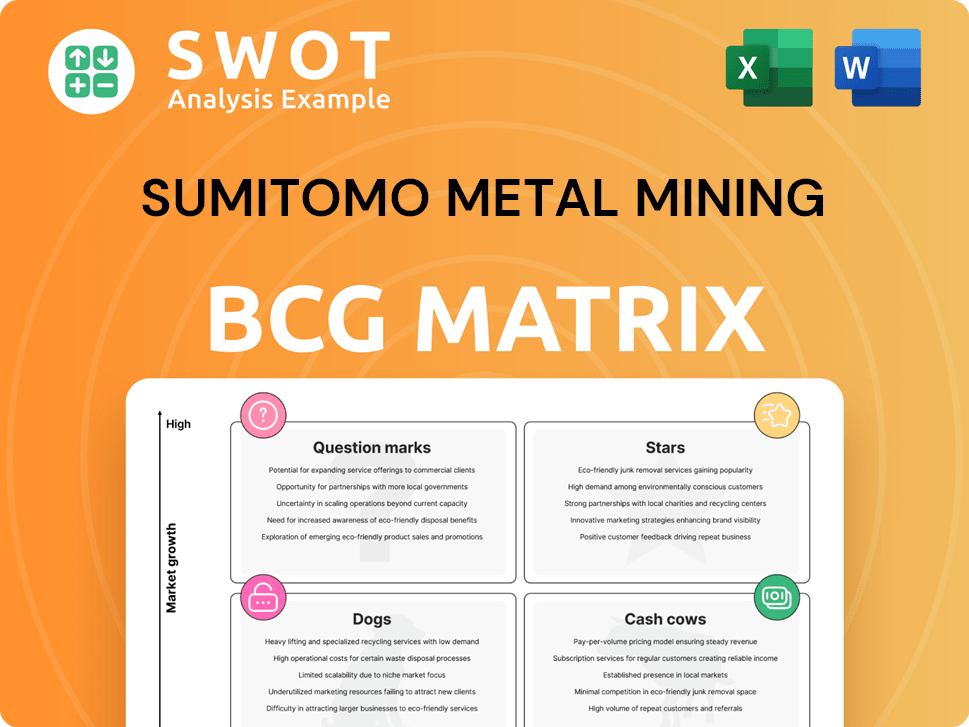

Sumitomo Metal Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Metal Mining Bundle

What is included in the product

Tailored analysis for Sumitomo's product portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, providing a concise overview for quick stakeholder understanding.

What You See Is What You Get

Sumitomo Metal Mining BCG Matrix

The Sumitomo Metal Mining BCG Matrix you see here is the full document you'll receive. It’s ready to download and integrate directly into your strategic planning immediately.

BCG Matrix Template

Sumitomo Metal Mining's BCG Matrix offers a glimpse into its diverse portfolio. We can see how its products are classified: Stars, Cash Cows, Dogs, and Question Marks. This quick look only scratches the surface of their strategic landscape. Gain a deeper understanding of their product positions and future prospects. Purchase the full BCG Matrix for detailed insights and a strategic roadmap.

Stars

High-purity electrolytic nickel is crucial for battery materials, driving demand. Sumitomo's expertise and supply chains are advantageous. In 2024, nickel prices fluctuated, impacting profitability. New facilities boost Sumitomo's position, with battery demand growing steadily.

Sumitomo Metal Mining's advanced materials for semiconductors show robust demand. Recent reports indicate a surge in demand for high-purity materials. The company's R&D boosts its competitive edge, with a focus on green materials. This strategic direction aligns with the growing emphasis on reducing GHG emissions in the semiconductor industry. In 2024, the semiconductor materials market is valued at over $60 billion.

Sumitomo Metal Mining's copper production is heavily influenced by projects like Quebrada Blanca Phase 2 (QB2). QB2's completion of project financing highlights its importance. The Winu copper-gold project, in collaboration with Rio Tinto, also plays a role. In 2024, global copper production is projected to reach approximately 27 million metric tons.

Gold Production from Hishikari Mine

The Hishikari Mine, a key profit driver, is a star in Sumitomo Metal Mining's portfolio. Its high-grade gold deposits justify ongoing investment and sustainable practices. Sumitomo Metal Mining utilizes its mining expertise, refined at the Besshi Copper Mine, to optimize operations. This ensures continued profitability and growth from Hishikari.

- Hishikari Mine has consistently produced high-quality gold, with annual production often exceeding several tons.

- The company's investment in advanced mining techniques and sustainable practices has kept the mine competitive.

- Sumitomo Metal Mining's technical capabilities, developed at Besshi, are applied to boost efficiency.

Nickel-Based Cathode Materials

Nickel-based cathode materials represent a strategic growth area for Sumitomo Metal Mining, especially given their role in lithium-ion batteries for major players like Panasonic and Tesla. Substantial investments are being made to expand production capacity, reflecting confidence in the future demand for these materials. The company's strategy involves significant capacity increases to meet the growing needs of the electric vehicle market.

- Sumitomo aims to produce 7,000 tonnes monthly by 2025.

- The target is to reach 10,000 tonnes per month by 2027.

- These expansions are crucial for supplying the EV industry.

The Hishikari Mine, a major gold producer, consistently yields several tons annually, securing its 'Star' status. Sumitomo's investments in advanced techniques bolster the mine's competitive edge and efficiency. This strategic approach, honed at the Besshi Copper Mine, boosts sustained profitability.

| Metric | Value | Note |

|---|---|---|

| Hishikari Gold Production (2024) | Approx. 6-8 tons | Annual estimate |

| Gold Price (2024) | $2,000-$2,400/oz | Fluctuating |

| Sumitomo's Mining Revenue (2024) | ~ ¥100 billion | Estimate, includes gold |

Cash Cows

Sumitomo Metal Mining's smelting and refining operations are a cash cow, processing copper, nickel, zinc, and precious metals. This segment consistently generates substantial revenue, supported by steady demand and efficient processes. The company's advanced technology, like High Pressure Acid Leach (HPAL), boosts efficiency. In 2024, this segment contributed significantly to overall profitability.

Sumitomo Metal Mining's established copper mines are cash cows. These mines, with rich operational histories, generate consistent revenue. The company has a long history in copper mining, starting with the Besshi Copper Mine in 1691. Efficient management and ongoing improvements boost profitability. In 2024, copper prices fluctuated between $3.70 and $4.50 per pound, impacting revenue.

Sumitomo Metal Mining's nickel production from existing mines generates reliable cash flow. Their integrated supply chains, spanning ore to battery materials, boost profitability. In 2024, nickel prices fluctuated, impacting revenue. Securing critical minerals is key for long-term production. The company's strategy aims for stable nickel output.

Silver Production

Sumitomo Metal Mining's silver production, though smaller than copper or nickel, consistently generates revenue. Its refining processes and market position solidify this cash cow status. The company's history includes silver output since its initial copper smelting. Silver production is a stable income stream.

- In 2023, Sumitomo Metal Mining produced approximately 2.4 million ounces of silver.

- Silver prices in 2024 have shown moderate volatility, impacting revenue.

- The company's refining operations are highly efficient, maximizing silver recovery.

- Sumitomo Metal Mining has a strong presence in the silver market.

Ferronickel Production

Sumitomo Metal Mining's ferronickel production, a cash cow, continues to generate stable cash flow despite possible output declines. This stability is bolstered by efficient operations and strong customer relations. The company focuses on cost reduction and productivity gains to sustain its competitive edge in 2024. Ferronickel's contribution is vital.

- Ferronickel production contributes significantly to Sumitomo Metal Mining's revenue.

- The company has invested in cost-saving measures.

- Customer relationships help maintain stable sales.

- Sumitomo Metal Mining aims for production efficiency.

Sumitomo's silver output consistently yields revenue. Efficient refining and market positioning fortify its cash cow status. In 2023, the company produced around 2.4 million ounces of silver. Silver's moderate price volatility in 2024 impacted sales.

| Metric | Value (2023) | Impact (2024) |

|---|---|---|

| Silver Production (oz) | 2.4M | Moderate Price Volatility |

| Refining Efficiency | High | Ongoing |

| Market Presence | Strong | Stable |

Dogs

Sumitomo Metal Mining's divested assets, including Sierra Gorda Copper Mine, are "Dogs" in the BCG matrix. These assets, no longer generating revenue, are cash traps. The company's 2024 financial reports show these divestitures. This strategic move helps the company focus on more profitable areas. The sale of the Sierra Gorda mine was completed in 2024.

Thallium's role for Sumitomo Metal Mining likely is not a major revenue source. As of late 2024, details remain scarce, suggesting it might be a byproduct. With potentially low growth, Sumitomo may reconsider thallium investments. The company generated ¥2.5 trillion in revenue in fiscal year 2024.

Lightweight foamed concrete, in Sumitomo Metal Mining's portfolio, might face slower growth than advanced materials. Competition and market dynamics could limit profit margins. In 2024, the construction sector's demand saw varied regional performance. The company may need innovation to boost its market position.

Automotive Exhaust Gas Treatment Catalysts

Automotive exhaust gas treatment catalysts are in the "Dogs" quadrant. The rise of electric vehicles poses a significant threat, potentially reducing demand. This sector faces increasing competition, impacting profitability. Sumitomo Metal Mining might need strategic diversification.

- EV sales increased, with 15% of global car sales being electric in 2024.

- Catalyst market revenue is projected to decline 5% annually through 2024.

- Competition is intensifying, especially from Chinese manufacturers.

- Sumitomo Metal Mining's catalyst revenue declined by 8% in Q3 2024.

Petroleum Refining Desulfurization Catalysts

Petroleum refining desulfurization catalysts, like automotive catalysts, are challenged by the shift away from fossil fuels. Reduced demand and market pressures could constrain growth. In 2024, the global desulfurization catalyst market was valued at approximately $1.5 billion. Sumitomo Metal Mining might need to diversify or innovate.

- Market pressures from the shift to renewable energy sources.

- Potential for declining demand as fossil fuel use decreases.

- Strategic need to explore new applications or technologies.

- Focus on markets that still rely on petroleum refining.

Sumitomo's "Dogs" include automotive catalysts. These face significant EV competition, with sales reaching 15% globally in 2024. Catalyst revenue declined 8% in Q3 2024, indicating a need for diversification.

| Category | 2024 Data | Implications |

|---|---|---|

| EV Sales | 15% of global car sales | Reduces catalyst demand |

| Catalyst Market | Projected decline of 5% annually | Intensifies competition |

| Sumitomo Catalyst Revenue | -8% in Q3 2024 | Requires diversification |

Question Marks

Sumitomo Metal Mining's new nickel matte facility is a major move. The project, backed by Japan's METI, aims to secure critical mineral supply. Its success hinges on nickel market dynamics and operational efficiency. Nickel prices in 2024 have fluctuated, impacting profitability.

The Kalgoorlie Nickel Project (KNP) - Goongarrie Hub, a collaboration with Mitsubishi Corporation, presents a high-growth, low-market-share opportunity. Its future, as a star or a dog, hinges on the feasibility study's outcomes. The project aims for an annual output of roughly 30,000 tonnes of nickel and 2,000 tonnes of cobalt, targeting a mine life exceeding 40 years. This venture is designed to capitalize on the growing demand for battery metals.

The Winu copper-gold project, a joint venture with Rio Tinto, is a question mark in Sumitomo Metal Mining's BCG matrix, representing potential high growth. Success hinges on exploration results and fluctuating market conditions, particularly copper prices, which averaged around $3.80 per pound in 2024. A pre-feasibility study is slated for 2025.

Battery Recycling Initiatives

Sumitomo Metal Mining (SMM) is increasingly focusing on battery recycling, a "Question Mark" in its BCG matrix. This involves recovering copper and nickel from lithium-ion batteries (LIBs). SMM has been involved in recovering and reusing copper and nickel from LIBs since 2017. However, the success hinges on technological advancements and market adoption.

- In 2024, the global battery recycling market was estimated at $15 billion.

- SMM's recycling plant capacity has been expanding to meet growing demand.

- Technological advancements in extraction efficiency are crucial for profitability.

- Market acceptance depends on the availability of recycled materials.

New Scandium Oxide Production

Scandium oxide production for Sumitomo Metal Mining is a "Question Mark" in the BCG matrix. This signifies a new market with uncertain demand, requiring strategic investment. Success hinges on market development and finding applications in advanced technologies. Sumitomo Metal Mining's production adds to its diverse portfolio.

- Scandium oxide is used in solid oxide fuel cells and high-intensity lighting.

- Demand is growing, especially in the electronics and aerospace industries.

- Market size for scandium is relatively small, making it a niche market.

- Sumitomo Metal Mining's production volume is expected to increase by 2024.

Sumitomo Metal Mining's "Question Marks" face uncertain futures. The Winu copper-gold project's value hinges on 2024's copper price. Battery recycling depends on technology and market adoption. Scandium's market is small, requiring niche applications.

| Project | Market Share | Growth Potential |

|---|---|---|

| Winu Copper-Gold | Low | High |

| Battery Recycling | Low | High |

| Scandium Oxide | Low | High |

BCG Matrix Data Sources

The BCG Matrix for Sumitomo Metal Mining uses financial statements, market research, and industry analysis for accurate strategic insights.