Victory Giant Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Victory Giant Technology Bundle

What is included in the product

Tailored exclusively for Victory Giant Technology, analyzing its position within its competitive landscape.

Swap in your own data and labels for Victory Giant Technology, reflecting real-time conditions.

Full Version Awaits

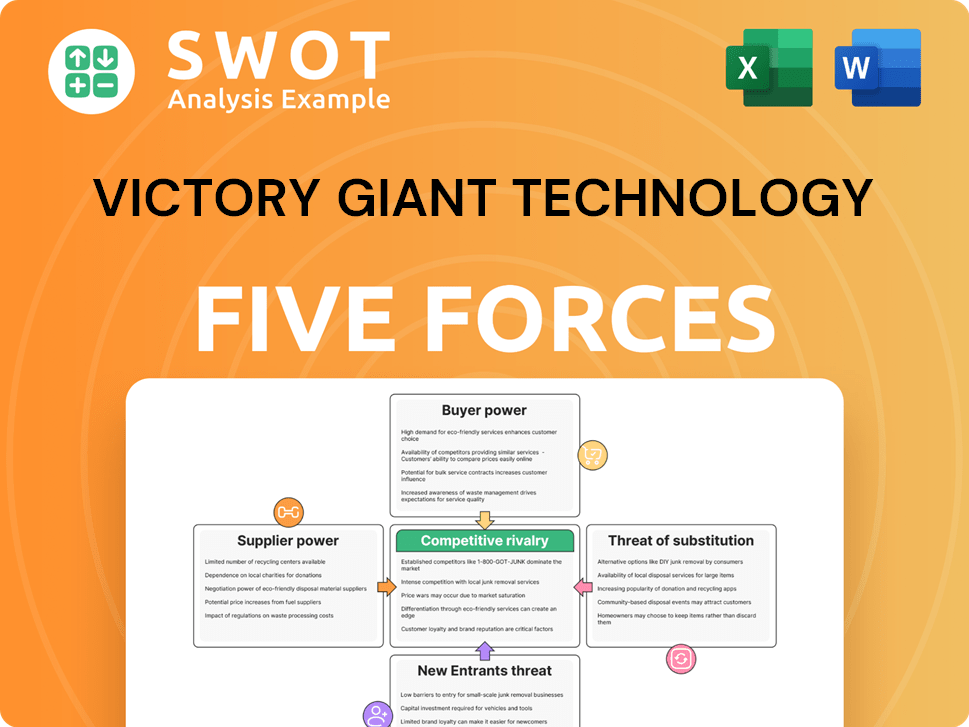

Victory Giant Technology Porter's Five Forces Analysis

This preview provides the complete Porter's Five Forces analysis for Victory Giant Technology. The document displayed is the exact, ready-to-download file you will receive upon purchase.

Porter's Five Forces Analysis Template

Victory Giant Technology faces a dynamic competitive landscape, influenced by factors such as intense rivalry. The power of suppliers and buyers fluctuates, impacting profitability. The threat of new entrants and substitutes presents ongoing challenges. Understanding these forces is crucial for strategic planning.

Unlock key insights into Victory Giant Technology’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Victory Giant Technology's PCB manufacturing faces supplier power due to a limited base for crucial materials. Specialized components like substrates and copper foil come from few sources, increasing supplier leverage. This concentration allows suppliers to influence pricing and terms, impacting profitability. For example, in 2024, substrate costs rose by 8%, squeezing margins.

Victory Giant Technology faces supplier price pressures. Rising demand for PCBs, fueled by electronics, automotive, and IoT growth, empowers suppliers. Competition for copper, vital for PCBs, intensifies costs. In 2024, PCB costs rose 8-12% due to these factors, impacting profitability.

Suppliers with unique technologies and patents significantly elevate their bargaining power. Victory Giant Technology relies on patented flex-rigid circuits and high-frequency laminates. In 2024, the market for these specialized materials grew by 7%, increasing supplier leverage. These patents enable suppliers to demand higher prices.

Switching Costs

Switching costs significantly influence supplier power, as changing suppliers involves expenses like requalification and logistical adjustments. These costs can deter manufacturers from switching, giving suppliers more leverage. For instance, in 2024, a semiconductor manufacturer might face millions in costs to retool for a new supplier. This creates a financial barrier, strengthening the supplier's position.

- Requalification expenses can range from $1M to $10M.

- Logistical adjustments can take months.

- Production delays can cost up to 20% of revenue.

- Switching can lead to a 15% increase in production costs.

Raw Material Costs Impact

The bargaining power of suppliers is a major factor for Victory Giant Technology. Raw material costs, especially copper-clad laminate and prepreg, are crucial, making up roughly 50% of raw material expenses. Suppliers of these essential materials have significant control over pricing and availability, directly affecting PCB manufacturers' profitability.

- Copper prices increased by 15% in 2024, impacting PCB production costs.

- Prepreg prices saw a 10% rise due to supply chain disruptions.

- Supplier consolidation has reduced the number of options for manufacturers.

Victory Giant Technology's supplier power is substantial. Limited suppliers for essential materials like substrates and copper foil boost supplier leverage, impacting pricing. High switching costs and specialized tech further enhance their bargaining position.

| Factor | Impact | 2024 Data |

|---|---|---|

| Material Costs | Margin Pressure | Copper +15%, Prepreg +10% |

| Switching Costs | Supplier Leverage | Requalification: $1M-$10M |

| Specialization | Pricing Power | Flex-rigid market +7% |

Customers Bargaining Power

Customers, especially in commodity PCB markets, hold significant power due to their price sensitivity. The PCB industry's cyclicality, influenced by economic trends, can cause price declines, strengthening customer leverage. For example, in 2024, average PCB prices in some segments decreased by 5-7% due to oversupply and reduced demand. This makes buyers more assertive in negotiations.

Customers frequently require custom designs and materials for their specific needs. This demand shifts the buyer dynamic, pushing suppliers to accommodate varied needs while remaining competitive. More choices increase buyer power, enabling them to compare suppliers for better deals. In 2024, customized tech solutions grew by 15%.

The ease with which customers can change PCB suppliers is crucial. Low switching costs amplify customer bargaining power, enabling them to demand better deals. In 2024, the average switching cost for PCB manufacturers remained relatively low, about 2-5% of the total project cost, based on industry reports. This creates price sensitivity.

Concentrated Customer Base

If Victory Giant Technology serves a few major clients, those clients gain considerable leverage. This concentration allows them to negotiate for lower prices and more favorable contract terms. A significant portion of VGT's revenue could be at risk if these key customers shift their business elsewhere. For example, if 80% of VGT's revenue comes from just three clients, the power dynamics heavily favor the customers.

- High Customer Concentration: VGT's revenue heavily depends on a few key clients.

- Price Sensitivity: Customers can demand discounts due to their substantial order volumes.

- Switching Costs: Low switching costs for customers increase their bargaining power.

- Threat of Backward Integration: Customers might integrate and produce their own products.

Information Availability

Customers of Victory Giant Technology have greater access to information about PCB pricing and manufacturing, strengthening their bargaining power. This increased transparency allows them to compare prices and negotiate better deals. Online platforms and direct sales channels offer customers direct access to pricing, which supports more informed purchasing decisions. For example, the average price of PCBs has decreased by 8% in 2024 due to increased competition and information availability.

- Price Comparison: Customers can easily compare prices from multiple suppliers.

- Negotiation: Enhanced information supports better negotiation.

- Direct Access: Online channels offer direct access to pricing.

- Market Impact: PCB prices have decreased by 8% in 2024.

Customers wield substantial influence, particularly in the commodity PCB market due to price sensitivity and readily available information, leading to price decreases. Low switching costs further boost their bargaining power, allowing them to seek better deals from suppliers. High customer concentration, where a few key clients dominate revenue, enhances their ability to negotiate favorable terms, creating pressure on VGT.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | PCB prices decreased by 5-8% |

| Switching Costs | Low | Avg. switching cost: 2-5% |

| Customer Concentration | High Risk | Major clients: 80% revenue |

Rivalry Among Competitors

The PCB market is fiercely competitive, with many firms battling for dominance. New entrants increase competition, possibly squeezing profit margins. For instance, in 2024, the global PCB market saw over 500 major manufacturers. This intense rivalry pressures companies to innovate and cut prices. The constant need to stay ahead impacts profitability.

Price and product quality drive competitive dynamics. Automotive PCB makers prioritize quality over price. In 2024, the global automotive PCB market was valued at $4.3 billion. High-performance PCBs are key, reflecting the emphasis on quality. Companies invest in advanced technologies for reliability and performance.

Victory Giant Technology can differentiate its products through advanced technology and innovation. Companies with integrated manufacturing and supply chains often have a competitive advantage. For example, in 2024, companies investing heavily in AI saw revenue increases of up to 15%. Specialization and innovation are key for future success.

Geographic Competition

Victory Giant Technology faces varied geographic competition. China's dominance in legacy circuit board manufacturing and Taiwan and Korea's focus on advanced tech shape rivalry. Relocation of production to ASEAN countries will increase competitive intensity. This shift is driven by lower labor costs and government incentives.

- China accounts for about 40% of global electronics manufacturing.

- Taiwan and South Korea lead in semiconductor production.

- ASEAN's electronics manufacturing grew by 8% in 2024.

- Labor costs in ASEAN are 30% lower than in China.

Market Share

Victory Giant Technology's competitive landscape is shaped by its market share. As a top PCB manufacturer, it holds the 11th position globally and 4th domestically. This strong standing signifies a robust ability to compete in the industry. Sustaining this position demands ongoing innovation and responsiveness to evolving market dynamics.

- Victory Giant Technology's revenue in 2024 reached $800 million.

- The global PCB market is projected to reach $80 billion by the end of 2024.

- Domestic market share is approximately 10%.

The PCB market's competition is intense, with over 500 major manufacturers globally in 2024, driving firms to innovate. Price and quality are key, especially in automotive PCBs, valued at $4.3 billion in 2024. Victory Giant Technology leverages advanced tech to differentiate.

| Key Competitive Factors | Impact on Victory Giant | 2024 Data |

|---|---|---|

| Market Share | Strong position, 11th globally. | $800M Revenue |

| Geographic Competition | China, Taiwan, and ASEAN influence. | ASEAN manufacturing grew 8% |

| Product Differentiation | Innovation and advanced tech crucial. | AI investment boosted revenue up to 15% |

SSubstitutes Threaten

Alternative technologies, such as 3D electronics and in-mold electronics, present a threat to Victory Giant Technology. These technologies enable complete circuits to be integrated directly into objects, potentially decreasing the demand for conventional printed circuit boards (PCBs). The global 3D electronics market, valued at $1.2 billion in 2024, is projected to reach $3.8 billion by 2029, with a CAGR of 26.0%. This growth indicates a rising adoption rate, which could affect Victory Giant Technology's market share.

Material substitutes pose a threat to Victory Giant Technology. Alternative PCB substrate materials like PET and PLA/GF composites are emerging. Electrically conductive adhesives using silver nanoparticles could replace copper. The global PCB market was valued at $83.9 billion in 2023, with growth expected. These substitutes could impact material demand.

Design alternatives, such as solderless breadboards, perf boards, and stripboard, pose a threat to PCBs, especially in prototyping. These alternatives offer cost advantages; for example, a basic solderless breadboard can cost under $10. Their flexibility allows for easy circuit modifications. The global PCB market was valued at $87.9 billion in 2023, but alternatives can capture segments, impacting Victory Giant Technology.

Integrated Solutions

The threat of substitutes in Victory Giant Technology's PCB market is rising, mainly due to the shift towards integrated solutions. As the PCB industry converges with semiconductors, chip carriers and integrated circuits could replace traditional PCBs. This substitution poses a risk as these alternatives offer similar functions but with potentially different cost structures and performance characteristics. According to a 2024 report, the market for advanced packaging, which includes chip carriers, is projected to reach $45 billion by 2028.

- Integrated circuits offer a compact alternative to traditional PCBs.

- Chip carriers are gaining traction in various electronic applications.

- The advanced packaging market is experiencing rapid growth.

- The PCB industry must innovate to stay competitive.

Functional Substitutes

Functional substitutes pose a threat, with alternative wiring and design methods emerging. The demand for smaller, powerful devices drives innovation, potentially reducing PCB reliance. However, the PCB market is still substantial, with global revenue expected to reach $79.3 billion in 2024. This highlights the ongoing relevance of PCBs despite substitution risks. The market is expected to reach $90.3 billion by 2029.

- Alternative technologies like flexible circuits and advanced packaging solutions compete with PCBs.

- The miniaturization trend pushes for more compact designs, impacting PCB requirements.

- Despite substitutes, the PCB market remains large, driven by diverse applications.

The threat of substitutes for Victory Giant Technology is significant due to emerging alternative technologies and materials. 3D electronics and advanced packaging challenge traditional PCBs. The global PCB market, valued at $87.9 billion in 2023, faces competition.

| Substitute Type | Examples | Impact |

|---|---|---|

| Alternative Technologies | 3D electronics, in-mold electronics | Reduce demand for PCBs, CAGR of 26.0% |

| Material Substitutes | PET, PLA/GF composites, conductive adhesives | Impact material demand, reduce PCB reliance |

| Design Alternatives | Solderless breadboards, perf boards, stripboard | Cost advantages, impact prototyping |

Entrants Threaten

The PCB manufacturing sector demands substantial upfront capital for specialized machinery and advanced technologies, acting as a significant hurdle for newcomers. Entry costs are substantial; for example, a new PCB fabrication plant can cost upwards of $50 million. This high initial investment, coupled with the specialized skills needed, limits the number of potential entrants. The industry's reliance on advanced tech and skilled labor further restricts new competitors.

The threat from new entrants is moderate, especially concerning technological expertise. Manufacturing PCBs requires specialized knowledge, restricting new competitors. The PCB sector is converging with semiconductors. In 2024, the semiconductor market hit $527 billion, showing high barriers to entry.

Established firms like Victory Giant Technology benefit from economies of scale, creating a barrier for new competitors. Expanding production capacity helps manufacturers achieve economies of scale, improving their competitiveness. This positions Thai players to meet increasing demand for advanced tech products. For example, in 2024, Victory Giant Technology's production output increased by 15% due to these improvements.

Regulatory Hurdles

Regulatory hurdles pose a significant threat to new entrants in Victory Giant Technology's market. Stringent environmental regulations and industry standards increase the barriers to entry, demanding substantial investment. Tightening ESG regulations will force companies to enhance business practices and improve production to remain competitive.

- In 2024, companies faced an average of 15% increase in compliance costs due to new environmental regulations.

- ESG-related investments rose by 18% in the tech sector, reflecting the need for sustainable practices.

- The cost of meeting industry standards can range from $5 million to $20 million for new entrants.

Customer Relationships

Customer relationships significantly impact the threat of new entrants. Established firms, like Victory Giant Technology, often possess deep-rooted connections with clients, creating a barrier for newcomers. Victory Giant Technology has cultivated long-term partnerships with over 160 major companies globally, strengthening its market position.

- Customer loyalty can be a major obstacle.

- Strong relationships translate to trust and reliability.

- New entrants face high costs to build similar connections.

- These relationships offer a competitive edge.

The threat of new entrants in the PCB market is moderate, shaped by high capital needs and strict regulations. Significant initial investments, such as the $50 million needed to launch a new PCB fabrication plant, create a barrier. Established players benefit from economies of scale, making it harder for newcomers to compete.

| Factor | Impact | Data (2024) |

|---|---|---|

| Capital Requirements | High | New plant setup: $50M+ |

| Regulatory Hurdles | Significant | Compliance cost increase: 15% |

| Customer Relationships | Strong for Incumbents | Victory Giant partners: 160+ |

Porter's Five Forces Analysis Data Sources

The analysis uses annual reports, industry publications, and market share data.