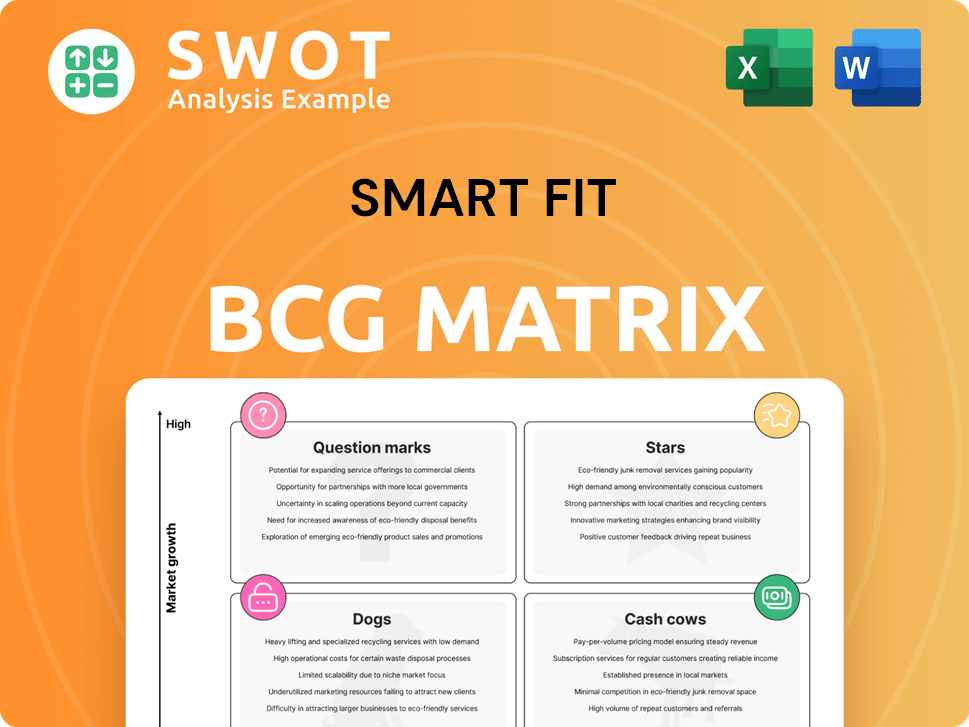

Smart Fit Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Smart Fit Bundle

What is included in the product

Tailored analysis for Smart Fit's product portfolio.

Export-ready design for quick drag-and-drop into PowerPoint to save time during presentations.

Delivered as Shown

Smart Fit BCG Matrix

The Smart Fit BCG Matrix preview is identical to the file you receive after purchase. This ready-to-use, professionally designed document offers clear strategic insights immediately. Download the full version and enhance your business planning instantly.

BCG Matrix Template

Smart Fit's BCG Matrix paints a clear picture of its product portfolio. Learn how each product fares as a Star, Cash Cow, Dog, or Question Mark. Discover how Smart Fit strategically manages its diverse offerings and makes vital investment decisions. This glimpse only scratches the surface of their market positioning. Purchase the full BCG Matrix for a detailed breakdown and strategic insights to guide your decisions.

Stars

Smart Fit dominates Latin America's gym market. In 2024, they opened 305 new gyms. This expansion boosts their lead significantly. They tap into growing health trends. Their market share is very strong in the region.

Smart Fit's success stems from its high-value, low-price model, providing affordable premium fitness. This strategy has boosted market share in health-conscious areas. The low-cost gym model now includes more services to stay competitive. In 2024, Smart Fit reported a revenue increase of 15% due to this approach. Over 1,300 gyms operate across Latin America.

Smart Fit's strategic expansion focuses on key markets such as Brazil and Mexico, boosting its continental footprint. This targeted growth leverages rising fitness service demand in these areas. In 2024, Smart Fit opened over 60 new gyms, with 80% in Brazil and Mexico. The company plans to open 30 gyms in Chile by 2025, indicating continued growth.

Growing Health Consciousness in Latin America

The Latin American fitness market is a "Star" for Smart Fit, exhibiting robust growth potential. A significant 61% of urban Latin Americans exercise at least twice a week, fueling demand. This positive trend positions Smart Fit favorably to leverage the region's increasing health consciousness. The company's strategic expansion aligns with this growing market.

- Market growth driven by rising health awareness.

- Significant portion of urban population exercises regularly.

- Strategic expansion aligns with market demand.

- Data from 2024 survey highlights fitness trends.

Continuous Innovation and Adaptation

Smart Fit thrives on innovation, enhancing customer experience and gym productivity. This adaptability helps it stay ahead of changing trends and maintain its market position. They're using tech like AI to personalize workouts and nutrition plans, aiming for a better user experience. In 2024, Smart Fit invested heavily in tech upgrades, seeing a 15% increase in user satisfaction.

- Tech investment led to 15% boost in user satisfaction in 2024.

- AI is being used to personalize workouts and nutrition.

- Focus is on adapting to changing consumer demands.

- Innovation is key to maintaining market distinctiveness.

Smart Fit exemplifies a "Star" in the BCG Matrix, given its strong market share and high growth potential within the Latin American fitness sector. The company's strategy capitalizes on increasing health consciousness and strategic expansion. Specifically, 61% of urban Latin Americans exercise at least twice weekly, driving Smart Fit's growth.

| Key Metric | 2024 Data | Growth |

|---|---|---|

| Gym Openings | 305 | Significant |

| Revenue Increase | 15% | Positive |

| User Satisfaction (Tech Upgrade) | 15% | Improved |

Cash Cows

Smart Fit's established presence in Brazil and Mexico positions it as a cash cow. Brazil and Mexico, key Latin American markets, boast large urban populations. These markets have growing disposable incomes, fueling demand for fitness. Smart Fit strategically balances its operations across these regions to optimize resource allocation. In 2024, Smart Fit's revenue in Latin America was substantial, with Brazil and Mexico contributing significantly.

Smart Fit's membership model generates consistent recurring revenue, vital for profitability and growth. Affordable plans broaden its customer base, boosting income. In 2024, recurring revenue from memberships was up 15% year-over-year. This predictable income stream supports expansion efforts.

Smart Fit, a cash cow in the BCG Matrix, prioritizes operational efficiency and cost optimization. This strategy involves managing costs, boosting black membership penetration, and adjusting store layouts. Mature gyms showcase strong EBITDA margins, confirming efficient operations. For example, in 2024, Smart Fit reported a 30% increase in black membership, boosting profitability.

Strong Brand Recognition and Customer Loyalty

Smart Fit benefits from strong brand recognition and customer loyalty in Latin America, vital for retaining members and attracting new ones. Customer satisfaction and continuous experience improvements boost its brand reputation. This strategy helps Smart Fit stand out in a competitive market. Building loyalty through shared values is a key focus.

- Smart Fit operates in 14 countries across Latin America.

- Customer satisfaction scores are consistently high, with Net Promoter Scores (NPS) above industry averages.

- The company has over 1.3 million active members as of 2024.

- Repeat membership rates are approximately 70%, showing strong loyalty.

Strategic Partnerships and Acquisitions

Smart Fit has strategically used partnerships and acquisitions to grow. Its purchase of Velocity, an indoor cycling brand, enhances its service range and income sources. Since 2020, the company has completed about a dozen acquisitions in Latin America.

- Velocity acquisition expanded Smart Fit's service offerings.

- Acquisitions in Latin America have been a key part of its growth strategy.

- Smart Fit aims to diversify and expand its market presence.

Smart Fit is a cash cow, excelling in Latin America, especially Brazil and Mexico. These markets provide steady revenue, fueled by memberships and operational efficiency. High customer loyalty, with repeat membership rates around 70% in 2024, solidifies its position.

| Metric | 2024 Data | Notes |

|---|---|---|

| Recurring Revenue Growth | +15% YoY | Driven by memberships |

| Black Membership Increase | +30% | Boosting profitability |

| Repeat Membership Rate | ~70% | Showing strong loyalty |

Dogs

Some Smart Fit locations could be struggling, possibly due to tough competition or local economic issues. These spots likely have slow growth and a small market share. Consider selling them or changing their structure, as fixing them could be costly and might not work. In 2024, underperforming gyms often see a revenue decrease of around 10-15% annually.

Some Smart Fit locations might struggle with outdated equipment, potentially hurting the member experience. These gyms may need considerable investment to stay competitive. For instance, in 2024, the fitness industry saw a 10% increase in demand for updated facilities. Regular upkeep is key; otherwise, member attrition could rise.

Smart Fit's marketing struggles in some areas lead to poor customer acquisition. This may stem from not grasping local market nuances or shifting consumer tastes. Targeted campaigns are key. In 2024, Smart Fit's revenue grew by only 5% in specific regions, highlighting the issue.

High Debt Load

Smart Fit's aggressive expansion strategy has led to a substantial increase in its debt. This elevated debt level potentially jeopardizes financial health, particularly if revenue growth falters or interest rates climb. The company's net debt significantly increased in 2024, impacting its leverage ratio. This could strain its ability to meet financial obligations if operational performance declines.

- Debt levels surged due to rapid expansion.

- Increased leverage raises financial stability concerns.

- Rising interest rates could exacerbate risks.

- Slowing revenue growth could worsen the situation.

Potential for Increased Competition

Smart Fit operates in a fiercely competitive fitness market. This includes established gym chains, trendy boutique studios, and convenient home fitness options. Such competition can squeeze Smart Fit's pricing and potentially erode its market share. For example, in 2024, the global fitness market was valued at over $96 billion, highlighting the scale of the competition. Differentiating its offerings is key to retaining members.

- Competition from major gym chains and boutique fitness studios.

- Growing popularity of home fitness solutions.

- Pressure on pricing and market share.

- Need for strong differentiation.

Dogs in the BCG matrix represent underperforming Smart Fit locations, with low market share and slow growth. These gyms often face challenges like outdated equipment and poor marketing. They require significant investment and face stiff competition. In 2024, many "Dogs" saw revenues fall by over 10% annually.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Market Share | Low | Under 5% in specific regions |

| Growth Rate | Slow | Under 3% annually |

| Investment Needs | High | Equipment upgrades 15-20% of revenue |

Question Marks

Smart Fit might introduce new fitness programs, such as specialized classes, fitting the "Question Mark" category in the BCG matrix. These programs, while having high growth potential, currently hold a low market share, demanding substantial investment. In 2024, the fitness industry's specialized segment saw a 15% growth, but Smart Fit's new offerings may only capture a fraction initially. Low returns are common initially due to low market presence.

Smart Fit's European expansion, a question mark in the BCG Matrix, signifies high growth potential coupled with substantial risks. The company must navigate market uncertainties and adapt its strategy for success. A test operation in Morocco marks its initial step outside Latin America. In 2024, the fitness market in Europe was valued at over €27 billion, showing considerable growth potential.

Smart Fit's digital fitness platforms, like online workouts, show promise but lag in market share versus gyms. These platforms need continuous investment in technology and content to stay competitive. The mobile fitness app market is booming, with revenue expected to reach $1.7 billion in 2024. This segment offers high growth prospects. Smart Fit must innovate to capture this digital fitness wave.

Premium Brand (Bio Ritmo) Expansion

Bio Ritmo's expansion is a question mark in Smart Fit's BCG matrix. This premium brand targets a different segment, demanding unique marketing and operational strategies. The first Bio Ritmo location in Chile is slated to open in March 2025, marking a significant strategic move. This expansion requires careful monitoring of market reception and financial performance.

- March 2025: Bio Ritmo's first sede opens in Chile.

- Different segment: Premium brand targeting a new market.

- Strategic move: Requires new marketing and operational approaches.

- Financial monitoring: Crucial for assessing future expansion.

Integration of Wearable Technology and AI

The integration of wearable technology and AI presents a question mark for Smart Fit within the BCG matrix. These technologies offer potential for enhanced member experiences and improved fitness outcomes. However, significant investment and expertise are required. Smart Fit is exploring AI to optimize workouts and personalize nutrition, a strategic move that may yield high returns.

- Investment in AI and wearable tech is projected to reach $19.6 billion by 2025, per Statista.

- Personalized fitness programs show a 20% increase in user engagement, according to a 2024 study.

- Smart Fit's revenue grew by 15% in 2024, indicating potential for growth in this area.

- The success hinges on effective data analysis and user adoption.

Smart Fit's "Question Marks" represent high-potential, low-share ventures requiring heavy investment. These include new programs, European expansion, digital platforms, Bio Ritmo's premium brand, and tech integration. Each initiative faces market uncertainties and demands strategic agility. The success depends on careful market analysis and financial monitoring for growth.

| Area | Challenge | 2024 Data/Fact |

|---|---|---|

| New Programs | Low market share, high investment needed | Specialized segment grew 15%. |

| European Expansion | Market uncertainty | €27B fitness market in Europe. |

| Digital Platforms | Need for innovation | $1.7B mobile fitness app market. |

| Bio Ritmo | New segment, marketing | Chile opening in March 2025. |

| Tech Integration | Investment & expertise | AI & wearable tech projected to reach $19.6B by 2025. |

BCG Matrix Data Sources

Smart Fit's BCG Matrix is data-driven. It uses sales figures, market analyses, and competitor benchmarks to inform strategic decisions.