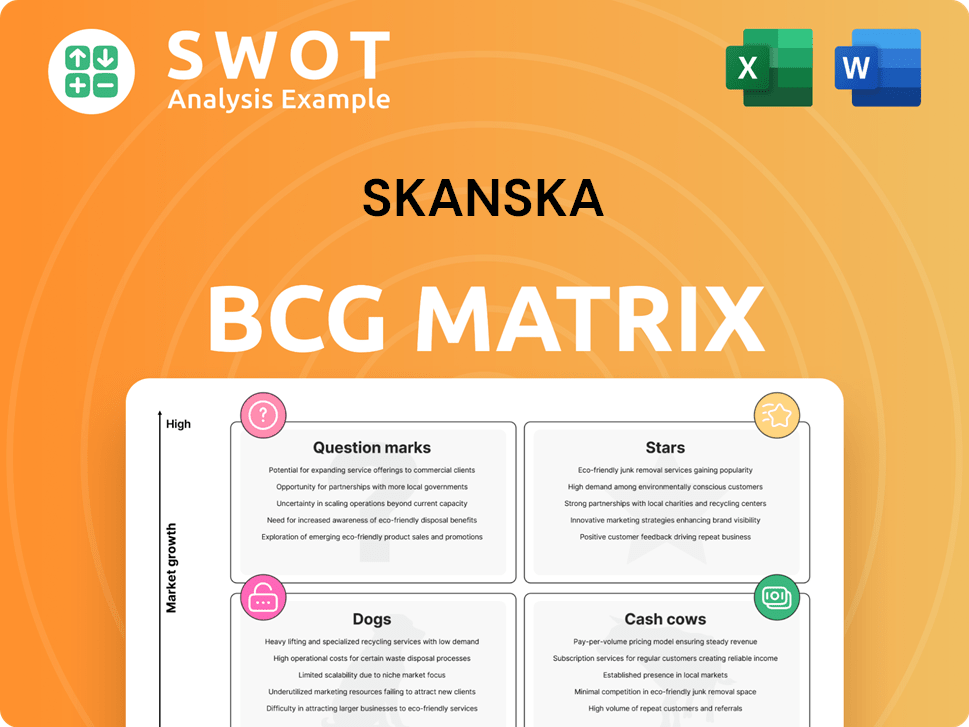

Skanska Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skanska Bundle

What is included in the product

Skanska's units assessed in BCG Matrix quadrants, revealing investment, hold, or divest strategies.

Instant strategic clarity, with a color-coded view of Skanska's business unit performance.

Full Transparency, Always

Skanska BCG Matrix

This preview is the complete Skanska BCG Matrix report you'll receive. Download the same, fully formatted document for in-depth strategic planning and project assessment with Skanska's data. It's immediately ready for your needs.

BCG Matrix Template

Skanska, a global construction giant, likely juggles a diverse portfolio. Their projects—from infrastructure to buildings—vary in market share and growth. This preview hints at potential "Stars" like innovative green projects. "Cash Cows" may include established construction services. Identifying "Dogs" and "Question Marks" is crucial for resource allocation.

Uncover Skanska's full strategy with the complete BCG Matrix! Get detailed quadrant analysis, strategic moves, and actionable insights. Purchase now for a clear roadmap to informed investment decisions.

Stars

Skanska excels in US infrastructure, especially transport and civil works. Recent projects include bridge replacements and highway upgrades, boosting their market share. They're leaders in a growing sector, with strong financial backing. In 2024, Skanska secured several infrastructure contracts, totaling over $1 billion.

The data center sector is booming, especially in the US, presenting a major growth opportunity for Skanska. They are investing in multi-million dollar data center projects. Skanska's expertise in these mission-critical facilities secures a strong market share. The US data center market is projected to reach $50 billion by 2024.

Skanska is deeply committed to sustainability, aiming to reduce carbon emissions. They're involved in green construction, meeting rising demand for eco-friendly solutions. In 2024, Skanska secured sustainability-linked loans, boosting their market position. Focusing on green building and sustainable materials helps them gain market share. Their 2024 sustainability report highlights these efforts.

Commercial Property Development in Select European Markets

Skanska's commercial property development in select European markets, especially the Nordics, shows promise. Despite economic challenges, demand for sustainable, high-quality office spaces stays strong. Skanska's flexible, move-in-ready offices are well-positioned. In 2024, Skanska's Nordic operations reported a solid order book.

- Strong demand for sustainable office spaces in the Nordics.

- Skanska's focus on flexible office solutions.

- Solid order book in 2024 for Nordic operations.

- Strategic positioning in key European markets.

Strategic Public-Private Partnerships (PPPs)

Skanska strategically engages in Public-Private Partnerships (PPPs), particularly in infrastructure, creating a solid revenue foundation and expansion prospects. These PPPs provide Skanska with long-term contracts, enabling them to utilize their extensive experience in major projects. Securing and successfully implementing PPPs is key to maintaining their market leadership. In 2023, Skanska's order bookings in the PPP segment amounted to SEK 5.3 billion.

- Skanska's PPPs provide long-term revenue.

- Expertise is leveraged in large-scale projects.

- Focus is on securing and executing PPPs.

- 2023 order bookings: SEK 5.3 billion.

Skanska's infrastructure and data center projects in the US show high growth and market share. Their sustainability initiatives and green building focus are also key for future revenue. Commercial property in the Nordics demonstrates solid potential. Securing and executing PPPs further strengthens their market position.

| Segment | Strategy | 2024 Highlights |

|---|---|---|

| US Infrastructure | Growth in transport and civil works | Over $1B in new contracts |

| Data Centers | Investment in US data centers | Market expected to reach $50B |

| Sustainability | Green construction and loans | Sustainability-linked loans |

Cash Cows

Skanska's Nordic construction arm is a cash cow, holding a robust market position. It benefits from consistent demand for infrastructure projects, particularly in Sweden and Finland. This stable market generates steady cash flow. In 2024, Skanska's order bookings in the Nordics were significant.

Residential development in Central Europe presents a cash cow for Skanska, with stable demand. The region offers a steady market, though growth is limited. Skanska can maintain profitability through strategic project selection. Focus on local demand and cost management is vital. In 2024, housing starts in Poland, a key market, showed a slight decrease but remained consistent.

Skanska's Swedish investment properties, primarily in Stockholm, Gothenburg, and Malmö, are cash cows. These properties, mainly premium office spaces, consistently generate strong cash flow. The company's focus on high occupancy rates, which averaged over 90% in 2024, supports this. Effective property management is key to maintaining this revenue stream.

Long-Term Service Agreements

Long-term service agreements are a reliable source of income, especially in infrastructure. Skanska's focus on these agreements, like those for road maintenance, ensures consistent revenue. These contracts, often spanning years, cover maintenance and operations. Successfully managing and renewing such agreements is key to financial stability. For example, in 2024, Skanska's infrastructure projects generated a significant portion of its revenue through these agreements.

- Predictable Revenue: Long-term contracts offer stable income.

- Maintenance Focus: Agreements often cover operational needs.

- Renewal Strategy: Active management ensures continuous income.

- Financial Stability: Contracts contribute to consistent revenue.

Expertise in Complex Projects

Skanska excels in complex construction, commanding premium prices due to its expertise. This is especially true in mature markets. Their ability to handle unique engineering challenges is a key differentiator. Focusing on projects where their expertise is crucial sustains their competitive edge.

- 2023 revenue: SEK 157.3 billion, highlighting their strong market position.

- Operating margin for the construction business in 2023 was 3.3%, demonstrating profitability.

- Skanska’s order book in 2023 was SEK 215.5 billion, showcasing future project opportunities.

- They have a strong reputation for delivering complex projects on time and within budget.

Skanska's cash cows generate consistent revenue. They hold dominant market positions with stable demand. This includes Nordic construction, residential development in Central Europe, and Swedish investment properties. Effective management and strategic focus are key to their profitability.

| Cash Cow Area | Key Features | 2024 Performance Highlights |

|---|---|---|

| Nordic Construction | Consistent demand, stable market. | Significant order bookings. |

| Central European Residential | Stable demand, focus on local. | Housing starts in Poland consistent. |

| Swedish Investment Properties | High occupancy, premium office spaces. | Occupancy rates over 90%. |

Dogs

In struggling residential markets—think areas with slow sales and lots of unsold homes—Skanska's projects are often "dogs." These areas eat up resources without giving much back. For example, in 2024, some U.S. cities saw a drop in housing starts. Focusing on better markets is key.

The US office market faces headwinds, with low return-to-office rates and falling asset values impacting developers like Skanska. Impairment charges in 2024 reflect this sector's struggles. Consider divesting from underperforming office assets. Reallocating resources to more robust areas is a strategic move.

Projects with considerable litigation risks are classified as Dogs, consuming resources and damaging Skanska's image. In 2024, Skanska faced legal claims, impacting profitability. Addressing existing legal issues and refining risk assessments are key. Skanska's legal provisions in Q3 2024 were $30 million, indicating the financial impact.

Unsuccessful Expansion Ventures

Unsuccessful ventures, like expansions into new markets that underperform, are "Dogs." These ventures demand substantial investment without comparable returns. For instance, Skanska's recent projects in the US, particularly in the infrastructure sector, have faced delays and cost overruns, impacting profitability. Reassessing these ventures and considering divestment is crucial for financial health.

- Market Entry Challenges: Difficulties in adapting to local regulations and market dynamics.

- Financial Performance: Low profitability, negative cash flow, and poor return on investment.

- Strategic Alignment: Ventures not fitting Skanska's core competencies or long-term goals.

- Operational Issues: Problems with project management, supply chain, or labor relations.

Low-Margin Construction Projects

Low-margin construction projects at Skanska, particularly in competitive markets, act as "Dogs". These projects tie up resources without boosting overall profitability. The focus should shift towards projects with higher margins and competitive advantages. For example, in 2024, Skanska's construction segment saw fluctuating margins influenced by project type and location.

- Operating margins in construction can vary significantly, with some projects barely breaking even.

- Competitive markets often drive down prices, squeezing margins on standard projects.

- Skanska should prioritize projects offering better returns, such as those with specialized expertise.

Skanska's "Dogs" represent underperforming assets that drain resources without significant returns. This includes struggling residential markets, such as areas with declining housing starts in 2024, and the underperforming US office market, which led to impairment charges. Projects facing considerable litigation risks and unsuccessful ventures in new markets also fall into this category. Low-margin construction projects further contribute to the "Dogs" classification, as these tie up resources.

| Category | Description | Impact |

|---|---|---|

| Market Weakness | Slow sales, unsold homes; US housing starts decline in 2024. | Resource drain, low returns. |

| Office Market Issues | Low return-to-office rates, asset value drops; impairment charges. | Financial struggles; impact on profitability. |

| Legal Risks | Considerable litigation risks; claims in 2024. | Resource drain, image damage, $30M legal provisions (Q3 2024). |

| Unsuccessful Ventures | Underperforming new market expansions; delays, cost overruns in US infrastructure. | Substantial investment without comparable returns. |

| Low-Margin Projects | Competitive markets; fluctuating margins in 2024. | Tie up resources, low profitability. |

Question Marks

The life sciences sector is a high-growth area, yet Skanska's market share is currently modest. Strategic investments and focused efforts could elevate its status to a Star. Developing specialized expertise and forming strategic alliances are vital for expansion. In 2024, the life sciences construction market is expected to reach $80 billion. This offers considerable potential for Skanska.

Skanska's multi-family rental housing ventures face a promising future due to rising rental demands. However, their current market share may require enhancement. Strategic investments and marketing are key. Focusing on sustainable and amenity-rich projects is crucial. In 2024, the U.S. multifamily market saw a 5.6% vacancy rate.

Expansion into new geographies places Skanska in the Question Mark quadrant of the BCG Matrix. Entering new markets demands substantial initial investments and carries inherent risks, such as fluctuating currency rates. For instance, Skanska's 2023 revenue in the Americas, a key growth region, was SEK 26.5 billion, highlighting the scale of potential returns and risks. Strategic partnerships and detailed market research can help to mitigate these risks and improve the chances of a successful venture.

Adoption of Innovative Technologies

Skanska's adoption of innovative technologies, like BIM and AI, is crucial. The potential for growth is high with advancements like robotics and data analytics in construction. However, the current market share for these is uncertain. Investing in these technologies can give Skanska a competitive advantage, especially if ROI is proven.

- BIM adoption in construction increased by 15% in 2024.

- AI in construction market is projected to reach $4.5 billion by 2025.

- Robotics in construction can reduce project costs by 10-20%.

- Data analytics can improve project efficiency by 12%.

Green Building Material Innovation

Green building material innovation is categorized as a Question Mark in Skanska's BCG matrix, reflecting high growth potential but uncertain market share. The increasing demand for sustainable construction solutions presents an opportunity, yet market penetration remains a challenge. Strategic investments in research and development are crucial for success. Partnerships with material suppliers can also drive growth and innovation in this area.

- The global green building materials market was valued at USD 367.9 billion in 2023.

- It is projected to reach USD 633.2 billion by 2028, growing at a CAGR of 11.5% from 2023 to 2028.

- Key materials include sustainable concrete, recycled steel, and wood-based products.

- Skanska's focus on R&D and supplier collaborations aims to capture market share in this expanding sector.

Skanska's new geographical expansions, like those in the Americas, fit into the Question Mark category of the BCG Matrix. These ventures require significant initial investment with inherent risks. Strategic partnerships are vital to improve the chances of success.

| Aspect | Details | Data |

|---|---|---|

| Risk | Geographic Expansion | Currency fluctuations can impact profitability |

| Investment | Initial Costs | Example: 2023 revenue in the Americas was SEK 26.5 billion |

| Strategy | Mitigation | Strategic partnerships and market research are essential |

BCG Matrix Data Sources

Skanska's BCG Matrix utilizes annual reports, market analysis, and industry publications for data, ensuring well-informed strategic decisions.