Shell Plc Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shell Plc Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

A clear, visual breakdown of Shell's portfolio, making strategic decisions simple and efficient.

What You See Is What You Get

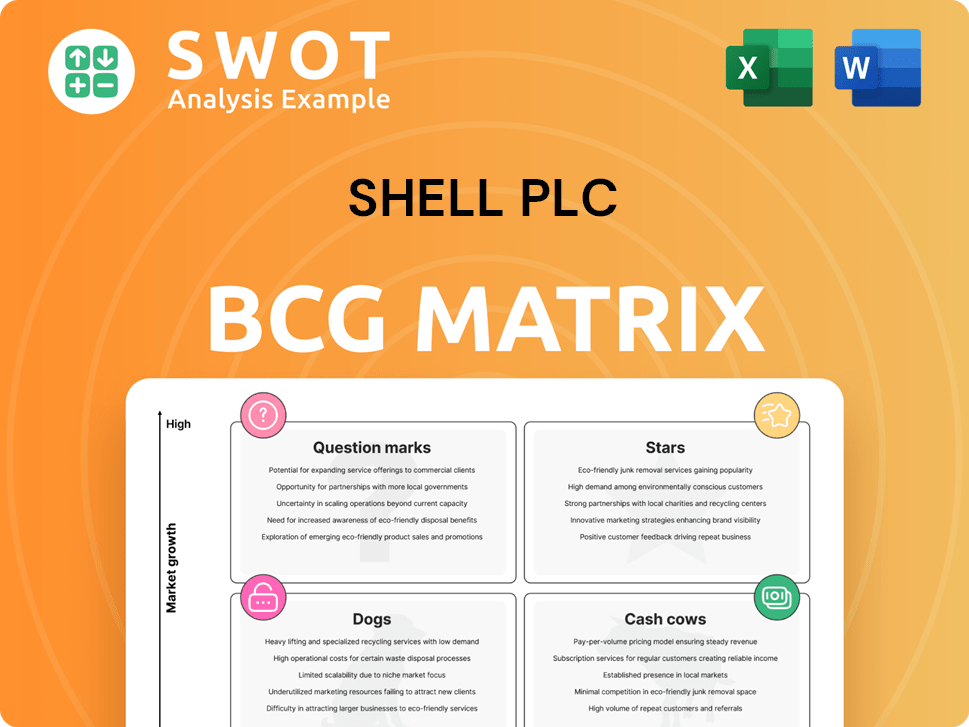

Shell Plc BCG Matrix

The Shell Plc BCG Matrix preview is identical to the purchased file. You get the full, ready-to-use report with the strategic insights and analysis. Download it instantly for your business needs.

BCG Matrix Template

Explore Shell Plc's portfolio with our BCG Matrix overview. We've categorized their offerings, hinting at market leaders and resource drains. This peek into Stars, Cash Cows, Dogs, and Question Marks gives you a strategic edge. See how Shell navigates the energy sector's complexities. Our analysis identifies key areas for growth and investment. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Shell's Integrated Gas (LNG) is a "Star" in its BCG matrix, reflecting strong growth and market share. Shell aims for 4-5% annual LNG sales growth through 2030. This growth is supported by increasing global demand, with LNG expected to rise. In 2024, Shell's LNG production reached approximately 7.6 million tonnes.

Shell's Upstream Production is considered a Star in its BCG Matrix. The company targets a 1% annual growth in combined Upstream and Integrated Gas production through 2030. Shell plans to maintain liquids production at 1.4 million barrels daily. This strategy balances production with lower carbon intensity. In 2024, Shell's upstream production reached 2.5 million barrels of oil equivalent per day.

Shell is concentrating on its Mobility and Lubricants segment for growth, aiming to boost returns. They are expanding their EV charging network, strategically placing chargers at Shell locations. This focus includes incorporating renewable hydrogen and green solutions to cut emissions in fuel production. In 2024, Shell's global EV charging network expanded, with over 50,000 charge points.

Trading and Optimisation

Shell's Trading and Optimisation segment is projected to outperform Q4 2024, mirroring the robust performance seen in Q2 and Q3 2024. This area is crucial for Shell, as it leverages market fluctuations to boost financial outcomes. Shell's proficiency in trading and optimization reinforces its market leadership. This strategic prowess allows Shell to skillfully navigate market risks and opportunities.

- Trading and Optimisation contributions are expected to be significantly higher than Q4 2024.

- Shell's trading capabilities enhance financial performance.

- The company effectively manages risks.

- Shell's market leadership is reinforced.

Shareholder Distributions

Shell Plc, a "Star" in its BCG matrix, is dedicated to boosting shareholder distributions. In 2024, Shell aims to return 40-50% of its CFFO to shareholders through dividends and buybacks. This strategy includes a progressive dividend policy, with a 4% annual increase, and share repurchase programs. These actions highlight Shell's financial health and dedication to investor value.

- Shareholder distributions target: 40-50% of CFFO.

- Dividend policy: 4% per annum progressive.

- Focus: Share buybacks and dividends.

- Goal: Deliver value to investors.

Shell's "Stars" include Integrated Gas, Upstream Production, and segments focused on growth like Mobility and Lubricants. These areas show strong growth and market share, crucial for Shell's strategy. The company invests to boost returns and shareholder value through focused growth areas.

| Segment | 2024 Performance/Target | Strategic Focus |

|---|---|---|

| Integrated Gas (LNG) | 7.6 MTPA production | 4-5% annual LNG sales growth through 2030 |

| Upstream Production | 2.5 MMboe/d | 1% growth in combined Upstream and Integrated Gas |

| Mobility/Lubricants | 50,000+ EV charge points | EV charging network expansion; renewable solutions |

Cash Cows

Shell's Downstream operations, including refining 1.3M barrels daily, are cash cows. Its extensive network of 46,000 service stations ensures consistent revenue. The focus is on converting refineries into energy and chemicals parks. This boosts competitiveness and cuts emissions, aligning with 2024 goals.

Shell is strategically managing its chemicals division. They're seeking partnerships in the US. Simultaneously, they are closing or upgrading assets in Europe. The goal is to boost value from their chemical holdings. Shell aims to enhance returns and cut capital use in chemicals by 2030. In 2024, Shell's chemicals segment saw adjusted earnings of $0.8 billion.

Shell's Integrated Gas segment, encompassing LNG infrastructure, is a Cash Cow due to its established market presence and long-term contracts. This sector consistently generates substantial cash flow, crucial for Shell's investments. In 2024, LNG production remained strong, contributing significantly to the company's financial performance. Shell strategically optimizes these assets to maximize returns and support its growth objectives within the LNG market.

Conventional Oil and Gas

Shell's conventional oil and gas operations remain a vital cash cow, fueling investments in future projects and technologies. The company acknowledges the importance of maintaining substantial liquids production during its energy transition. Shell's focus is on enhancing cash flow resilience and returns within its Downstream and Renewables & Energy Solutions sectors. In 2024, Shell's oil and gas production was approximately 1.9 million barrels of oil equivalent per day.

- Shell's oil and gas segment generated $20 billion in free cash flow in 2023.

- Shell plans to maintain oil production at around 1.8 million barrels per day through 2025.

- The company is investing heavily in LNG projects to ensure continued revenue from conventional sources.

- Shell aims to reduce operational expenses by $2-3 billion by the end of 2025.

Refining and Marketing

Shell's refining and marketing operations are cash cows, thanks to their global reach and brand strength. They consistently generate substantial cash flow. Shell actively optimizes these operations to boost efficiency and cut costs. The marketing segment thrives with a vast customer base and diverse offerings.

- In 2024, Shell's marketing segment saw robust performance, with a focus on premium fuels.

- Refining margins were impacted by market volatility, yet Shell aimed to enhance operational excellence.

- Shell's retail network expansion in key markets supported sustained cash generation.

- Investments in sustainable fuels and services are increasingly influencing the marketing strategies.

Shell's Cash Cows are robust, including refining and marketing, which generate substantial cash flow. These segments are vital, like Integrated Gas, which consistently produces solid financials. Their strategy focuses on optimizing assets for efficiency and returns, and in 2023 oil and gas segment generated $20 billion in free cash flow.

| Segment | 2024 Performance Highlights | Strategic Focus |

|---|---|---|

| Downstream (Refining & Marketing) | Refining 1.3M barrels daily, marketing segment robust | Efficiency, cost reduction, sustainable fuels and retail expansion |

| Integrated Gas | Strong LNG production and long-term contracts | Maximize returns and support growth within the LNG market |

| Conventional Oil and Gas | Production approx. 1.9 million boe/d. Oil production targets of 1.8M bpd by 2025. | Enhance cash flow resilience, maintain production |

Dogs

Shell's legacy exploration projects are "Dogs" in its BCG Matrix, indicating low market share and growth. These projects, with dwindling returns, face high costs and low success rates. Shell aims to sell or shut down these assets to boost portfolio performance. In 2024, Shell's focus is on streamlining operations, including shedding underperforming assets.

Shell has halted some biofuel projects, like the Rotterdam facility, due to tough market conditions and oversupply. These ventures are considered "question marks" in the BCG Matrix, demanding high investment with uncertain profits. The company is now rethinking its biofuel strategy, favoring other low-carbon fuel options. In 2024, Shell's capital expenditure was approximately $23 billion, with a focus on returns. The Rotterdam project's future remains uncertain.

Shell is reportedly evaluating the sale of its lower-margin chemicals businesses in the US and Europe. These are considered "Dogs" in BCG matrix due to low returns. In 2023, Shell's chemicals division saw an adjusted earnings of $2.2 billion.

Power Division (Selected Assets)

Shell's shift away from new offshore wind investments and the restructuring of its power division signal that some assets are Dogs. These assets, like offshore wind projects, demand substantial capital with potentially low returns. This strategic adjustment reflects Shell's move to concentrate on high-yield areas. In 2024, Shell's renewable power generation capacity was approximately 1.5 GW.

- Offshore wind projects require significant investment.

- Returns are uncertain.

- Shell is focusing on areas with competitive advantages.

- Shell's 2024 renewable power capacity was roughly 1.5 GW.

Assets with High Carbon Intensity

Shell is actively reducing carbon emissions. Assets with high carbon intensity and limited decarbonization potential are considered "Dogs" in their BCG matrix. The company is focused on divesting or decommissioning these assets to align with climate goals. This strategic shift aims to improve portfolio sustainability. In 2024, Shell's Scope 1 and 2 emissions decreased by 15%.

- Carbon Reduction: Shell aims to achieve net-zero emissions by 2050.

- Divestment Strategy: Shell plans to sell off assets deemed unsustainable.

- Portfolio Improvement: Focus on cleaner energy sources and lower-emission assets.

- Financial Impact: These changes are expected to influence long-term profitability.

Shell designates assets like legacy exploration and chemicals businesses as "Dogs" due to low market share and growth, often leading to divestment. These assets may involve high costs and lower returns. In 2024, Shell's strategic focus involved streamlining operations and reducing carbon emissions.

| Asset Type | BCG Status | Strategic Action |

|---|---|---|

| Legacy Exploration | Dog | Sale/Shutdown |

| Chemicals Businesses | Dog | Potential Sale |

| High-Carbon Assets | Dog | Divestment/Decommissioning |

Question Marks

Shell's Renewables and Energy Solutions, a question mark in its BCG matrix, competes in the high-growth renewable energy market. In 2024, Shell allocated a substantial portion of its $22-25 billion capital expenditure towards this segment, aiming for future growth. Despite investments, the segment's market share remains relatively small compared to established players. Shell's strategic focus includes renewable power, e-mobility, and low-carbon fuels, seeking to capture a larger market share.

Shell is strategically investing in hydrogen production, exemplified by the Holland Hydrogen I project, focusing on renewable hydrogen. Despite the rapidly expanding hydrogen market, Shell's current market share is modest. To gain a competitive edge, Shell must significantly boost its production capacity and decrease operational costs. Recent reports show the global hydrogen market was valued at $130 billion in 2023, projected to reach $300 billion by 2030.

Shell is investing in Carbon Capture and Storage (CCS), with projects like Polaris in Canada. Despite market growth, Shell's CCS market share is currently low. To lead, Shell must scale up CCS capacity and improve its technology. In 2024, global CCS capacity is expected to reach 60 million tons of CO2 per year.

Sustainable Aviation Fuel (SAF)

Shell's foray into Sustainable Aviation Fuel (SAF) places it in the "Question Mark" quadrant of the BCG matrix. The SAF market is expanding, driven by the need for lower-carbon aviation fuels. Shell is investing to increase production. However, its current market share is modest, indicating a need for significant growth.

- In 2023, the SAF market was valued at $1.1 billion.

- Shell aims to produce around 2 million tons of SAF annually by 2030.

- The cost of SAF remains a challenge, typically 3-5 times more than conventional jet fuel.

- Key competitors include Neste and TotalEnergies.

E-mobility Infrastructure

E-mobility infrastructure is a "Question Mark" for Shell Plc in its BCG Matrix. Shell is actively growing its public EV charging network to capitalize on the expanding e-mobility market. Despite the rapid growth in the EV sector, Shell's current market share in charging infrastructure is relatively small, positioning it as a challenger. Shell needs to invest significantly in network expansion and service improvements to gain a leading position.

- Shell aims to have over 500,000 charge points by 2025.

- In 2024, Shell had a smaller market share in EV charging compared to established players.

- Investments in e-mobility are crucial for Shell's long-term strategy.

- The "Question Mark" status reflects the high growth potential but also high investment needs and risks.

Shell's "Question Marks" include SAF, e-mobility, CCS, and hydrogen. These segments are in high-growth markets but have low market share, needing substantial investment to grow. Shell targets SAF production of 2 million tons by 2030; the SAF market was $1.1B in 2023.

| Segment | Market Share | Strategic Focus |

|---|---|---|

| SAF | Modest | Expand production, reduce costs |

| Hydrogen | Modest | Increase production capacity |

| CCS | Low | Scale up capacity, improve technology |

| E-mobility | Small | Network expansion, service improvements |

BCG Matrix Data Sources

The Shell Plc BCG Matrix uses financial statements, market analyses, and energy industry publications, providing accurate and actional insights.