Shift4 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shift4 Bundle

What is included in the product

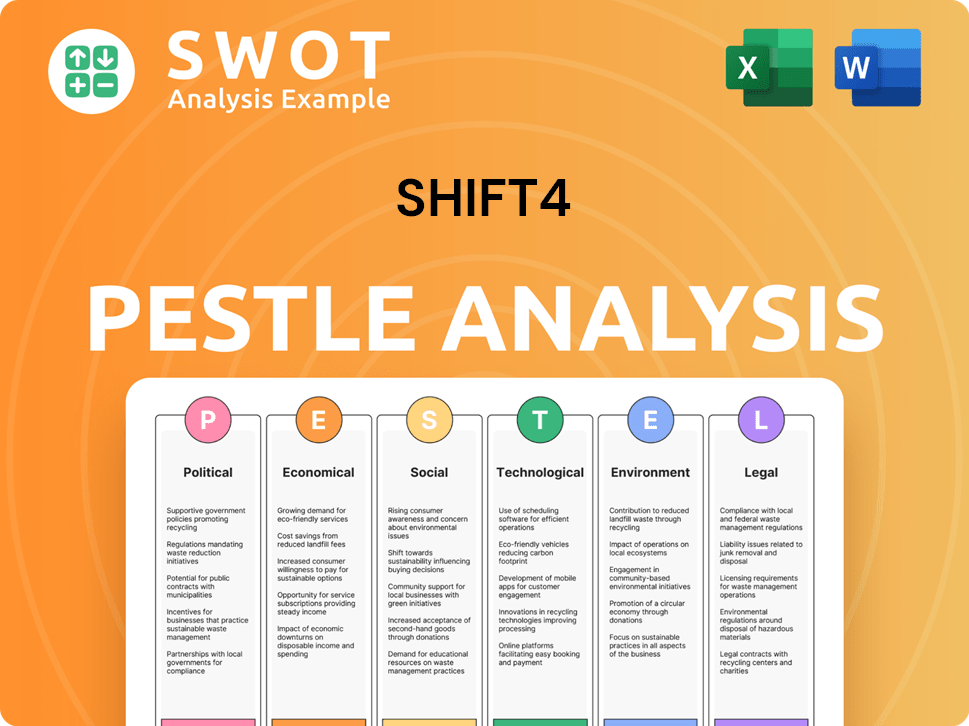

Explores external factors affecting Shift4 across six dimensions: Political, Economic, Social, Technological, Environmental, and Legal.

Provides a concise version for use in quick presentations or as a key decision-making document.

What You See Is What You Get

Shift4 PESTLE Analysis

This Shift4 PESTLE Analysis preview is the full report. After purchase, you will get the identical document.

It's a comprehensive analysis, no content differences from the preview. Expect a polished, ready-to-use PDF immediately.

The same professionally formatted file will be yours, completely accessible after checkout.

Download this document—as displayed— instantly. All aspects shown will be the same.

PESTLE Analysis Template

Explore Shift4's strategic landscape with our PESTLE Analysis. Discover how external factors shape their market position and identify potential opportunities. Understand the political, economic, social, technological, legal, and environmental forces impacting Shift4. Get crucial insights to enhance your decision-making and strategic planning. Buy the full version now for a complete, actionable analysis.

Political factors

Shift4 faces intense government regulation, especially in financial services. They must comply with laws like anti-money laundering and data privacy regulations. For example, in 2024, the costs for financial services compliance rose by approximately 15%. Changes in these regulations can significantly affect their business. Non-compliance can lead to hefty fines and operational disruptions.

Shift4's international growth exposes it to foreign policies and currency risks. Geopolitical instability can affect spending, impacting Shift4's results. In 2024, geopolitical events led to a 2% decrease in international revenue for some payment processors. Shifts in political landscapes necessitate careful risk management.

Government spending trends significantly influence sectors like hospitality and retail, vital for Shift4. For instance, in 2024, U.S. government spending on consumer services increased by 3.5%, impacting payment volumes. Shifts in these expenditures directly affect Shift4's transaction volumes. Changes in fiscal policies can create both opportunities and challenges.

Trade Policies and Protectionism

Trade policies and protectionism are evolving, with cross-border trade projected to grow, vital for digital payments. Shift4's international expansion could be affected by policy shifts. The World Trade Organization forecasts a 2.6% increase in global trade volume for 2024. Protectionist measures, like tariffs, could affect Shift4’s cross-border transactions, impacting revenue streams.

- Global trade volume is expected to increase by 2.6% in 2024.

- Changes in tariffs could affect Shift4's international revenue.

Regulatory Scrutiny and Enforcement

Shift4 faces regulatory scrutiny, particularly from the SEC. Non-compliance, such as the undisclosed payments settlement, leads to penalties. This impacts the company's reputation and financial performance. Regulatory risks are ongoing concerns for Shift4, demanding robust compliance measures.

- SEC settlement: $1.8 million in 2024

- Compliance costs: Increase of 15% in 2024

- Reputational damage: Potential loss of 5% in market value

Shift4 navigates complex regulations, including anti-money laundering rules, where compliance costs rose by 15% in 2024. Geopolitical events impacted international revenue, causing a 2% decrease in 2024. Government spending and trade policies influence key sectors, with a 2.6% expected increase in global trade volume in 2024.

| Regulatory Area | Impact | Data (2024) |

|---|---|---|

| Compliance | Increased Costs | 15% rise |

| Geopolitical Instability | Revenue Decrease (International) | -2% |

| Global Trade | Growth | +2.6% |

Economic factors

Inflation impacts consumer spending, crucial for Shift4. High inflation might curb spending, affecting transaction volumes in hospitality and retail. Despite stable trends, economic uncertainties could challenge Shift4. In March 2024, U.S. inflation was 3.5%, impacting spending. Shift4's revenue growth in 2023 was 22%.

Global economic growth and international trade are vital for digital payment companies like Shift4. The World Bank projects global GDP growth of 2.6% in 2024, increasing to 2.7% in 2025. The World Trade Organization forecasts merchandise trade volume growth of 2.6% in 2024 and 3.3% in 2025, supporting Shift4's global expansion. Strong growth in these areas creates more opportunities for digital payment solutions.

Interest rates significantly affect business investment. Potential rate cuts by central banks, mirroring decreasing inflation, could boost capital goods investment. This could indirectly help Shift4's clients. The Federal Reserve held rates steady in May 2024, but future cuts are expected. This could lower borrowing costs for merchants.

Acquisitions and Strategic Investments

Shift4's strategic moves, like acquiring Global Blue, are big economic plays to grow its market share and global reach. These acquisitions involve considerable financial investments and are projected to boost revenue and EBITDA. For example, Shift4's 2024 revenue is forecasted to be around $2.9 billion, reflecting growth from these strategic investments. These acquisitions are expected to contribute significantly to future financial performance.

- Global Blue acquisition is a key step in expanding Shift4's international footprint.

- Shift4's 2024 revenue projections include contributions from recent acquisitions.

- Strategic investments are aimed at boosting long-term revenue and EBITDA growth.

Market Competition

The payments landscape is fiercely competitive, especially for companies like Shift4. Their success hinges on staying ahead in a market where innovation is constant. Shift4 faces rivals such as Block, Inc. and Fiserv, Inc., all vying for market share. Maintaining a competitive edge requires continuous investment in technology and strategic partnerships. The global payment processing market is projected to reach $127.49 billion by 2029, with a CAGR of 11.9% from 2022 to 2029.

- Shift4's revenue for Q1 2024 was $736.8 million, a 25% increase YoY.

- Block, Inc. reported $5.96 billion in gross profit in 2023.

- Fiserv's total revenue for 2023 reached $18.89 billion.

- The U.S. payment processing market is expected to grow, reaching $2.1 trillion by 2027.

Economic factors profoundly influence Shift4's performance.

Inflation's impact on consumer spending and potential interest rate cuts need consideration.

Global economic growth and Shift4's strategic acquisitions will drive future results.

| Factor | Impact on Shift4 | 2024/2025 Data |

|---|---|---|

| Inflation | Affects transaction volumes. | US inflation 3.5% (March 2024) |

| Economic Growth | Supports global expansion. | Global GDP: 2.6% (2024), 2.7% (2025) |

| Interest Rates | Affect business investments. | Fed held rates steady in May 2024. |

Sociological factors

Consumer behavior significantly impacts digital payments. The shift towards digital wallets and BNPL boosts Shift4. In 2024, digital payments grew; BNPL transactions surged. This trend aligns with Shift4's expansion. For example, in Q1 2024, BNPL spending rose 15%.

Shift4's growth hinges on adapting to changing consumer preferences. For example, in 2024, mobile payments surged, with projections showing continued growth. Consumers now favor diverse payment methods. This includes digital wallets and contactless options. Understanding these shifts is critical for Shift4's market position.

Shift4's focus on hospitality means tourism trends are key. Global Blue's acquisition boosts its travel sector role. Post-COVID, travel's rebounded; 2024 forecasts show continued growth. International tourism spending is projected to reach $1.9 trillion in 2024. This fuels transaction volumes for Shift4.

Social Risks in the Travel Industry

The travel industry, a growing sector for Shift4, faces social risks impacting its operations. These risks include health scares and terrorism, which can indirectly affect Shift4's business performance in this area. For instance, the World Travel & Tourism Council (WTTC) predicted a 9.1% increase in the travel sector's contribution to global GDP in 2024, but this growth is vulnerable.

- Terrorism incidents can lead to a decrease in travel bookings, affecting payment processing.

- Health crises, like pandemics, can halt travel, impacting Shift4's revenue from travel-related transactions.

- Safety perceptions influence travel choices, potentially diverting business away from affected regions.

Workforce and Labor Trends

Sociological factors, especially workforce and labor trends, indirectly affect Shift4's clients. These trends include shifts in consumer behavior, and evolving employee expectations. The hospitality and retail sectors, Shift4's primary client base, are significantly impacted by these changes. Focusing on these trends helps Shift4 anticipate and adapt to client needs.

- The U.S. hospitality sector employed over 15.8 million people in 2024.

- Labor shortages and rising wages are key challenges.

- Changing consumer preferences are driving innovation.

Sociological shifts like consumer behavior and workforce trends affect Shift4. Digital payment adoption and preferences drive market adaptation. These dynamics shape how clients in hospitality and retail operate, impacting Shift4.

| Factor | Impact | Data (2024) |

|---|---|---|

| Consumer Behavior | Digital payments, BNPL growth | BNPL spending +15% (Q1 2024) |

| Workforce Trends | Labor shortages, wage changes | Hospitality sector ~15.8M employees |

| Client Focus | Adapt to shifts in tech | Mobile payments saw major increase |

Technological factors

The payment processing sector is rapidly changing. Shift4 must innovate to stay competitive. In 2024, mobile payments grew by 25%. Integration with various platforms is key. Shift4 processes over $200B annually.

The surge in digital transactions fuels the payment security market, yet amplifies cybersecurity risks. Shift4 faces threats like data breaches, requiring robust security measures. The global cybersecurity market is projected to reach $345.7 billion by 2025. Strong IT systems are crucial for protecting sensitive data.

The rise of e-commerce and omnichannel strategies fuels Shift4's growth. Global e-commerce sales are projected to hit $8.1 trillion in 2024. Shift4 can capitalize on this trend by offering seamless payment solutions. This includes integrating with platforms to enhance customer experiences. These platforms will increase sales, boosting Shift4's revenue potential.

Reliance on Third-Party Vendors and IT Systems

Shift4 relies heavily on third-party vendors for certain products and services, integrating their IT systems. This reliance introduces risks related to the security and dependability of these external systems. Any disruptions or breaches affecting these vendors could directly impact Shift4's operational capabilities. For instance, in 2024, over 60% of data breaches involved third-party vendors, highlighting the vulnerability.

- Data breaches through third-party vendors increased by 15% in 2024.

- Shift4's operational efficiency is directly tied to the performance of these external systems.

Integration of Acquired Technologies

Shift4's success hinges on effectively merging new tech from acquisitions. This includes Global Blue's tech, aiming for unified services and cost savings. Successful integration boosts efficiency and strengthens market position. A smooth tech transition is key to unlocking growth opportunities. For example, Shift4's revenue in Q1 2024 was $758.6 million, a 25% increase year-over-year, highlighting the impact of strategic tech integration.

- Streamlining operations post-acquisition.

- Enhancing service offerings through combined tech.

- Driving cost efficiencies via unified platforms.

- Boosting market competitiveness.

Technological advancements shape Shift4's strategy significantly.

The integration of various platforms and third-party vendors' security needs are also important.

Successful tech integration post-acquisitions is crucial. Cyberattacks caused a global loss of over $8.4 trillion in 2024.

| Key Tech Aspect | Impact | Data Point (2024/2025) |

|---|---|---|

| Mobile Payments | Growth Driver | 25% growth in 2024 |

| Cybersecurity | Risk & Cost | Global market projected to reach $345.7B by 2025 |

| E-commerce | Revenue opportunity | Projected sales: $8.1T in 2024 |

Legal factors

Shift4 operates in a heavily regulated financial services sector. Compliance includes payment processing rules, anti-money laundering, and counter-terrorist financing. These regulations vary across different geographic locations. In 2024, financial services companies faced increased scrutiny, with regulatory fines reaching billions globally.

Shift4 must adhere to data protection laws like GDPR, crucial for handling sensitive payment data. In 2024, GDPR fines reached $1.5 billion. Cybersecurity breaches cost businesses an average of $4.45 million in 2023. Compliance is vital to avoid penalties and maintain customer trust.

Shift4 must comply with consumer protection laws to safeguard user data and prevent fraud. These regulations, like those enforced by the FTC, require data security measures. According to the FTC, in 2024, businesses paid over $1.5 billion in penalties for data breaches. Non-compliance can lead to significant fines and legal repercussions. Shift4's adherence to these laws builds trust with merchants and consumers.

Acquisition and Merger Regulations

Strategic acquisitions, similar to Shift4's Global Blue deal, face regulatory hurdles. These approvals are essential for finalizing mergers and acquisitions. Delays or rejections from regulatory bodies can significantly impact deal timelines and outcomes. For instance, the Global Blue acquisition faced scrutiny, potentially affecting its completion. Regulatory scrutiny is common in the financial sector.

- Global Blue acquisition deal was valued at approximately $1.2 billion.

- Regulatory approvals can take several months, sometimes even longer.

- Antitrust concerns often lead to in-depth reviews by regulatory agencies.

- Failure to obtain approvals can lead to deals being restructured or terminated.

Tax Regulations

Tax regulations are a crucial legal factor for Shift4. Changes, like Pillar Two rules, affect income tax expenses. The OECD's Pillar Two aims for a 15% global minimum tax rate. Shift4's effective tax rate in 2023 was 23.3%. Compliance with evolving tax laws is essential.

- Pillar Two's impact on effective tax rates.

- Shift4's 2023 effective tax rate: 23.3%.

- Importance of staying compliant with tax laws.

Shift4 faces intense legal scrutiny in financial services. Data protection, like GDPR, is critical, with fines in 2024 hitting billions. Consumer protection laws and antitrust reviews of acquisitions like the Global Blue deal at $1.2 billion are also pivotal. Tax regulations, including Pillar Two, influence compliance.

| Legal Factor | Impact | 2024/2025 Data |

|---|---|---|

| Data Protection (GDPR) | Compliance, Customer Trust | Fines: Billions |

| Consumer Protection | User Data, Fraud Prevention | FTC Penalties: $1.5B+ (2024) |

| Mergers/Acquisitions | Deal Timeline, Outcome | Global Blue Deal: $1.2B |

| Tax Regulations | Income Tax, Expenses | Shift4’s Tax Rate (2023): 23.3% |

Environmental factors

Shift4's indirect environmental impact stems from its clients' practices. Hospitality and retail, key sectors for Shift4, are under increasing pressure for sustainability. For example, in 2024, the global sustainable tourism market was valued at $235 billion. This trend affects the payment solutions these businesses need.

Climate change presents indirect risks to Shift4. Sectors like travel and hospitality, key clients, face climate-related disruptions. For example, the World Travel & Tourism Council estimates that climate change could reduce tourism revenue by up to 10% by 2030. This could affect transaction volumes.

The energy consumption of data centers and technological infrastructure is a significant environmental factor. These facilities, crucial for payment processing, consume substantial electricity. According to the U.S. Energy Information Administration, data centers accounted for approximately 2% of total U.S. electricity consumption in 2023. This figure is expected to grow. Shift4, like all companies relying on technology, must consider its energy use.

Electronic Waste from POS Systems

The lifecycle of point-of-sale (POS) systems and related hardware significantly contributes to electronic waste, posing an environmental concern. These devices, including terminals, printers, and scanners, become obsolete or damaged, often ending up in landfills. According to the EPA, in 2019, only 15% of e-waste was recycled. The increase in POS system deployments exacerbates this issue, generating more electronic waste.

- E-waste from POS systems includes terminals, printers, and scanners.

- In 2019, only 15% of e-waste was recycled in the US.

- Increased POS deployments lead to more e-waste generation.

Corporate Environmental Responsibility

Corporate environmental responsibility is increasingly vital. Stakeholders expect companies like Shift4 to address indirect environmental impacts and promote sustainability. This includes evaluating the environmental footprint of their operations and supply chains. Shift4's commitment to sustainability could enhance its brand image and attract environmentally conscious investors. The rise in ESG (Environmental, Social, and Governance) investing shows this trend.

- In 2024, ESG assets reached over $40 trillion globally.

- Companies with strong ESG performance often see higher valuations.

- Shift4 could adopt carbon-reduction targets and renewable energy use.

Environmental concerns indirectly affect Shift4. Hospitality and retail clients face sustainability pressures; the global sustainable tourism market reached $235 billion in 2024. Climate risks could impact transaction volumes; the World Travel & Tourism Council estimates potential revenue declines by 2030.

Data center energy consumption is a significant factor, with U.S. data centers using roughly 2% of total electricity in 2023. E-waste from POS systems also presents an issue; in 2019, only 15% of e-waste was recycled.

Corporate environmental responsibility is key; ESG assets globally reached over $40 trillion in 2024. Shift4 can improve its brand and attract investors by focusing on its sustainability.

| Factor | Impact on Shift4 | Data Point (2024/2025) |

|---|---|---|

| Sustainability Trends | Client demands for sustainable practices | $235B - Sustainable Tourism Market (2024) |

| Climate Change | Potential disruption of key sectors | Up to 10% - Tourism Revenue Decline (by 2030) |

| Data Center Energy Use | Indirect environmental impact | 2% - U.S. Electricity Consumption (Data Centers in 2023) |

| E-waste | Disposal of POS hardware | 15% - E-waste Recycling Rate (US, 2019) |

| Corporate Responsibility | Stakeholder Expectations | $40T+ - Global ESG Assets (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis integrates financial data, government policies, tech advancements, and market analysis reports for informed insights.