Siemens Healthineers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Healthineers Bundle

What is included in the product

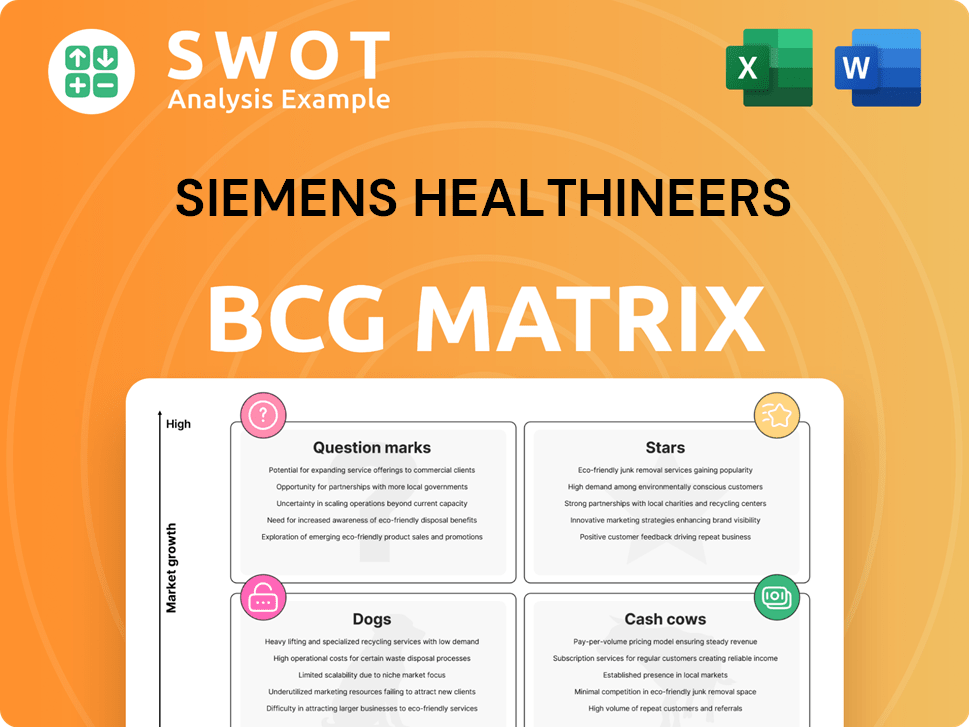

Siemens Healthineers' BCG Matrix showcases product portfolio strategies with investment, hold, and divestment recommendations.

Export-ready design for quick drag-and-drop into PowerPoint, saving time and ensuring impactful executive presentations.

Delivered as Shown

Siemens Healthineers BCG Matrix

The Siemens Healthineers BCG Matrix preview is the complete report you'll receive. This document, ready for strategic insights, contains the same detailed analysis and presentation-ready formatting as the purchased file.

BCG Matrix Template

Siemens Healthineers' BCG Matrix helps decode its diverse portfolio, from high-growth Stars to steady Cash Cows. Analyze its market share and growth potential with key product placements. See which areas thrive and which need strategic adjustments for optimal performance. This snapshot is insightful, but there's more to uncover. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Advanced Imaging Systems are a 'Star' for Siemens Healthineers. They lead in MRI and CT, with high growth. Demand for accurate diagnostics fuels this sector. In Q1 2024, Imaging revenue rose, driven by strong performance in advanced therapies. Siemens Healthineers's imaging segment saw a 7.7% growth in fiscal year 2024.

Siemens Healthineers' Varian Cancer Care Solutions is a 'Star' in its BCG Matrix. Post-acquisition, it's shown strong growth, leading the market. This segment uses advanced tech, aiming for continued high growth. For example, in 2024, Varian's revenue grew, reflecting its market dominance.

Siemens Healthineers is strategically focusing on digital health, heavily investing in AI integration. The digital health market is experiencing rapid expansion, with projections estimating it will reach $600 billion by 2024. This sector's high growth potential positions these solutions as a 'Star'. In 2023, Siemens Healthineers saw a 15% increase in digital revenue. These advancements are designed to enhance patient care and drive significant revenue growth.

Molecular Imaging

Molecular imaging, specifically PET/CT, is a key growth area for Siemens Healthineers, fitting the 'Star' quadrant of its BCG Matrix. This segment benefits from the precision medicine trend, driving demand for advanced diagnostic tools. The acquisition of Novartis' AAA Molecular Imaging business strengthened Siemens' position in this market. This strategic move aligns with the company's focus on high-growth, innovative healthcare solutions.

- Siemens Healthineers' revenue in imaging was approximately €10.9 billion in fiscal year 2023.

- The global molecular imaging market is projected to reach $7.4 billion by 2029.

- The PET/CT market is expected to grow significantly due to advancements in technology and clinical applications.

Precision Medicine Initiatives

Siemens Healthineers actively invests in precision medicine, a high-growth area. Their AI lab collaboration with IISc exemplifies this commitment. Precision medicine solutions promise to revolutionize healthcare, presenting substantial growth prospects, thus categorizing it as a 'Star'. These initiatives align with the company's strategic focus on advanced diagnostics and therapies. Siemens Healthineers' revenue increased to €21.7 billion in fiscal year 2023, reflecting its investments in high-growth areas.

- AI lab collaboration with IISc.

- Revenue of €21.7 billion in fiscal year 2023.

- Focus on advanced diagnostics and therapies.

- High-growth area with significant potential.

Siemens Healthineers' "Stars" include Advanced Imaging, Varian Cancer Care, and Digital Health. These segments show strong growth with high market share. Revenue in Imaging grew by 7.7% in 2024, and digital revenue by 15% in 2023. Strategic investments drive their success.

| Star Segment | Key Feature | 2024 Data |

|---|---|---|

| Advanced Imaging | MRI/CT leadership | Imaging revenue +7.7% |

| Varian Cancer Care | Market dominance | Revenue growth |

| Digital Health | AI integration | 2023 digital rev +15% |

Cash Cows

Siemens Healthineers' conventional X-ray systems are cash cows. They hold a solid market share in a mature market, ensuring stable revenue. These systems require minimal investment, providing consistent cash flow. In 2024, the X-ray market was valued at $12.5 billion, with Siemens Healthineers maintaining a significant portion.

Siemens Healthineers' lab diagnostics is a 'Cash Cow'. It boasts a large base and steady demand. This segment generates significant revenue. Its high market share ensures profitability. In 2024, the Diagnostics segment sales were €8.2 billion.

Siemens Healthineers is a major player in the ultrasound market, generating consistent revenue and cash flow. Ultrasound technology, although mature, benefits from the company's strong brand. In 2024, the global ultrasound market was valued at approximately $8.1 billion. This solid position makes it a 'Cash Cow' for the company.

Point-of-Care Testing (POCT) in Mature Markets

In established markets, Siemens Healthineers' point-of-care testing (POCT) is a cash cow, with a strong market presence. These solutions leverage existing infrastructure and customer loyalty, ensuring steady revenue streams. For instance, in 2024, POCT contributed significantly to the company's diagnostics segment, reflecting its profitability. This sector benefits from high customer retention rates and recurring testing needs.

- High market share in mature regions.

- Consistent cash flow generation.

- Established infrastructure and customer relationships.

- Significant contribution to the diagnostics segment.

Enterprise Services

Siemens Healthineers offers enterprise services like consulting and value partnerships to healthcare providers. These services are a steady source of income. They are characterized by moderate growth, making them 'Cash Cows' in their BCG matrix. For instance, service revenue in 2024 comprised a significant portion of the total revenue.

- Recurring revenue streams.

- Moderate growth rate.

- Consulting and value partnerships.

- Steady cash flow.

Siemens Healthineers' cash cows include X-ray, lab diagnostics, and ultrasound, with significant market shares. These segments generate steady revenues due to high customer retention. Enterprise services also act as cash cows. In 2024, POCT was a key contributor.

| Cash Cow Segment | Market Share (Approx. 2024) | Revenue (Approx. 2024) |

|---|---|---|

| X-ray Systems | Significant | $12.5 Billion (Market Value) |

| Lab Diagnostics | High | €8.2 Billion |

| Ultrasound | Strong | $8.1 Billion (Market Value) |

Dogs

Siemens Healthineers is discontinuing support for legacy testing platforms, including ADVIA, BEP, and Dimension, as clients transition to advanced Atellica systems. These older systems are classified as "Dogs" in the BCG Matrix. In 2024, the market share of these legacy platforms decreased by approximately 5%. This decline is due to their low growth and reduced market presence. The company is focusing investments on its high-growth areas.

Certain mature imaging products within Siemens Healthineers, like older MRI or CT scanners, likely face slower growth. These products, possibly showing low market share, are categorized as Dogs in the BCG matrix. In 2024, Siemens Healthineers' revenue from Imaging was around €14.5 billion. These need careful management, possibly divestiture.

Siemens Healthineers' 'Dogs' include product lines with declining sales. The SOMATOM Definition AS CT scanner is one example. In 2024, such products face low growth. Strategic decisions about their future are crucial.

Products Facing Intense Competition

In Siemens Healthineers' BCG matrix, "Dogs" represent products facing fierce competition. These products often struggle to hold onto market share, demanding substantial investment for a turnaround. Their long-term success is uncertain, posing challenges for the company. For example, in 2024, certain in-vitro diagnostics saw intensified competition, impacting profitability.

- Intense competition in diagnostics affects profitability.

- Significant investment needed for struggling products.

- Uncertain long-term viability for these products.

- Market share struggles are a key characteristic.

Niche Products with Limited Market

Niche products with limited market potential and low growth rates are considered "Dogs" in the BCG matrix. These products often don't justify substantial investment. Siemens Healthineers might consider selling off or stopping these products to free up resources. In 2024, divesting underperforming segments is a common strategy.

- Low growth, small market.

- May require divestiture.

- Focus on resource allocation.

- Prioritize profitable areas.

Siemens Healthineers' "Dogs" include legacy platforms and mature products with low growth and market share.

These products, facing intense competition, demand significant investment. Strategic decisions, like divestiture, are crucial for these underperforming segments to free up resources.

In 2024, declining sales and profitability in diagnostics highlight the challenges, with competition intensifying.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Legacy Systems | Low Growth, Market Share Decline | 5% Market Share Decline |

| Mature Imaging Products | Slower Growth | €14.5B Imaging Revenue |

| Niche Products | Limited Potential, Low Growth | Divestment Strategies |

Question Marks

Siemens Healthineers' digital health platforms face challenges in emerging markets, despite high growth potential. They currently have a low market share, signaling a need for strategic adjustments. Investments are crucial to boost adoption, considering the digital health market in emerging economies is projected to reach $135 billion by 2025. Success hinges on effective market penetration strategies.

Siemens Healthineers' new AI-based diagnostic tools are considered "Question Marks" in the BCG matrix. These tools are in a high-growth market but currently have low market share. They require significant investment to prove their worth and gain customer adoption. For example, Siemens invested over €2 billion in R&D in 2023.

Molecular diagnostics in developing regions show strong growth potential, yet market penetration remains low. Siemens Healthineers must invest in infrastructure and market development. Consider that the global molecular diagnostics market was valued at $9.2 billion in 2024. Investing could yield substantial returns. This aligns with Siemens Healthineers' strategic goals.

Personalized Medicine Solutions

Siemens Healthineers' personalized medicine solutions, though in a high-growth market, currently hold a low market share. These solutions, crucial for tailored healthcare, are still in their early stages. Significant investments are needed to prove their clinical and economic benefits, classifying them as Question Marks in the BCG Matrix.

- Siemens Healthineers invested €2.2 billion in R&D in fiscal year 2024.

- The personalized medicine market is projected to reach $4.5 trillion by 2030.

- Early-stage solutions typically have lower revenue contributions initially.

- Clinical trials and regulatory approvals require substantial financial commitment.

Advanced Therapy Solutions in Niche Markets

Advanced therapy solutions in niche markets, such as those offered by Siemens Healthineers, currently have a low market share but exhibit high growth potential. These solutions often require substantial, targeted investments to foster innovation and expansion. Strategic partnerships are crucial for navigating the complexities of these specialized markets and achieving market leadership. This positioning aligns with the "question mark" quadrant of the BCG matrix, indicating a need for careful evaluation and strategic resource allocation.

- High Growth Potential: Niche markets, such as advanced therapies, often experience rapid expansion.

- Low Market Share: Siemens Healthineers may have a limited presence in these emerging areas initially.

- Targeted Investments: Significant financial commitments are needed for research, development, and market entry.

- Strategic Partnerships: Collaborations can accelerate growth and mitigate risks.

Siemens Healthineers' AI-based diagnostics, personalized medicine, and advanced therapies are "Question Marks". These are in high-growth markets but have low market shares. Substantial investment is crucial for market penetration and customer adoption; the company invested €2.2 billion in R&D in 2024.

| Category | Characteristics | Strategic Implication |

|---|---|---|

| AI Diagnostics | High growth, low market share. | Requires focused investment. |

| Personalized Medicine | High growth, low market share. | Demands significant R&D investment. |

| Advanced Therapies | High growth, low market share. | Needs targeted strategic partnerships. |

BCG Matrix Data Sources

The BCG Matrix relies on Siemens Healthineers' financial reports, market research, and industry analyses. External sources also provide competitive landscape insights.