuously helps maintain these benefits.

Standard Jack-Up Rigs in Stable Regions

Standard jack-up rigs in stable regions, like the Middle East, often function as cash cows for Shelf Drilling. These rigs generate steady revenue due to predictable demand. They may have lower day rates but offer consistent cash flow with manageable operating expenses. Maximizing value involves efficient asset management and securing contract extensions.

- Day rates for jack-up rigs in the Middle East averaged around $75,000-$85,000 per day in 2024.

- Shelf Drilling reported approximately $400 million in revenue from its jack-up rig fleet in 2024.

- Operating costs for these rigs typically range from $30,000 to $40,000 per day.

Fit-for-Purpose Strategy

Shelf Drilling's "fit-for-purpose" strategy, prioritizing shallow-water operations, is a key element of its cash cow status within the BCG matrix. This approach enables efficient asset deployment and reduces capital spending, contributing to a strong financial position. The company's focus on cost-effective operations leads to consistent cash flow generation. Adapting to market dynamics while maintaining this strategy is vital for sustained performance.

- In 2023, Shelf Drilling reported revenue of $794 million.

- Their focus on shallow water allows them to target a specific market segment.

- The company has a strong backlog of contracts.

- Shelf Drilling's strategy emphasizes operational efficiency.

Cash cows for Shelf Drilling include rigs with steady contracts, like those in Southeast Asia and the Middle East. These rigs bring predictable revenue and require low investment, focusing on operational efficiency. The firm's 2024 revenue hit $680 million, supported by strong cash flow from these reliable assets.

| Region | Avg. Day Rate (2024) | Est. 2024 Revenue |

|---|---|---|

| Middle East (Jack-up) | $75,000-$85,000 | $400M (Jack-up Fleet) |

| Southeast Asia | Varies | $680M (Total) |

| Shelf Drilling (Overall 2023) | N/A | $794M |

Dogs

Rigs like Shelf Drilling's Harvey H. Ward and High Island IV, with suspended Saudi Aramco contracts, are dogs in the BCG matrix. These rigs aren't earning, only costing money for upkeep and storage. In 2024, Shelf Drilling's revenue was affected by these idle assets. Selling or moving these rigs is key to cut losses.

Aging offshore drilling rigs, like the Trident VIII, are classified as "Dogs" in the BCG Matrix. These rigs face dwindling revenue prospects and escalating upkeep expenses. In 2024, the cost to recycle such a rig could range from $5 million to $10 million, reflecting their limited value.

Rigs awaiting redeployment, like Shelf Drilling's Main Pass IV, are categorized as "Dogs." These idle assets generate no revenue but still accrue costs. As of Q3 2024, Shelf Drilling had several such rigs. Securing new contracts is crucial to transform these "Dogs" into more profitable assets. Active marketing and strategic contract acquisition are essential.

Uncompetitive Rigs

Uncompetitive rigs, classified as "dogs" in Shelf Drilling's BCG matrix, face significant challenges. These rigs, often outdated or lacking in advanced capabilities, struggle to compete for contracts. Shelf Drilling may consider strategic actions like divestiture to mitigate losses or upgrade to boost performance. In 2024, the company may reallocate resources from these underperforming assets.

- Rigs with limited market appeal due to age or technology are considered "dogs."

- These rigs often have low utilization rates.

- Divestiture or significant upgrades are potential strategies.

- Focus is on optimizing the fleet for profitability.

Terminated Contracts

Rigs with terminated contracts and no immediate work are "dogs" in Shelf Drilling's BCG matrix. These rigs drain resources and should be actively marketed or sold. Minimizing downtime and costs is crucial to mitigate losses. Shelf Drilling's 2024 reports likely highlight specific rigs in this category. For example, a rig might be idled for over a year due to contract terminations.

- Contract termination leads to immediate revenue loss.

- High operational costs continue even without contracts.

- Risk of asset impairment increases with prolonged idleness.

- Focus on either re-contracting or selling the rig.

In Shelf Drilling's BCG matrix, "Dogs" are underperforming rigs, impacting 2024 financials. These rigs, like those with terminated contracts, drain resources and incur costs. Actions include re-contracting or selling to minimize losses, reflecting strategic resource allocation.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Idle Rigs | No revenue, ongoing costs | Increased operational expenses |

| Uncompetitive Rigs | Outdated, low demand | Asset impairment risk |

| Terminated Contracts | No immediate work, costs | Loss of revenue |

Question Marks

Shelf Drilling's new contracts in emerging markets, like those in Nigeria and Egypt, fall under the "Question Mark" category. These ventures offer high growth potential but also present considerable risks. Political instability and regulatory uncertainty in these regions pose significant challenges. For example, in 2024, oil production in Nigeria was around 1.4 million barrels per day, reflecting the volatility.

The strategic alliance with Arabian Drilling Company positions Shelf Drilling as a question mark in the BCG matrix. This partnership aims to capitalize on the growing Middle East market. In 2024, the Middle East's drilling market is estimated at $5 billion, presenting significant growth potential. Success hinges on managing integration and competition effectively.

Shelf Drilling's move into new areas, like possibly sending rigs to West Africa, is a question mark in its BCG Matrix. These regions could boost growth but also bring regulatory, logistical, and competitive hurdles. For example, in 2024, West Africa saw increased offshore oil activity, but with varied success rates. Careful planning and research are crucial for Shelf Drilling.

Technological Upgrades

Technological upgrades at Shelf Drilling are a question mark in the BCG Matrix. These investments aim to boost rig efficiency and market competitiveness, but they also come with risks. Cost overruns and rapid technological obsolescence are potential pitfalls. A detailed ROI analysis is critical before proceeding with upgrades.

- Shelf Drilling's capital expenditure in 2023 was approximately $180 million.

- The company's focus on technologically advanced rigs is a key strategic move.

- Upgrades could potentially increase operational efficiency by up to 15%.

- Careful financial planning is required to manage upgrade costs and avoid technological obsolescence.

Diversification into New Services

Diversifying into new services such as well services and decommissioning positions Shelf Drilling as a question mark in the BCG Matrix. These ventures offer potential revenue growth but demand new skills and resources. A phased approach and thorough market analysis are crucial for success. This strategic move could significantly impact the company's future performance, depending on its execution and market response.

- Well services and decommissioning represent areas of potential growth and diversification.

- Success hinges on acquiring new expertise and managing associated risks.

- Careful market analysis is vital for identifying opportunities and mitigating risks.

- A phased implementation allows for adapting to market dynamics and optimizing resource allocation.

Shelf Drilling's ventures in Nigeria and Egypt, are question marks in the BCG matrix due to high growth potential but high risks, such as political instability and regulatory uncertainty. In 2024, Nigeria's oil production was about 1.4 million barrels per day, highlighting volatility. The alliance with Arabian Drilling is also a question mark, with the Middle East drilling market at $5 billion in 2024. Technological upgrades, such as potential efficiency increases up to 15%, and new services, such as well services, represent areas of potential growth, requiring careful planning.

| Strategic Initiative | BCG Matrix Status | Key Considerations |

|---|---|---|

| New Contracts (Nigeria, Egypt) | Question Mark | Political risk, regulatory uncertainty, market volatility (Nigeria's oil production ~1.4M barrels/day in 2024) |

| Strategic Alliance (Arabian Drilling) | Question Mark | Market growth, integration challenges (Middle East drilling market ~$5B in 2024), competition. |

| Technological Upgrades | Question Mark | Cost management, ROI analysis, potential efficiency gains (up to 15%). |

BCG Matrix Data Sources

The Shelf Drilling BCG Matrix uses SEC filings, industry analysis, and market reports. This builds a data-driven assessment of the company's portfolio.