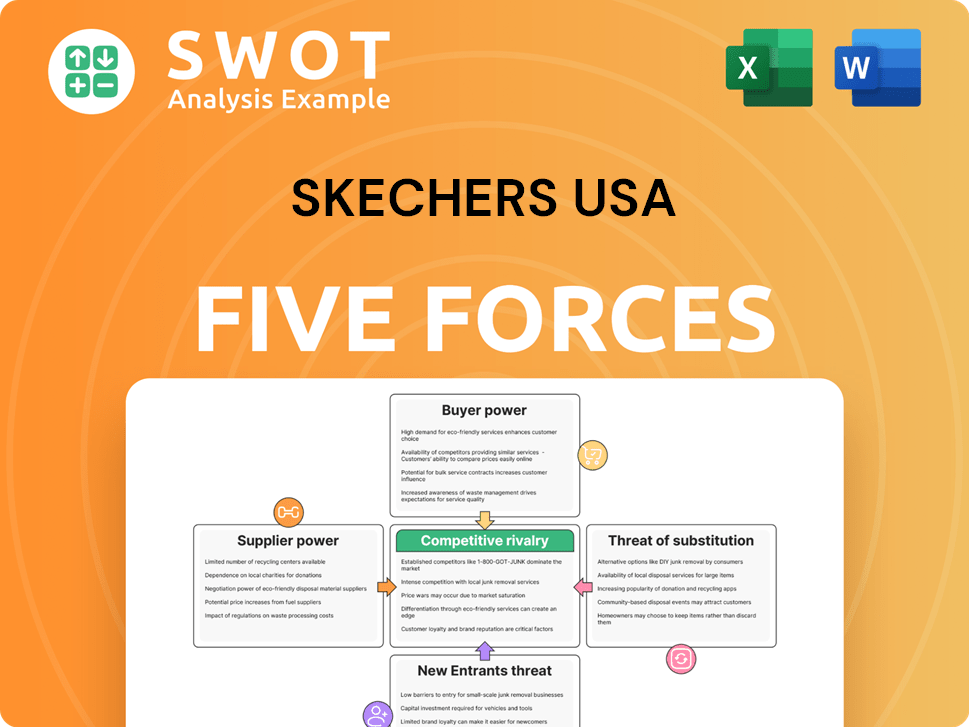

Skechers USA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skechers USA Bundle

What is included in the product

Tailored exclusively for Skechers USA, analyzing its position within its competitive landscape.

Customize pressure levels to swiftly adapt to shifting competitive landscapes.

Full Version Awaits

Skechers USA Porter's Five Forces Analysis

This is the comprehensive Skechers USA Porter's Five Forces analysis you'll receive after purchase. It details competitive rivalry, the threat of new entrants, supplier power, buyer power, and the threat of substitutes.

Porter's Five Forces Analysis Template

Skechers USA faces moderate rivalry, intense competition from established brands. Bargaining power of suppliers is relatively low. Buyer power is moderate, with consumers having numerous footwear options. The threat of substitutes (e.g., athletic apparel) is present. New entrants pose a moderate threat.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Skechers USA’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Skechers' supplier concentration is a factor, as it depends on a limited number of Asian suppliers for materials. This situation gives suppliers some power to negotiate prices. In 2023, Skechers reported a gross profit margin of 51.9%, potentially impacted by supplier costs. Diversifying suppliers and securing contracts are key strategies to manage this.

Raw material costs, like rubber and leather, influence supplier bargaining power. Rising costs let suppliers push price hikes onto Skechers, impacting profits. In 2024, leather prices varied, affecting footwear makers. Skechers must watch markets and secure good deals to counter this.

Rising labor costs, especially in manufacturing hubs like China and Vietnam, boost supplier bargaining power. Suppliers may increase prices to offset these costs. In 2024, China's average manufacturing wage rose, impacting production expenses. Automation investments and finding alternative sourcing can help manage these costs. For example, Skechers could explore diversifying its supplier base to countries with lower labor expenses.

Supplier Switching Costs

For Skechers, the costs of switching suppliers are a critical factor. These costs can include finding new vendors, ensuring consistent quality, and adapting production processes. High switching costs increase supplier bargaining power, potentially impacting Skechers' profitability. In 2024, Skechers' cost of goods sold was approximately $3.4 billion, showing the financial impact of supplier relationships. Reducing these costs is essential.

- Supplier relationships influence Skechers' production costs.

- High switching costs can give suppliers more leverage.

- Skechers focuses on quality control and efficiency.

- Standardizing materials can lower supplier dependency.

Ethical Sourcing

The increasing scrutiny of ethical sourcing practices, encompassing labor standards and environmental impacts, significantly influences supplier power dynamics. Suppliers meeting higher ethical standards might command premium prices or gain preferential treatment from companies like Skechers. Skechers' Supplier Code of Conduct demonstrates its commitment to ethical sourcing. This commitment impacts how Skechers interacts with its suppliers.

- Ethical sourcing practices are under increasing scrutiny.

- Suppliers with higher ethical standards can charge more.

- Skechers has a Supplier Code of Conduct.

- This code affects supplier relationships.

Skechers faces supplier bargaining power due to concentrated sourcing, especially in Asia. Raw material and labor costs influence supplier pricing. High switching costs and ethical sourcing further impact this dynamic. In 2024, Skechers' COGS were about $3.4B; its response is critical.

| Factor | Impact | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | Limited options increase supplier power. | Dependent on Asian suppliers; potential for price negotiation by suppliers. |

| Raw Material Costs | Rising costs can lead to price hikes. | Leather price fluctuations, impacting footwear makers. |

| Labor Costs | Higher wages can increase supplier prices. | China's manufacturing wage increases in 2024. |

Customers Bargaining Power

Customers' price sensitivity significantly impacts Skechers. A 2024 study showed 60% of footwear buyers prioritize price. This high price sensitivity boosts buyer power. Skechers must balance pricing to maintain customer loyalty. In 2024, Skechers' average price point was $75.

Switching costs for footwear, like Skechers, are typically low, allowing consumers to easily switch brands. This ease of switching significantly increases buyer power. Skechers' 2023 revenue was $7.46 billion, showing the importance of maintaining customer loyalty. Effective marketing and innovative designs are crucial to reduce buyer power. Enhancing brand loyalty through comfort technologies is one way to reduce the impact of low switching costs.

Skechers distributes products through retail, online, and wholesale channels. In 2023, no single customer represented a significant percentage of Skechers' sales, indicating dispersed customer concentration. This distribution strategy reduces the influence any single customer could exert. A diversified customer base, as demonstrated by Skechers' sales figures, is key to maintaining this balance.

Product Differentiation

Skechers faces moderate customer bargaining power due to product similarity in the footwear market. While Skechers emphasizes comfort and design, numerous competitors offer comparable products. This lack of strong differentiation allows customers to easily switch brands, increasing their influence. To counter this, Skechers must focus on innovation to maintain customer loyalty.

- The global footwear market was valued at approximately $400 billion in 2024.

- Skechers' revenue for 2023 was around $7.46 billion.

- Nike and Adidas are major competitors with strong brand recognition.

Availability of Information

Customers wield significant power due to readily available information. Online platforms offer easy access to footwear prices, features, and reviews, increasing transparency. This enables informed decision-making and comparison shopping, putting pressure on brands. Skechers must manage its online reputation and competitive pricing strategies. In 2024, online sales accounted for approximately 30% of Skechers' total revenue.

- Online reviews and ratings directly influence purchasing decisions.

- Price comparison tools allow customers to quickly find the best deals.

- Social media amplifies customer feedback, impacting brand perception.

- Skechers must adapt to changing customer preferences and expectations.

Customer bargaining power for Skechers is moderate. High price sensitivity and low switching costs empower consumers. Skechers' diverse distribution and the importance of online presence impact this dynamic.

| Factor | Impact | Data |

|---|---|---|

| Price Sensitivity | High | 60% of buyers prioritize price (2024) |

| Switching Costs | Low | Easy brand switching |

| Customer Concentration | Dispersed | No single customer dominates sales |

Rivalry Among Competitors

Skechers USA confronts fierce competition from industry giants such as Nike and Adidas. This intense rivalry pressures pricing, marketing, and innovation strategies. In 2024, Nike held approximately 30% of the U.S. athletic footwear market, intensifying the battle for market share. Skechers must differentiate itself through comfort technologies and targeted marketing to remain competitive.

Skechers holds a notable position in the global footwear market, but its market share lags behind industry giants. The quest to capture more market share fuels intense competition. For example, in 2024, Nike's market share was about 25%, while Skechers' was around 5%. Strategic moves like brand building and venturing into new markets are crucial for Skechers to boost its market share.

The footwear industry thrives on relentless product innovation, pushing companies to unveil novel designs and technologies. This constant evolution heightens competitive pressure. Skechers needs robust R&D to stay ahead. In 2024, Skechers' R&D spending was approximately $170 million, showing commitment to innovation. This is crucial for maintaining market share.

Marketing and Promotion

Marketing and promotion are critical in the footwear industry, with brands like Nike and Adidas investing significantly. This competitive landscape pressures Skechers to maintain a strong brand presence. Effective campaigns and endorsements are key for consumer attraction. In 2024, Nike's marketing spend was around $4 billion, showcasing the high stakes.

- Nike's marketing spend in 2024 was approximately $4 billion.

- Celebrity endorsements significantly boost brand visibility.

- Intense marketing rivalry increases pressure on Skechers.

- Effective campaigns are crucial for attracting consumers.

Global Expansion

The footwear industry sees intense rivalry due to global expansion efforts. Many companies, including Skechers, are aggressively entering new markets, particularly in developing economies. This global push heightens competition as brands vie for market dominance in various regions. Skechers' international growth is critical for its ongoing success.

- Skechers' international sales accounted for over 60% of total sales in 2024.

- Emerging markets, like China and India, are key battlegrounds for footwear companies.

- Nike and Adidas are major competitors, also with significant global footprints.

- Skechers' expansion strategy includes opening new stores and increasing brand visibility.

Competitive rivalry in the footwear market, including for Skechers, is extremely intense. This involves major players like Nike and Adidas. These companies relentlessly compete on pricing, marketing, and product innovation.

In 2024, Nike invested roughly $4 billion in marketing. Skechers’ international sales in 2024 were over 60% of total sales. This intense competition pressures profit margins and requires continuous efforts to capture and maintain market share.

| Aspect | Details | Impact on Skechers |

|---|---|---|

| Market Share Battle | Nike held ~30% of the U.S. athletic footwear market in 2024. | Requires Skechers to differentiate and focus on marketing. |

| Innovation Race | Skechers' R&D spending was ~$170 million in 2024. | Ongoing R&D is vital for staying competitive. |

| Marketing Wars | Nike's marketing spend was about $4 billion in 2024. | Requires effective campaigns and brand building to compete. |

SSubstitutes Threaten

Generic footwear presents a considerable threat to Skechers. These budget-friendly alternatives can lure price-conscious consumers. Skechers' market share in 2024 was approximately 5.6%, indicating strong competition. To combat this, Skechers should highlight its product's unique value. Offering superior comfort or style can justify a higher price.

Retailers' private label footwear brands pose a threat by offering lower-priced alternatives to Skechers. These brands compete directly, impacting sales. Skechers must build brand loyalty and offer unique products to counter this. In 2024, the private label market grew, intensifying the competition. The goal is to maintain market share.

Alternative footwear categories, like sandals and slip-ons, pose a threat to Skechers. Consumers may opt for these based on comfort or style, impacting Skechers' sales. In 2024, the global footwear market was valued at approximately $400 billion. Diversifying product lines to meet varied preferences is crucial.

Used Footwear

The used footwear market is expanding, offering budget-friendly and eco-conscious choices. This growth presents a substitute threat to Skechers. Consumers might opt for pre-owned Skechers, impacting new sales. Skechers can counter this by emphasizing product longevity and value.

- Market for used shoes is valued at billions of dollars globally.

- Resale platforms like ThredUp and Poshmark report rising sales in the footwear category.

- Skechers' focus on durable materials and comfort can be a key differentiator.

- Offering a trade-in or recycling program can also help.

Minimalist Footwear

The rise of minimalist footwear presents a threat to Skechers. These shoes attract consumers looking for a different feel. Skechers must adapt its designs to meet these changing demands. In 2024, the minimalist footwear market saw a 15% growth.

- Market growth of 15% in 2024.

- Consumer preference shifts towards minimalist styles.

- Skechers needs to innovate and adapt its designs.

- Focus on comfort and support is key.

Substitutes, like generic brands, challenge Skechers, especially for budget buyers. Private labels also compete, increasing the need for strong branding and unique products. Alternative footwear, including minimalist styles, and the expanding used shoe market further intensify the competition.

| Threat | Impact | Skechers' Response |

|---|---|---|

| Generic Footwear | Price-sensitive consumers switch. | Highlight unique value and comfort. |

| Private Labels | Direct sales competition. | Build brand loyalty; innovate products. |

| Alternative Footwear | Diversion of consumer choice. | Diversify product lines. |

Entrants Threaten

The footwear industry, especially for niche markets, might not demand huge upfront capital. This makes it easier for new businesses to enter the market, boosting the threat to established companies. In 2024, the athletic footwear market alone was valued at over $100 billion globally. Skechers must prioritize innovation and brand development to stay competitive. Skechers' 2023 revenue was about $7.46 billion, indicating its strong brand presence.

The rise of e-commerce platforms has lowered barriers for new footwear brands. This shift allows direct-to-consumer sales, bypassing traditional retail networks. Skechers must strengthen its online presence to compete effectively. In 2024, online sales accounted for a significant portion of footwear revenue, highlighting this threat.

Contract manufacturing significantly lowers the barrier to entry for new footwear brands. This is because they can outsource production without investing in factories. Skechers, for example, relies on contract manufacturers, as do many competitors. In 2024, the global footwear contract manufacturing market was valued at approximately $80 billion, illustrating its scale and accessibility. New entrants can focus on design and marketing, making it easier to compete. However, strong relationships with manufacturers and rigorous quality control are vital for success.

Brand Loyalty

New entrants face an uphill battle against Skechers' brand loyalty. Consumers often stick with familiar brands, making it tough for newcomers to gain traction. Building a strong brand reputation and fostering customer loyalty are crucial to deter new competitors in the footwear market. Effective marketing, including digital campaigns, and consistent customer engagement are vital for establishing a foothold. In 2024, Skechers' marketing spend reached $800 million, highlighting their investment in brand recognition.

- High brand recognition is a key advantage.

- Marketing investments aim to maintain customer loyalty.

- New entrants struggle against established brand preferences.

- Skechers' strong market presence deters new competitors.

Distribution Channels

New footwear companies face hurdles in accessing established distribution channels, as retailers often favor well-known brands. This preference creates a significant barrier to entry. Skechers can protect its market position by expanding its own retail network. Additionally, fortifying relationships with major retailers is crucial.

- Skechers' global sales in 2023 were approximately $7.46 billion.

- Skechers operates a vast network of over 5,000 stores worldwide.

- The footwear industry's distribution landscape is highly competitive.

New entrants challenge Skechers through accessible e-commerce and contract manufacturing. The footwear industry's low capital needs and rising online sales make market entry easier, especially for niche brands. Skechers faces competition from companies focusing on design and marketing, requiring a strong online presence. Despite brand loyalty, new entrants can still gain traction with effective marketing.

| Factor | Impact on Skechers | Data (2024) |

|---|---|---|

| E-commerce | Increased competition | Online footwear sales: ~30% market share |

| Contract Manufacturing | Lower entry barriers | Global footwear contract market: $80B |

| Brand Loyalty | Competitive Advantage | Skechers marketing spend: $800M |

Porter's Five Forces Analysis Data Sources

The Skechers analysis uses SEC filings, financial reports, market share data, and industry research. It also includes competitor strategies.