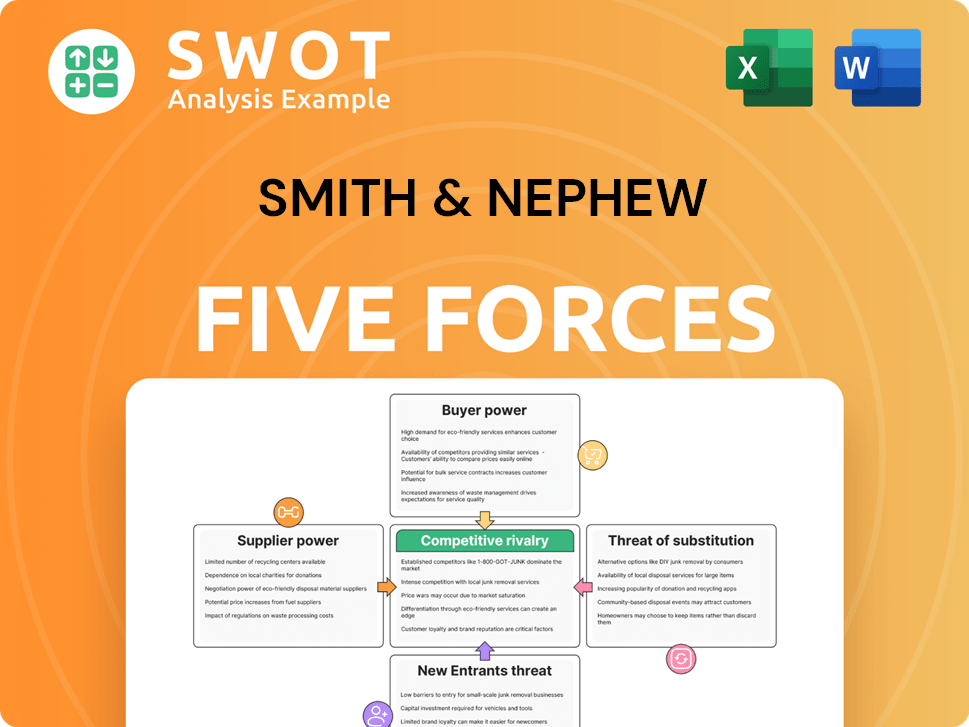

Smith & Nephew Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Smith & Nephew Bundle

What is included in the product

Analyzes Smith & Nephew's competitive landscape, evaluating supplier/buyer power, threats, and rivalry.

Instantly identify threats and opportunities with a dynamic, interactive dashboard.

Same Document Delivered

Smith & Nephew Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Smith & Nephew you'll receive. This is the complete, ready-to-use document, thoroughly researched and formatted. The moment you purchase, you'll have immediate access to this exact file, complete with analysis details. There are no edits or alterations; what you see is what you get. This professionally prepared analysis is ready to download and use.

Porter's Five Forces Analysis Template

Smith & Nephew faces moderate rivalry in the medical devices market, driven by established competitors. Buyer power is moderate, influenced by healthcare provider negotiations. Supplier power is also moderate, with key material and component suppliers. The threat of new entrants is low, due to high capital costs and regulations. Substitute products pose a moderate threat from alternative treatments.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Smith & Nephew’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Smith & Nephew's operations depend on suppliers for specialized materials. The bargaining power of these suppliers is moderate. Disruptions or cost increases could hit profits. For example, in 2024, medical device material costs rose by about 3-5% due to global supply chain issues.

Smith & Nephew faces supplier bargaining power, especially due to regulatory compliance. Suppliers must meet stringent standards, which elevates their operational expenses. This factor can strengthen suppliers' negotiating positions. In 2024, the medical device industry saw approximately a 7% increase in compliance-related expenditures. Smith & Nephew must manage these supplier relationships carefully.

Smith & Nephew's ability to negotiate favorable terms with suppliers is affected by long-term contracts. These contracts offer stability but might limit flexibility. For instance, in 2024, S&N had several long-term supply agreements. Periodic evaluation and adjustment of these contracts are crucial. This helps S&N maintain a competitive edge.

Supplier concentration matters

Supplier concentration significantly impacts Smith & Nephew's bargaining power. In the medical device sector, a concentrated supplier base, especially for critical components, gives suppliers more leverage. This can lead to higher costs and reduced profitability for Smith & Nephew. To counter this, the company must strategically diversify its suppliers.

- High supplier concentration increases supplier power.

- Diversification reduces dependency and risk.

- Supply chain disruptions can severely impact production.

- In 2024, MedTech supply chain issues continue to affect margins.

Innovation dependency exists

Smith & Nephew's innovation hinges on its suppliers, especially for materials and technologies. Suppliers with significant R&D investments can dictate prices, impacting Smith & Nephew's cost structure. This dependency necessitates strong supplier relationships to ensure access to the newest innovations. In 2024, Smith & Nephew's cost of sales was approximately $2.7 billion, reflecting the influence of supplier pricing.

- Innovation is critical for Smith & Nephew's competitive edge.

- Suppliers with advanced tech can exert pricing power.

- Collaboration is key to accessing new developments.

- Supplier costs directly affect profitability.

Smith & Nephew's suppliers hold moderate bargaining power. This power is influenced by material costs and regulatory compliance, which drove up expenses. Long-term contracts and supplier concentration also play a role.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Material Costs | Affects production costs | Increased 3-5% |

| Regulatory Compliance | Raises supplier expenses | 7% increase in industry costs |

| Supplier Concentration | Increases supplier leverage | Affects pricing & availability |

Customers Bargaining Power

The bargaining power of Smith & Nephew's customers, including healthcare providers, hospitals, and patients, fluctuates based on product type and location. Price sensitivity is high in competitive markets. For instance, in 2024, cost-containment efforts affected pricing. Smith & Nephew adjusted strategies to manage these regional price differences effectively.

Group purchasing organizations (GPOs) enhance customer bargaining power by aggregating purchasing volume, leading to better price negotiations. They can pressure suppliers like Smith & Nephew to offer discounts and favorable terms. GPOs significantly influence market access and sales volume for medical device companies. For 2024, the healthcare GPO market is estimated at $800 billion, impacting supplier profitability.

Smith & Nephew's product differentiation is crucial in managing customer bargaining power. Innovation and superior performance help reduce customer price sensitivity. For instance, in 2024, Smith & Nephew invested heavily in R&D to launch advanced wound care products. These products provide unique benefits, making customers less price-sensitive. Sustaining a competitive edge through continuous innovation remains vital.

Switching costs influence decisions

Switching costs are a key factor in customer bargaining power for Smith & Nephew. The medical device industry often involves high switching costs. These costs include training, equipment compatibility, and existing supplier relationships. Despite these barriers, customers might switch if competitors offer significant advantages. For instance, in 2024, the global orthopedic devices market was valued at approximately $59 billion.

- Training requirements for new devices can be extensive, adding to the switching costs.

- Compatibility issues with existing hospital infrastructure also increase switching costs.

- Strong relationships with current suppliers can reduce the incentive to switch.

- However, superior product performance or cost savings can overcome these barriers.

Information availability matters

Customers today have more information about medical devices than ever before, thanks to the internet. This increased access includes clinical data and pricing details, which allows them to make better purchasing choices. This transparency gives customers more power when negotiating prices. Smith & Nephew must clearly show the value of its products to justify its costs.

- Online reviews and forums provide direct customer feedback, influencing purchasing decisions.

- Hospital procurement departments are increasingly sophisticated, comparing prices and features.

- In 2024, the global medical device market was valued at approximately $560 billion.

- Smith & Nephew's ability to differentiate its products is crucial in maintaining pricing power.

Customer bargaining power at Smith & Nephew varies with market and product type. Group purchasing organizations (GPOs) boost customer leverage; the GPO market reached $800 billion in 2024. Differentiation and high switching costs, such as training, lessen price sensitivity. Increased information access also empowers customers.

| Factor | Impact | 2024 Data |

|---|---|---|

| GPO Influence | Enhances customer bargaining power | $800B GPO market |

| Product Differentiation | Reduces price sensitivity | R&D investments in advanced wound care |

| Switching Costs | Increases customer stickiness | $59B orthopedic devices market |

Rivalry Among Competitors

Intense competition defines the medical device industry, involving both established and new companies. Smith & Nephew competes with rivals offering similar products across the same markets. This rivalry fuels innovation, leading to price competition and heightened marketing strategies. In 2024, the global medical devices market was valued at over $500 billion, showcasing the scale of competition.

Innovation fuels competitive rivalry in medical devices. New product development is critical for competitive advantage. Smith & Nephew (SNN) competes with giants like Johnson & Johnson. SNN invested $237 million in R&D in 2023. Continuous R&D is vital to stay ahead.

The medical device industry is experiencing a wave of consolidation, with major players acquiring smaller firms. This trend concentrates market share, intensifying competition. In 2024, mergers and acquisitions in the medtech sector totaled over $50 billion, highlighting this consolidation. Smith & Nephew must adjust its strategies to thrive in this environment, possibly through strategic partnerships or acquisitions.

Global market dynamics exist

Smith & Nephew navigates a global market, competing with firms across regions. These competitors have diverse cost structures and regulatory environments, impacting market strategies. Adapting to these dynamics is vital for Smith & Nephew. Focusing on local needs and preferences is key to maintaining a competitive edge. In 2024, the global medical devices market was valued at approximately $500 billion.

- Competition varies regionally, influencing strategic decisions.

- Local adaptation is essential for market success.

- Market size presents significant growth opportunities.

- Smith & Nephew needs to consider global regulatory differences.

Marketing and branding matter

Effective marketing and branding are critical in the medical device sector. Differentiation and customer loyalty hinge on a strong brand reputation. Smith & Nephew's investments in marketing help maintain its market position. This is vital in a market where competitors constantly vie for market share. In 2024, Smith & Nephew's marketing spend was approximately $400 million, reflecting its commitment.

- Marketing spend: ~$400M (2024)

- Brand reputation focus

- Customer loyalty building

- Competitive advantage aim

Competition is fierce in the medical device market, impacting Smith & Nephew's strategies. Innovation and marketing are key to gaining market share. In 2024, the medtech M&A activity exceeded $50B. SNN invested ~$237M in R&D in 2023.

| Factor | Details | Impact |

|---|---|---|

| R&D Spend (SNN, 2023) | $237 million | Drives innovation |

| Marketing Spend (SNN, 2024 est.) | ~$400 million | Enhances brand and market presence |

| Medtech M&A (2024) | >$50 billion | Consolidates competition |

SSubstitutes Threaten

The threat of substitutes for Smith & Nephew includes alternative treatments. These alternatives can range from non-surgical options to pharmaceutical solutions. In 2024, the global market for orthopedic implants, a key area for Smith & Nephew, was valued at approximately $50 billion. The company must adapt to innovations to stay competitive. Competition is fierce, with companies like Zimmer Biomet and Stryker also vying for market share.

Technological advancements continually reshape the medical device landscape, spawning new substitutes. Minimally invasive surgeries and regenerative medicine are prime examples, potentially lessening the demand for conventional products. Smith & Nephew must proactively invest in these emerging technologies to stay competitive. In 2024, the global market for minimally invasive surgical instruments reached approximately $40 billion, highlighting the scale of this shift. This necessitates strategic R&D spending to counteract the threat of substitutes.

The cost-effectiveness of substitutes significantly impacts their adoption rates. If alternatives provide comparable results at a lower cost, they can capture market share. Smith & Nephew must highlight the value and cost-effectiveness of its offerings compared to substitutes. For instance, the shift towards outpatient procedures, which are generally less expensive than inpatient surgeries, can boost the use of cost-effective alternatives. In 2024, the global orthopedic devices market, including Smith & Nephew's products, was valued at approximately $56 billion.

Regulatory approvals matter

The regulatory approval process significantly influences the threat of substitutes for Smith & Nephew. New medical treatments and devices, which could act as substitutes, must navigate extensive testing and approval phases before market entry. Smith & Nephew must closely monitor regulatory changes to anticipate how these may affect the availability and acceptance of alternative products. This proactive approach is essential for maintaining its competitive advantage. Regulatory hurdles can delay or prevent the entry of substitutes.

- In 2024, the FDA approved 20 new medical devices, highlighting the ongoing regulatory activity in the medical device market.

- Smith & Nephew spent approximately $250 million on R&D in 2023, including regulatory compliance.

- Clinical trials for new medical devices typically require 3-7 years for completion and approval.

- The EU's Medical Device Regulation (MDR) has increased the stringency of regulatory requirements.

Patient preferences influence choices

Patient choices significantly affect the use of alternatives to Smith & Nephew products. Some patients might favor non-surgical options or alternative treatments, driven by worries about surgery or its side effects. Smith & Nephew must understand these preferences to adjust its marketing and educational strategies. For example, in 2024, the global market for non-surgical orthopedic treatments was valued at approximately $15 billion. This highlights the importance of addressing patient concerns.

- Patient preferences influence treatment choices.

- Non-surgical options and alternative therapies are preferred by some.

- Smith & Nephew needs to adapt marketing efforts.

- The non-surgical orthopedic market was ~$15B in 2024.

Substitutes, like non-surgical treatments, challenge Smith & Nephew. Technological shifts, such as minimally invasive surgeries, introduce new competitors. Cost-effectiveness of alternatives influences their adoption rate, impacting market share. Regulatory approvals and patient preferences further affect the market.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Alternative Treatments | Non-surgical options & pharma solutions | Orthopedic implants: ~$50B |

| Technological Advancements | Minimally invasive surgeries & regenerative medicine | Minimally invasive instruments: ~$40B |

| Cost-Effectiveness | Lower-cost alternatives gain share | Orthopedic devices market: ~$56B |

Entrants Threaten

The medical device industry's high capital needs, including research, production, and regulatory compliance, are a significant barrier. These high entry costs limit new competitors. Smith & Nephew, with its established infrastructure, has an advantage. In 2024, Smith & Nephew's R&D spending was around $250 million, highlighting the financial commitment needed.

The medical device industry faces stringent regulatory hurdles, particularly in markets like the U.S. and Europe. New entrants must secure approvals from bodies such as the FDA and EMA. These regulatory requirements significantly increase both the time and financial investment needed to enter the market. This acts as a barrier, lessening the threat from new competitors. Smith & Nephew benefits from its experience in navigating these complex regulatory processes.

Smith & Nephew, a well-established company, profits from solid brand loyalty and existing ties within the healthcare sector. New competitors find it tough to match this established loyalty and capture market share. Constructing a powerful brand reputation demands both time and financial backing. In 2024, Smith & Nephew's brand recognition helped it maintain a significant market presence, despite facing new competitors.

Specialized knowledge is essential

The medical device industry demands specialized knowledge, including engineering and clinical research, which can be a barrier for new entrants. Without this expertise, newcomers struggle to compete effectively. Smith & Nephew benefits from its experienced workforce, creating a significant competitive advantage. This established expertise helps protect its market position. In 2023, Smith & Nephew invested $227 million in R&D to maintain its competitive edge.

- Specialized knowledge is crucial for the medical device industry.

- New entrants often lack the required expertise.

- Smith & Nephew's experienced workforce is a key asset.

- R&D investment in 2023 was $227 million.

Distribution network access is key

Distribution network access is vital in the medical device industry. New entrants face challenges due to the difficulty in establishing these networks. Smith & Nephew benefits from its well-established distribution channels, giving them a competitive edge. This makes it harder for new companies to gain market share. The established networks act as a barrier to entry.

- Smith & Nephew's strong distribution network supports market reach.

- New entrants struggle to match established distribution capabilities.

- Access to distribution is a key factor in the medical device market.

The threat of new entrants to Smith & Nephew is moderate due to significant barriers. High capital needs, including R&D, create hurdles; Smith & Nephew spent around $250 million on R&D in 2024. Regulatory requirements and strong brand loyalty also protect Smith & Nephew's market position.

| Barrier | Impact | Smith & Nephew Advantage |

|---|---|---|

| High Capital Costs | Limits new entrants | Established infrastructure |

| Regulatory Hurdles | Increases entry time and cost | Experience in approvals |

| Brand Loyalty | Difficult to gain market share | Strong brand recognition |

Porter's Five Forces Analysis Data Sources

The analysis leverages financial statements, market reports, and industry databases to assess the competitive landscape for Smith & Nephew.