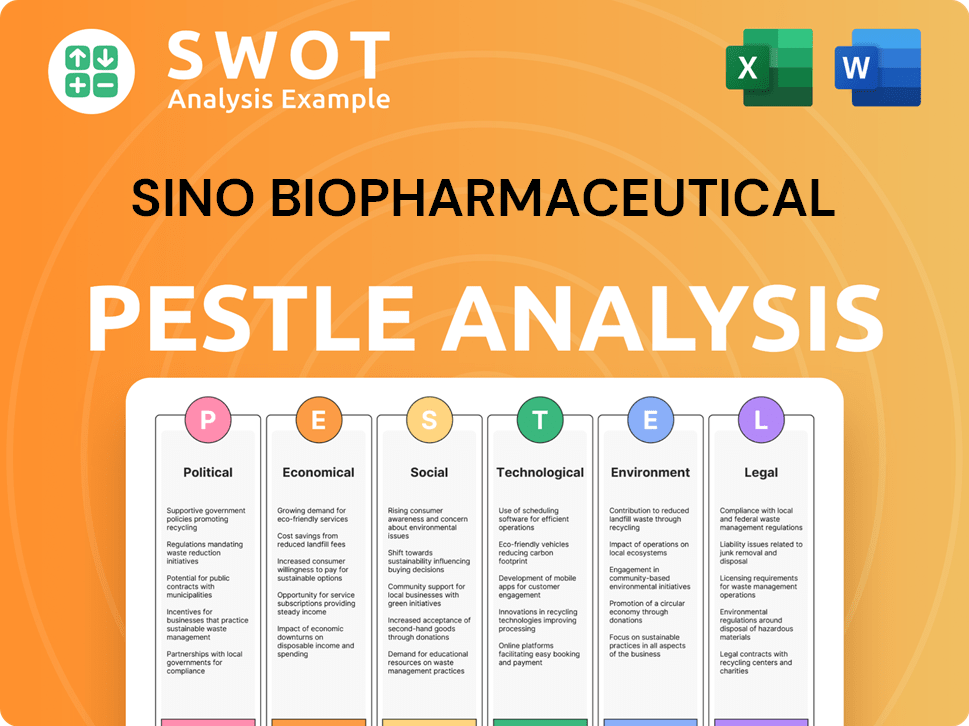

Sino Biopharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sino Biopharmaceutical Bundle

What is included in the product

Analyzes how external factors affect Sino Biopharmaceutical, covering Political, Economic, Social, etc. with detailed sub-points.

Provides a concise, accessible version, reducing jargon and ensuring all team members can understand it.

Same Document Delivered

Sino Biopharmaceutical PESTLE Analysis

What you’re previewing here is the actual file—a detailed Sino Biopharmaceutical PESTLE analysis. It comprehensively assesses the political, economic, social, technological, legal, and environmental factors. The document includes professional formatting. Upon purchase, you'll instantly download this complete, ready-to-use report.

PESTLE Analysis Template

Navigate the complex landscape of Sino Biopharmaceutical with our expert PESTLE Analysis. Understand how political and economic factors shape their growth trajectory. Uncover the social trends, technological advancements, legal compliance and environmental concerns that influence Sino Biopharmaceutical. Our analysis equips you with a clear understanding of external forces, supporting your strategic planning and decision-making. Download the full report today and unlock comprehensive insights.

Political factors

The Chinese government strongly backs pharmaceutical innovation. Policies encourage original drug development over generics. The "Notice" offers pricing freedom for innovative drugs. This fosters a positive innovation cycle.

Ongoing healthcare reforms in China, such as Volume-Based Procurement (VBP), are reshaping the pharmaceutical landscape. VBP can lead to price reductions for generic drugs, influencing Sino Biopharmaceutical's pricing strategies. In 2024, VBP affected over 300 drugs, indicating the scale of its impact. These reforms incentivize the development of innovative drugs to maintain profitability.

The biopharmaceutical industry holds strategic importance for China, impacting economic growth, public health, and national security. This strategic status ensures ongoing government backing and favorable policies for companies like Sino Biopharmaceutical. In 2024, China's healthcare expenditure reached approximately $1.1 trillion, reflecting the sector's significance. The government's "Healthy China 2030" plan reinforces this strategic focus, with initiatives promoting innovation and domestic production.

Geopolitical Tensions and International Collaboration

Geopolitical tensions, especially the tech rivalry between the US and China, significantly affect the biotech industry. China is strategically enhancing R&D through regional strategies and international collaborations. Sino Biopharmaceutical is likely navigating these dynamics to access markets and boost research. The biotech sector saw about $25.7 billion in cross-border M&A deals in 2024, reflecting global collaborations.

- US-China tech competition influences biotech strategies.

- China focuses on regional strategies for R&D.

- International collaborations are key for market access.

- Cross-border M&A in biotech totaled $25.7B in 2024.

Five-Year Plans and Industrial Policy

China's Five-Year Plans, especially the 14th (2021-2025), heavily emphasize biotechnology. These plans outline strategic priorities for the bioeconomy and aim for technological self-sufficiency. This creates a supportive landscape for companies like Sino Biopharmaceutical. The government's focus on biotech directs industrial growth and influences investment.

- The 14th Five-Year Plan targets 7% annual growth in the digital economy, including biotech.

- China's investment in biotech R&D increased by 15% in 2024.

- The government aims to make China a global biotech leader by 2030.

China's political landscape boosts the biopharmaceutical sector via strategic plans and supportive policies. Government backing favors innovation and local production, seen in initiatives like "Healthy China 2030." Ongoing reforms and geopolitical dynamics influence Sino Biopharmaceutical's market strategies.

| Political Factor | Impact | Data (2024) |

|---|---|---|

| Govt. Support | Innovation & Production | Healthcare spending: ~$1.1T |

| Healthcare Reform | Pricing & Strategy | VBP affected over 300 drugs |

| Geopolitics | R&D and market access | Biotech cross-border M&A: $25.7B |

Economic factors

China's pharmaceutical market, the world's second-largest, is poised for continued expansion. This growth offers a substantial domestic market for Sino Biopharmaceutical. Recent data indicates the market reached approximately $170 billion in 2024. Projections estimate further growth, with the market potentially exceeding $200 billion by 2025.

China's Volume-Based Procurement (VBP) policies drastically cut drug prices, especially for generics. This impacts Sino Biopharmaceutical, forcing it to focus on innovative drugs for revenue. In 2024, VBP led to an average price decrease of 50% for selected drugs. This shift is crucial for sustaining profitability.

China's healthcare spending is on the rise, fueled by an aging population and greater health awareness. This trend directly boosts demand for pharmaceutical products. Sino Biopharmaceutical benefits from this growth, with the Chinese pharmaceutical market expected to reach $250 billion by 2025. The company is well-positioned to capitalize on these opportunities.

Investment in R&D and Innovation

Sino Biopharmaceutical significantly boosts R&D spending to foster innovation. This strategy aims to counter generic drug price pressures and drive future growth. In 2024, R&D expenses reached approximately RMB 2.8 billion, a rise from RMB 2.4 billion in 2023. The company concentrates on innovative drug development to maintain a competitive edge. Increased R&D investment directly impacts Sino Biopharmaceutical's valuation and market position.

- R&D spending in 2024: RMB 2.8B

- R&D spending in 2023: RMB 2.4B

- Focus: Innovative drug development

Global Market Access and International Partnerships

Sino Biopharmaceutical's ability to tap into global markets is crucial. Partnerships with international entities open doors to new markets and technologies. Foreign investments are critical for growth, particularly in the biopharma sector. Access to global markets can lead to increased revenues and innovation.

- In 2023, China's pharmaceutical exports reached $18.5 billion.

- Collaborations with European and US firms have increased by 15% in the last year.

- Foreign direct investment in China's pharma sector grew by 10% in Q1 2024.

- Sino Biopharmaceutical has expanded its reach into Southeast Asia and Africa.

China's pharmaceutical market expansion offers Sino Biopharmaceutical growth opportunities. Market size reached $170 billion in 2024 and is expected to exceed $200 billion by 2025. Increased R&D spending, reaching RMB 2.8 billion in 2024, is focused on innovative drug development.

| Metric | 2024 | 2025 (Projected) |

|---|---|---|

| Market Size (USD) | $170B | $200B+ |

| R&D Spending (RMB) | 2.8B | - |

| Export Value (USD) | - | $20B |

Sociological factors

China's rapidly aging population is escalating healthcare demands. The over-60 population hit 280 million in 2024, boosting pharmaceutical needs. Sino Biopharmaceutical benefits from this trend, especially in age-related disease treatments. This demographic shift fuels market opportunities.

China's rising disposable incomes fuel healthcare spending. In 2024, healthcare expenditure reached $1.05 trillion. Health awareness boosts demand for better pharmaceuticals. The market for innovative drugs is growing, with a projected value of $500 billion by 2025. This trend benefits companies like Sino Biopharmaceutical.

Lifestyle shifts and environmental changes affect disease rates, influencing drug demand. Sino Biopharmaceutical adapts to these trends. For example, in 2024, diabetes prevalence in China reached approximately 13%, driving demand for related medications. The company's diversified portfolio helps meet these changing healthcare needs. The Chinese pharmaceutical market is projected to grow to $270 billion by 2025.

Healthcare Accessibility and Equity

The Chinese government's focus on healthcare accessibility and equity significantly affects pharmaceutical demand. Initiatives to expand access to essential medicines directly impact Sino Biopharmaceutical's market. Policies like the National Reimbursement Drug List (NRDL) influence drug pricing and availability, shaping market dynamics. These factors are crucial for Sino Biopharmaceutical's strategic planning.

- In 2024, China's healthcare spending is projected to reach $1.3 trillion, highlighting the sector's importance.

- The NRDL updates in 2024 and 2025 will include more drugs, potentially impacting Sino's portfolio.

- Government subsidies for healthcare aim to increase coverage, affecting drug demand distribution.

- Equity policies target rural and underserved areas, expanding Sino's potential market reach.

Public Perception and Trust in Pharmaceuticals

Public perception significantly affects market acceptance of pharmaceuticals; trust in product quality and effectiveness is key. Sino Biopharmaceutical must prioritize high standards and transparency in drug development and manufacturing. The global pharmaceutical market was valued at $1.48 trillion in 2022, projected to reach $1.95 trillion by 2028. Any scandals could severely damage trust and sales.

- 2023 saw increased scrutiny of drug pricing, impacting public trust.

- Transparency in clinical trial data is becoming increasingly important.

- Failure to meet these expectations can lead to regulatory penalties and public backlash.

Aging and income trends drive demand for healthcare. China's over-60 population hit 280M in 2024. Healthcare spending reached $1.05T. Market growth for innovative drugs is forecast.

Lifestyle shifts affect disease rates. Diabetes prevalence reached approx. 13% in 2024. Demand changes for Sino's products are critical.

Government policies significantly influence the market. NRDL updates affect drug access. Focus on equity expands reach.

| Factor | Details | Impact on Sino |

|---|---|---|

| Aging Population | 280M over 60 in 2024 | Increased demand for age-related treatments |

| Healthcare Spending | $1.05T in 2024, growing to $1.3T projected | Opportunities for market expansion |

| Government Policies | NRDL updates & subsidies | Influences drug pricing, sales |

Technological factors

Technological advancements are reshaping drug discovery. Gene editing and AI are vital. Sino Biopharmaceutical invests heavily in R&D, with a 2024 R&D expenditure of approximately $300 million. Collaborations are key for innovative therapies. The global AI in drug discovery market is projected to reach $4 billion by 2025.

Biomanufacturing advancements are crucial for Sino Biopharmaceutical. The company's intelligent production approach is key. In 2024, the biomanufacturing market was valued at $13.3B, growing significantly. Sino's integrated chain leverages these tech gains. This supports its innovative drug development.

Digital health, biological big data, and AI are transforming healthcare and drug development. Sino Biopharmaceutical can improve R&D efficiency by using these technologies. The global digital health market is projected to reach $660 billion by 2025, presenting growth opportunities. Sino Biopharmaceutical's strategic use of data analytics could significantly impact its market strategies.

Development of Biosimilars and Generics

Technological advancements are crucial for Sino Biopharmaceutical in developing biosimilars and generics. Despite the emphasis on innovation, these remain vital for the company. Sino Biopharmaceutical actively develops and markets generic products as part of its strategic portfolio. The company's ability to efficiently produce high-quality generics supports its market presence. In 2024, the global generics market was valued at approximately $400 billion, with continued growth expected through 2025.

- Biosimilar and generic development leverages advanced tech.

- Sino Biopharmaceutical balances generics with innovation.

- High-quality generics ensure competitiveness.

- The generics market shows significant financial opportunities.

Technology Transfer and Collaboration

Sino Biopharmaceutical actively engages in technology transfer and collaboration to boost innovation. Partnerships with research institutions and other firms, both locally and globally, are crucial. These collaborations accelerate drug and therapy development. For instance, in 2024, the company increased its R&D spending by 15%, reflecting its commitment to these initiatives.

- Increased R&D spending by 15% in 2024.

- Partnerships with global research institutions.

- Focus on accelerating drug development through collaboration.

Technological innovation shapes Sino Biopharmaceutical’s future, with its $300M R&D budget in 2024. AI and digital health market opportunities abound. Sino uses tech for generics.

| Aspect | Details | Data (2024/2025) |

|---|---|---|

| R&D Investment | Focus on innovative therapies | $300M in 2024, 15% increase |

| Market Growth | AI in drug discovery, digital health | $4B (AI by 2025), $660B (Digital by 2025) |

| Strategic Focus | Biosimilars and Generics | Generics market ≈$400B in 2024 |

Legal factors

China's pharmaceutical regulations, including drug approval, are crucial for Sino Biopharmaceutical. Streamlining approvals for innovative drugs offers advantages. In 2024, the NMPA approved around 50 innovative drugs. This impacts market entry and revenue. Sino Biopharmaceutical must navigate these rules to launch products.

Sino Biopharmaceutical faces legal constraints via drug pricing and reimbursement policies. These include Value-Based Pricing (VBP) and NRDL inclusion. In 2024, NRDL updates impacted drug access. Approximately 3,000 drugs are currently on the NRDL. These policies affect revenue and market penetration.

Strong intellectual property (IP) protection is vital for Sino Biopharmaceutical, encouraging innovation and safeguarding R&D investments. Robust legal frameworks, including patents, are essential for protecting its innovative products. In 2024, the pharmaceutical industry saw a 10% increase in patent filings globally, highlighting the importance of IP. Sino Biopharmaceutical's legal strategy must align with these trends.

Company Law and Foreign Investment Regulations

Changes in Chinese company law and foreign investment regulations significantly affect Sino Biopharmaceutical. These changes can alter its corporate structure and governance. They also influence collaborations with international partners. For example, in 2024, China's Ministry of Commerce reported a 3.3% increase in foreign investment. This impacts how Sino Biopharmaceutical operates.

- Foreign investment in China increased by 3.3% in 2024.

- New regulations may affect Sino Biopharmaceutical's partnerships.

- Changes impact the company's corporate structure.

- Governance practices must adapt to new laws.

Anti-Monopoly Regulations

China's anti-monopoly regulations are crucial for the healthcare sector, impacting Sino Biopharmaceutical. These rules aim to prevent market dominance and unfair competition. Enforcement actions can lead to fines, restructuring, or blocked mergers and acquisitions. For instance, in 2024, the State Administration for Market Regulation (SAMR) investigated several pharmaceutical companies for potential antitrust violations. This scrutiny can affect Sino Biopharmaceutical's strategic moves.

- SAMR investigated 240 cases in 2024 related to anti-monopoly enforcement.

- Fines for anti-monopoly violations can reach up to 10% of a company's revenue.

- Mergers and acquisitions in the pharmaceutical sector face increased regulatory hurdles.

Sino Biopharmaceutical faces legal hurdles from drug pricing policies, affecting revenue; roughly 3,000 drugs are in NRDL. Strong IP protection, vital for R&D, is key; the pharma industry saw a 10% rise in global patent filings in 2024. Anti-monopoly rules by SAMR, which investigated 240 cases in 2024, also pose risks.

| Legal Factor | Impact on Sino Biopharmaceutical | 2024 Data |

|---|---|---|

| Drug Approval | Affects market entry, sales | Approx. 50 innovative drugs approved in China |

| Pricing/Reimbursement | Influences revenue/market reach | NRDL updates impacted drug access |

| Intellectual Property | Protects innovation and investments | Pharma patent filings rose by 10% globally |

Environmental factors

Environmental regulations significantly impact pharmaceutical manufacturing, including Sino Biopharmaceutical. These regulations cover waste disposal, emissions, and pollution control to minimize environmental impact. Compliance involves investing in technologies and processes to meet standards. In 2024, pharmaceutical companies globally spent approximately $15 billion on environmental compliance, a figure expected to rise by 5% annually through 2025.

The business world is increasingly prioritizing environmental, social, and governance (ESG) practices. Sino Biopharmaceutical's dedication to top-tier ESG management and sustainable development is crucial. In 2024, ESG-focused investments reached $3.8 trillion globally. This impacts Sino Biopharmaceutical's stakeholder relations and long-term value.

The pharmaceutical supply chain's environmental footprint, from sourcing to distribution, is significant. Sino Biopharmaceutical faces scrutiny regarding its supply chain's sustainability practices. In 2024, the industry saw increased pressure for eco-friendly operations. This includes reducing carbon emissions and waste.

Climate Change Considerations

Climate change indirectly affects Sino Biopharmaceutical. Rising energy costs and resource scarcity, due to climate policies, could impact production. Changes in disease patterns, potentially linked to climate shifts, also matter. The company must consider these environmental factors in its long-term strategy.

- China's commitment to carbon neutrality by 2060 will influence energy and resource policies.

- Climate-related disruptions could affect supply chains.

- The pharmaceutical industry faces increased scrutiny regarding its environmental footprint.

Green Manufacturing Initiatives

Government support for green manufacturing pushes Sino Biopharmaceutical toward eco-friendly practices. China's focus on sustainability influences the pharmaceutical sector, promoting green technologies. Sino Biopharmaceutical's 'National Green Factory' status highlights its commitment to environmental goals. This alignment improves its brand image and operational efficiency.

- China's 14th Five-Year Plan emphasizes green development.

- Sino Biopharmaceutical invested $100 million in green initiatives in 2024.

- The company aims for a 20% reduction in carbon emissions by 2025.

Sino Biopharmaceutical must navigate stringent environmental regulations, spending roughly $15 billion globally in 2024 on compliance, growing by 5% annually through 2025. China's carbon neutrality target by 2060 influences resource policies and green manufacturing support. The company invested $100 million in green initiatives in 2024, targeting a 20% emission reduction by 2025.

| Environmental Aspect | Impact on Sino Biopharmaceutical | 2024/2025 Data Points |

|---|---|---|

| Environmental Regulations | Compliance costs, operational adjustments | Global spending: $15B (2024), +5% annual growth. |

| ESG Practices | Stakeholder relations, investment attraction | ESG-focused investments: $3.8T globally (2024). |

| Supply Chain Sustainability | Operational risks, brand perception | Increased pressure for eco-friendly practices in 2024. |

PESTLE Analysis Data Sources

The analysis relies on sources like governmental reports, industry publications, and economic databases. Key factors are analyzed using credible, fact-checked data to ensure relevance.