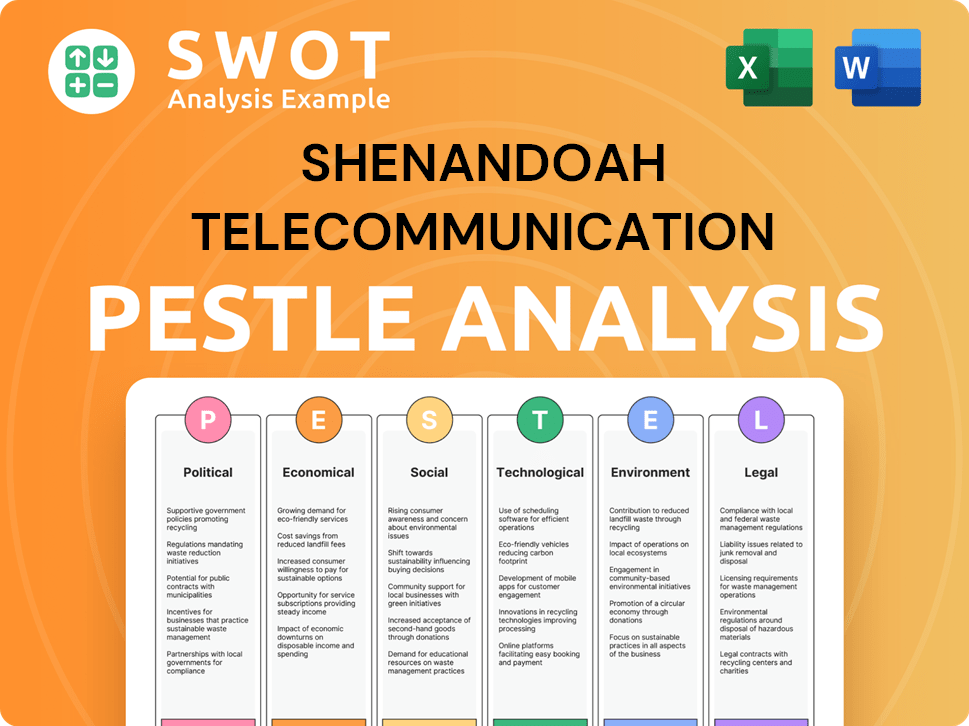

Shenandoah Telecommunication PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenandoah Telecommunication Bundle

What is included in the product

The analysis examines Shenandoah Telecommunication through political, economic, social, technological, environmental, and legal lenses.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

Shenandoah Telecommunication PESTLE Analysis

The preview displays the complete Shenandoah Telecommunication PESTLE analysis. This comprehensive document, exactly as presented, becomes yours upon purchase.

PESTLE Analysis Template

Navigate the evolving landscape of Shenandoah Telecommunication with our comprehensive PESTLE Analysis. Understand how political decisions, economic factors, social trends, technological advancements, legal frameworks, and environmental concerns impact its operations. Uncover potential opportunities and risks to refine your strategic planning. Gain a competitive edge and get the full, ready-to-use analysis now.

Political factors

Government regulations and policies significantly shape the telecommunications industry. Spectrum allocation, net neutrality rules, and consumer protection laws directly affect Shentel's operations and competitiveness. The Federal Communications Commission (FCC) and other regulatory bodies continuously adjust oversight to maintain fair practices. In 2024, the FCC is reviewing net neutrality rules, impacting Shentel's service offerings and investment strategies. Regulatory changes can lead to both challenges and opportunities for the company.

Government broadband initiatives, like those in the Infrastructure Investment and Jobs Act, offer Shentel opportunities for funding network expansion. These programs, allocating billions for broadband, aim to bridge the digital divide. However, Shentel faces potential competition from other providers vying for these funds. Compliance with program requirements, such as speed and affordability targets, is crucial for Shentel. For example, in 2024, the FCC announced over $4 billion in funding for rural broadband projects.

Geopolitical factors significantly impact Shenandoah Telecommunication. Trade policies and international relations affect supply chains and equipment costs. For instance, tariffs can raise prices of network components. In 2024, disruptions from geopolitical events increased operational expenses by 3% for telecom firms. These factors influence technology availability and affordability.

Data Privacy and Security Policies

Governments globally are intensifying their focus on data privacy and security, resulting in more stringent regulations. Shentel faces the challenge of adapting to these evolving legal frameworks to ensure compliance. Failure to do so could lead to significant penalties and damage customer trust. Staying informed about legislation, such as the GDPR or CCPA, is crucial. These laws impact how data is handled.

- Data breaches cost US businesses an average of $9.48 million in 2024.

- The global data security market is projected to reach $278.8 billion by 2025.

- GDPR fines can reach up to 4% of annual global turnover.

Political Stability in Operating Regions

Political stability is crucial for Shenandoah Telecommunication's operations. Regions with stable governments offer a predictable environment for business, supporting long-term investments. Changes in political priorities can impact infrastructure projects, potentially delaying or altering them. Market conditions can also shift based on government policies, affecting Shentel's strategic planning. Political risks include regulatory changes and tax adjustments.

- Political stability directly impacts investment confidence.

- Regulatory shifts can influence operational costs.

- Tax policies can affect profitability.

- Infrastructure projects are vulnerable to policy changes.

Political factors like regulations and policies significantly influence Shenandoah Telecommunication. Broadband initiatives offer funding opportunities, yet introduce competition. Compliance with data privacy laws, like GDPR, is crucial; data breaches cost US businesses ~$9.48M in 2024. Political stability also directly impacts investments.

| Political Factor | Impact on Shentel | 2024/2025 Data |

|---|---|---|

| Regulations | Affects operations, competitiveness | FCC reviewed net neutrality rules; GDPR fines possible |

| Broadband Initiatives | Opportunities for funding/expansion | FCC allocated >$4B for rural broadband |

| Data Privacy | Compliance costs/risks | US breach costs ~$9.48M; Global market ~$278.8B by 2025 |

Economic factors

Inflation and interest rates significantly affect Shentel. Higher inflation can increase Shentel's operational expenses and capital spending. For instance, in 2024, the Federal Reserve maintained interest rates, impacting borrowing costs for network upgrades. Elevated rates can also reduce consumer spending on services.

The Mid-Atlantic region's economic growth directly impacts Shentel's broadband demand. Strong economies boost spending on services. In 2024, the region saw moderate growth, with consumer spending remaining stable. Economic downturns could push customers towards cheaper alternatives. This economic sensitivity requires Shentel to adapt its pricing and offerings.

Shenandoah Telecommunications (Shentel) faces stiff competition. The telecommunications market is crowded with established providers and new technologies. This impacts Shentel's pricing and market share. For instance, the broadband market's competitive intensity increased in 2024, affecting Shentel's subscriber growth.

Cost of Services and Operations

The cost of services and operations is a crucial economic factor for Shenandoah Telecommunications (Shentel). Providing broadband services involves substantial expenses, including network maintenance, equipment upgrades, and labor costs. These costs directly affect Shentel's profitability; fluctuations in these areas require careful financial management. For 2024, Shentel's operating expenses accounted for a significant portion of its revenue, highlighting the importance of cost control.

- Network maintenance costs can vary based on technology and geographic coverage.

- Equipment expenses are influenced by technological advancements and market prices.

- Labor costs are affected by regional wage rates and workforce size.

- Shentel's profitability relies on effective cost management and pricing strategies.

Capital Expenditure Requirements

Shenandoah Telecommunications (Shentel) faces significant capital expenditure requirements, primarily for expanding and upgrading its network infrastructure, especially its fiber network. These investments are crucial for Shentel's future growth and competitiveness in the telecommunications market. The company's ability to secure financing and effectively manage these expenditures directly impacts its financial performance and strategic goals. In 2024, Shentel's capital expenditures were approximately $200 million, with a focus on fiber network expansion.

- Capital expenditures are vital for network expansion.

- Financing and expenditure management are key.

- 2024 capex was around $200 million.

Economic conditions significantly influence Shentel, impacting operational costs. Inflation and interest rates, like the Federal Reserve's maintained rates in 2024, affect borrowing and consumer spending. The Mid-Atlantic region's economic health is also crucial; stable growth boosts broadband demand.

| Economic Factor | Impact on Shentel | 2024/2025 Data Point |

|---|---|---|

| Inflation/Interest Rates | Higher costs, reduced consumer spending | 2024: Fed maintained rates, impacting borrowing |

| Regional Economic Growth | Impacts broadband demand | 2024: Moderate growth, stable spending |

| Cost of Services | Affects profitability, influenced by network costs | 2024: OpEx accounted for a significant portion of revenue |

Sociological factors

Broadband is now crucial for education, work, and socializing. This dependence boosts demand for fast internet services, like Shentel's. In 2024, over 90% of US households have internet access. Shentel's focus on reliable connectivity taps into this essential need. Furthermore, the FCC aims to close the digital divide, supporting Shentel's growth.

Digital inclusion highlights the urban-rural broadband gap, crucial for Shentel. In 2024, approximately 25% of rural Americans lacked high-speed internet, compared to only 3% in urban areas. This disparity influences societal expectations for equal access. Government initiatives, such as the FCC's $42.5 billion Broadband Equity, Access, and Deployment (BEAD) program, aim to bridge this divide, impacting Shentel's strategy in the Mid-Atlantic region.

Evolving consumer habits significantly impact Shenandoah Telecommunication (Shentel). Increased streaming, online gaming, and remote work fuel demand for higher bandwidth. Shentel must adapt its services to meet these changing needs. The U.S. broadband market is projected to reach $125.5 billion by 2025, highlighting the need for Shentel to innovate.

Customer Expectations for Service and Value

Customer expectations for service and value significantly impact Shenandoah Telecommunication's performance. Societal demands for excellent customer service and transparent pricing are on the rise. Consumers now expect seamless service and clear value propositions from their telecom providers. A recent study showed that 78% of customers will switch providers due to poor customer service.

- Customer satisfaction heavily relies on service quality and transparency.

- Clear pricing models and value-driven offerings are essential.

- High customer expectations lead to increased pressure on telecom companies.

- Poor customer service is a major driver of churn.

Remote Work and Learning Trends

The rise of remote work and online education significantly boosts the need for dependable home broadband. This shift directly influences Shentel's residential internet service demand. In 2024, approximately 30% of the U.S. workforce worked remotely, a trend expected to continue. Shentel's focus on expanding its fiber-optic network addresses this growing need.

- U.S. remote work participation rate in 2024: ~30%

- Shentel's fiber-optic network expansion is crucial.

Societal needs for internet and quality service drive Shentel's strategies. Consumer expectations around service quality and transparent pricing influence Shentel's performance directly. The remote work trend, with ~30% of the US workforce remote in 2024, boosts home broadband demand, making Shentel's fiber expansion crucial.

| Factor | Impact on Shentel | Data (2024-2025) |

|---|---|---|

| Customer Expectations | Demand for good service and pricing | 78% churn rate for poor service. |

| Remote Work | Higher home broadband demand | ~30% U.S. workforce remote (2024). |

| Digital Divide | Need for reliable internet across all regions | 25% rural lack high-speed internet (2024). |

Technological factors

Shenandoah Telecommunications (Shentel) heavily relies on fiber optic network development. Fiber advancements boost speeds and capacity, vital for data needs. Shentel's fiber-to-the-home (FTTH) passes grew to 497,800 in Q1 2024. This expansion supports its growth strategy. Shentel aims to further expand its fiber footprint in 2024/2025.

The advancement of 5G and upcoming 6G technologies significantly shapes the telecom sector. Although Shentel is wireline-focused, wireless innovations impact competition and service integration. According to a 2024 report, 5G subscriptions are expected to reach 1.3 billion globally. These advancements could influence Shentel's strategic decisions.

Artificial Intelligence (AI) and automation are reshaping the telecom sector, potentially impacting Shentel. AI can streamline network management and boost customer service. Shentel might invest in AI to enhance operational efficiency and personalize customer interactions. The global AI in telecom market is projected to reach $47.9 billion by 2025.

Cybersecurity and Network Security

Rapid technological advancements amplify cybersecurity threats. Shentel needs robust security measures for its network and data. The global cybersecurity market is projected to reach $345.4 billion in 2024. Shentel's investment is crucial to avoid financial losses and reputational damage. Staying ahead of threats is vital for sustained operations.

- Cybersecurity market forecast: $345.4B in 2024.

- Data breaches can cost millions to recover.

- Regular security audits are essential.

- Employee training on cyber threats is a must.

Evolution of Devices and Applications

The surge in connected devices and data-heavy applications necessitates continuous network upgrades for Shenandoah Telecommunications (Shentel). This includes adapting to technologies like 5G, which, by late 2024, covered over 85% of the U.S. population. Shentel's network must evolve to accommodate these demands, ensuring it remains competitive. This adaptation involves significant capital expenditure, with the telecom industry investing billions annually in infrastructure.

- 5G adoption is rapidly increasing, with 2024 seeing a 40% rise in 5G device usage.

- Data consumption per user is projected to grow by 25% annually through 2025.

- Shentel’s fiber-optic network expansion is critical for supporting these high-bandwidth applications.

Technological factors significantly influence Shenandoah Telecommunications (Shentel). Fiber optic and 5G/6G advancements are crucial for service delivery and market competitiveness. Investment in AI and robust cybersecurity, with the cybersecurity market valued at $345.4B in 2024, are essential. The continuous upgrades of its network infrastructure and services are vital for Shentel's sustained growth, with data consumption projected to grow by 25% annually through 2025.

| Technology Area | Impact on Shentel | 2024/2025 Data |

|---|---|---|

| Fiber Optic Networks | Enhances speed and capacity, supports FTTH expansion. | FTTH passes grew to 497,800 in Q1 2024; ongoing expansion. |

| 5G and Future Generations | Influences competition, service integration and market strategy. | 5G subscriptions expected to hit 1.3B globally. |

| Artificial Intelligence | Streamlines network, customer service optimization. | AI in telecom market projected to $47.9B by 2025. |

Legal factors

Shenandoah Telecommunications (Shentel) is heavily regulated. It must adhere to federal, state, and local telecommunications laws. These regulations govern licensing, service quality, and network infrastructure. For instance, Shentel spent $18.7 million on regulatory compliance in 2023.

Shenandoah Telecommunications (Shentel) must rigorously adhere to data privacy regulations, especially concerning customer data and network usage. Compliance with laws like GDPR and CCPA is essential. Non-compliance can lead to hefty fines and reputational damage, impacting investor confidence. In 2024, data breaches cost companies an average of $4.45 million globally, underscoring the financial risks.

Consumer protection regulations, crucial for Shentel, cover billing, service agreements, and advertising. These rules ensure fair practices. In 2024, the Federal Communications Commission (FCC) continued to enforce consumer protection, with potential fines for violations. Shentel must adhere to these to avoid legal issues and maintain customer trust. Compliance is a key operational and financial factor.

Net Neutrality Principles

Net neutrality, the principle that all internet traffic should be treated equally, is a significant legal factor for Shentel. Debates around these rules, which dictate how internet service providers manage data, can impact Shentel's network operations and business strategy. Changes could affect Shentel's ability to manage its network and offer services. The Federal Communications Commission (FCC) has been involved in these discussions, influencing the regulatory landscape. Regulatory shifts could lead to increased costs or altered service offerings.

- FCC's net neutrality rules were reinstated in 2021.

- Shentel's network management must comply with these rules.

- Potential future changes could affect Shentel's business model.

Antitrust and Competition Laws

Antitrust and competition laws significantly impact Shenandoah Telecommunication's strategic decisions. These regulations scrutinize mergers and acquisitions, potentially limiting Shenandoah's ability to expand through such means. The Federal Communications Commission (FCC) and the Department of Justice (DOJ) enforce these laws, ensuring fair market competition. In 2024, the DOJ blocked several mergers in the telecom sector, reflecting heightened scrutiny.

- FCC fines for antitrust violations totaled over $50 million in 2024.

- Shenandoah's market share in its primary service areas is approximately 1.5%.

Shenandoah Telecommunications faces significant legal challenges related to telecommunications laws, with a focus on licensing, service quality, and network infrastructure. Data privacy is critical, particularly in line with GDPR and CCPA. Antitrust regulations significantly impact mergers, affecting growth strategies.

Consumer protection, including billing and advertising, is essential, as is adherence to net neutrality rules. In 2024, FCC fines totaled over $50 million, with data breaches costing companies an average of $4.45 million globally.

These factors directly influence operational costs and strategic decisions. In 2023, Shentel spent $18.7 million on regulatory compliance. As of Q1 2024, the company's market share is roughly 1.5% in its primary service areas.

| Legal Aspect | Regulatory Body | Impact on Shentel |

|---|---|---|

| Compliance Costs | FCC, State Agencies | $18.7M spent in 2023 |

| Data Privacy | GDPR, CCPA | Avoidance of fines ($4.45M average breach cost, 2024) |

| Net Neutrality | FCC | Network operations and service offerings |

Environmental factors

The telecommunications industry's energy use is a key environmental issue, especially with data centers and network infrastructure. Shentel must address sustainability to cut its carbon footprint. Data centers can consume vast amounts of power. In 2024, the industry saw increased scrutiny regarding its environmental impact.

Electronic waste disposal presents an environmental challenge for Shenandoah Telecommunications. Regulations mandate responsible disposal and recycling of e-waste from network infrastructure and customer equipment. The global e-waste market is projected to reach $80.7 billion by 2025. This necessitates adherence to environmental standards and investment in sustainable practices.

Climate change and severe weather events, such as hurricanes and floods, are increasing in frequency, potentially causing service disruptions to Shentel's infrastructure. For instance, in 2024, extreme weather caused over $100 billion in damages in the U.S., impacting various sectors, including telecommunications. Shentel must assess the vulnerability of its network components, like cell towers and fiber optic cables, to these environmental threats. Investing in resilient infrastructure and disaster recovery plans is crucial for maintaining service availability.

Environmental Regulations for Network Deployment

Shentel's network deployment is subject to environmental regulations impacting land use and environmental impact assessments. These regulations can cause project delays and increase costs, especially in environmentally sensitive areas. For example, the Federal Communications Commission (FCC) has specific guidelines. These guidelines address potential environmental effects of construction and operation. Compliance with these regulations is essential for Shentel to obtain necessary permits and approvals for network expansion.

- FCC's Environmental Review: Mandates environmental reviews for projects potentially affecting the environment.

- Land Use Permits: Requires permits for construction on specific lands.

- Mitigation Measures: May necessitate mitigation plans to reduce environmental impact.

Push for Green Technologies

Shenandoah Telecommunication faces increasing pressure to adopt green technologies. This includes energy-efficient equipment and renewable energy sources. Embracing these technologies demonstrates environmental responsibility and can reduce operational costs. In 2024, the telecom industry saw a 15% rise in investments in green infrastructure.

- Green initiatives can lead to significant long-term cost savings.

- Consumer preference is shifting towards environmentally responsible companies.

- Government regulations increasingly favor sustainable practices.

Environmental concerns are pivotal for Shenandoah Telecommunication's operations. Energy consumption from data centers and networks poses sustainability challenges. E-waste disposal, with a market hitting $80.7B by 2025, demands regulatory compliance. Climate change risks necessitate infrastructure resilience.

| Environmental Factor | Impact on Shentel | Data/Statistics |

|---|---|---|

| Energy Use | High energy consumption | Telecom industry saw 15% rise in green tech investments by 2024. |

| E-waste | Regulatory compliance needed | E-waste market projected to reach $80.7B by 2025. |

| Climate Change | Risk of service disruption | Extreme weather caused >$100B in US damages by 2024. |

PESTLE Analysis Data Sources

This Shenandoah Telecommunications PESTLE leverages official U.S. government reports, financial data, industry publications, and market analysis for an informed evaluation.