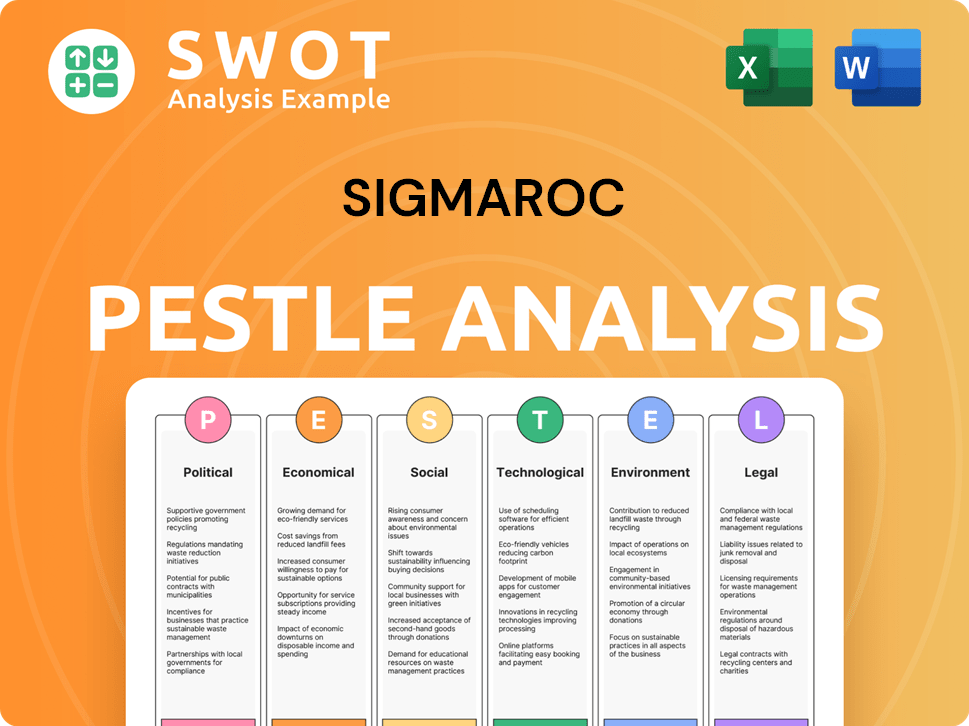

SigmaRoc PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SigmaRoc Bundle

What is included in the product

Evaluates SigmaRoc via PESTLE to uncover external factors across political, economic, etc.

Helps stakeholders quickly understand key external factors, guiding effective decision-making.

Preview Before You Purchase

SigmaRoc PESTLE Analysis

What you’re previewing is the final, complete SigmaRoc PESTLE Analysis.

No hidden parts, just the full, professional document.

Everything, including format & structure, is identical.

This file is ready to download and utilize after purchase.

See it now, own it instantly.

PESTLE Analysis Template

Explore the external forces shaping SigmaRoc's trajectory with our detailed PESTLE analysis. We delve into political landscapes, economic shifts, social trends, technological advancements, legal frameworks, and environmental factors impacting the company. Gain a comprehensive understanding of SigmaRoc's opportunities and challenges, and strengthen your decision-making. Download the full analysis now to uncover actionable insights that drive strategic advantage.

Political factors

Government infrastructure spending is a key political factor affecting SigmaRoc. Increased investment in projects like roads and utilities boosts demand for construction materials. The Infrastructure Investment and Jobs Act in the US and similar European programs drive growth in non-residential construction. SigmaRoc's aggregates and cement businesses directly benefit from this public spending. For example, in 2024, EU infrastructure spending is projected at €400 billion.

Political stability in European markets, where SigmaRoc operates, is vital. Geopolitical tensions, such as the war in Ukraine, introduce economic uncertainty. This impacts supply chains and energy prices. In 2024, construction material prices have seen fluctuations due to these factors. A stable climate encourages investment.

Changes in trade policies and tariffs significantly affect SigmaRoc's import/export costs and product competitiveness. Recent tariffs on steel and aluminum, for example, could increase sourcing costs. In 2024, the EU imposed tariffs on certain Chinese steel imports, potentially impacting SigmaRoc's supply chain. These tariffs can lead to price adjustments and strategic sourcing shifts across European markets.

EU Regulations and Directives

EU regulations and directives are crucial for SigmaRoc. These rules cover construction products, environmental standards, and market oversight. Compliance impacts product development, manufacturing, and market access. The revised Construction Products Regulation (CPR) sets new environmental benchmarks.

- The EU construction market was valued at €1.6 trillion in 2023.

- The CPR aims to reduce construction's environmental footprint.

- Non-compliance can lead to significant financial penalties.

National and Regional Planning Policies

National and regional planning policies significantly influence construction activities across Europe. Reforms aimed at increasing housing or utilizing specific land types directly affect construction, thus impacting SigmaRoc's material demand. For example, the UK government's planning reforms in 2023 aimed to streamline housing development, potentially boosting demand. Conversely, stricter environmental regulations could limit construction in certain areas, affecting SigmaRoc. These policies create market opportunities and constraints.

- UK's 2023 planning reforms: Aimed to expedite housing projects.

- EU Green Deal: May impose stricter environmental rules.

- Regional variations: Planning policies differ across EU member states.

Political factors significantly influence SigmaRoc's operational landscape, particularly infrastructure spending and geopolitical stability. Governmental initiatives, such as the EU's €400 billion infrastructure spending in 2024, drive demand for construction materials. Stability, especially amid geopolitical tensions, directly impacts supply chains and pricing.

Trade policies and regulations also shape SigmaRoc's strategies, as seen with EU tariffs on steel, influencing import costs. Compliance with EU directives, like the Construction Products Regulation (CPR), and national planning policies is essential.

These policies affect market access, product development, and compliance. The construction market was valued at €1.6 trillion in 2023, with continued environmental and planning reforms changing the market landscape, including UK housing development streamlines.

| Political Factor | Impact on SigmaRoc | Example |

|---|---|---|

| Infrastructure Spending | Increased demand | EU infrastructure spending of €400B in 2024 |

| Geopolitical Stability | Affects supply chains, pricing | Fluctuations in construction material prices |

| Trade Policies/Tariffs | Impacts import/export costs | EU tariffs on Chinese steel |

Economic factors

High interest rates hinder construction projects, increasing financing costs. Inflation affects SigmaRoc's expenses, impacting profitability. The U.S. Federal Reserve held rates steady in May 2024. Inflation in the Eurozone was 2.4% in April 2024, affecting material costs. Anticipated rate cuts could boost construction investments.

Economic growth significantly impacts construction material demand. Robust economies foster construction in residential, commercial, and infrastructure projects. For instance, in 2024, the EU construction output grew by 1.8%, indicating a positive trend. Downturns, however, like the projected 0.5% EU GDP growth in 2025, could slow this sector, affecting companies like SigmaRoc.

The residential construction market's health is crucial. Lower mortgage rates can increase housing demand, boosting construction. In 2024, US housing starts were around 1.4 million, a slight decrease from 2023. Lending challenges and affordability issues can slow building, affecting material demand. For instance, lumber prices in Q1 2024 fluctuated, mirroring market uncertainty.

Input Costs and Supply Chain Stability

SigmaRoc's profitability is directly tied to input costs, including cement, aggregates, lime, and energy. In 2024, fluctuations in energy prices, particularly impacting production costs, were notable. Supply chain stability is crucial; disruptions can cause material shortages and price volatility, as seen during recent global events. The company must manage these factors to maintain profitability.

- Energy price volatility affects production costs.

- Supply chain disruptions can cause material shortages.

- Stable supply chains are essential for profitability.

Availability of Financing and Investment

The availability of financing significantly impacts SigmaRoc's growth within the construction materials sector. Easier access to project financing stimulates new construction and infrastructure developments, boosting demand for its products. Recent data shows a mixed picture; while interest rates remain elevated, private equity interest in construction materials persists. This creates both opportunities and challenges for expansion, requiring strategic financial planning.

- Increased interest rates in 2024/2025 may limit financing availability.

- Private equity investments in the sector could drive M&A activity.

- Government infrastructure spending plans can create opportunities.

- SigmaRoc needs robust financial strategies.

Economic factors heavily influence SigmaRoc. Elevated interest rates and inflation in early 2024, with Eurozone inflation at 2.4% in April, impact material costs and construction financing, affecting profitability. Demand hinges on economic growth; EU construction output grew by 1.8% in 2024. Fluctuations in energy prices and supply chain disruptions also play critical roles.

| Factor | Impact on SigmaRoc | 2024 Data/Forecasts |

|---|---|---|

| Interest Rates | Increase financing costs, affect project viability | US Federal Reserve held rates steady in May. |

| Inflation | Raises material and operational expenses | Eurozone at 2.4% in April 2024. |

| Economic Growth | Drives construction demand | EU construction output grew by 1.8% in 2024, GDP growth forecast for 0.5% in 2025. |

Sociological factors

The European construction industry is grappling with an aging workforce and skilled labor shortages. In 2024, the average age of construction workers in many European countries is over 50, with fewer young people entering the field, as reported by Eurostat. This demographic shift is contributing to rising labor costs; in 2024, labor costs in the construction sector increased by 3-5% across various European nations. These shortages can lead to project delays, potentially affecting the demand for construction materials like those supplied by SigmaRoc.

Urbanization and population growth in Europe fuel demand for new construction. This necessitates residential, commercial, and infrastructure development. SigmaRoc is poised to capitalize on this trend. The European construction market is projected to reach $1.8 trillion by 2025.

Evolving lifestyles drive housing preferences. Sustainable, energy-efficient homes are in demand. Eco-friendly construction materials are gaining traction. SigmaRoc must adapt to meet these market shifts. In 2024, the green building materials market was valued at $368.3 billion, expected to reach $578.7 billion by 2029.

Health and Safety Awareness

Health and safety awareness is significantly increasing in the construction sector, influencing material handling, site operations, and product specifications. SigmaRoc, like other construction material providers, must comply with strict health and safety rules to safeguard its employees and foster safer construction methods. A robust safety record also boosts a company's image. The construction industry's injury rate per 100 full-time workers was 2.7 in 2023, showing ongoing efforts to improve safety.

- Compliance with health and safety regulations is paramount.

- A good safety record improves corporate reputation.

- Safer construction practices are becoming more prevalent.

Public Perception and Community Engagement

Public perception significantly impacts SigmaRoc's operations. The construction industry faces scrutiny regarding environmental impact, especially from quarries. Positive community engagement is crucial for securing social licenses. Addressing public concerns and building strong relationships fosters long-term sustainability. SigmaRoc must prioritize transparent communication to manage its reputation effectively. In 2024, construction sector public approval ratings remained around 60%.

- Environmental concerns, like quarry impacts, can lead to local opposition.

- Community engagement is vital for obtaining social licenses to operate.

- Positive relations and addressing public issues support sustainability.

- Transparent communication is essential for reputation management.

Sociological factors, such as an aging workforce and skill shortages, continue to challenge the construction industry, increasing labor costs by 3-5% in 2024 across various European countries. Urbanization and population growth, alongside evolving lifestyles, drive the demand for sustainable housing and construction, with the green building materials market projected to reach $578.7 billion by 2029. Health and safety awareness is also increasing, as evidenced by the construction industry's 2.7 injury rate per 100 full-time workers in 2023.

| Factor | Impact | Data Point |

|---|---|---|

| Aging Workforce | Increased labor costs and project delays | Labor costs up 3-5% (2024) |

| Urbanization | Boosts construction demand | European construction market ~$1.8T (2025) |

| Sustainability | Demand for green materials | Green materials market to $578.7B (2029) |

Technological factors

Digitalization and Building Information Modeling (BIM) are reshaping construction. Adoption rates are rising, spurred by efficiency goals and regulations. SigmaRoc could integrate with customer digital workflows. The global BIM market is forecast to reach $15.9 billion by 2024. Digital tools boost project efficiency, which is expected to continue.

Advanced construction techniques, such as prefabrication, are reshaping the industry. These methods, aiming for efficiency, can alter demand for materials. SigmaRoc must adapt its offerings to meet these new construction trends. Globally, the prefabrication market is projected to reach $200 billion by 2028.

Technological advancements drive new construction materials, including those with lower carbon footprints. The market for sustainable materials is growing. SigmaRoc can innovate with eco-friendly products. The global green building materials market is forecast to reach $483.3 billion by 2027. This offers SigmaRoc opportunities.

Automation and Robotics in Production

Automation and robotics can revolutionize construction material production, boosting efficiency and safety for SigmaRoc. Though the construction industry has lagged in tech adoption, interest is growing for productivity gains. SigmaRoc should assess automation across its operations, potentially lowering costs. Implementing automation can be a costly investment, but the long-term benefits are substantial.

- Global construction robotics market is projected to reach $2.5 billion by 2025.

- Automation can reduce labor costs by up to 30% in manufacturing.

- Robotics can increase production output by 20% or more.

Data Analytics and AI

SigmaRoc can enhance operations using data analytics and AI. This includes optimizing production, logistics, and market analysis. Data-driven insights lead to better decisions and efficiency gains. The construction sector is seeing rising AI adoption.

- AI in construction market expected to reach $4.5 billion by 2025.

- Data analytics can reduce project costs by up to 15%.

- Predictive maintenance using AI can cut downtime by 20%.

Technological advancements significantly influence SigmaRoc. Digital tools and BIM adoption reshape workflows, with the global market expected at $15.9B in 2024. Automation offers potential cost reductions and boosts productivity. Data analytics and AI further optimize operations. AI in the construction market is projected to reach $4.5 billion by 2025.

| Technology Area | Impact on SigmaRoc | Data Point (2024/2025) |

|---|---|---|

| BIM Adoption | Improved Efficiency | Global market: $15.9B (2024) |

| Automation | Cost Reduction, Increased Output | Robotics Market: $2.5B (2025) |

| AI & Data Analytics | Optimized Operations, Predictive Maintenance | AI in construction: $4.5B (2025) |

Legal factors

The Construction Products Regulation (CPR) in the EU, effective from January 2025, sets standards for construction products. This includes new environmental performance requirements and a digital product passport system. SigmaRoc needs to ensure its products comply with these standards. Failure to comply could result in significant financial penalties. The EU construction market was valued at €1.5 trillion in 2024.

SigmaRoc faces environmental regulations across Europe concerning emissions, waste, and resource extraction. The European Green Deal intensifies these regulations, pushing for cleaner technologies and sustainable practices. For instance, EU emissions trading system (ETS) affects cement production, which is a key SigmaRoc activity. In 2024, the ETS allowance price averaged around €70 per tonne of CO2.

SigmaRoc faces stringent health and safety regulations across its operations, impacting quarries, facilities, and construction sites. These laws are crucial for protecting employees and contractors, necessitating strict compliance. In 2024, the construction sector saw over 100,000 injuries, highlighting the need for rigorous adherence. Non-compliance can lead to legal problems and reputational damage, potentially affecting SigmaRoc's financial performance.

Competition Law and Anti-trust Regulations

SigmaRoc, with its acquisition-focused strategy, must navigate competition law and anti-trust regulations across the EU and specific countries. These laws, like those enforced by the European Commission, prevent anti-competitive behavior. For example, in 2024, the Commission investigated several mergers. Compliance is crucial for SigmaRoc's acquisitions and market operations. Non-compliance can lead to significant fines and hinder growth.

- EU fines for anti-trust violations can reach up to 10% of a company's global turnover.

- The European Commission reviewed 1,670 mergers in 2024.

- SigmaRoc needs to consider market concentration thresholds in each country.

Land Use and Planning Laws

Land use and planning laws are critical for SigmaRoc, especially for quarry operations and facility development. Compliance with these regulations is essential for obtaining permits and accessing raw materials. Any shifts in these laws can influence land availability and costs, potentially impacting project timelines and budgets. For example, in 2024, the average cost of land permits increased by 5% across several European regions where SigmaRoc operates.

- Permit delays: Can stall projects.

- Increased costs: Due to new regulations.

- Land availability: Zoning restrictions limit options.

- Environmental impact: Stricter rules affect operations.

SigmaRoc faces stringent regulations under the CPR, impacting product compliance and market access. In 2024, the EU construction market was worth €1.5 trillion, highlighting the stakes. Non-compliance can lead to significant penalties.

Strict adherence to health and safety laws is crucial for SigmaRoc's operations to protect employees and avoid legal issues. Over 100,000 injuries were reported in the construction sector in 2024, showing the importance of compliance. Penalties may damage SigmaRoc's finances and reputation.

Compliance with competition laws, such as those enforced by the European Commission, is vital for SigmaRoc's acquisitions. In 2024, the Commission investigated several mergers. Anti-trust violations can lead to fines, which can be up to 10% of a company's global turnover. The European Commission reviewed 1,670 mergers in 2024.

| Regulation | Impact on SigmaRoc | 2024/2025 Data |

|---|---|---|

| CPR Compliance | Product Standards | EU construction market: €1.5T (2024), Fines for non-compliance. |

| Health & Safety | Operational Safety | Over 100,000 construction injuries, risk of lawsuits. |

| Competition Law | Mergers & Acquisitions | EU Commission: 1,670 merger reviews, fines up to 10% of global turnover. |

Environmental factors

Climate change and decarbonization targets are reshaping the construction sector. The EU aims for a 55% emissions cut by 2030. Buildings account for 40% of global energy consumption and 36% of energy-related CO2 emissions. SigmaRoc must adapt to reduce its carbon footprint.

Resource depletion and circular economy initiatives are key environmental factors. The EU's focus on sustainability boosts demand for eco-friendly construction. This includes recycled materials and deconstruction design. SigmaRoc should consider recycled materials and support circularity. The global recycled aggregates market is projected to reach $68.5 billion by 2032.

Quarrying and construction material production significantly impact the environment. Habitat disruption, dust, and water usage are major concerns. Stricter regulations are emerging, demanding mitigation efforts. SigmaRoc needs to adhere to permits and standards. For example, in 2024, the construction sector faced increased scrutiny regarding its carbon footprint, with new regulations proposed in several European countries.

Energy Consumption and Transition to Renewable Energy

The construction materials sector heavily relies on energy for production. Transitioning to renewable energy and boosting energy efficiency are crucial environmental factors for SigmaRoc. Such investments can significantly cut its environmental impact and operational expenses. For example, in 2024, the global construction industry's energy consumption was approximately 30% of total energy use.

- SigmaRoc can explore solar power adoption at its sites, which can generate cost savings.

- Investing in more fuel-efficient machinery can reduce energy consumption.

- Advancing its sustainability strategy can improve SigmaRoc's market positioning.

Waste Management and Recycling

Regulations are tightening on construction waste, pushing for landfill diversion and material reuse. This shift impacts SigmaRoc's operations, requiring sustainable practices. The EU's Circular Economy Action Plan, for example, sets ambitious recycling targets. SigmaRoc can thrive by developing products that support recycling efforts and incorporate recycled materials.

- EU aims for 70% recycling of construction and demolition waste by 2020 (already exceeded).

- Construction sector generates about 35% of total waste in the EU.

- Recycled aggregates market projected to reach $60 billion by 2028.

Environmental regulations and sustainability trends significantly impact SigmaRoc, influencing operational costs and market positioning. The company must reduce its carbon footprint due to growing decarbonization pressures, particularly with the EU's ambitious targets, including a 55% emissions reduction by 2030. Transitioning to circular economy models by incorporating recycled materials is becoming crucial.

Construction generates approximately 35% of the EU's total waste. Strict rules require companies to implement sustainable practices.

| Environmental Aspect | Impact on SigmaRoc | Data Point (2024/2025) |

|---|---|---|

| Climate Change/Decarbonization | Regulatory Compliance, Operational Costs | EU 55% emissions cut target by 2030. |

| Resource Depletion/Circularity | Demand for Recycled Materials, Waste Reduction | Global recycled aggregates market projected to reach $68.5B by 2032. |

| Waste Management | Compliance with Landfill Diversion, Product Development | EU's Circular Economy Action Plan targets >70% recycling. |

PESTLE Analysis Data Sources

The SigmaRoc PESTLE analysis uses data from industry reports, economic databases, and government publications, focusing on credible insights. Analysis includes regulatory, market, and consumer behavior information.